Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse

Description

How to fill out Deed Conveying Condominium Unit To Charity With Reservation Of Life Tenancy In Donor And Donor's Spouse?

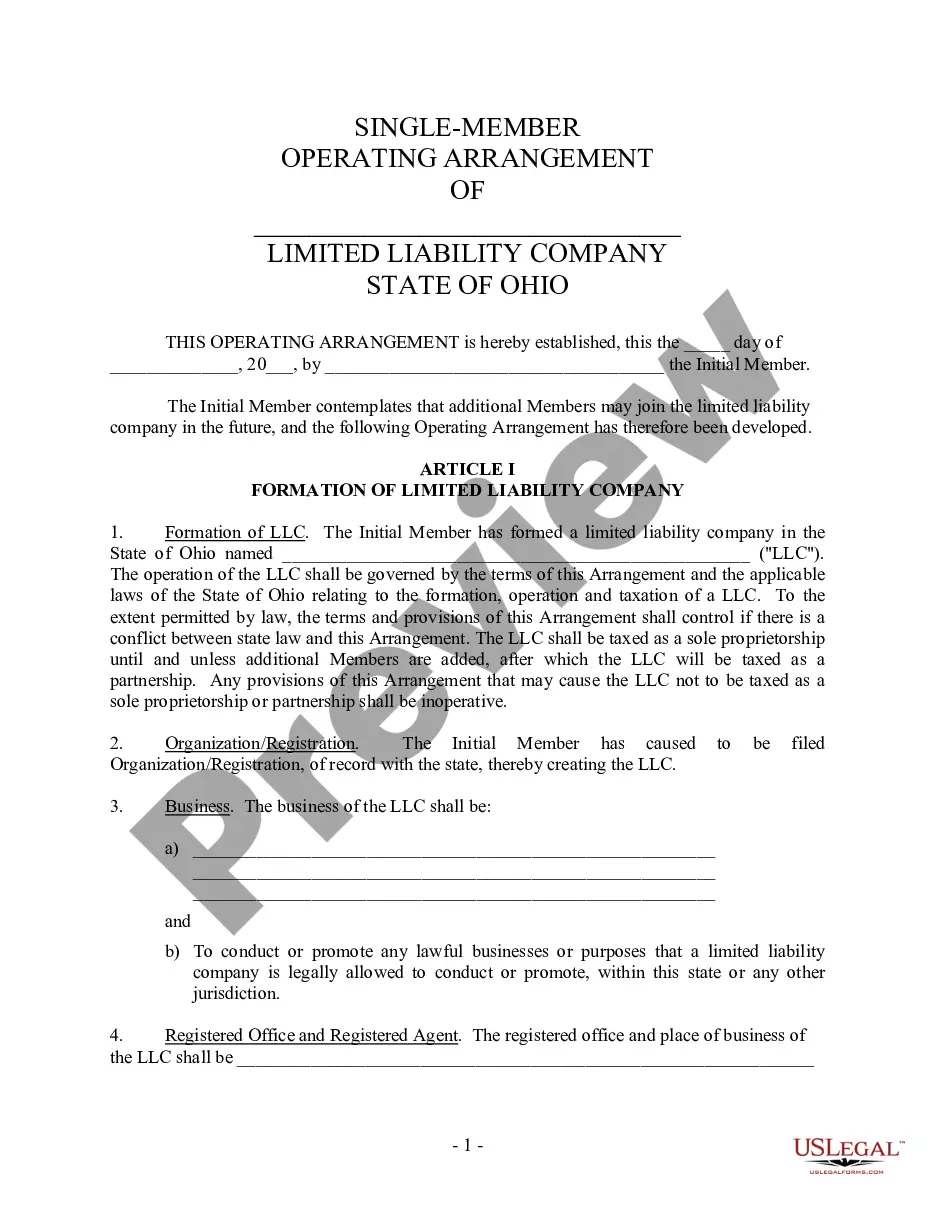

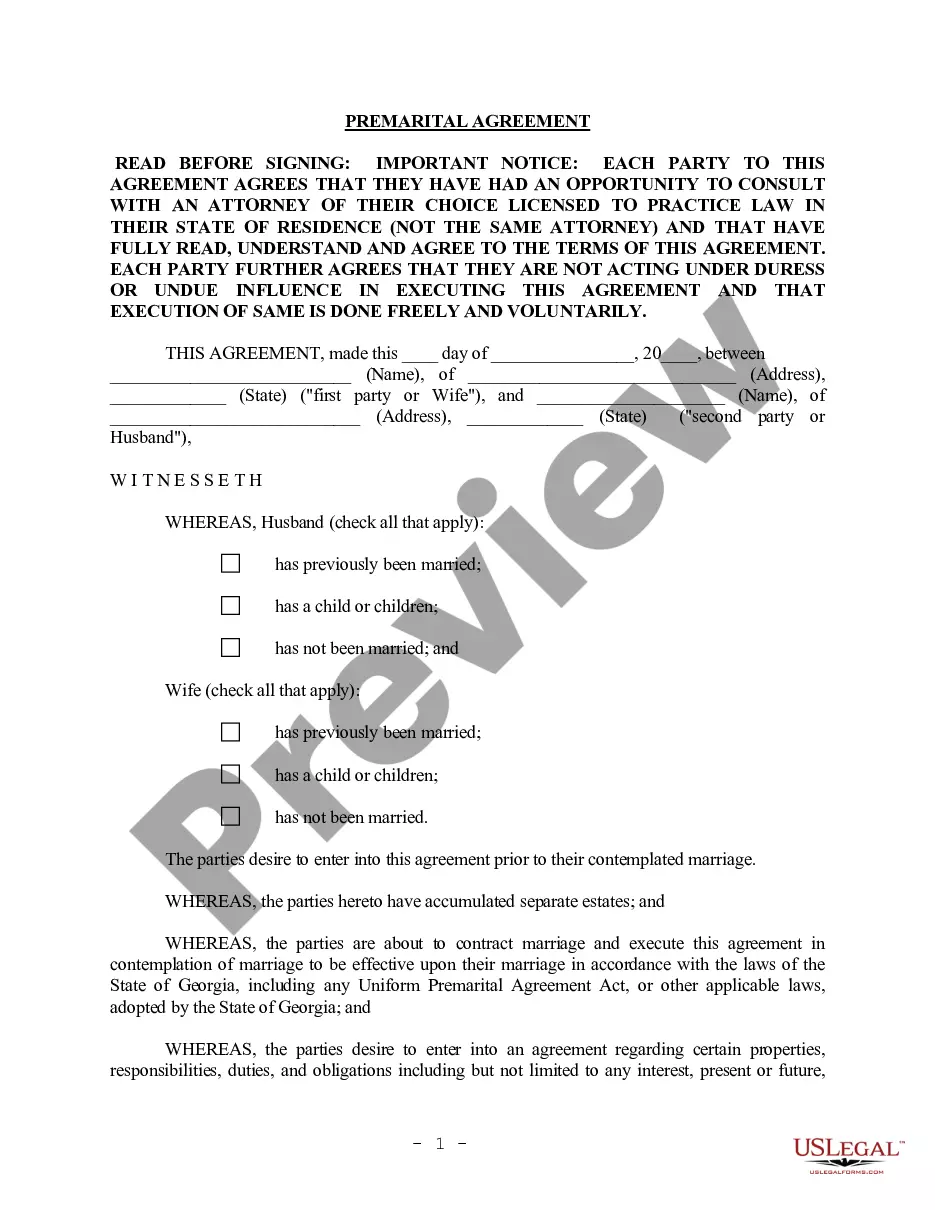

Use the most complete legal library of forms. US Legal Forms is the best place for finding up-to-date Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse templates. Our platform provides a huge number of legal forms drafted by licensed attorneys and categorized by state.

To get a sample from US Legal Forms, users just need to sign up for an account first. If you’re already registered on our platform, log in and choose the document you need and buy it. Right after buying forms, users can find them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the steps below:

- Find out if the Form name you have found is state-specific and suits your needs.

- If the template features a Preview option, utilize it to check the sample.

- In case the sample does not suit you, utilize the search bar to find a better one.

- PressClick Buy Now if the sample corresponds to your expections.

- Select a pricing plan.

- Create a free account.

- Pay with the help of PayPal or with the credit/visa or mastercard.

- Select a document format and download the sample.

- When it’s downloaded, print it and fill it out.

Save your effort and time using our service to find, download, and fill out the Form name. Join thousands of satisfied clients who’re already using US Legal Forms!

Form popularity

FAQ

Pursuant to ' 2036(a) of the IRC, the transfer of a residence with a retained life estate permits the transferee of the residence to receive a full step up in his or her cost basis in the premises upon the death of the transferor, to its fair market value on the transferor's date of death.

The cost basis, because it was a gift (not inherited after death) is the same cost basis as it was for your mother. $30,000, plus any capital improvements after her purchase and before it was transferred to you.

When a person (the beneficiary) receives an asset from a giver (the benefactor) after the benefactor dies, the asset often receives a stepped-up basis, which is its market value at the time the benefactor dies (Internal Revenue Code § 1014(a)).

Generally, the writing takes the form of the following language: I, Smith, convey my real property to Jones for life. The writing, whose exact language requirements may differ between states, is typically contained in a deed or a will.

There is a value to a life estate. Upon sale, the life tenant is entitled to compensation for the sale of their interest. Life estates are valued using the age of the life tenant and the present fair market value of the property.

Assets That May Not Be Eligible for a Step-Up in Basis 401(k) accounts. Pensions. Tax deferred annuities. Certificates of deposit.

A life estate is usually property that has been acquired during the lifetime of a person with his or her ownership only lasting through the time he or she lives.This also means he or she cannot sell it, rent it or alter it until the life tenant passes on or leaves permanently.

Remainderman Rights and Life Estates Typically, the deed will state that the occupant of property is allowed to use it for the duration of their life. Almost all deeds creating a life estate will also name a remaindermanthe person or persons who get the property when the life tenant dies.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.