Sample Letter to Union Pension Administrator regarding Request for Plan Description

Description

Key Concepts & Definitions

Understanding key terms such as pension plan information, union pension benefits, and employee retirement plans is crucial for efficient communication with your union pension administrator. A pension administrator manages the day-to-day operations and compliance of pension plans. Personal pension administrator suggests a more individualized contact within larger pension management systems, often seen in unionized environments.

Step-by-Step Guide: Writing a Sample Letter to a Union Pension Administrator

- Gather Necessary Information: Compile details about your pension plan, including any personal identification and plan member numbers.

- Clear Purpose: Specify whether the communication is a name change request, seeking pension plan information, or a benefit preapproval application.

- Draft the Letter: Address it directly to your personal pension administrator, stating the matter clearly and providing all necessary financial credit information or related details.

- Review and Send: Double-check for any errors, ensure that the tone is professional and courteous, then mail or email the letter as per your plan's communication preference.

Risk Analysis

When requesting information or making changes to your union pension benefits, inaccuracies in the request or miscommunication due to unclear letter formatting can lead to delays or misinformation. Ensuring that you have provided all required information and have followed up appropriately mitigates these risks.

Best Practices

- Clarity and Conciseness: Clearly state your request or inquiry to avoid any misunderstandings and speed up the processing time.

- Include All Relevant Information: Depending on your request, include related keywords and exact information like real estate contracts data if it influences your pension results.

- Professional Tone: Maintain a formal, respectful tone throughout the letter to ensure professional communication.

Common Mistakes & How to Avoid Them

- Omitting Member Information: Always include your full member identification details to avoid delays in processing your query or request.

- Vague Language: Be explicit about what you are requesting, whether it's a request for plan description or a name change request. Specificity saves time and effort for both parties.

FAQ

- What should I include in a letter to a union pension administrator? Include your member ID, specific request, all necessary personal and financial information, and a clear statement of purpose.

- How often can I update my information with the pension administrator? While it may vary by plan, typically updates can be made annually or as significant life events occur, such as marriage or relocation.

How to fill out Sample Letter To Union Pension Administrator Regarding Request For Plan Description?

