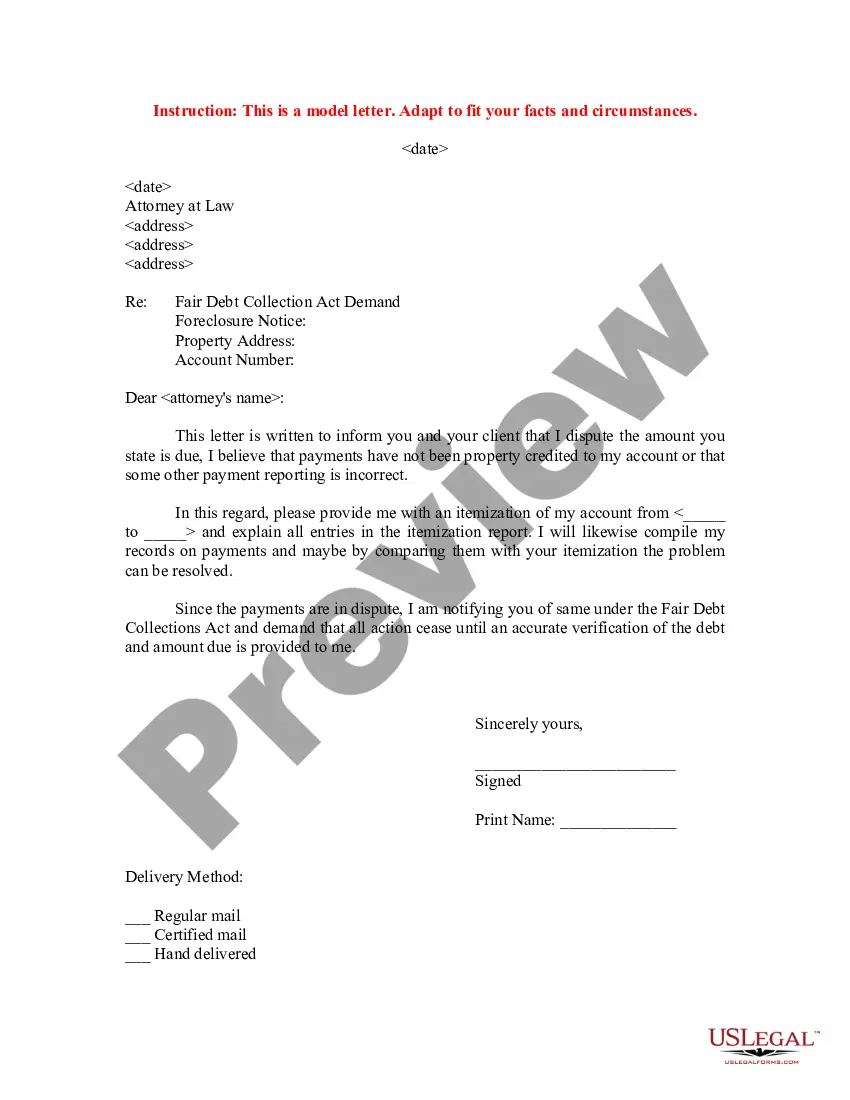

Sample Letter to Foreclosure Attorney - Payment Dispute

Description

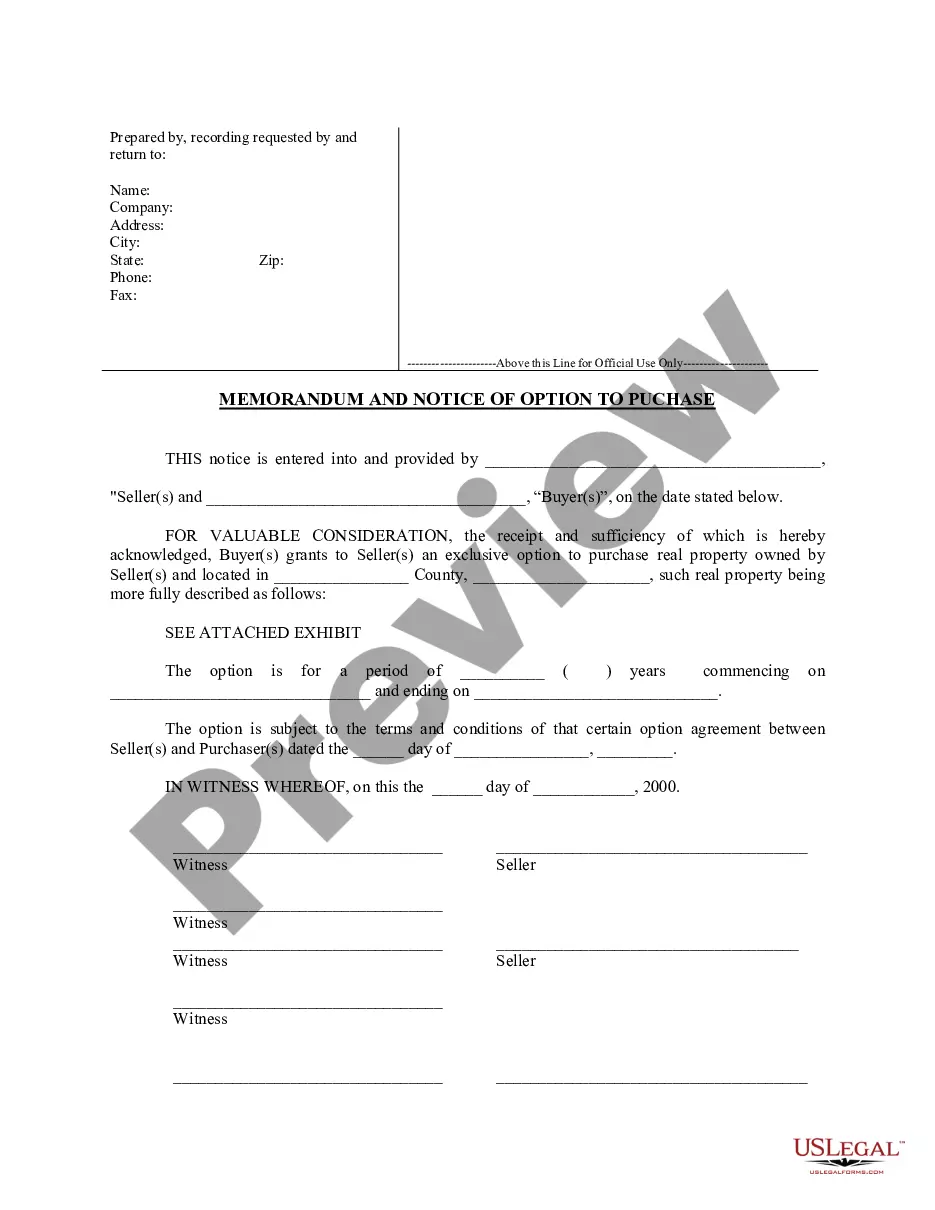

How to fill out Sample Letter To Foreclosure Attorney - Payment Dispute?

Use US Legal Forms to obtain a printable Sample Letter to Foreclosure Attorney - Payment Dispute. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most comprehensive Forms catalogue on the internet and offers affordable and accurate templates for customers and attorneys, and SMBs. The documents are categorized into state-based categories and a few of them can be previewed prior to being downloaded.

To download templates, customers need to have a subscription and to log in to their account. Press Download next to any template you need and find it in My Forms.

For individuals who don’t have a subscription, follow the following guidelines to easily find and download Sample Letter to Foreclosure Attorney - Payment Dispute:

- Check out to make sure you get the correct template with regards to the state it’s needed in.

- Review the document by looking through the description and by using the Preview feature.

- Hit Buy Now if it is the document you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it multiple times.

- Make use of the Search field if you want to get another document template.

US Legal Forms provides thousands of legal and tax templates and packages for business and personal needs, including Sample Letter to Foreclosure Attorney - Payment Dispute. More than three million users have utilized our service successfully. Select your subscription plan and obtain high-quality documents within a few clicks.

Form popularity

FAQ

