Convertible Promissory Note

Description

How to fill out Convertible Promissory Note?

How much time and resources do you normally spend on drafting formal documentation? There’s a better way to get such forms than hiring legal specialists or spending hours browsing the web for a proper template. US Legal Forms is the leading online library that offers professionally drafted and verified state-specific legal documents for any purpose, like the Convertible Promissory Note.

To acquire and prepare a suitable Convertible Promissory Note template, adhere to these simple steps:

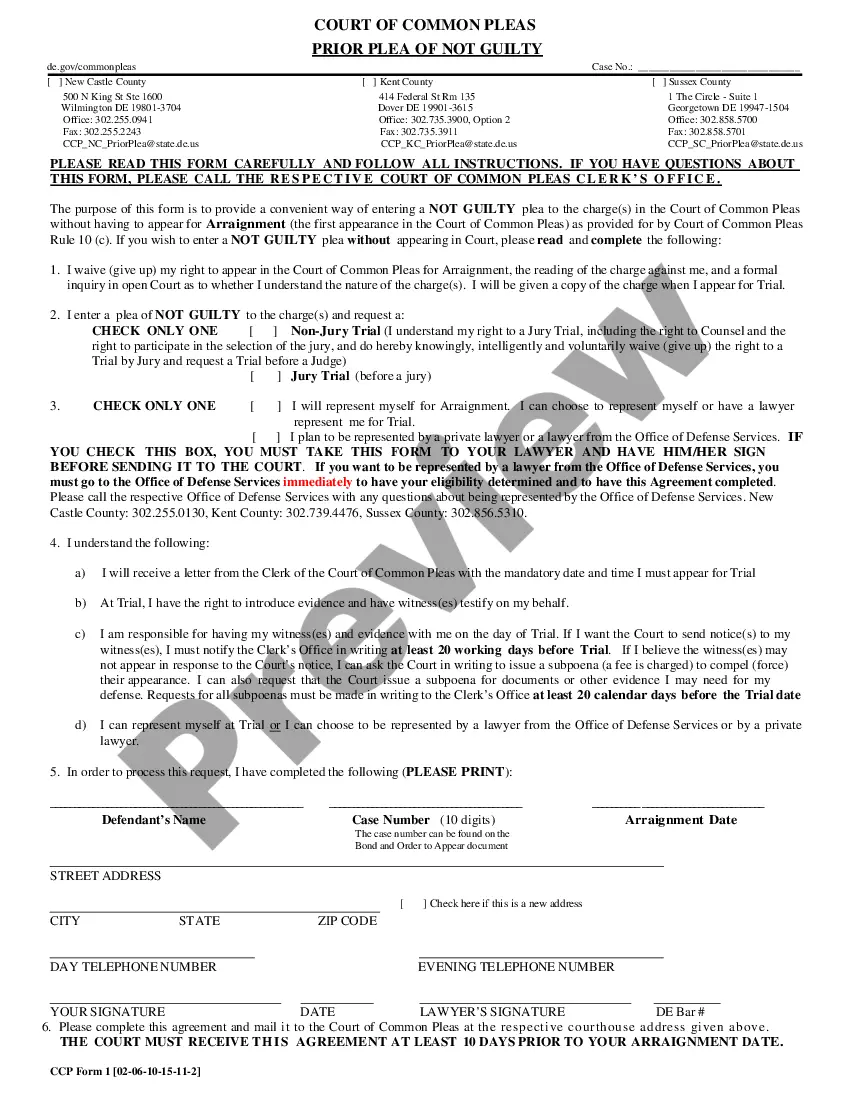

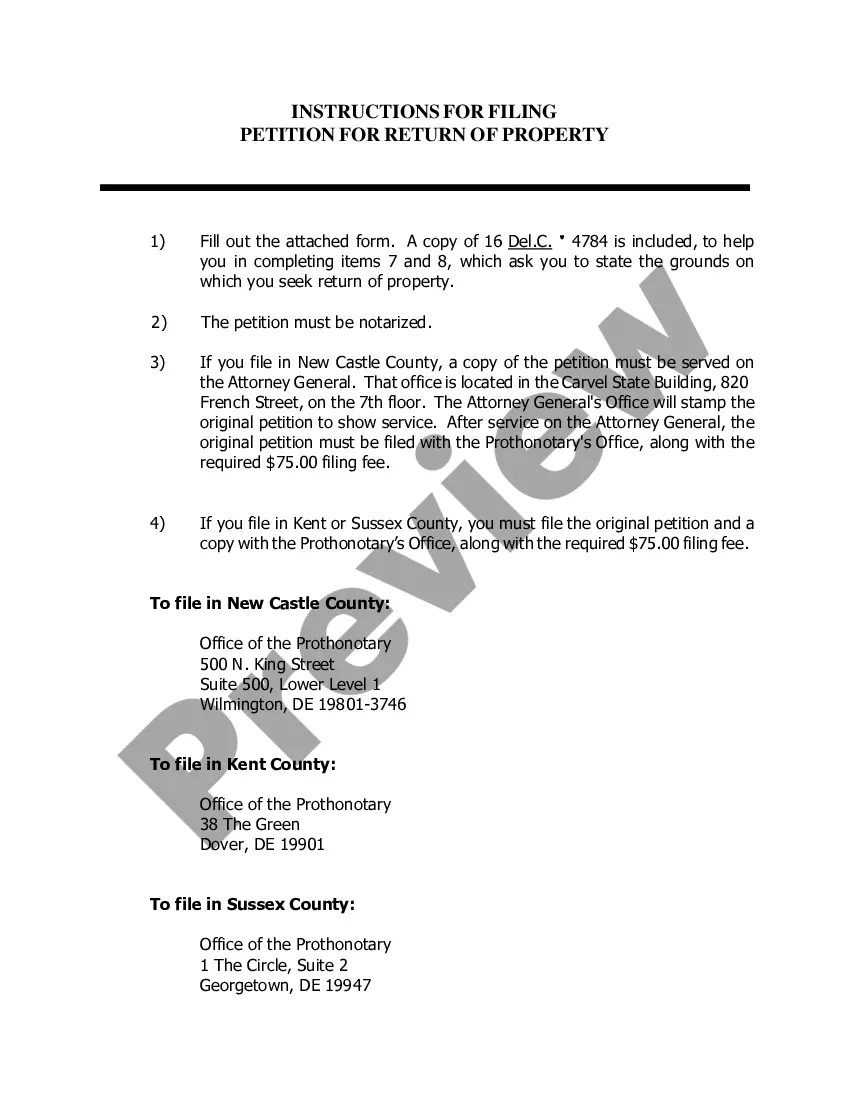

- Examine the form content to ensure it complies with your state requirements. To do so, read the form description or take advantage of the Preview option.

- If your legal template doesn’t meet your requirements, locate a different one using the search tab at the top of the page.

- If you already have an account with us, log in and download the Convertible Promissory Note. Otherwise, proceed to the next steps.

- Click Buy now once you find the correct document. Opt for the subscription plan that suits you best to access our library’s full service.

- Create an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is absolutely safe for that.

- Download your Convertible Promissory Note on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously downloaded documents that you safely store in your profile in the My Forms tab. Get them anytime and re-complete your paperwork as frequently as you need.

Save time and effort completing formal paperwork with US Legal Forms, one of the most trusted web solutions. Join us now!

Form popularity

FAQ

