Loan Agreement for Property

Description

How to fill out Loan Agreement For Property?

Use US Legal Forms to obtain a printable Loan Agreement for Property. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most comprehensive Forms library on the web and offers cost-effective and accurate samples for consumers and lawyers, and SMBs. The templates are grouped into state-based categories and some of them can be previewed before being downloaded.

To download templates, users need to have a subscription and to log in to their account. Press Download next to any form you want and find it in My Forms.

For individuals who don’t have a subscription, follow the tips below to quickly find and download Loan Agreement for Property:

- Check to make sure you have the right form in relation to the state it’s needed in.

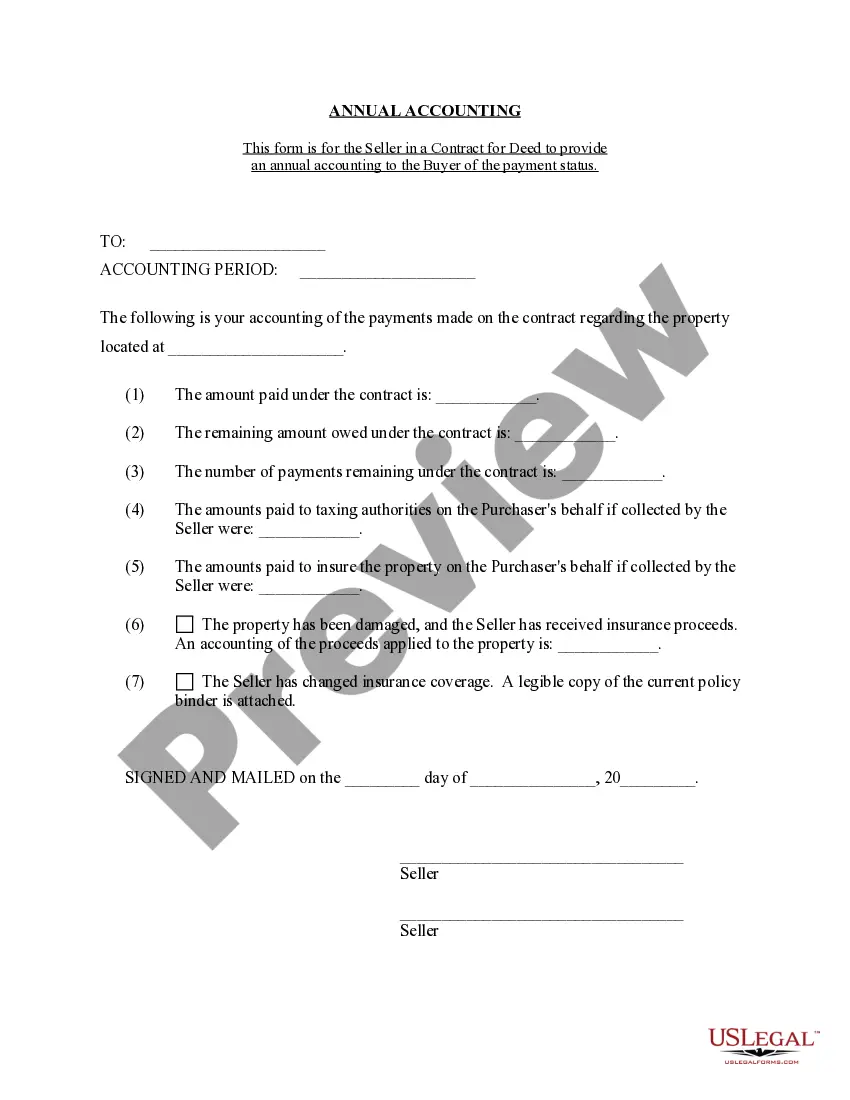