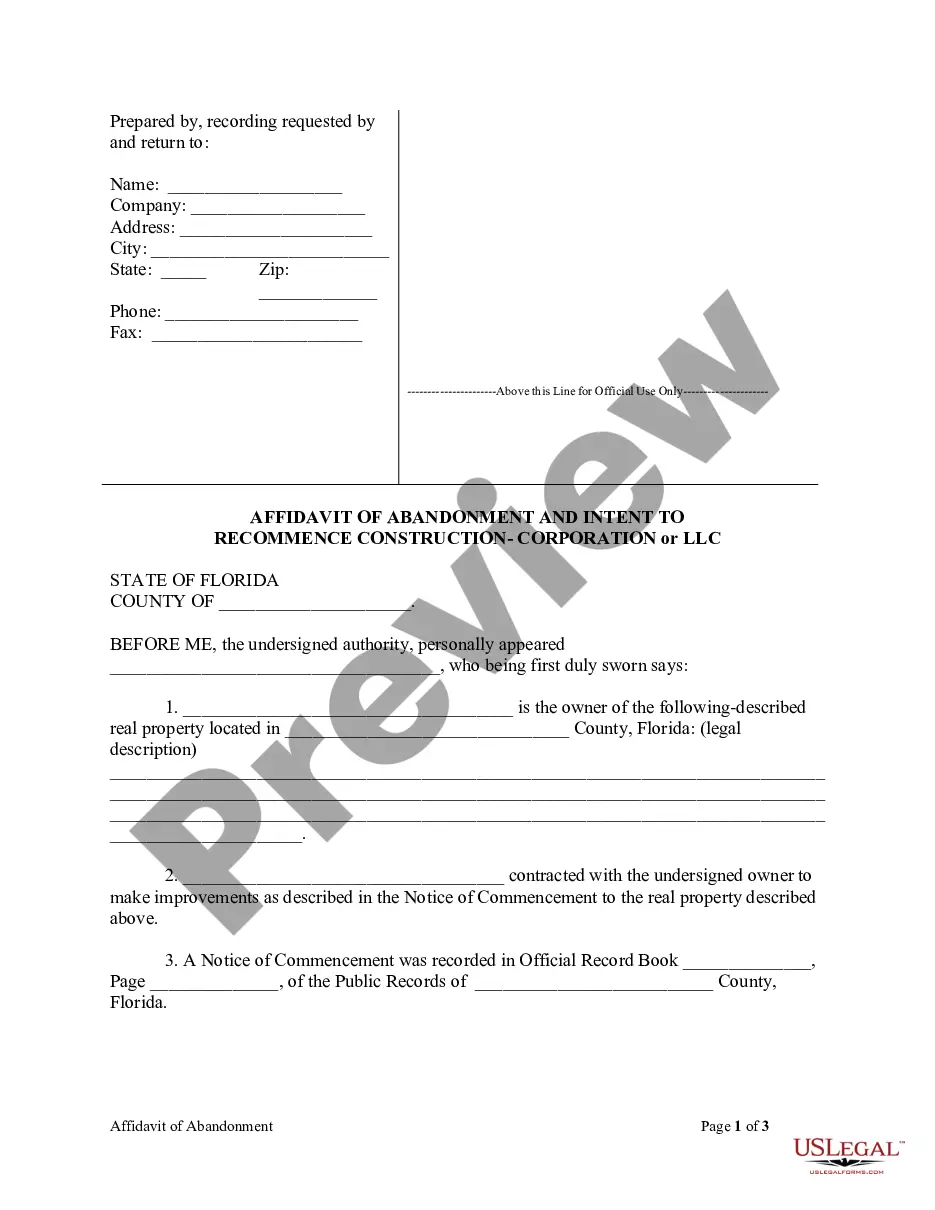

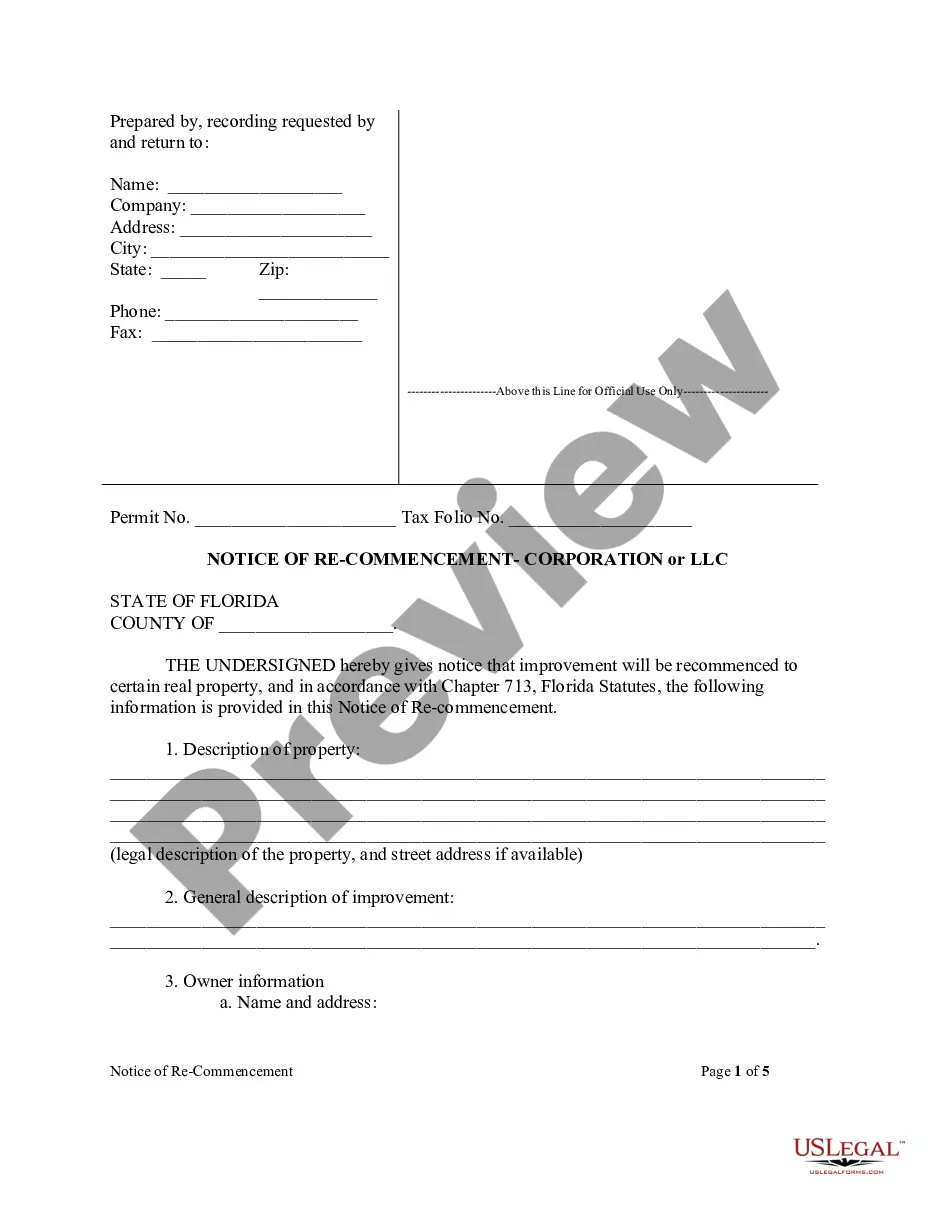

Use US Legal Forms to obtain a printable Sample Letter to Union Pension Administrator regarding Request for Plan Description. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most extensive Forms library online and provides cost-effective and accurate samples for consumers and attorneys, and SMBs. The templates are grouped into state-based categories and some of them might be previewed before being downloaded.

To download templates, customers must have a subscription and to log in to their account. Hit Download next to any template you need and find it in My Forms.

For individuals who do not have a subscription, follow the following guidelines to quickly find and download Sample Letter to Union Pension Administrator regarding Request for Plan Description:

- Check to ensure that you get the right template in relation to the state it is needed in.

- Review the document by looking through the description and using the Preview feature.

- Hit Buy Now if it’s the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it many times.

- Use the Search field if you need to get another document template.

US Legal Forms provides thousands of legal and tax templates and packages for business and personal needs, including Sample Letter to Union Pension Administrator regarding Request for Plan Description. Above three million users have utilized our service successfully. Select your subscription plan and get high-quality documents within a few clicks.

Form popularity

FAQ

Step 1 Gathering Information. Step 2 Drafting your QDRO. Step 3 Approval By the Other Party. Step 4 Approval by Plan as Draft. Step 5 Signature of QDRO by Judge of the State Divorce Court. Step 6 Obtain a Certified Copy of the QDRO.