Convertible notes are promissory notes that serve an additional business purpose other than merely representing debt. Convertible notes include all of the terms of a vanilla promissory note, such as an interest rate and the pledge of underlying security (if applicable).

Convertible notes are a type of loan that gives investors the right to convert their debt into equity at a predetermined event.

A convertible promissory note is a legal document that is a type of debt instrument that can be converted into equity for a business. A convertible promissory note will typically have a fixed interest rate and a maturity date, but the holder has the option to convert it into shares at any time before its due date.

The main benefit of a convertible note is their relatively simple structure. Startup financing rounds can quickly become complex and take up significant time and money. Convertible note financings tend to be faster, simpler, and cheaper than priced rounds.

Convertible notes are promissory notes that serve an additional business purpose other than merely representing debt. Convertible notes include all of the terms of a vanilla promissory note, such as an interest rate and the pledge of underlying security (if applicable).

A convertible note is a short-term debt agreement that converts into equity at a future date. Usually, this happens when one of these events takes place: The company raises enough capital to reach a pre-determined benchmark. The term of the loan expires.

A convertible note should be classified as a Long Term Liability that then converts to Equity as stipulated from the contract (usually a new fundraising round).

A convertible note is a short-term debt that eventually converts into equity. Convertible notes operate as loans and are typically issued in conjunction with future financing rounds.