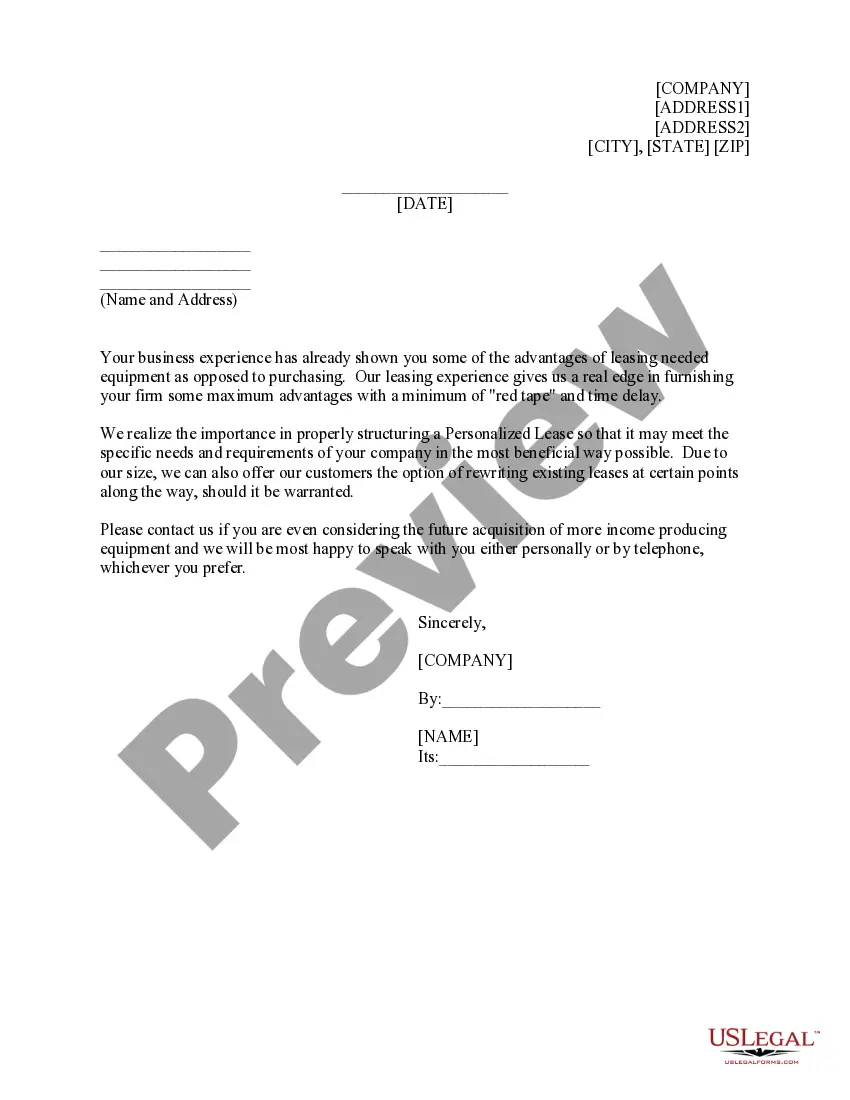

Sales Letter 1, Equipment Leasing

Description

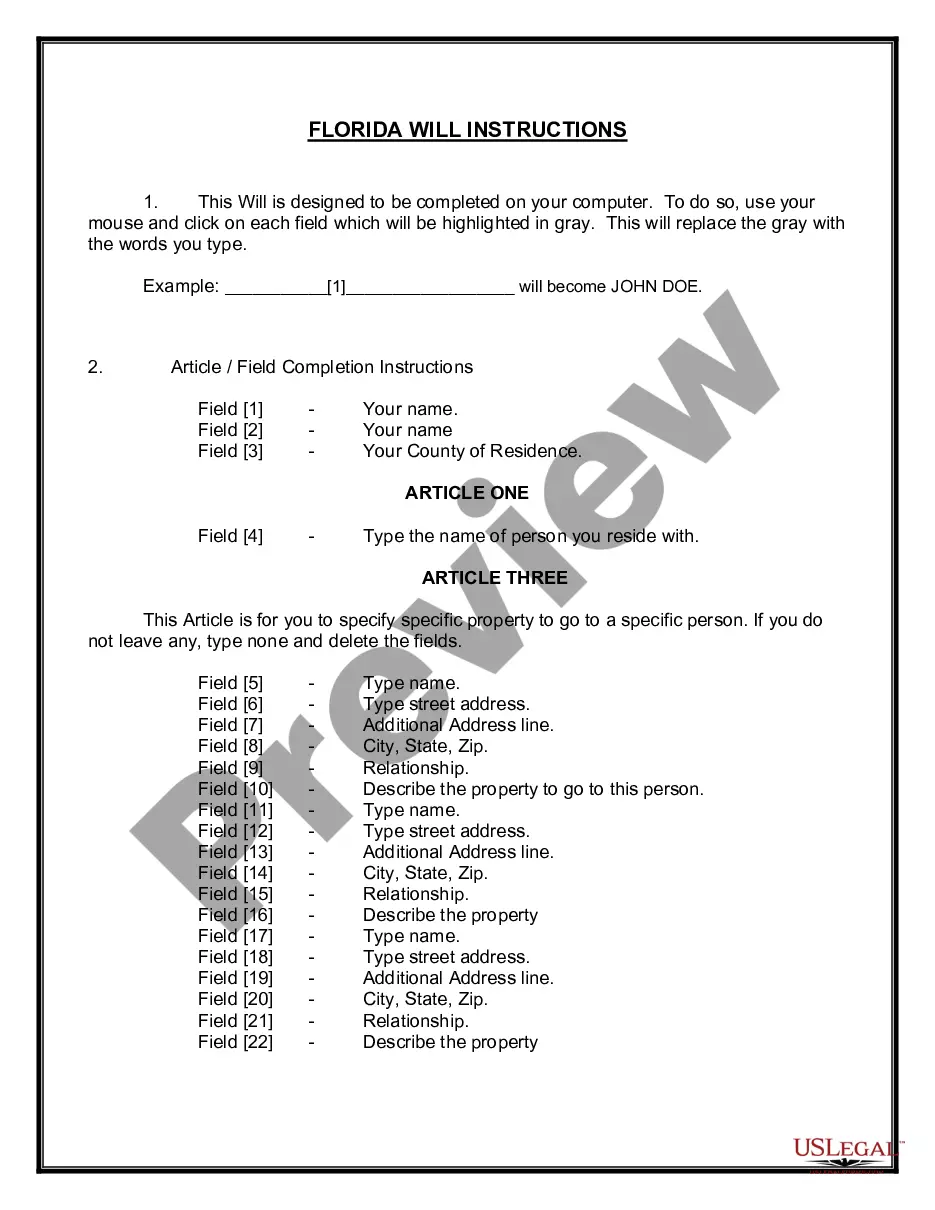

How to fill out Sales Letter 1, Equipment Leasing?

How much time and resources do you typically spend on composing official documentation? There’s a greater opportunity to get such forms than hiring legal specialists or spending hours browsing the web for a suitable template. US Legal Forms is the premier online library that offers professionally designed and verified state-specific legal documents for any purpose, such as the Sales Letter 1, Equipment Leasing.

To obtain and prepare a suitable Sales Letter 1, Equipment Leasing template, adhere to these easy steps:

- Examine the form content to make sure it complies with your state laws. To do so, check the form description or utilize the Preview option.

- If your legal template doesn’t meet your needs, locate another one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the Sales Letter 1, Equipment Leasing. Otherwise, proceed to the next steps.

- Click Buy now once you find the correct blank. Opt for the subscription plan that suits you best to access our library’s full opportunities.

- Register for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is absolutely secure for that.

- Download your Sales Letter 1, Equipment Leasing on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously downloaded documents that you safely store in your profile in the My Forms tab. Obtain them anytime and re-complete your paperwork as often as you need.

Save time and effort completing legal paperwork with US Legal Forms, one of the most trusted web services. Sign up for us today!

Form popularity

FAQ

There are two primary types of equipment leases: operating leases and financial leases.

Under ASC 842, leases containing a purchase option are accounted for as finance leases if the lease contains a purchase option the lessee is reasonably certain to exercise. Additionally, a title transfer at the end of a lease, designates the lease as finance.

The lessee records the leased right as an item of property, plant, and equipment, which is then depreciated over its useful life to the lessee. The lessee must also record a liability reflecting the obligation to make continuing payments under the lease agreement, similar to the accounting for a note payable.

The equipment account in the balance sheet is debited by the present value of the minimum lease payments, and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year.

Unlike an outright purchase or equipment secured through a standard loan, equipment under an operating lease cannot be listed as capital. It's accounted for as a rental expense. This provides two specific financial advantages: Equipment is not recorded as an asset or liability.

Accounting for an Operating Lease Click on the Create icon ?. In the Other column, choose Journal Entry. Add the relevant asset account for Operating Lease- Right-of-Use asset. Debit the present value of your lease payments. Choose the applicable liability account and input the present value of your lease payments.

Three Effective Ways to Open a Sales Letter Ask a question ? A good question is immediately reader involving; it provokes thought and will draw the reader into your message.If I could show you a way to slash your health insurance costs by 40% ? and still get top-quality care?would you be interested?