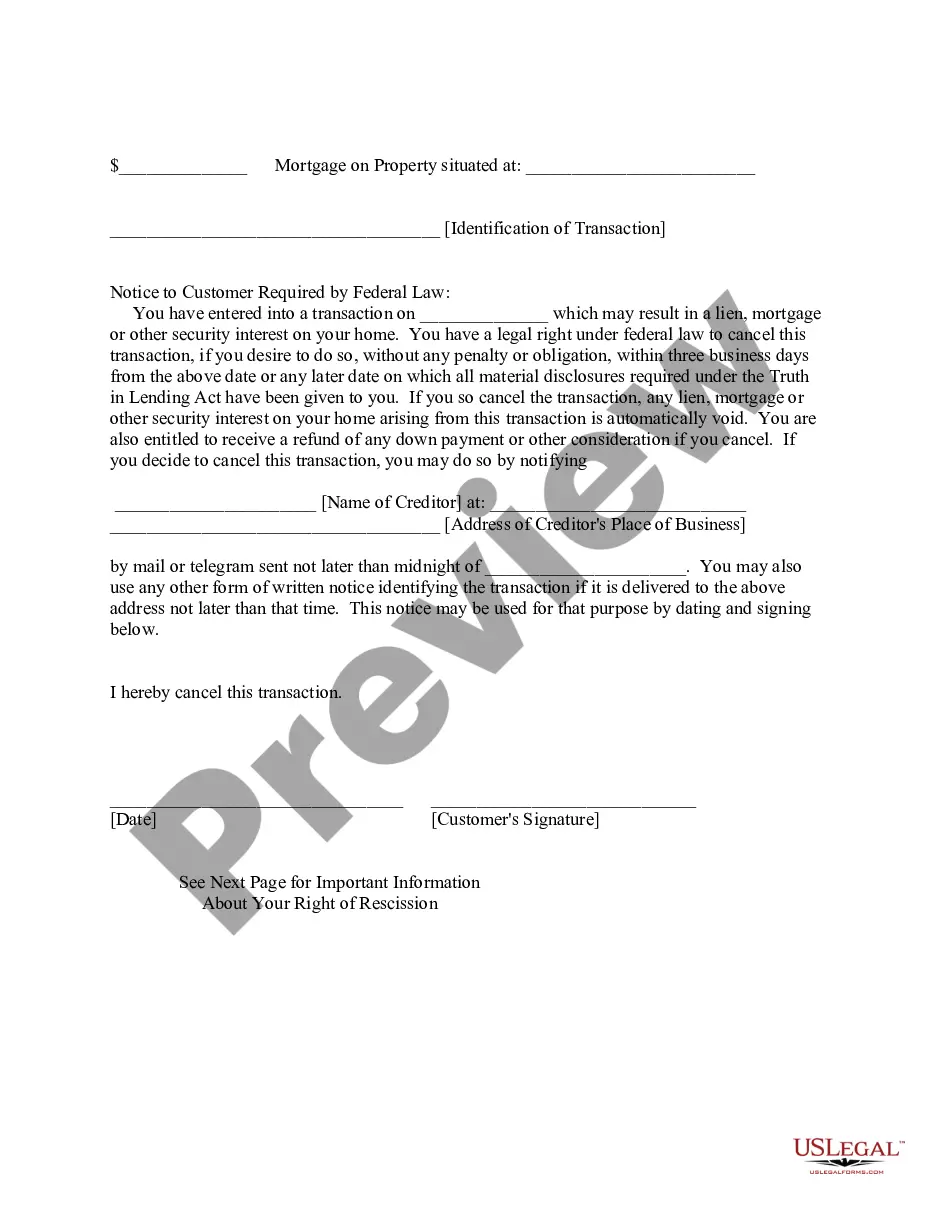

A Notice of Right of Rescission is a document informing an individual or business that they have the right to cancel a contract or agreement. It is typically used in consumer finance. It is required by the Truth in Lending Act, which provides consumer protection from deceptive practices in credit transactions. This notice informs borrowers of their right to cancel certain types of loan transactions within three days of signing the contract. There are two types of Notice of Right of Rescission. The first is used for residential mortgages and refinances, and the second is used for home equity lines of credit. A Notice of Right of Rescission must include the name of the lender, the borrower’s name, the date the contract was signed, the address of the property, the amount of the loan, and the date the rescission period ends. It must also provide specific instructions on how to exercise the right of rescission and state any applicable fees or charges associated with the rescission.

Notice of Right of Rescission

Description

What is a Notice of Right of Rescission?

A Notice of Right of Rescission is a legal document that informs a borrower of their right to cancel a financial agreement. This is typically applicable in the United States for certain types of borrowing transactions, such as refinances or home equity loans, allowing the borrower a specified period, usually three business days, to rescind or withdraw from the loan agreement without penalty.

