Sample Letter to Foreclosure Attorney - Fair Debt Collection - Failure to Provide Notice

Description

How to fill out Sample Letter To Foreclosure Attorney - Fair Debt Collection - Failure To Provide Notice?

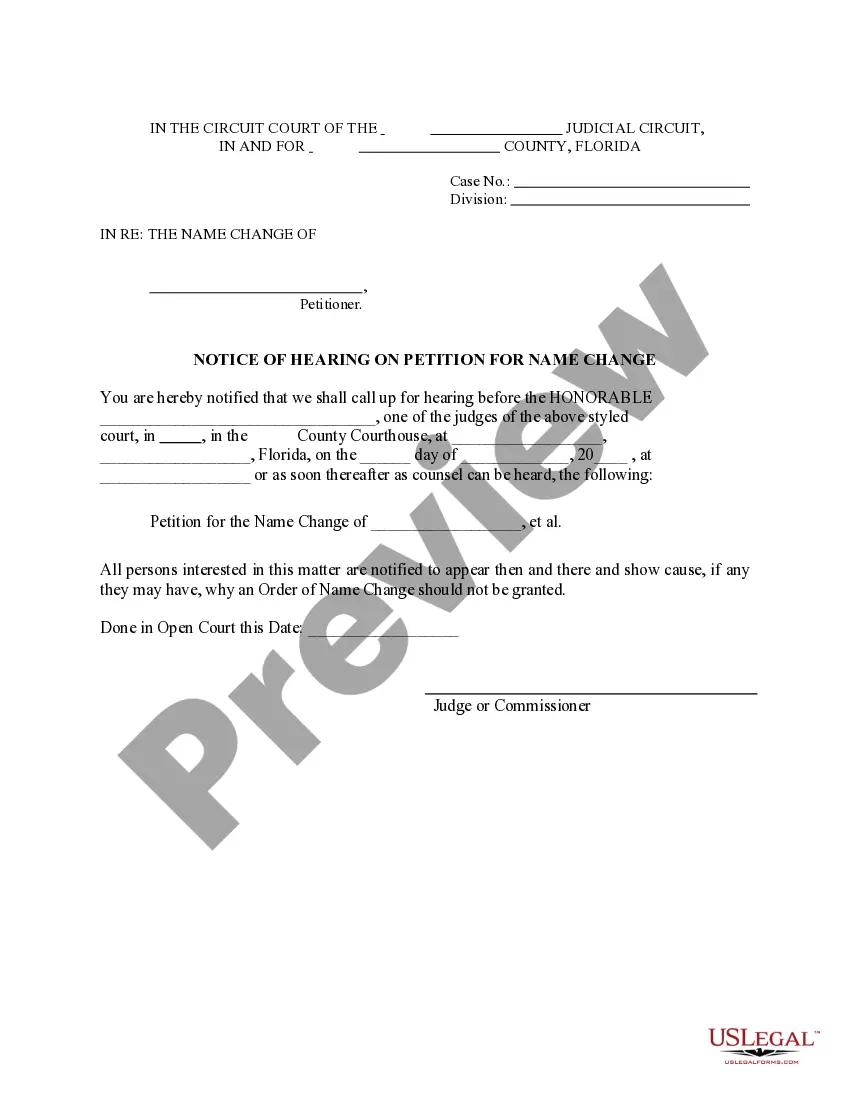

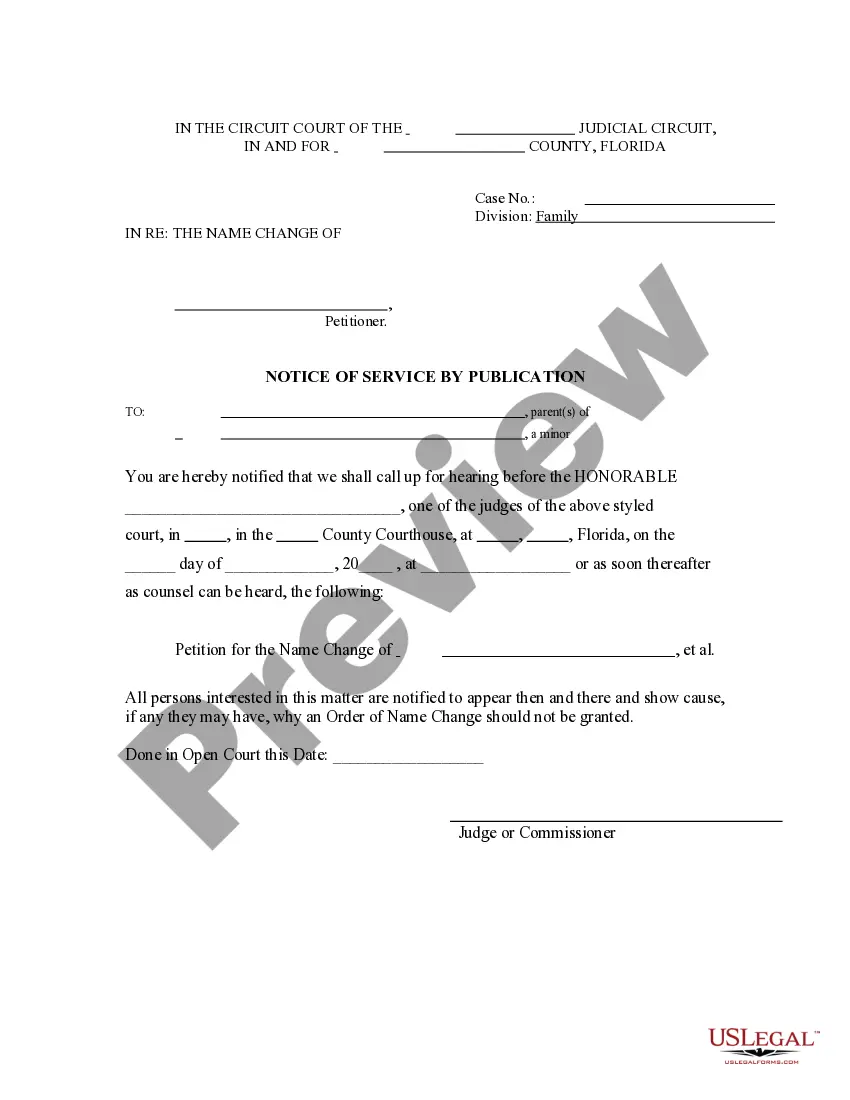

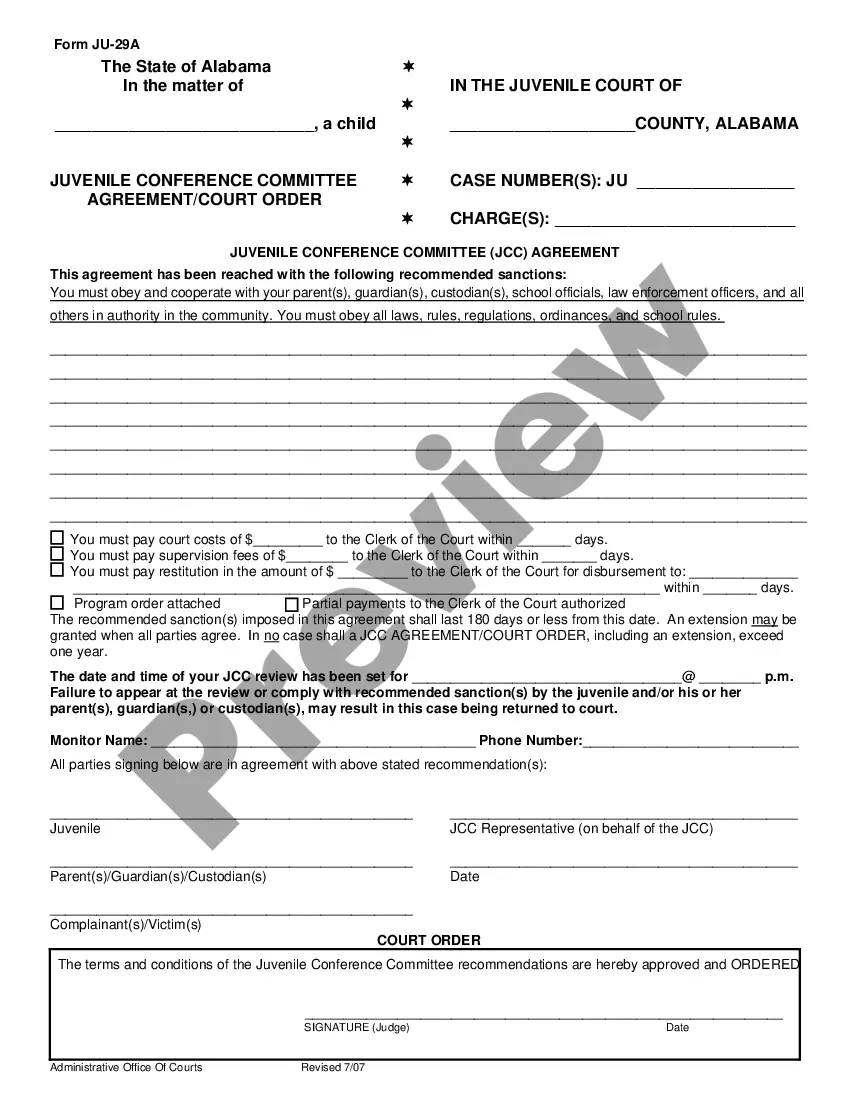

Use US Legal Forms to get a printable Sample Letter to Foreclosure Attorney - Fair Debt Collection - Failure to Provide Notice. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most extensive Forms library online and offers reasonably priced and accurate samples for customers and lawyers, and SMBs. The documents are grouped into state-based categories and many of them might be previewed before being downloaded.

To download templates, users must have a subscription and to log in to their account. Press Download next to any form you want and find it in My Forms.

For those who don’t have a subscription, follow the following guidelines to quickly find and download Sample Letter to Foreclosure Attorney - Fair Debt Collection - Failure to Provide Notice:

- Check out to make sure you have the correct form with regards to the state it is needed in.

