Sample Letter to Beneficiaries regarding Trust Money

Description Rights Of Trust Beneficiaries

How to fill out Letter Beneficiaries Regarding Trust?

Use US Legal Forms to get a printable Sample Letter to Beneficiaries regarding Trust Money. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most complete Forms library on the internet and offers reasonably priced and accurate samples for customers and legal professionals, and SMBs. The templates are categorized into state-based categories and some of them can be previewed prior to being downloaded.

To download samples, customers must have a subscription and to log in to their account. Click Download next to any form you need and find it in My Forms.

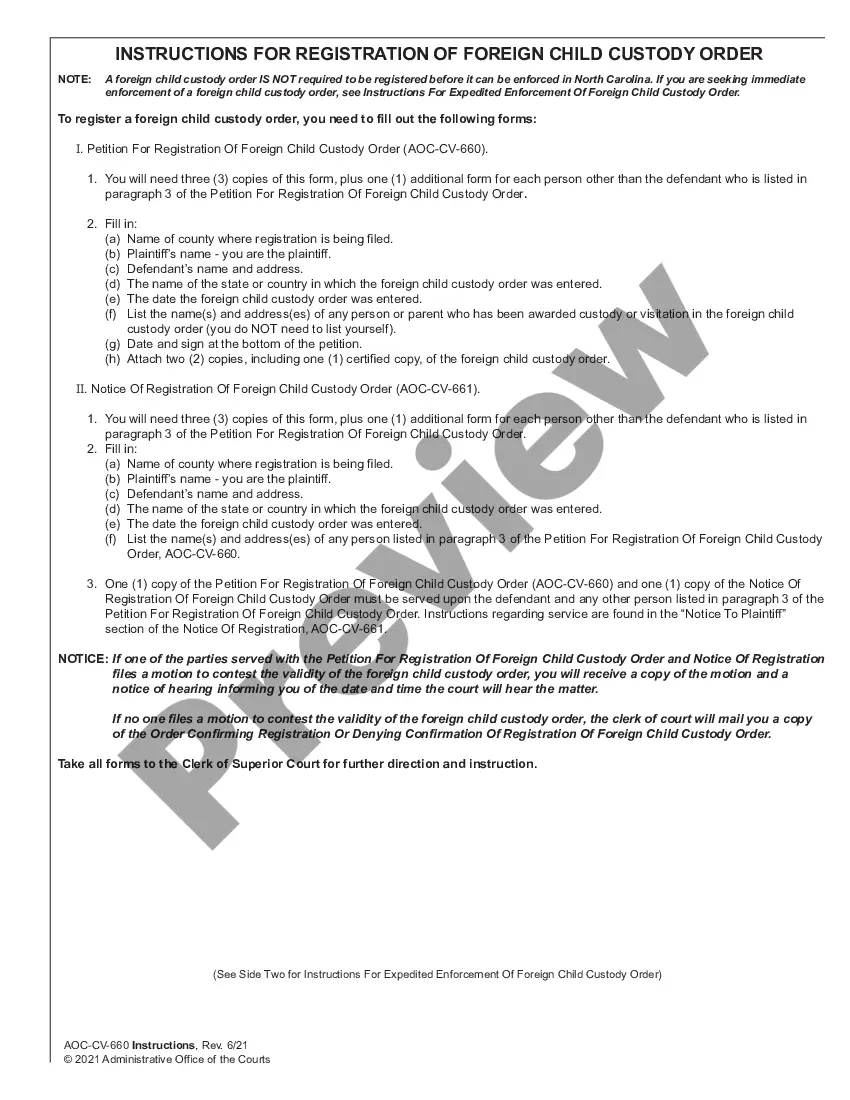

For people who do not have a subscription, follow the tips below to quickly find and download Sample Letter to Beneficiaries regarding Trust Money:

- Check to ensure that you have the correct template in relation to the state it is needed in.

- Review the document by reading the description and using the Preview feature.

- Press Buy Now if it is the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it multiple times.

- Use the Search engine if you want to find another document template.

US Legal Forms offers thousands of legal and tax templates and packages for business and personal needs, including Sample Letter to Beneficiaries regarding Trust Money. More than three million users have already utilized our platform successfully. Select your subscription plan and obtain high-quality forms within a few clicks.

Letter To Beneficiary Notification Form popularity

Beneficiaries Regarding Trust Other Form Names

Beneficiaries Trust Account FAQ

The short answer to the question, Can you withdraw cash from a trust account? is Yes, but there are some caveats.If you have created a revocable trust and have appointed someone else as trustee, you will have to request the cash withdrawal from the person you appointed as the trustee.

Identify yourself as a beneficiary of the irrevocable trust in the body of the letter. State that you are requesting money from the trust, and the reason for the request. Include supporting documentation. For example, if you are requesting money to pay medical bills, enclose copies of the bills.

A trustee has a duty to report and account to the trust beneficiaries. If you are a trust beneficiary, you have a right to information about the trust, your interest in the trust, and the various assets of the trust and how they are being administered, invested and distributed.

Generally speaking, a letter of intent, also known as a side letter is a letter from the grantor to the trustee that provides guidance to the trustee in the exercise of some discretionary power.

There are three main ways for a beneficiary to receive an inheritance from a trust: Outright distributions. Staggered distributions. Discretionary distributions.

Give the letter a personal touch and address each of your heirs and beneficiaries personally. Tell them any last wishes you may have or any hopes you have for their future. Write as clearly as possible. Use specific details and avoid using shorthand.

Most Trusts take 12 months to 18 months to settle and distribute assets to the beneficiaries and heirs. What determines how long a Trustee takes will depend on the complexity of the estate where properties and other assets may have to be bought or sold before distribution to the Beneficiaries.

On headed paper. Addressed personally to the named contact for the funding body. Short and to the point. Keep your letter to two sides of A4. Written in plain language. Do not use jargon or abbreviations. Signed by a member of your group who can be contacted for further information.

If you inherit from a simple trust, you must report and pay taxes on the money. By definition, anything you receive from a simple trust is income earned by it during that tax year.Any portion of the money that derives from the trust's capital gains is capital income, and this is taxable to the trust.