Loan Agreement for LLC

Description Loan Agreement

How to fill out Loan Agrement?

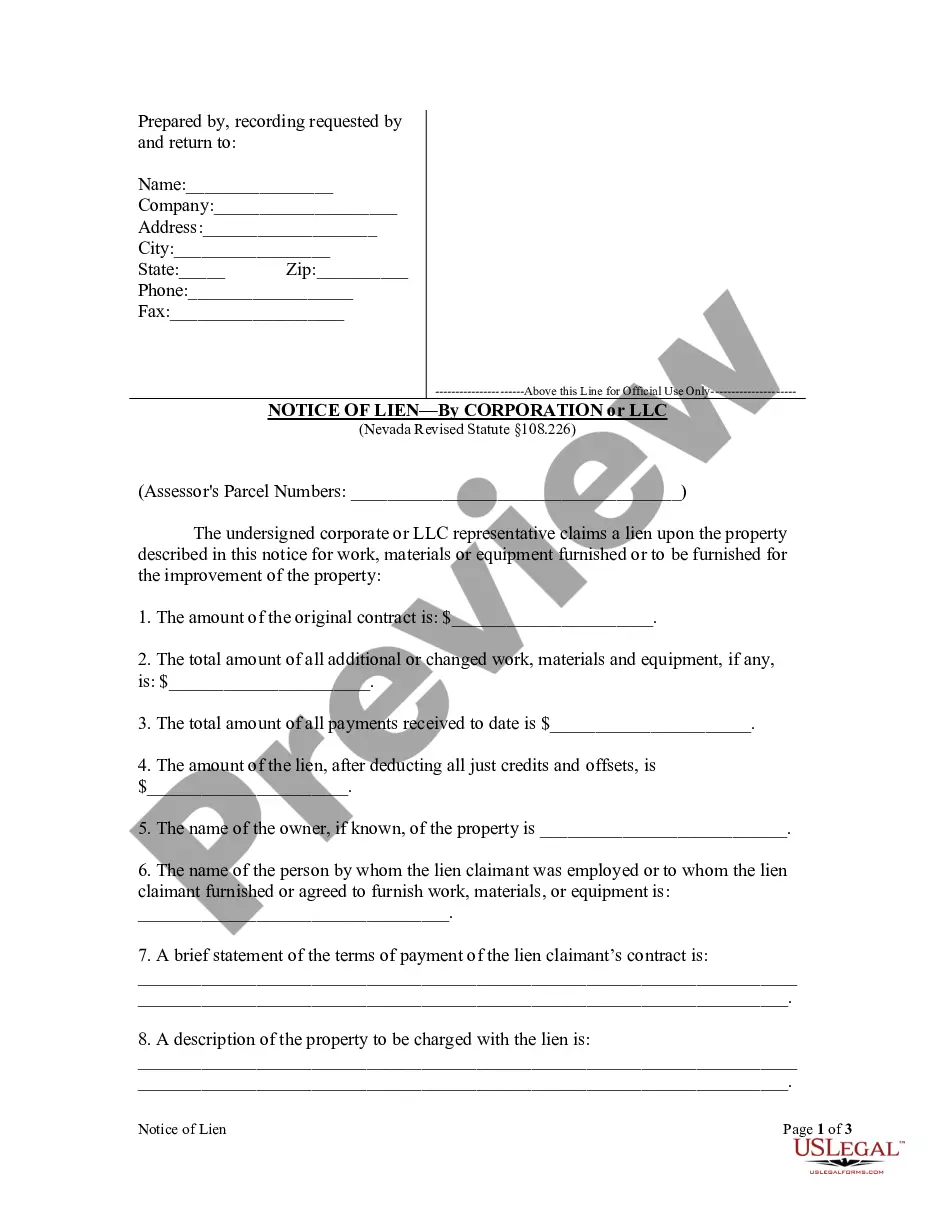

Use US Legal Forms to obtain a printable Loan Agreement for LLC. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most extensive Forms library on the web and offers cost-effective and accurate samples for consumers and attorneys, and SMBs. The templates are grouped into state-based categories and a number of them can be previewed before being downloaded.

To download samples, customers must have a subscription and to log in to their account. Press Download next to any form you need and find it in My Forms.

For people who do not have a subscription, follow the tips below to easily find and download Loan Agreement for LLC:

- Check out to make sure you have the correct form with regards to the state it is needed in.

- Review the document by reading the description and by using the Preview feature.

- Click Buy Now if it is the template you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it multiple times.

- Use the Search engine if you need to find another document template.

US Legal Forms offers thousands of legal and tax templates and packages for business and personal needs, including Loan Agreement for LLC. Above three million users have already utilized our service successfully. Choose your subscription plan and have high-quality forms in just a few clicks.

How To Write Up A Loan Contract Form popularity

How To Write A Loan Agreement Between Two Parties Other Form Names

Loan Contract FAQ

If you are a member of a limited liability company (LLC), you can borrow money from the company.If there are other members involved, you must get approval from them before borrowing any money from the business. If the LLC is being treated as a pass-through entity, there is no need to borrow money from the company.