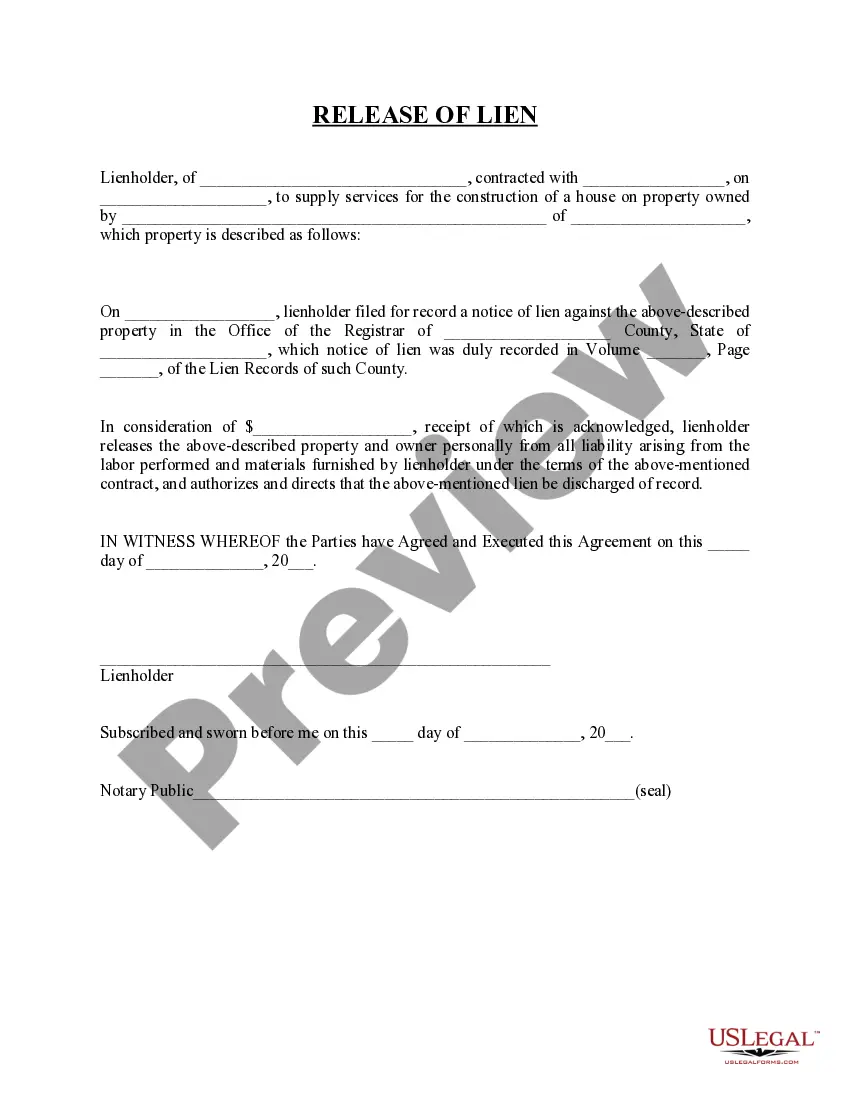

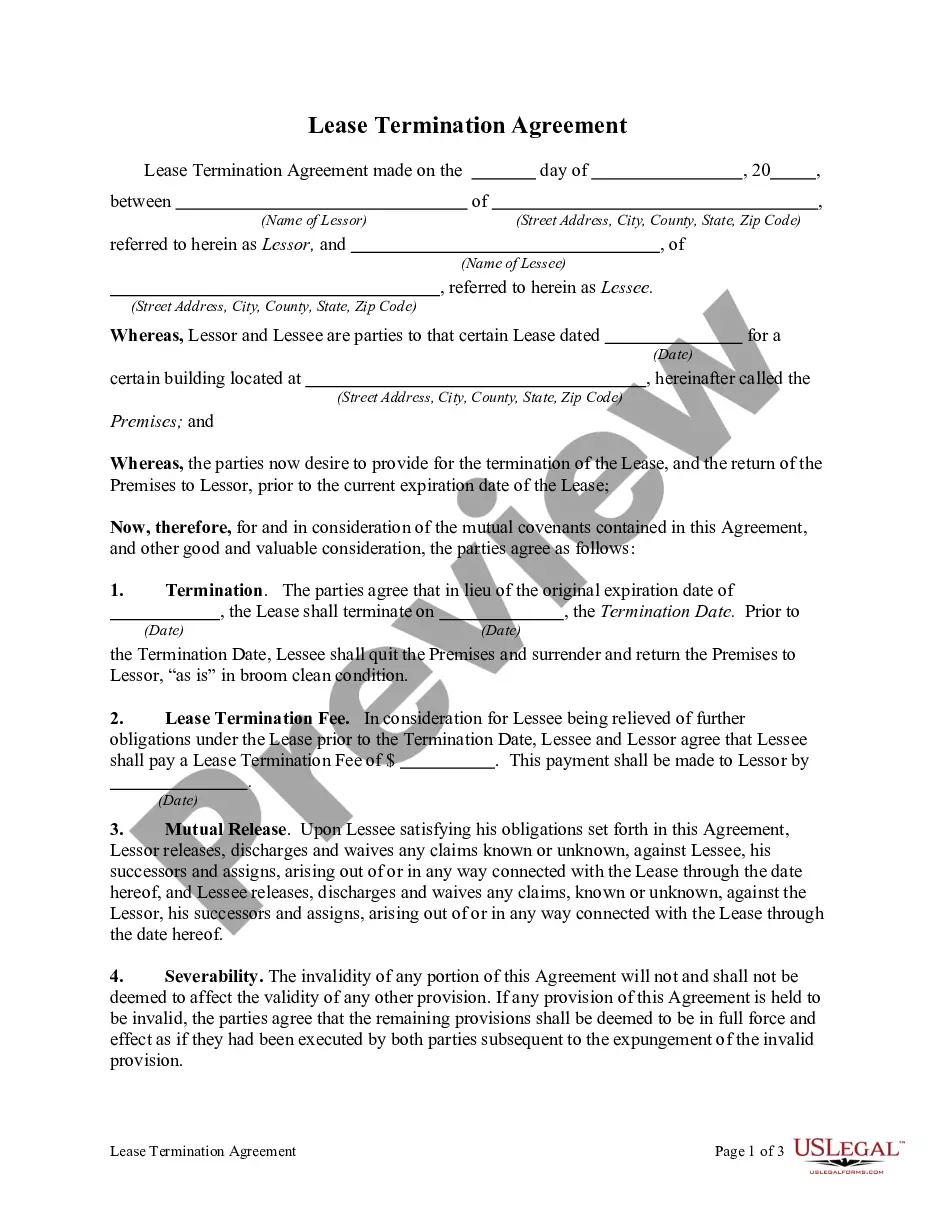

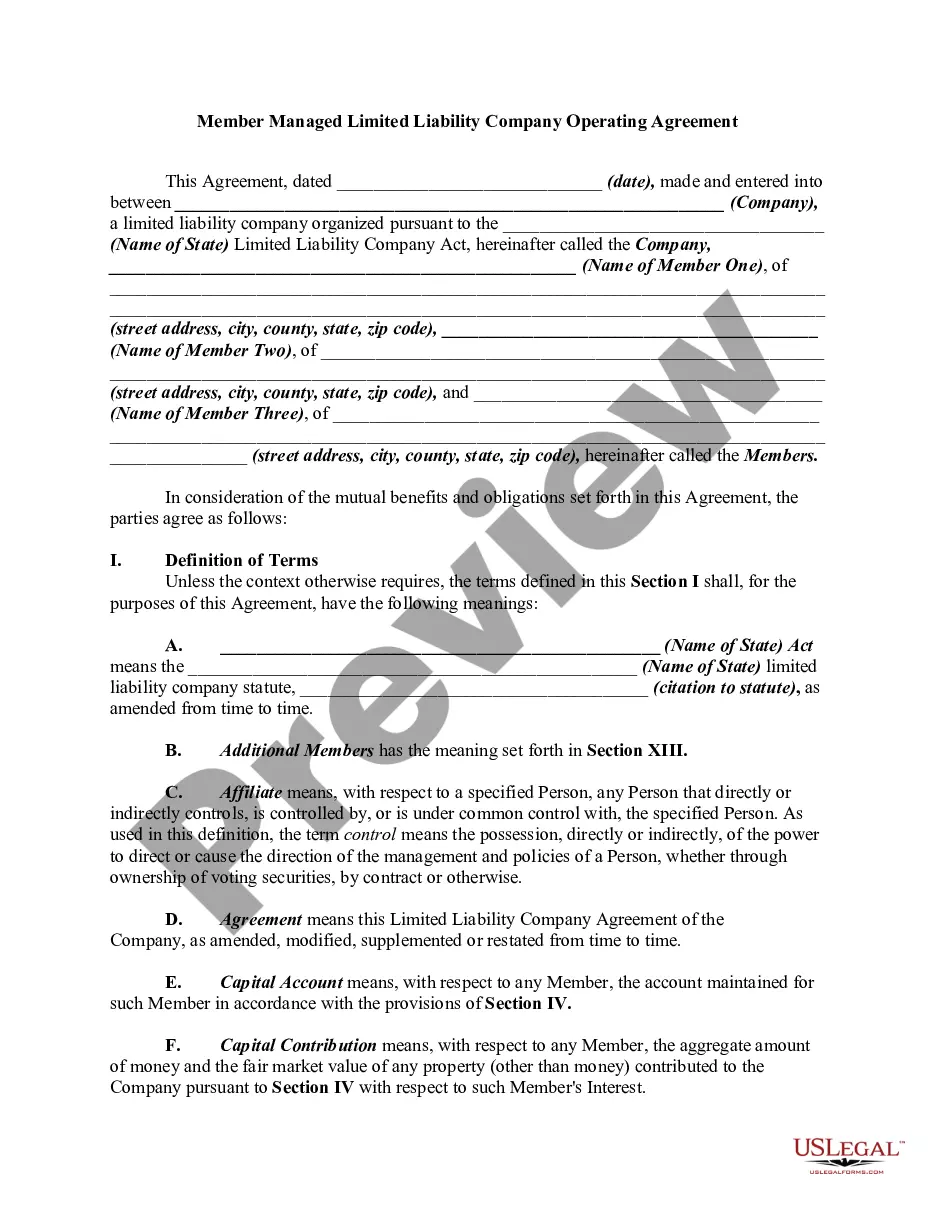

- Review the form by looking through the description and using the Preview feature.

- Hit Buy Now if it’s the document you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Make use of the Search engine if you need to get another document template.

US Legal Forms provides a large number of legal and tax samples and packages for business and personal needs, including Loan Agreement for Property. Over three million users already have used our service successfully. Choose your subscription plan and obtain high-quality documents in a few clicks.

Form popularity

FAQ

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties. You may choose to keep a copy in your county recorder's office if you wish, though it's not legally necessary. It's sufficient for both parties to keep their own copy, ideally in a safe place.

Loan agreements are binding contracts between two or more parties to formalize a loan process.Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid.

Identity of the Parties. The names of the lender and borrower need to be stated. Date of the Agreement. Interest Rate. Repayment Terms. Default provisions. Signatures. Choice of Law. Severability.

Come up with a schedule for repayment. Use a family contract template that includes a repayment schedule. Set and interest rate. Put your agreement in writing. Keep payment records.

Starting the Document. Write the date at the top of the page. Write the Terms of the Loan. State the purpose of the personal payment agreement and the terms for returning the money. Date the Document. Statement of Agreement. Sign the Document. Record the Document.

The most basic loan agreement is commonly called an "IOU." These are typically used between friends or relatives for small amounts of money, and simply state the dollar amount that is owed. They do not usually say when payment is due, nor include any interest provisions.

A loan agreement does not require a notary signature. The purpose of a notary seal is to provide evidence that the signature is genuinely the signature of the person signing.

State the purpose for the loan. #Set forth the amount and terms of the loan. Your agreement should clearly state the amount of money you're lending your friend, the interest rate, and the total amount your friend will pay you back.

A personal loan agreement is a legally binding document regardless of whether the lender is a financial institution or another person.As a borrower, you could be sued by the lender or lose the asset or assets used to secure the loan.