Amended Uniform commercial code security agreement

Description Uniform Commercial Code Buy

How to fill out Commercial Code Agreement?

Use the most complete legal library of forms. US Legal Forms is the best platform for finding updated Amended Uniform commercial code security agreement templates. Our platform provides a large number of legal forms drafted by licensed attorneys and sorted by state.

To download a sample from US Legal Forms, users just need to sign up for a free account first. If you are already registered on our platform, log in and select the template you need and purchase it. After purchasing templates, users can see them in the My Forms section.

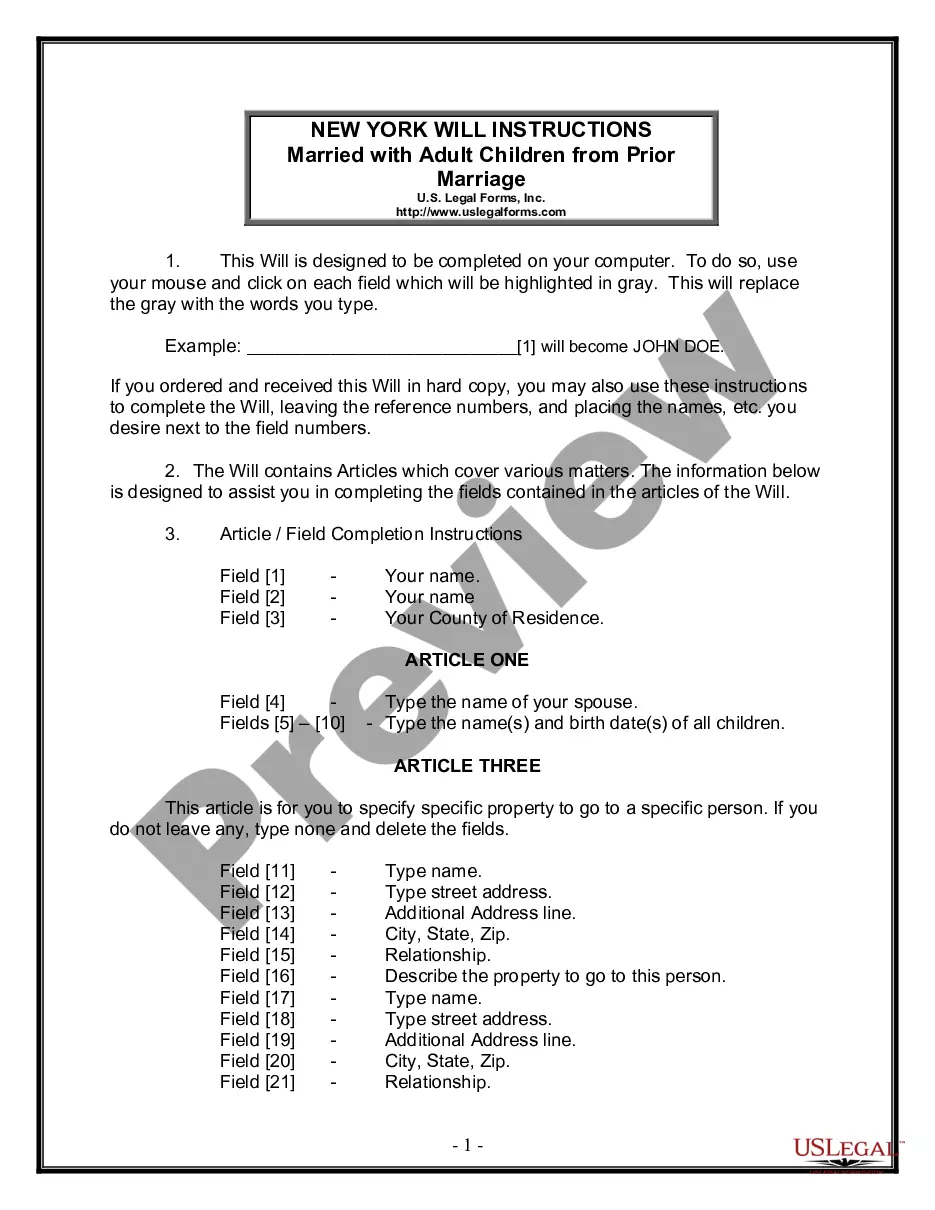

To get a US Legal Forms subscription online, follow the steps listed below:

- Find out if the Form name you’ve found is state-specific and suits your requirements.

- When the template features a Preview function, use it to check the sample.

- In case the sample doesn’t suit you, make use of the search bar to find a better one.

- Hit Buy Now if the sample meets your needs.

- Choose a pricing plan.

- Create your account.

- Pay with the help of PayPal or with the debit/bank card.

- Select a document format and download the template.

- Once it is downloaded, print it and fill it out.

Save your time and effort using our service to find, download, and fill in the Form name. Join thousands of satisfied clients who’re already using US Legal Forms!

Commercial Security Agreement Pdf Form popularity

Amended Security Agreement Other Form Names

Code Security Agreement FAQ

UCC-1 Financing Statements do not have to be signed by either the Debtor or Secured Party; however, they must be authorized.Although the UCC-1 Financing Statement does not require signatures, any attachment such as the legal description or special terms and conditions may require the signature of the Debtor.

Also known as a UCC-3, and, depending on the context, a UCC-3 financing statement amendment, a UCC-3 termination statement, and a UCC-3 continuation statement. Under the Uniform Commercial Code, a UCC-3 is used to continue, assign, terminate, or amend an existing UCC-1 financing statement (UCC-1).

It should be noted that UCC financing statements filed now generally do not contain a grant of the security interest and generally are not signed or otherwise authenticated by the Debtor and therefore would not satisfy the requirement of a security agreement.

As was true under former Article 9 "goods" are defined, in new section 9-102(a)(44), to mean all things that are movable when a security interest attaches, including fixtures, standing timber that is to be cut and removed under a conveyance or contract for sale, the unborn young of animals, crops grown, growing, or to

Having a UCC filed on your business credit report can have negative effects in general on your overall credit risk, scoring and other associated risk analysis, (across all three business credit bureaus) and can even kill your chances at getting financing for your business.

Updated Jun 1, 2020. A UCC-Uniform Commercial Code-1 statement is a legal notice filed by creditors as a way to publicly declare their rights to potentially obtain the personal properties of debtors who default on business loans they extend.

Article 9 is an article under the Uniform Commercial Code (UCC) that governs secured transactions, or those transactions that pair a debt with the creditor's interest in the secured property.

The Uniform Commercial Code (UCC) is a set of business laws that regulate financial contracts and transactions employed across states. The UCC code consists of nine separate articles, each of which covers separate aspects of banking and loans.

The Uniform Commercial Code (UCC) contains rules applying to many types of commercial contracts, including contracts related to the sale of goods, leasing of goods, use of negotiable instruments, banking transactions, letters of credit, documents of title for goods, investment securities, and secured transactions.