Sample Letter for Response to Inquiry - Mortgage Company

Description Inquiry Letter Template

How to fill out Letter Inquiry?

Among lots of free and paid samples that you can get on the internet, you can't be certain about their reliability. For example, who created them or if they are qualified enough to deal with what you require these to. Keep calm and utilize US Legal Forms! Find Sample Letter for Response to Inquiry - Mortgage Company samples developed by professional lawyers and avoid the costly and time-consuming procedure of looking for an lawyer or attorney and then paying them to write a papers for you that you can easily find on your own.

If you already have a subscription, log in to your account and find the Download button next to the form you are searching for. You'll also be able to access your earlier acquired templates in the My Forms menu.

If you are utilizing our service the first time, follow the tips listed below to get your Sample Letter for Response to Inquiry - Mortgage Company fast:

- Make certain that the document you discover is valid where you live.

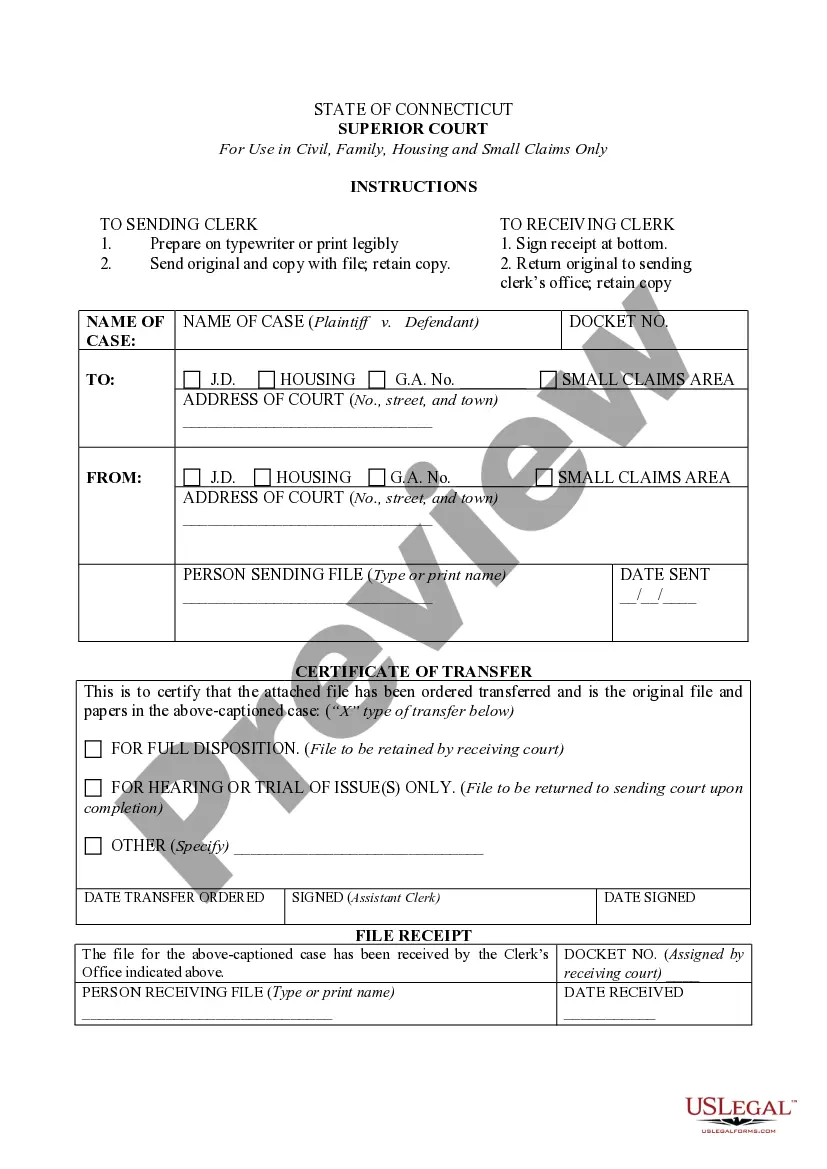

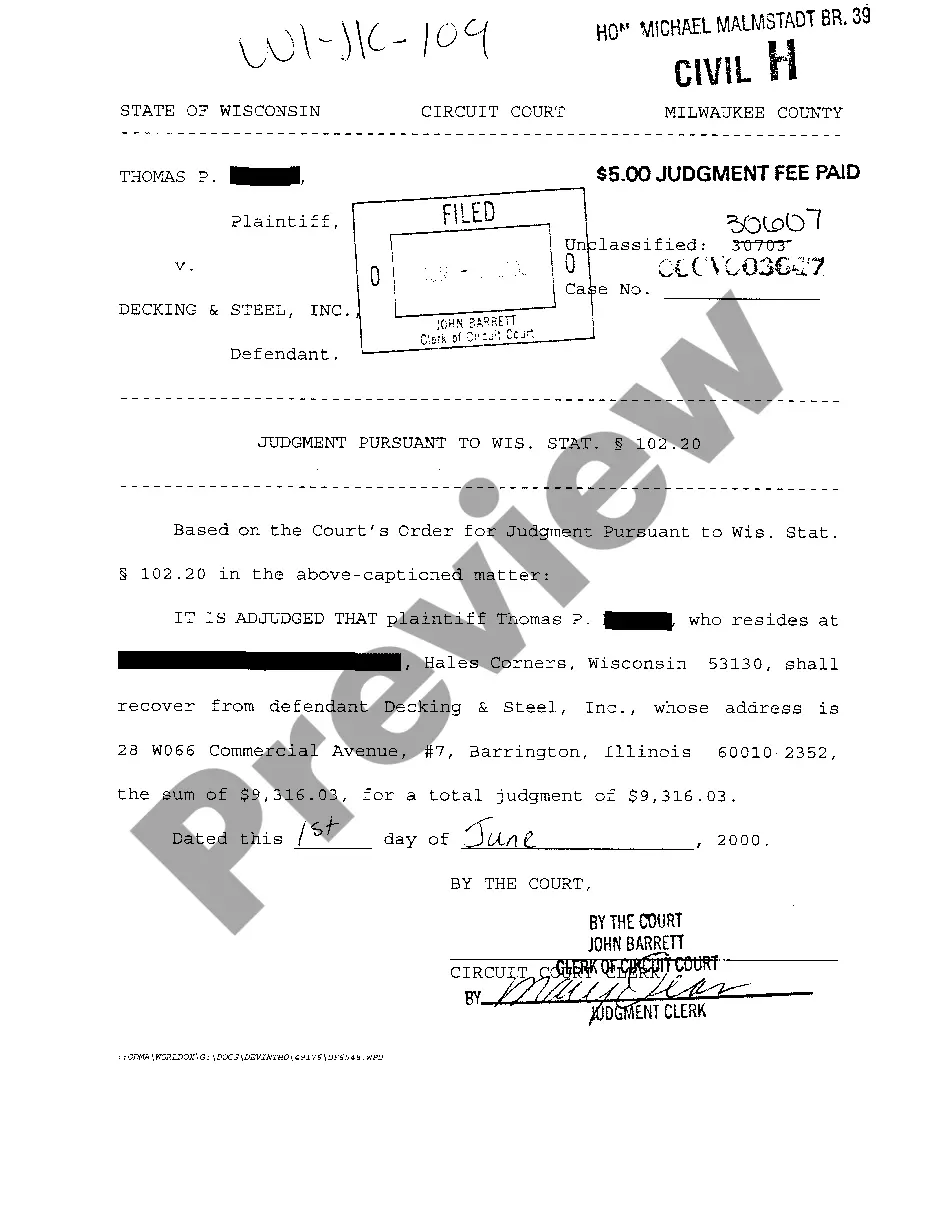

- Review the template by reading the description for using the Preview function.

- Click Buy Now to begin the ordering process or look for another example utilizing the Search field in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

As soon as you have signed up and paid for your subscription, you can utilize your Sample Letter for Response to Inquiry - Mortgage Company as many times as you need or for as long as it remains valid in your state. Edit it with your preferred editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

How To Reply Explanation Letter Form popularity

Reply Of Explanation Letter Other Form Names

Letter Inquiry Blank FAQ

Give precise details of the situation or circumstances. Describe the facts that resulted in the current situation. Be truthful so that you may not find yourself in a difficult position. Provide supporting documents if they are available. Describe what you will do to make the correction.