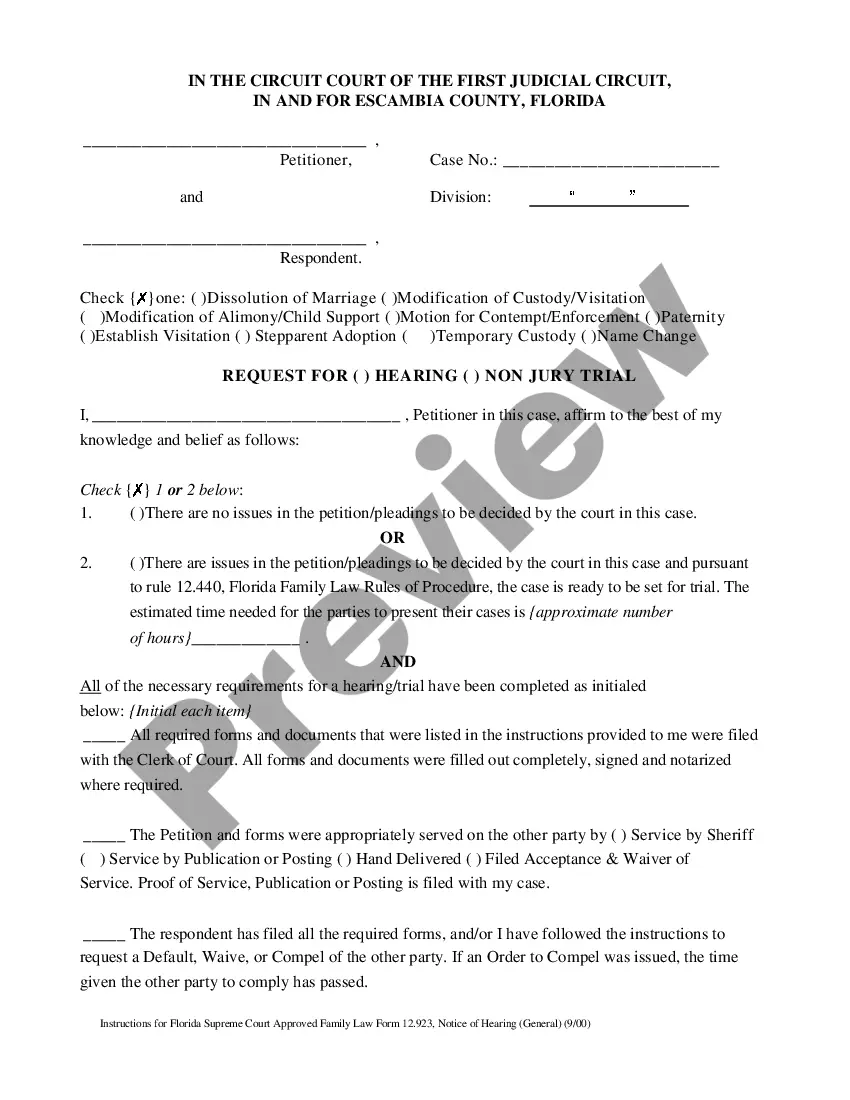

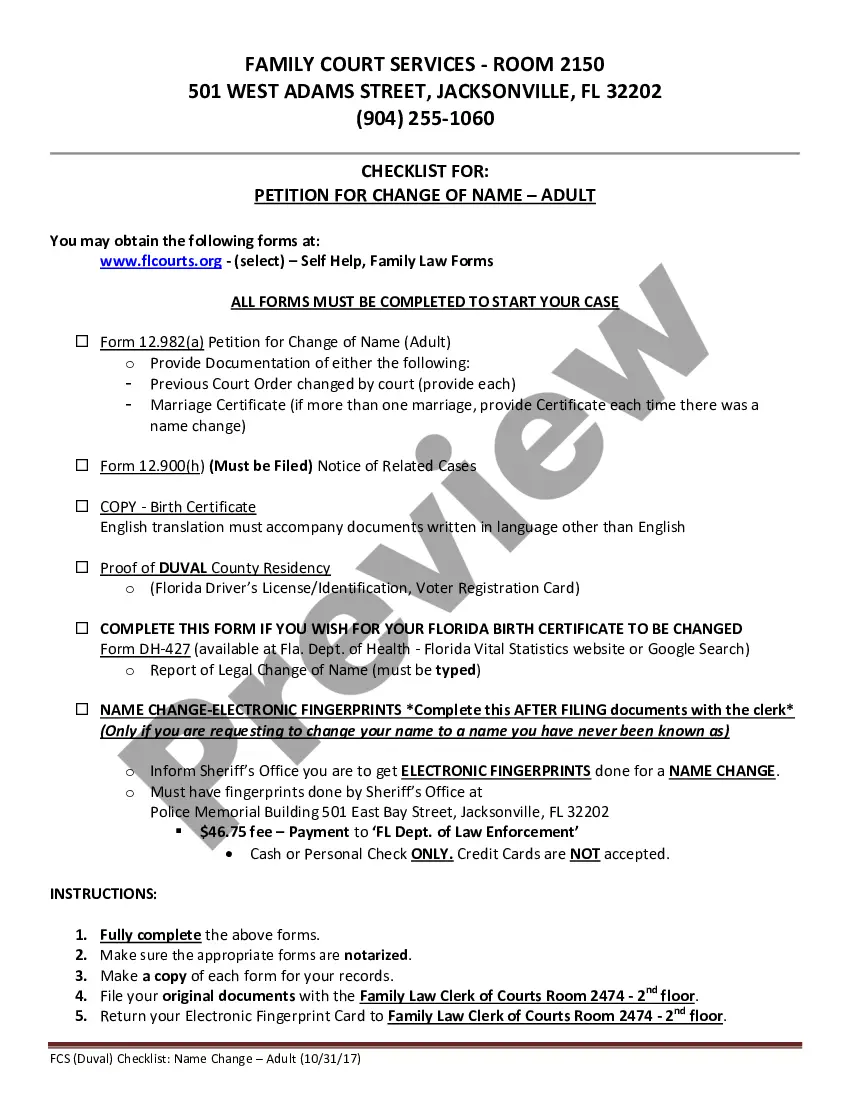

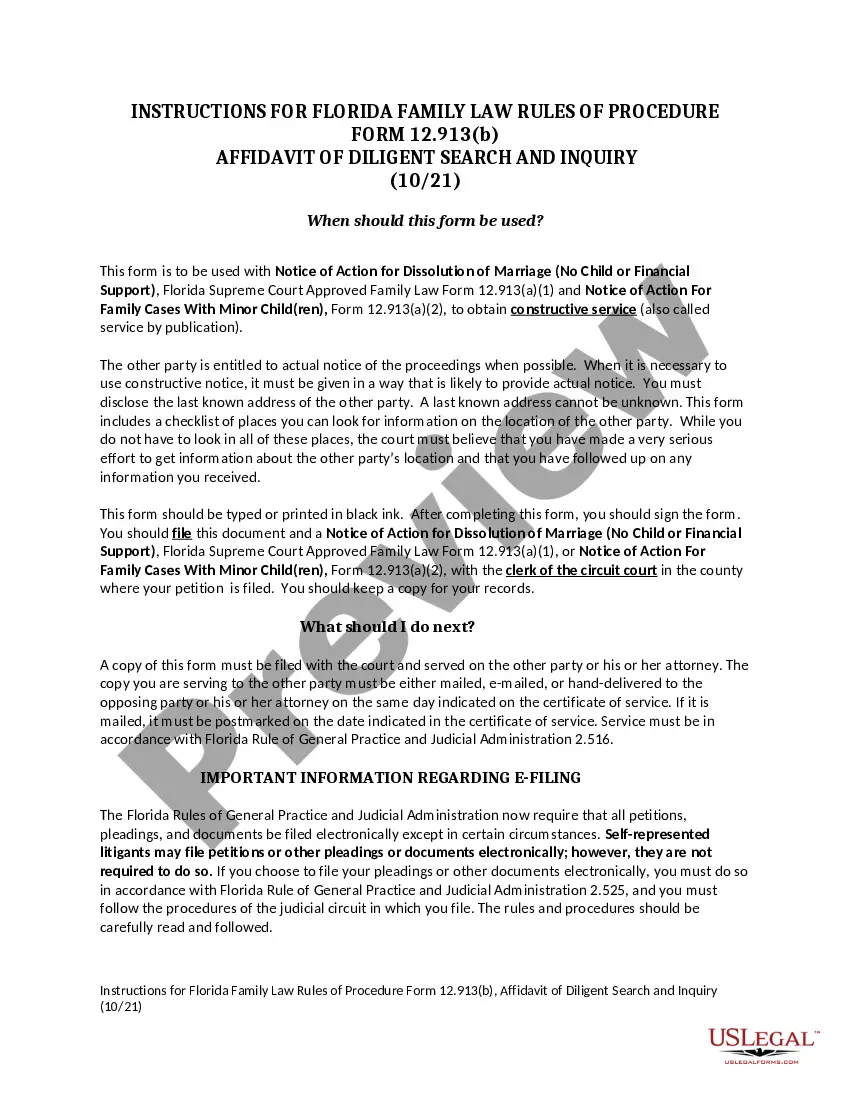

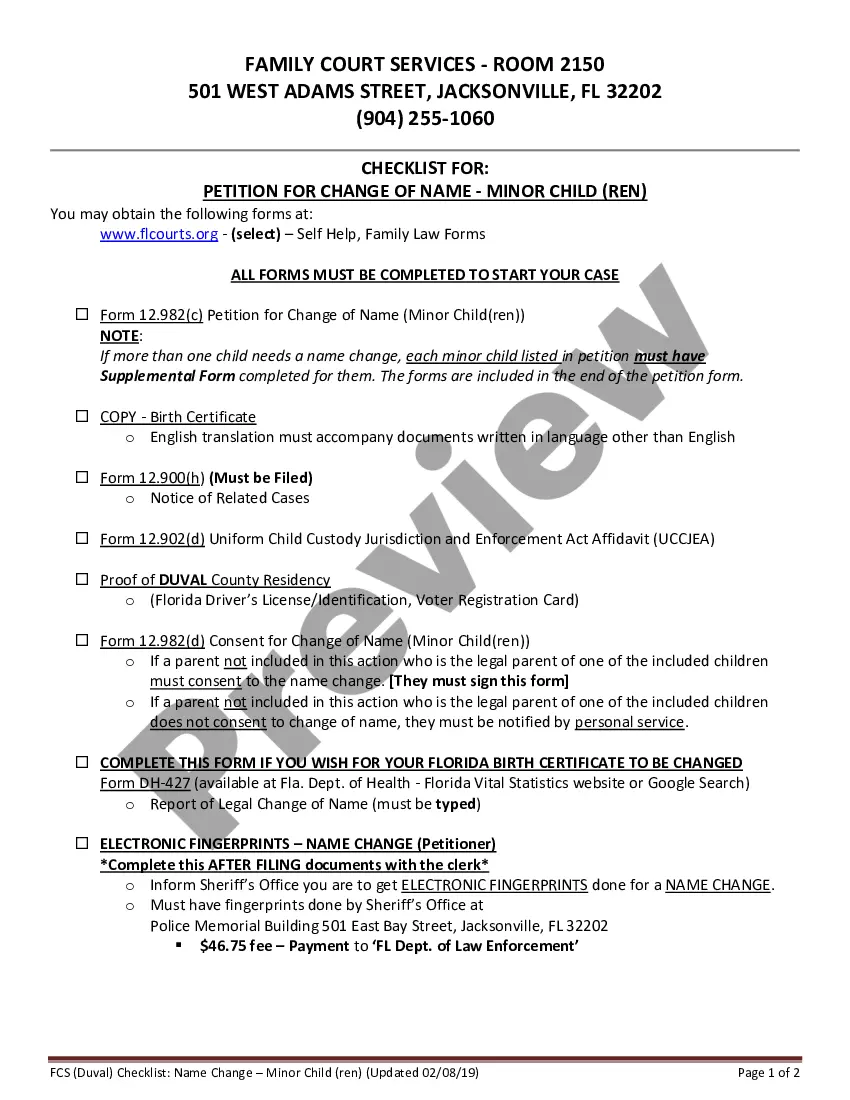

- Review the form by reading the description and using the Preview feature.

- Press Buy Now if it’s the document you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Make use of the Search engine if you want to get another document template.

US Legal Forms provides thousands of legal and tax templates and packages for business and personal needs, including Sample Letter to Foreclosure Attorney - Fair Debt Collection - Failure to Provide Notice. More than three million users already have used our service successfully. Select your subscription plan and have high-quality documents in just a few clicks.