If you are a member of a limited liability company (LLC), you can borrow money from the company.If there are other members involved, you must get approval from them before borrowing any money from the business. If the LLC is being treated as a pass-through entity, there is no need to borrow money from the company.

It is no problem to lend money to your company, however there are many disincentives to borrow money from your company. It is important that any balances between you and your company are documented in the same way as any other company transactions.

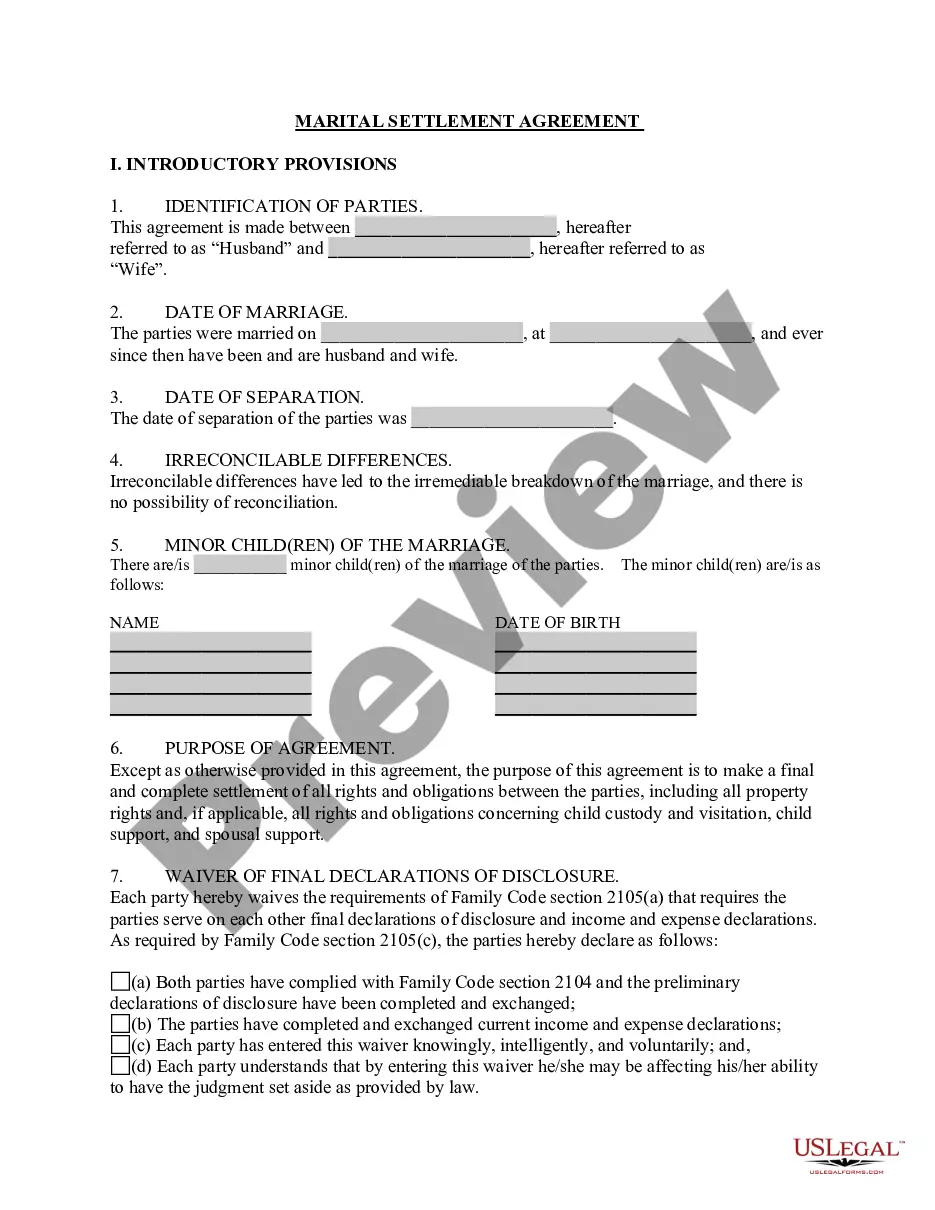

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

To have an enforceable loan, put the terms in written form. Clearly designate the relationship between you, the creditor, and your LLC, the debtor. Set forth the loan amounts, the expectation of repayment, the LLC's repayment schedule, and the consequences of failure to make a timely payment.

The core elements of an LLC operating agreement include provisions relating to equity structure (contributions, capital accounts, allocations of profits, losses and distributions), management, voting, limitation on liability and indemnification, books and records, anti-dilution protections, if any, restrictions on

To have an enforceable loan, put the terms in written form. Clearly designate the relationship between you, the creditor, and your LLC, the debtor. Set forth the loan amounts, the expectation of repayment, the LLC's repayment schedule, and the consequences of failure to make a timely payment.

Borrowing money from your own corporation allows you to collect more than your normal salary or dividends at a tax-free rate. However, you can't just take as much money as you want. You need to follow specific tax rules.

Starting the Document. Write the date at the top of the page. Write the Terms of the Loan. State the purpose of the personal payment agreement and the terms for returning the money. Date the Document. Statement of Agreement. Sign the Document. Record the Document.