The key to writing a great letter of explanation is to keep it short, simple and informative. Be clear and write with as much detail as you can since someone else will need to understand your situation. Avoid including irrelevant information or answers to questions the underwriter didn't ask.

Inquiries tell other creditors that you are thinking of taking on new debt. An inquiry typically has a small, but negative, impact on your credit score. Inquiries are a necessary part of applying for a mortgage, so you can't avoid them altogether.

The Inquiry letter is used to explain all credit inquiries in the last 120 days. When the lender pulls credit OR when credit is automatically pulled at borrower submission. Notes:If they do, then Blend will treat those 2 or 3 inquiries as the same and only request one single inquiry from the borrower.

Give precise details of the situation or circumstances. Describe the facts that resulted in the current situation. Be truthful so that you may not find yourself in a difficult position. Provide supporting documents if they are available. Describe what you will do to make the correction.

An underwriter may request a letter of explanation from you if they're unsure about something they see.They might simply need clarification or more information about your credit report or bank statement. Letters of explanation are requirements from secondary authorities that own or back the loan in many cases.

Typically, hard inquiries occur when lenders look at your credit report after you have applied for credit. A hard inquiry often has a negative effect on your credit score. Lenders may do a hard inquiry when you request a preapproval or submit a formal application as you are mortgage shopping.

To send a credit inquiry removal letter, you should contact any credit reporting agency that is reporting the inquiry. Credit inquiry removal letters can be sent to both the credit reporting agencies and the lender who issued the credit inquiry.

If the borrower had six or more months in job gaps, then they need to be with a full-time job for at least six months to qualify for a mortgage loan. If the borrower had gaps in employment for less than six months, then they can qualify for a mortgage with a new full-time job.