Form popularity

FAQ

Debt validation is your federal right granted under the Fair Debt Collection Practices Act (FDCPA). To request debt validation, you must send a written request to the debt collector within 30 days of being contacted by the collection agency.

The FDCPA gives you a set period of time to dispute debts with collection agencies, but you can still request a debt validation after 30 days.

Under the Fair Debt collection Practices Act (FDCPA), I have the right to request validation of the debt you say I owe you. I am requesting proof that I am indeed the party you are asking to pay this debt, and there is some contractual obligation that is binding on me to pay this debt.

A debt validation letter can be an effective tool for dealing with debt collectors.

You have the right to force the debt collector to prove you owe the money. Debt validation is your federal right granted under the Fair Debt Collection Practices Act (FDCPA). To request debt validation, you must send a written request to the debt collector within 30 days of being contacted by the collection agency.

It's a violation of the collection practices act for a debt collector to refuse to send a validation notice or fail to respond to your verification letter. If you encounter such behavior, you can file a complaint with the Consumer Financial Protection Bureau.

Fair Debt Collection Practices Act (FDCPA) Validation Letter The Fair Debt Collection Practices Act (FDCPA) is a federal law that protects consumers from abusive collection practices by debt collectors and collection agencies.

You have the right to force the debt collector to prove you owe the money. Debt validation is your federal right granted under the Fair Debt Collection Practices Act (FDCPA). To request debt validation, you must send a written request to the debt collector within 30 days of being contacted by the collection agency.

Debt collectors are legally required to send you a debt validation letter, which outlines what the debt is, how much you owe and other information. If you're still uncertain about the debt you're being asked to pay, you can send the debt collector a debt verification letter requesting more information.