Loan Agreement for Car

Description Car Loan Agreement Template

How to fill out Loan Vehicle Agreement Form?

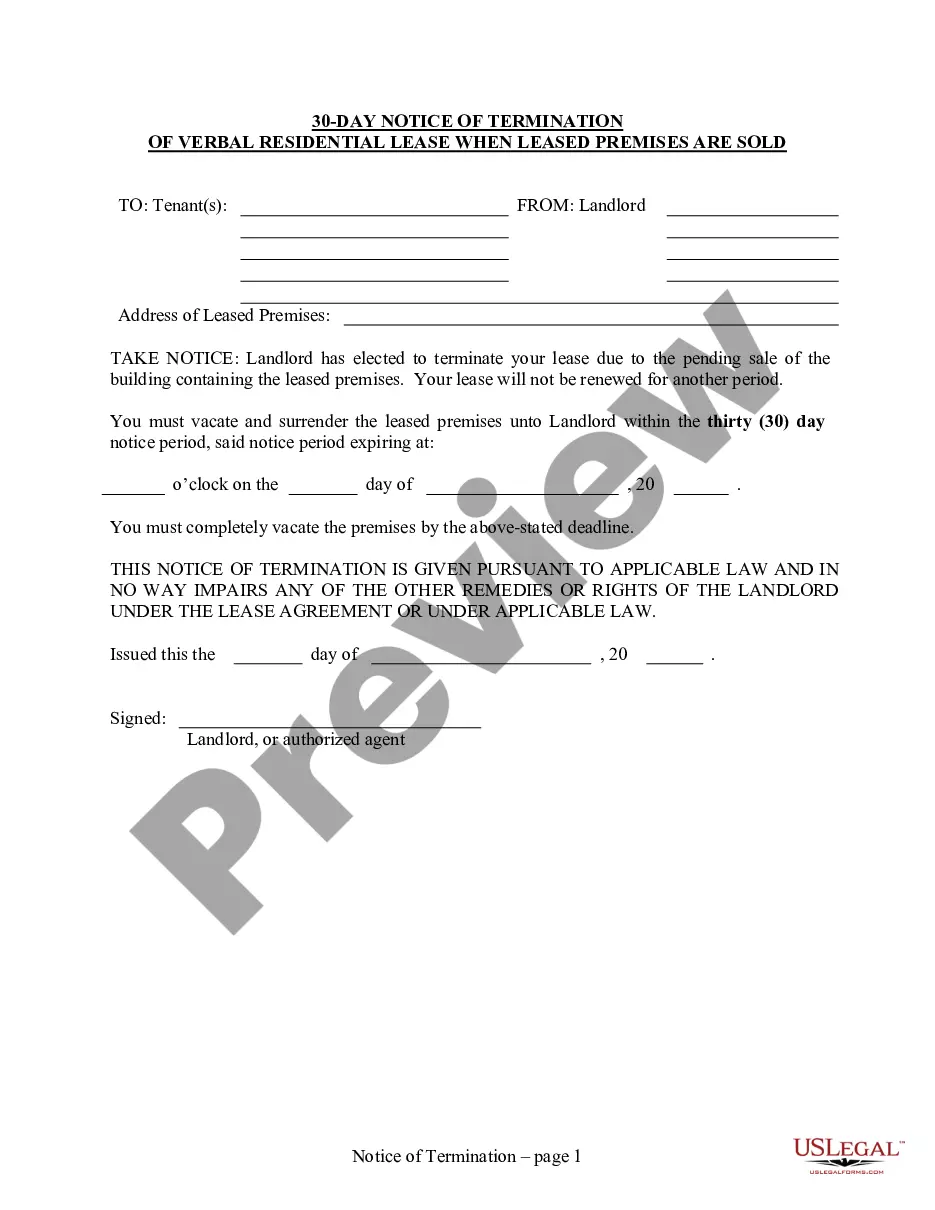

Use US Legal Forms to obtain a printable Loan Agreement for Car. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most extensive Forms catalogue online and offers affordable and accurate samples for consumers and lawyers, and SMBs. The templates are categorized into state-based categories and a number of them might be previewed prior to being downloaded.

To download templates, customers must have a subscription and to log in to their account. Hit Download next to any form you want and find it in My Forms.

For individuals who do not have a subscription, follow the following guidelines to easily find and download Loan Agreement for Car:

- Check to ensure that you get the right form in relation to the state it is needed in.

- Review the document by looking through the description and by using the Preview feature.

- Hit Buy Now if it is the document you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it multiple times.

- Make use of the Search engine if you want to find another document template.

US Legal Forms provides a large number of legal and tax templates and packages for business and personal needs, including Loan Agreement for Car. Over three million users already have utilized our service successfully. Select your subscription plan and obtain high-quality forms in a few clicks.

