Withdrawal of Credit on Past Due Account 2

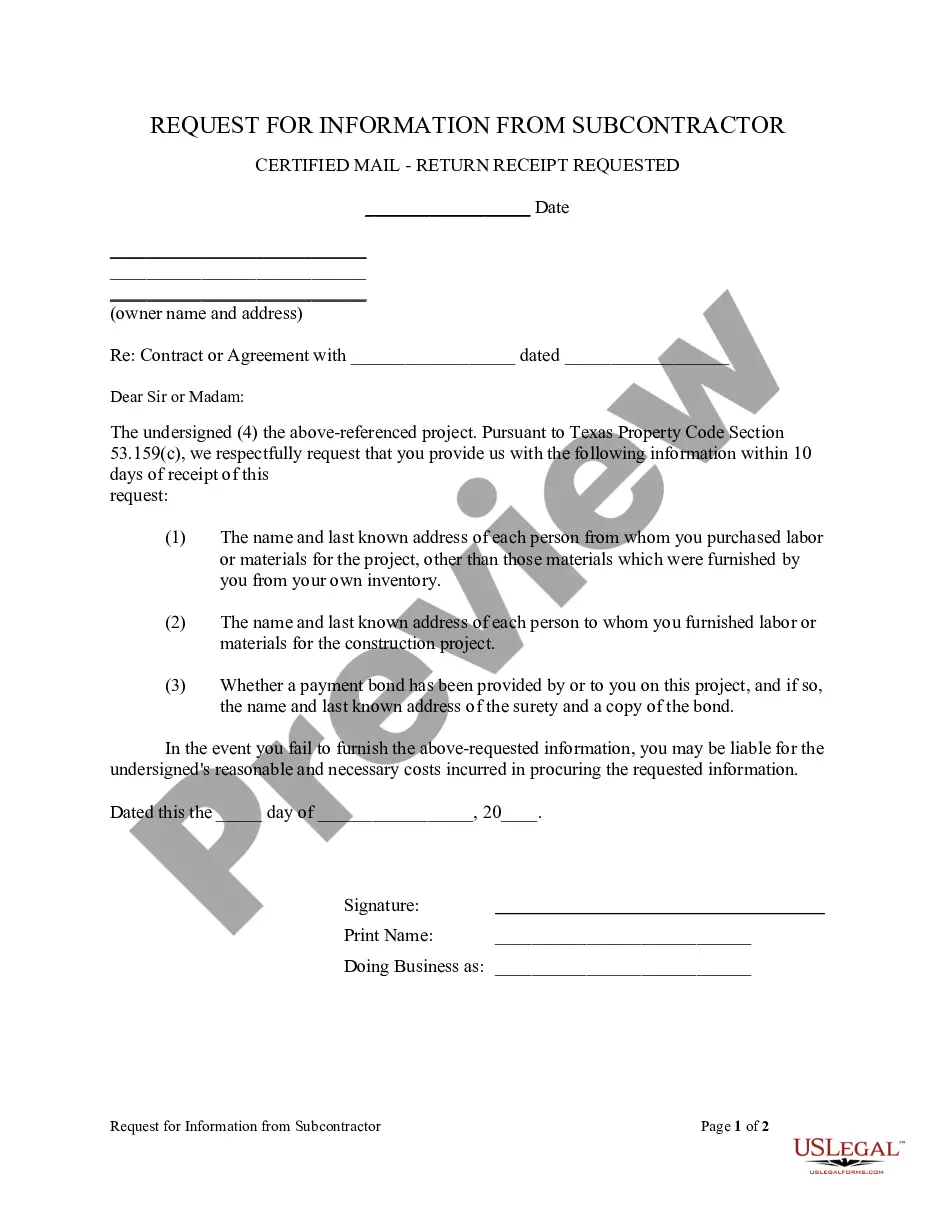

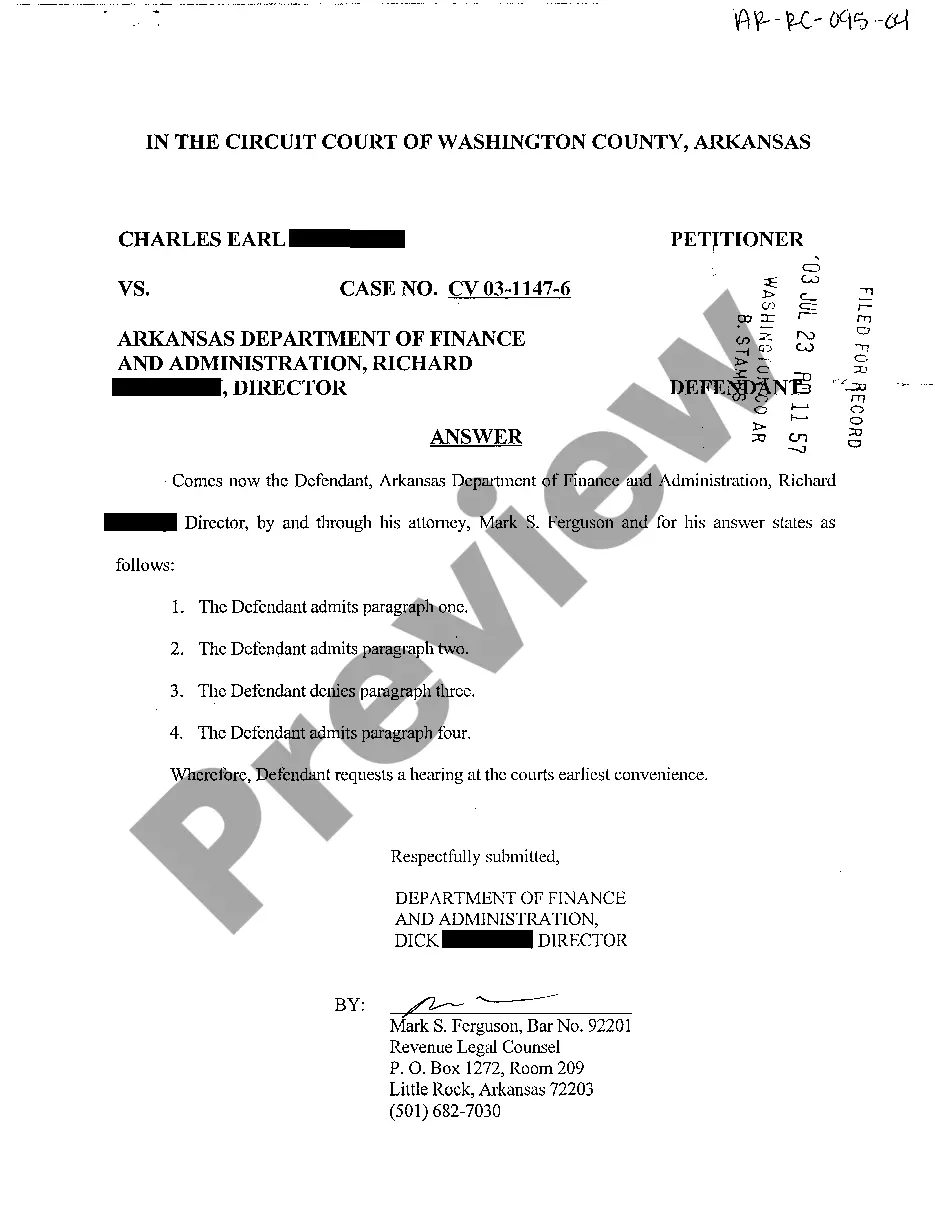

Description

How to fill out Withdrawal Of Credit On Past Due Account 2?

If you’re searching for a way to properly prepare the Withdrawal of Credit on Past Due Account 2 without hiring a legal professional, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every private and business scenario. Every piece of documentation you find on our online service is designed in accordance with nationwide and state regulations, so you can be sure that your documents are in order.

Adhere to these straightforward guidelines on how to obtain the ready-to-use Withdrawal of Credit on Past Due Account 2:

- Make sure the document you see on the page meets your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Enter the form name in the Search tab on the top of the page and select your state from the list to find another template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Sign up for the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to get your Withdrawal of Credit on Past Due Account 2 and download it by clicking the appropriate button.

- Upload your template to an online editor to fill out and sign it quickly or print it out to prepare your paper copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

Call your lender on the phone and ask to have the payment deleted. The first person you talk with most likely will not be able to help you. Politely ask to escalate the issue and speak with a manager or a department that can approve your request. Once you have them on the line, make your case politely.

If you accidentally make less than the required minimum payment or you miss your Credit One Visa due date entirely, you can always ask customer service to waive the late fee by calling 877-825-3242. This...

Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may still incur late fees.

You can ask the creditor ? either the original creditor or a debt collector ? for what's called a ?goodwill deletion.? Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage.

With so much on your mind, a credit card or loan payment can easily get missed. A debt is considered past due when you miss making a payment by the due date.

If you don't pay on time, you might not be able to use your card for new purchases until your account is current. When a credit card account goes 180 days?a full six months?past due, the credit card issuer must close and charge off the account.

Even if you repay overdue bills, the late payment won't fall off your credit report until after seven years. And no matter how late your payment is, say 30 days versus 60 days, it will still take seven years to drop off.

Remember: Accurately reported late payments can't be removed from your credit reports. And you can't pay someone else to remove accurate information from your reports either. But late payments will fall off your credit reports after seven years.