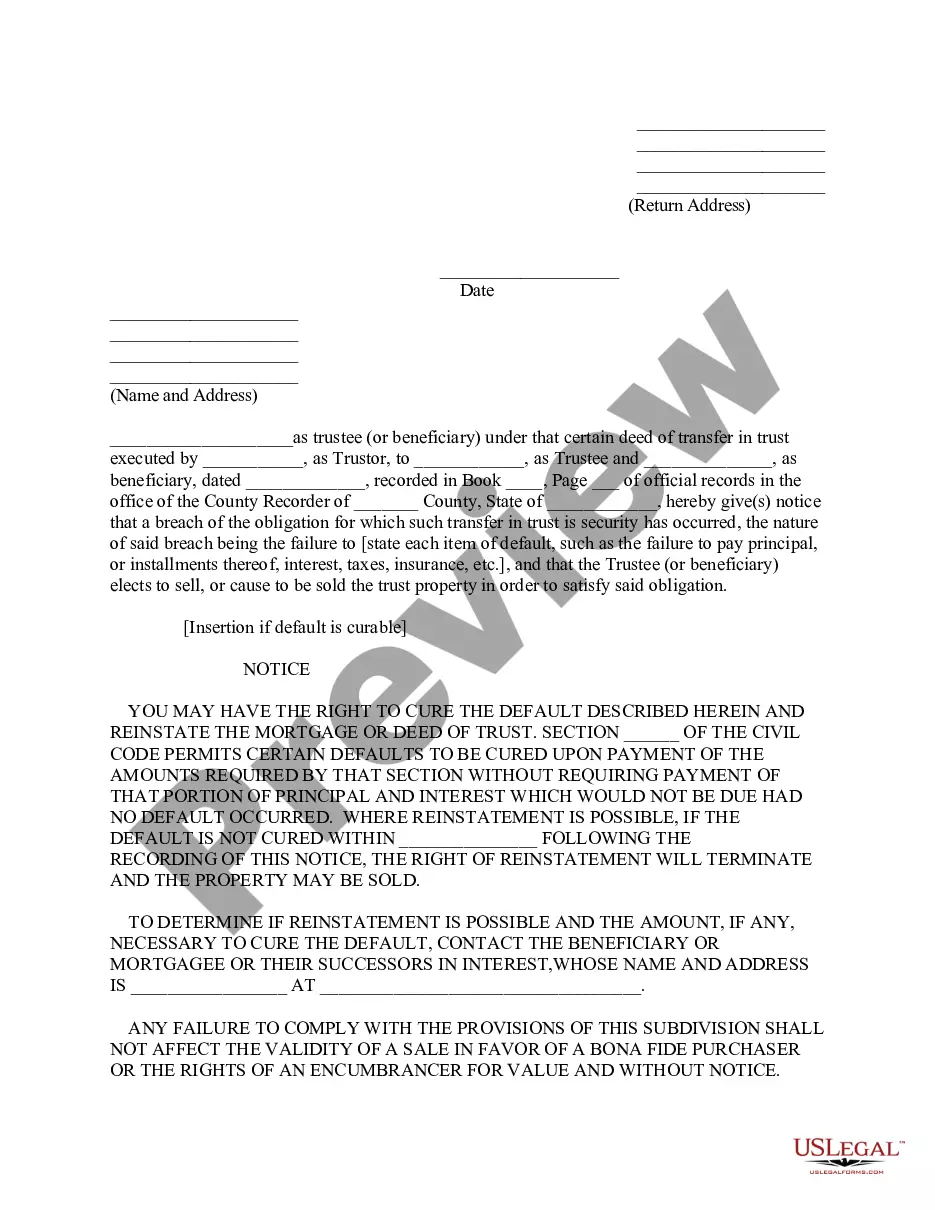

Notice of Default

Description Notice Default Sample

How to fill out Notice Of Default?

US Legal Forms is the most simple and affordable way to locate suitable legal templates. It’s the most extensive online library of business and personal legal documentation drafted and checked by lawyers. Here, you can find printable and fillable templates that comply with national and local regulations - just like your Notice of Default.

Obtaining your template takes just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted Notice of Default if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to make certain you’ve found the one corresponding to your needs, or find another one utilizing the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and judge the subscription plan you prefer most.

- Register for an account with our service, sign in, and purchase your subscription using PayPal or you credit card.

- Decide on the preferred file format for your Notice of Default and download it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - simply find it in your profile, re-download it for printing and manual completion or import it to an online editor to fill it out and sign more proficiently.

Benefit from US Legal Forms, your trustworthy assistant in obtaining the required formal documentation. Give it a try!

Notice Default Make Form popularity

Notice Default Get Other Form Names

FAQ

What is the Notice of Default? The notice of default is a public notice that is filed in the county where your home is located stating that you are in default on your mortgage. It is used to notify you that you are in breach of your mortgage contract and that the lender is initiating the formal foreclosure process.

What happens if I don't pay the notice of default? If you have not repaid the arrears or set up a repayment agreement with your creditor within 14 days of receiving the notice of default form, your credit agreement can be terminated and the default will be registered on your credit file for 6 years.

Receiving a default notice is serious and can result in your creditor passing on your debt to a debt collection agency, or even starting legal proceedings against you to recover the debt.

Dear Sir/Madam, I entered into an/the attached agreement with you on date invoice number can be added in brackets if necessary. You/name of company failed to comply with the agreement. The agreement obliges you/name company to explain the obligations to which the party has failed to comply.

How long does a default stay on your credit file? A default will remain on your credit file for six years. After six years, the default will be removed, even if the debt from the default hasn't been fully cleared.

Credit Reporting and defaults Your client must be 60 days in default. Your client must also be sent a section 21D(3) (of the Privacy Act) informing your client that a default will be listed. The listing cannot be made until 14 days after the notice or more than 3 months after the notice. Enforcement (Part 5 NCC) - Legal Aid NSW nsw.gov.au ? the-credit-law ? enfor... nsw.gov.au ? the-credit-law ? enfor...

After the Notice of Default is filed, the homeowner has 90 days to cure the default, which usually means paying everything that is owed. If the borrower does not pay within the 90-day timeline, the bank can record a Notice of Sale announcing that the property will be sold at auction. California Foreclosure Process Timeline DebtStoppers debtstoppers.com ? blog ? california-foreclo... debtstoppers.com ? blog ? california-foreclo...

A default notice is a notification from a lender asking you to catch up with your payments or else have your account closed. It's your chance to stop a default from happening. You should try and pay the amount you owe immediately to avoid a default.

When you receive the Notice of Default, you have 180 days to get your loan current or the bank can take the next step in the foreclosure process. The next step, called the Notice of Trustee's Sale, sets a date for a public foreclosure auction of your home.