Personal Car Loan Agreement Form popularity

Car Loan Document Template Other Form Names

Automobile Loan Agreement FAQ

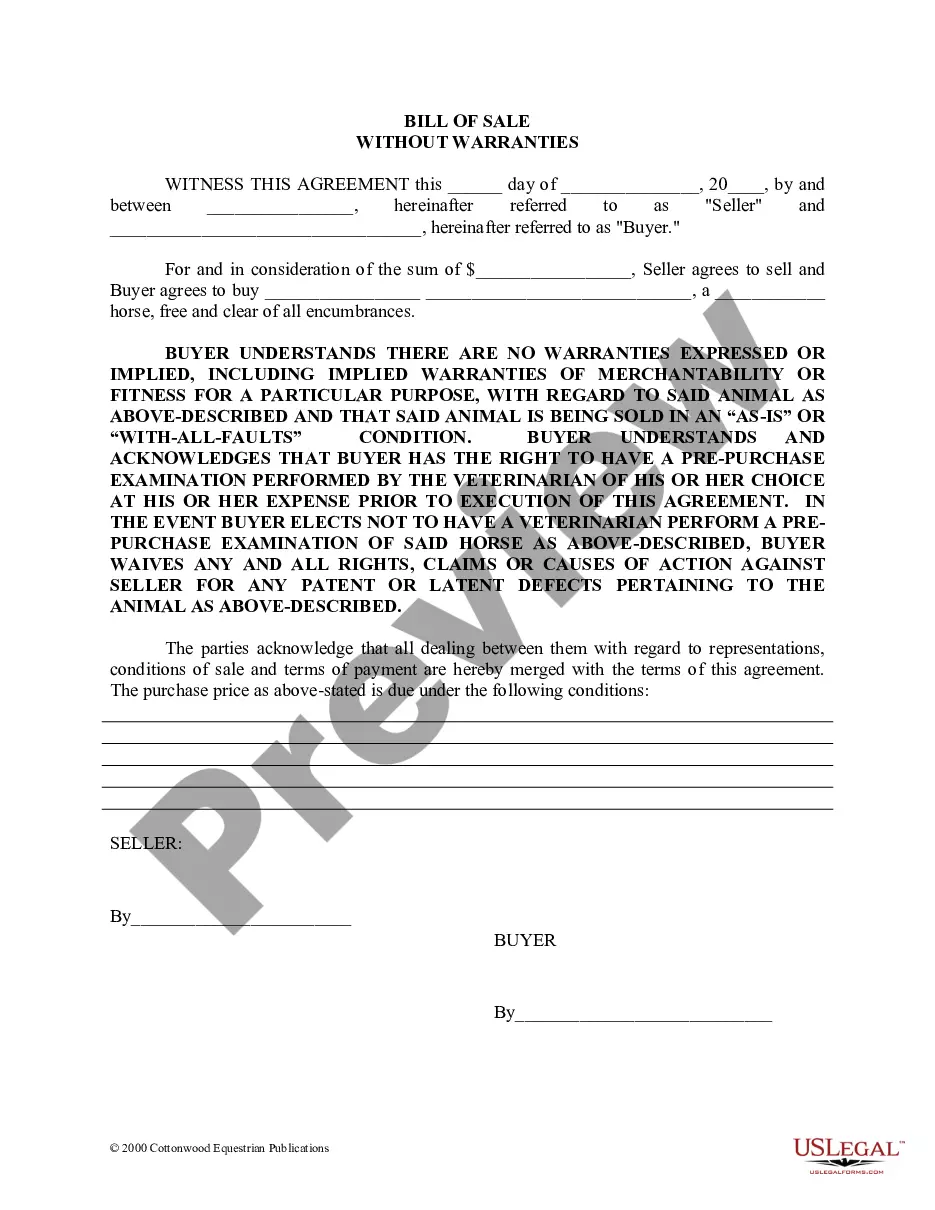

Identity of the Parties. The names of the lender and borrower need to be stated. Date of the Agreement. Interest Rate. Repayment Terms. Default provisions. Signatures. Choice of Law. Severability.

Make an Outline of All the Details. Starting with an outline allows you to arrange the information in your car loan form accordingly. Add the Contents Under Each Section. Provide Blanks to Write on. Include the Terms and Conditions.

The balance. This is how much you're borrowing for your car. Sales tax and registration fees. The term of the loan. The annual percentage rate (APR).

A loan agreement does not require a notary signature. The purpose of a notary seal is to provide evidence that the signature is genuinely the signature of the person signing.

State the purpose for the loan. #Set forth the amount and terms of the loan. Your agreement should clearly state the amount of money you're lending your friend, the interest rate, and the total amount your friend will pay you back.

Starting the Document. Write the date at the top of the page. Write the Terms of the Loan. State the purpose of the personal payment agreement and the terms for returning the money. Date the Document. Statement of Agreement. Sign the Document. Record the Document.

Starting the Document. Write the date at the top of the page. Write the Terms of the Loan. State the purpose of the personal payment agreement and the terms for returning the money. Date the Document. Statement of Agreement. Sign the Document. Record the Document.

A personal loan agreement is a legally binding document regardless of whether the lender is a financial institution or another person.As a borrower, you could be sued by the lender or lose the asset or assets used to secure the loan.