A hardship letter should Start by stating the purpose of the letter whether it is a loan modification or a short sale so the lender knows what homeowners want. It should say something like I need to restructure my mortgage and obtain a lower, fixed interest rate2026, in a way that force them to find out why.

Financial hardship typically refers to a situation in which a person cannot keep up with debt payments and bills or if the amount you need to pay each month is more than the amount you earn, due to a circumstance beyond your control.

Some of the most common types of hardship are: job loss, pay reduction, underemployment, declining business revenue, death of a coborrower, illness, injury, and divorce.

I am writing to dispute a billing error in the amount of $______ on my account. The amount is inaccurate because describe the problem. I am requesting that the error be corrected, that any finance and other charges related to the disputed amount be credited as well, and that I receive an accurate statement.

Tell the Story. Your letter should start with an introduction of who you are and what kind of loan you are applying for. Lead into your story with something like "We want to explain our foreclosure from six years ago." Then, launch right into the details that led you to lose your home.

Your name, address, phone number and account number. The type of debt resolution you're seeking. Your financial situation that has caused you to fall behind in your payments. A detailed budget and your plan for making payments (if you want to keep your home)

Hardship Examples. There are a variety of situations that may qualify as a hardship. Keep it original. Be honest. Keep it concise. Don't cast blame or shirk responsibility. Don't use jargon or fancy words. Keep your objectives in mind. Provide the creditor an action plan.