Key Concepts & Definitions

- Rescission Period: The time within which a borrower can rescind a loan agreement, typically three business days following the loan closing.

- Truth in Lending Act (TILA): U.S. federal law designed to promote the informed use of consumer credit, by requiring disclosures about its terms and cost.

- Recision Notice: The physical or digital document that must be given to a borrower, clearly stating their rights under the TILA.

Step-by-Step Guide on How to Exercise Your Right of Rescission

- Review Loan Agreement: Start by reviewing your loan documents thoroughly. Ensure that you have received all the required forms, including the Notice of Right of Rescission.

- Understand Your Rights: Understand the scope and conditions under which you can rescind the agreement.

- Decide to Rescind: Decide whether you wish to cancel your loan during the rescission period.

- Notify Lender: Send a written notice to your lender stating your intent to rescind. Ensure it is delivered within the three-day period.

- Keep Documentation: Keep copies of your rescission notice and any correspondence related to your rescission.

Risk Analysis of Failing to Use Your Right of Rescission

Failing to exercise your right of rescission within the allocated time frame can lead to irreversibility of the loan agreement, potentially resulting in undesired financial commitments and terms. It might affect one's financial stability and credit score if not handled properly.

Best Practices for Effective Use of Your Right of Rescission

To effectively utilize your right of rescission, act swiftly and decisively. Send all communications via certified mail with return receipt requested for proof of dispatch and receipt within the three-day period. Consult with a legal or financial adviser to ensure full compliance and understanding of your rights and responsibilities.

Common Mistakes & How to Avoid Them

- Ignoring Timeline: One common mistake is not sending the rescission notice within the three-day period. Always check the dates carefully.

- Insufficient Documentation: Failing to keep copies of all communications and documentation pertaining to the rescission notice can be problematic. Always keep detailed records.

- Verbal Communication: Relying on verbal communication for rescission. Rescission should be executed in writing.

How to fill out Notice Of Right Of Rescission?

How much time and resources do you typically spend on composing official documentation? There’s a better option to get such forms than hiring legal experts or wasting hours searching the web for an appropriate blank. US Legal Forms is the premier online library that provides professionally drafted and verified state-specific legal documents for any purpose, including the Notice of Right of Rescission.

To acquire and complete a suitable Notice of Right of Rescission blank, adhere to these simple steps:

- Look through the form content to ensure it complies with your state laws. To do so, read the form description or take advantage of the Preview option.

- If your legal template doesn’t satisfy your needs, locate another one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Notice of Right of Rescission. Otherwise, proceed to the next steps.

- Click Buy now once you find the right document. Select the subscription plan that suits you best to access our library’s full opportunities.

- Create an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is totally secure for that.

- Download your Notice of Right of Rescission on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously purchased documents that you securely store in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as often as you need.

Save time and effort preparing legal paperwork with US Legal Forms, one of the most trusted web services. Sign up for us today!

Form popularity

FAQ

But in some instances, you actually have the ability to cancel the loan within a certain period of time. Here's what you need to know. The right of rescission is a legal right to cancel a contract (aka rescind) certain types of loans within a specified period of time without being financially penalized.

Recession of Contract ing to section 75, the party who rescinds has the right to receive damages or compensation for that. For example, A promises B to buy his goods on 3rd January at the price of 3000, but B failed to deliver the goods on the specified date.

The Basic Law of the Right to Rescind See California Civil Code §1689 Rescission extinguishes the contract, terminates further liability on the agreement, and restores the parties to their former positions. This generally requires each party to return any consideration received prior to the rescission.

Established by the Truth in Lending Act (TILA) under U.S. federal law, the right of rescission allows a borrower to cancel a home equity loan, home equity line of credit (HELOC), or refinance with a new lender, other than with the current mortgagee, within three days of closing.

The right of rescission refers to the right of a consumer to cancel certain types of loans. If you are refinancing a mortgage, and you want to rescind (cancel) your mortgage contract; the three-day clock does not start until. You sign the credit contract (usually known as the Promissory Note)

What Loans Have a Right of Rescission? The right of rescission applies only to certain types of home loans: home refinancing, home equity loans, home equity lines of credit (HELOCs) and some reverse mortgages. You can't, for instance, cancel a contract on a new home purchase.

One common example of a rescission in the United States is known as the 3-Day Right of Rescission. The right gives borrowers and loan refinance customers extra time to carefully consider their decisions.

There are two kinds of rescission, namely rescission in equity and rescission de futuro. Also referred to as rescission ab initio, i.e., from the beginning, rescission in equity works by rolling back the contract to the initial state of affairs, before the parties in question accepted the terms of the contract.