Notice of Dishonored Check

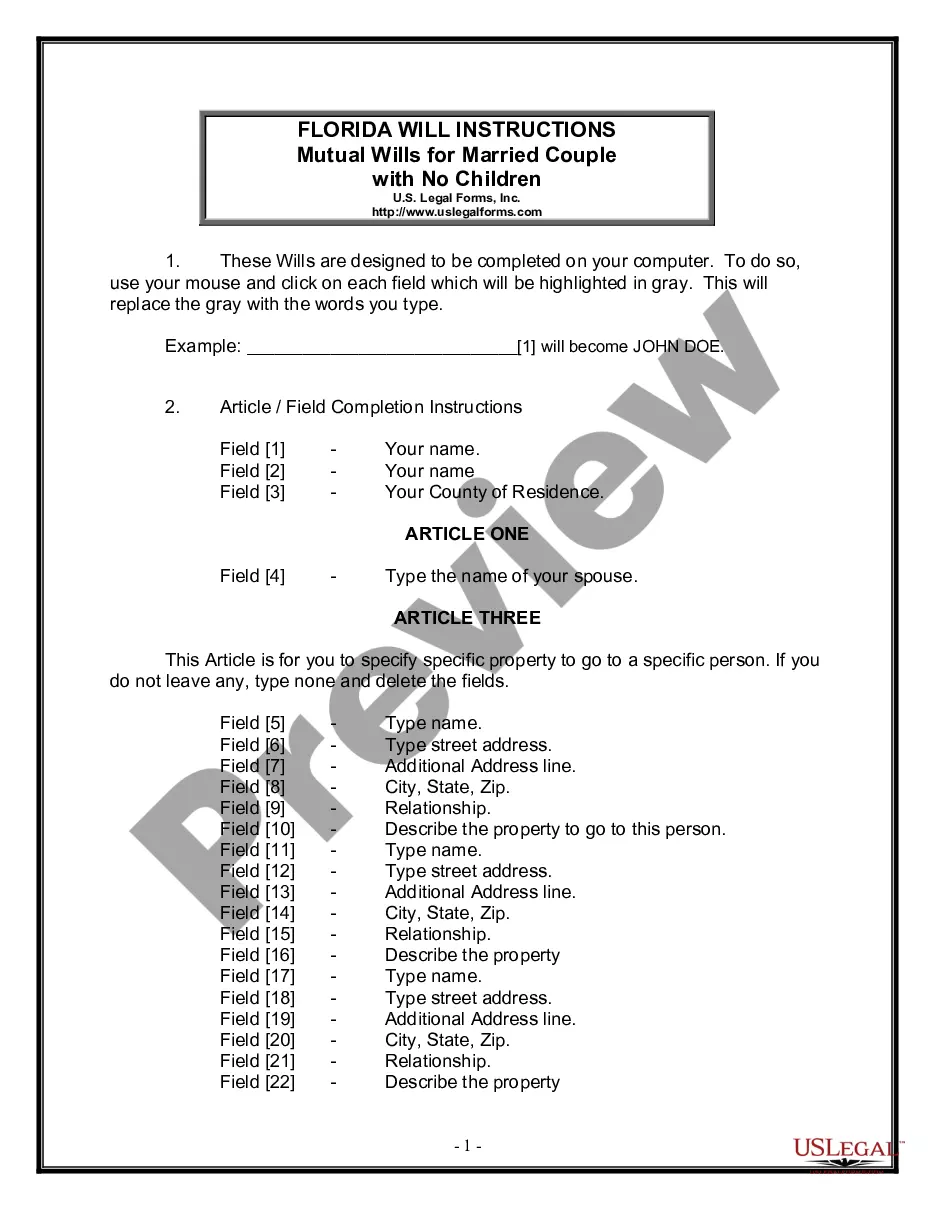

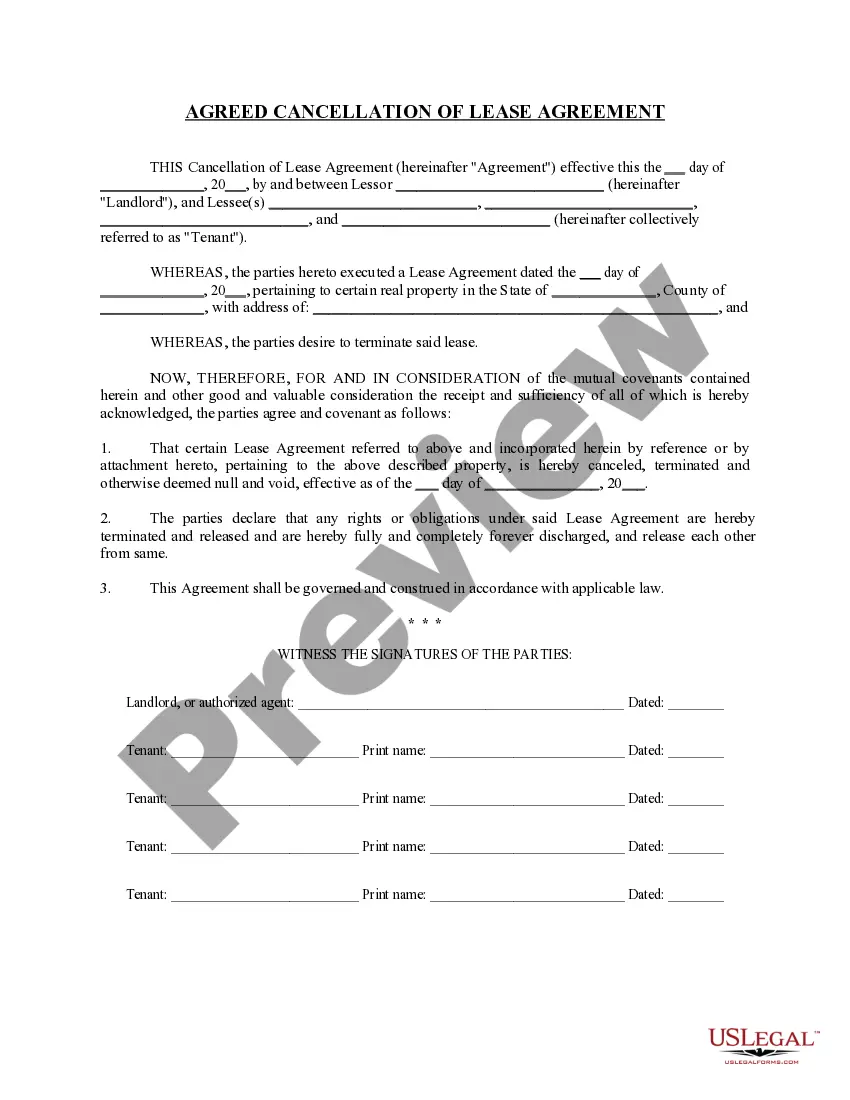

Description

How to fill out Notice Of Dishonored Check?

US Legal Forms is the most easy and cost-effective way to find appropriate legal templates. It’s the most extensive web-based library of business and personal legal paperwork drafted and checked by lawyers. Here, you can find printable and fillable templates that comply with national and local regulations - just like your Notice of Dishonored Check.

Obtaining your template requires only a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the document on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a professionally drafted Notice of Dishonored Check if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to ensure you’ve found the one meeting your requirements, or locate another one utilizing the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and choose the subscription plan you like most.

- Create an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Decide on the preferred file format for your Notice of Dishonored Check and download it on your device with the appropriate button.

Once you save a template, you can reaccess it at any time - just find it in your profile, re-download it for printing and manual completion or upload it to an online editor to fill it out and sign more efficiently.

Take full advantage of US Legal Forms, your reliable assistant in obtaining the corresponding official documentation. Try it out!

Form popularity

FAQ

Dishonored checks are items deposited at a depository bank, but are returned to the State due to non-sufficient funds or other reasons preventing the bank from cashing the items.

You are responsible for the payment of the fees and any resulting penalties.