Sub: Request for Pension Release (or Gratuity Fund) Respected sir, With due respect, I want to say that my father, (Name), who has been an employee (Job Designation) of your company (Department name) since (Date: DD/MM/YY), passed away (Date) due to serious illness (Cause of death). May God bless his soul in peace.

Explain precisely what your request is. Mention the reason for the request. Use polite language and a professional tone. Demonstrate respect and gratitude to the reader. The content of the letter should be official. You may provide contact information where you can be reached.

Step 1 Gathering Information. Step 2 Drafting your QDRO. Step 3 Approval By the Other Party. Step 4 Approval by Plan as Draft. Step 5 Signature of QDRO by Judge of the State Divorce Court. Step 6 Obtain a Certified Copy of the QDRO.

It is critical to check with the plan administrator for each plan and QDRO, which is done by a QDRO preparer . Attorneys do not typically prepare QDROs, as they are prepared by actuaries and companies specializing in QDROs.

The answer to this question depends on what type of retirement plan is being divided. If it is a defined contribution plan (a 401(k), 457, 403(b) or similar plan), or an IRA, the funds are typically transferred into an account in the alternate payee's name within two to five weeks.

Who determines whether an order is a QDRO? Under Federal law, the administrator of the retirement plan that provides the benefits affected by an order is the individual (or entity) initially responsible for determining whether a domestic relations order is a QDRO.

During divorce proceedings, both parties will identify the assets that need to be divided, including retirement plans. If you're awarded part of your former spouse's retirement account (either through a property settlement or via a judge), the court will issue a QDRO that may have been drafted by your divorce attorney.