Sample Letter for Collection

Description

How to fill out Sample Letter For Collection?

Use US Legal Forms to get a printable Sample Letter for Collection. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most comprehensive Forms library on the internet and offers reasonably priced and accurate samples for consumers and legal professionals, and SMBs. The documents are categorized into state-based categories and many of them might be previewed before being downloaded.

To download samples, customers need to have a subscription and to log in to their account. Hit Download next to any template you need and find it in My Forms.

For people who do not have a subscription, follow the tips below to easily find and download Sample Letter for Collection:

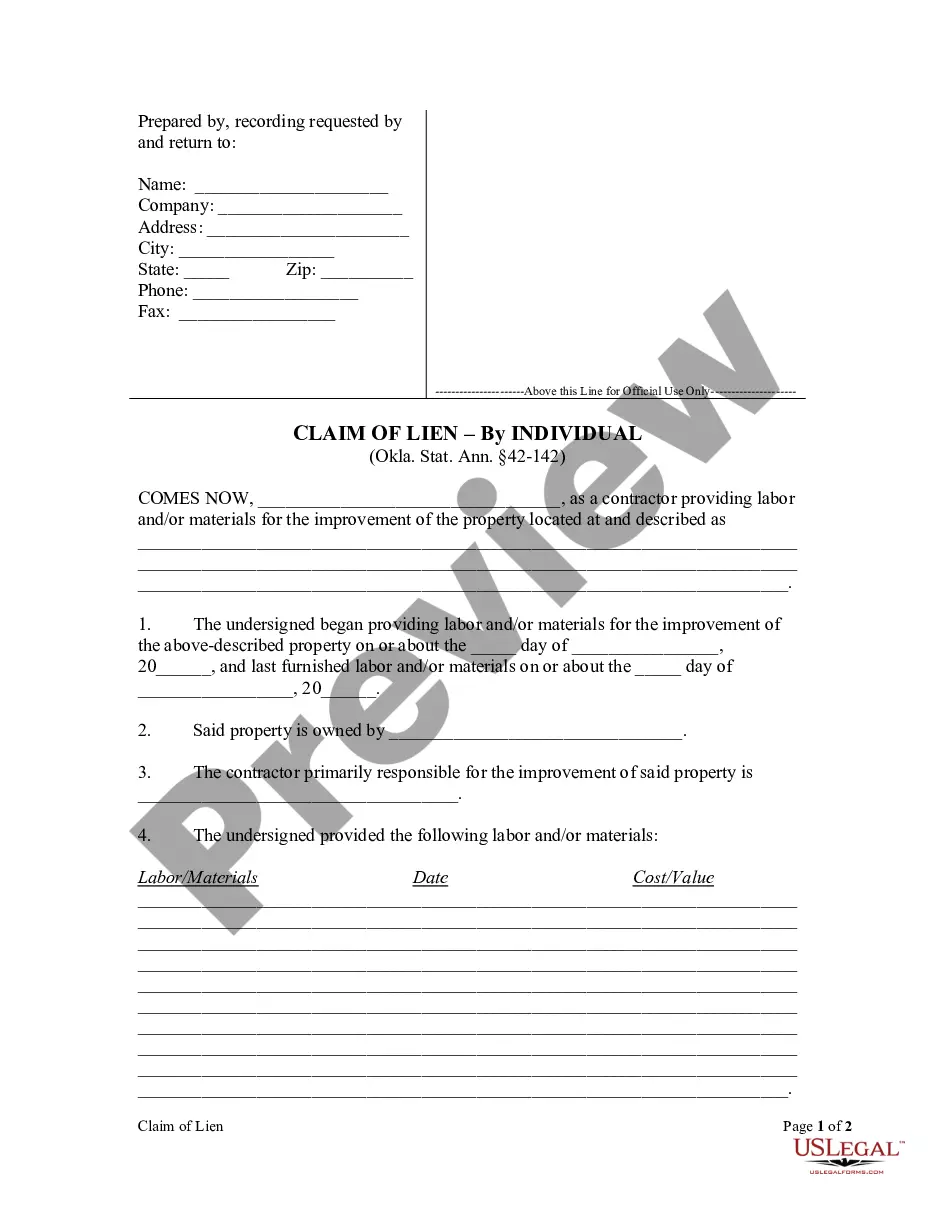

- Check to make sure you get the correct template with regards to the state it is needed in.

- Review the document by looking through the description and using the Preview feature.

- Press Buy Now if it is the document you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it multiple times.

- Make use of the Search engine if you need to get another document template.

US Legal Forms offers a large number of legal and tax templates and packages for business and personal needs, including Sample Letter for Collection. Above three million users already have used our service successfully. Select your subscription plan and obtain high-quality forms in just a few clicks.

Form popularity

FAQ

This is not a good time. Please call back at 6. I don't believe I owe this debt. Can you send information on it? I prefer to pay the original creditor. Give me your address so I can send you a cease and desist letter. My employer does not allow me to take these calls at work.

Reference the products or services that were purchased. Make it very clear what you did for your client and how much it costs. Maintain a friendly but firm tone. Remind the payee of their contract or agreement with you. Offer multiple ways the payee can take action. Add a personal touch. Give them a new deadline.

The debt dispute letter should include your personal identifying information; verification of the amount of debt owed; the name of the creditor for the debt; and a request that the debt not be reported to credit reporting agencies until the matter is resolved or have it removed from the report, if it already has been

Mention of all previous attempts to collect. Invoice number and amount. Original invoice due date. Current days past due. Instructions on what they should do next. A warning of the impending consequences.

Know What to Include A demand letter should include the name of the creditor, the amount owed, action required, debt reference, deadline, and the consequences. Ensure you include all these details so your letter is not only compliant with the FDCPA, but also practical.

Your full name and address. The collections agency's name and address. A request for the amount of the debt claimed to be owed. A request for the name of the original creditor. A request for the judgment information (if applicable) A request for proof of the company's license.

Days past due. Amount due. Note previous attempts to collect. Summary of account. Instructions- what would you like them to do next? Due date for payment- it is important to use an actually date, not in the next 7 business days as this can be vauge.

If you pay the collection agency directly, the debt is removed from your credit report in six years from the date of payment. If you don't pay, it purges six years from the last activity date, but you may be at risk for wage garnishment.

Creditors do not have to respond to every debt verification letter sent to them. Under the FDCPA, if a collector contacts you about a debt, you have 30 days to request validation. If you send a verification request within that time, the creditor is legally obligated to respond to you.