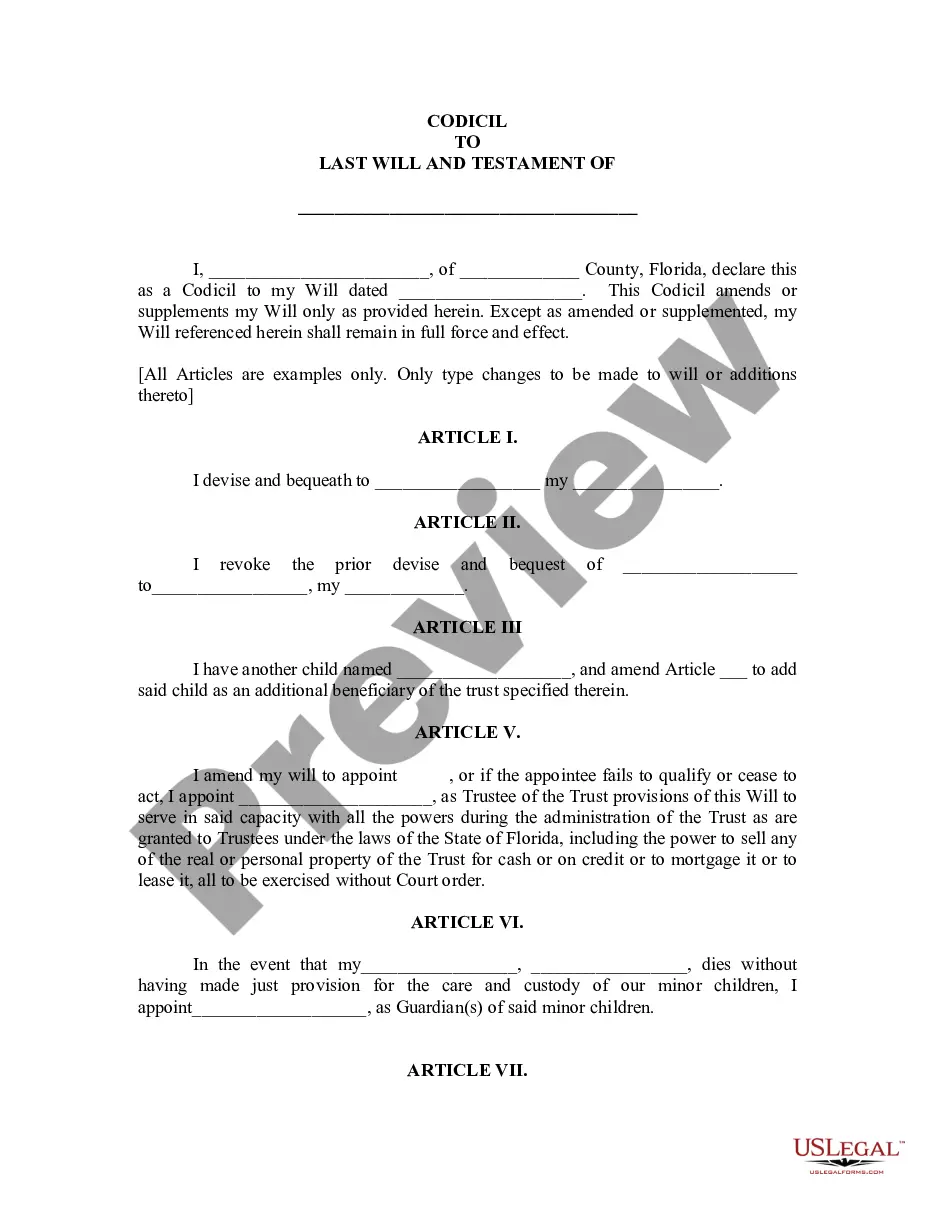

Sir/Madam: You are hereby notified that your (name of bank) Check No. dated , 20, in the amount of P paid to us and acknowledged by our Official Receipt No. dated , 20 has been deposited but was dishonored and returned to us due to .

Dishonored checks are items deposited at a depository bank, but are returned to the State due to non-sufficient funds or other reasons preventing the bank from cashing the items.

A failure to timely file a Form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues, beginning 90 days after the IRS notifies the taxpayer of the failure, with no maximum penalty.

Penalty. Less than $1,250. The payment amount or $25, whichever is less. $1,250 or more. 2% of the payment amount.

(a) A drawer negotiating a check who knows or should know that payment of such check will be refused by the drawee bank either because the drawer has no account with such bank or because the drawer has insufficient funds on deposit with such bank shall be liable to the payee for damages, in addition to the face amount

When a check or other commercial payment instrument the IRS receives for payment of taxes doesn't clear the bank, a penalty of 2 percent of the amount of the check or other commercial payment instrument generally applies.