Asset Information Sheet

Description

How to fill out Asset Information Sheet?

Make use of the most comprehensive legal library of forms. US Legal Forms is the perfect platform for finding up-to-date Asset Information Sheet templates. Our service provides a large number of legal forms drafted by licensed lawyers and sorted by state.

To get a template from US Legal Forms, users only need to sign up for a free account first. If you are already registered on our platform, log in and choose the template you need and buy it. After purchasing forms, users can find them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the steps below:

- Check if the Form name you have found is state-specific and suits your requirements.

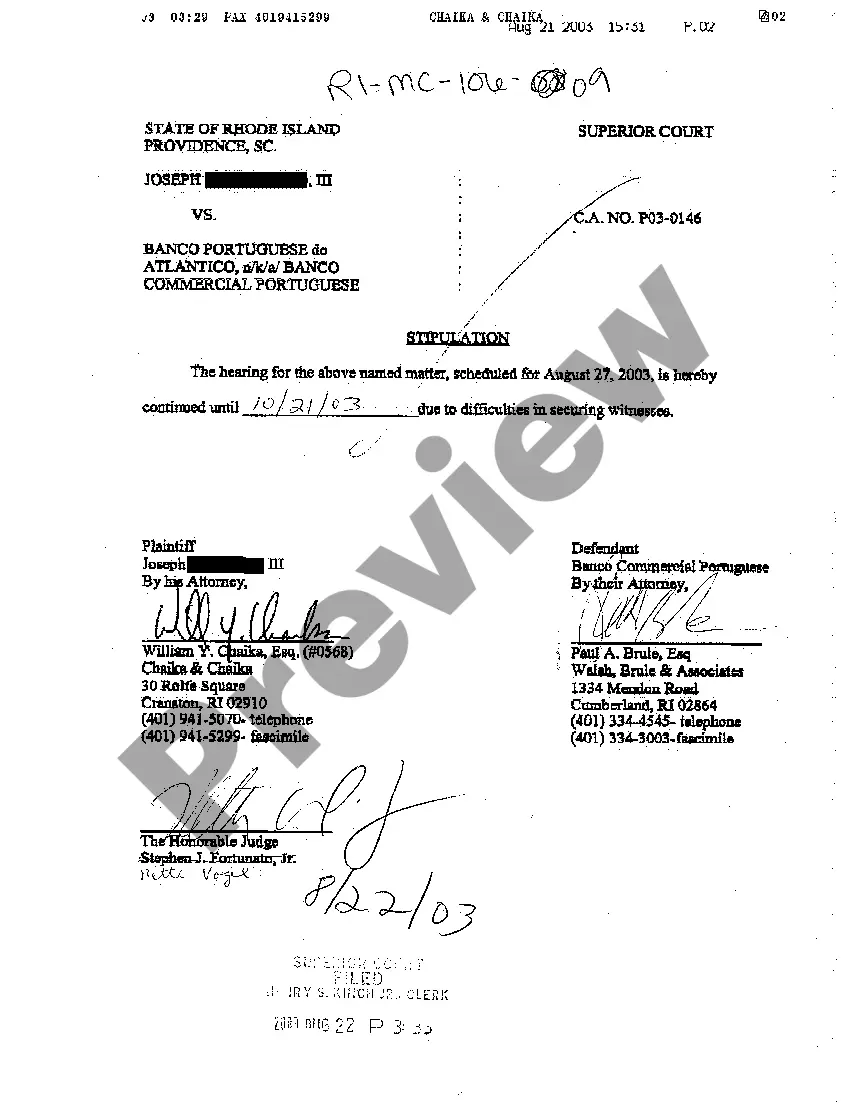

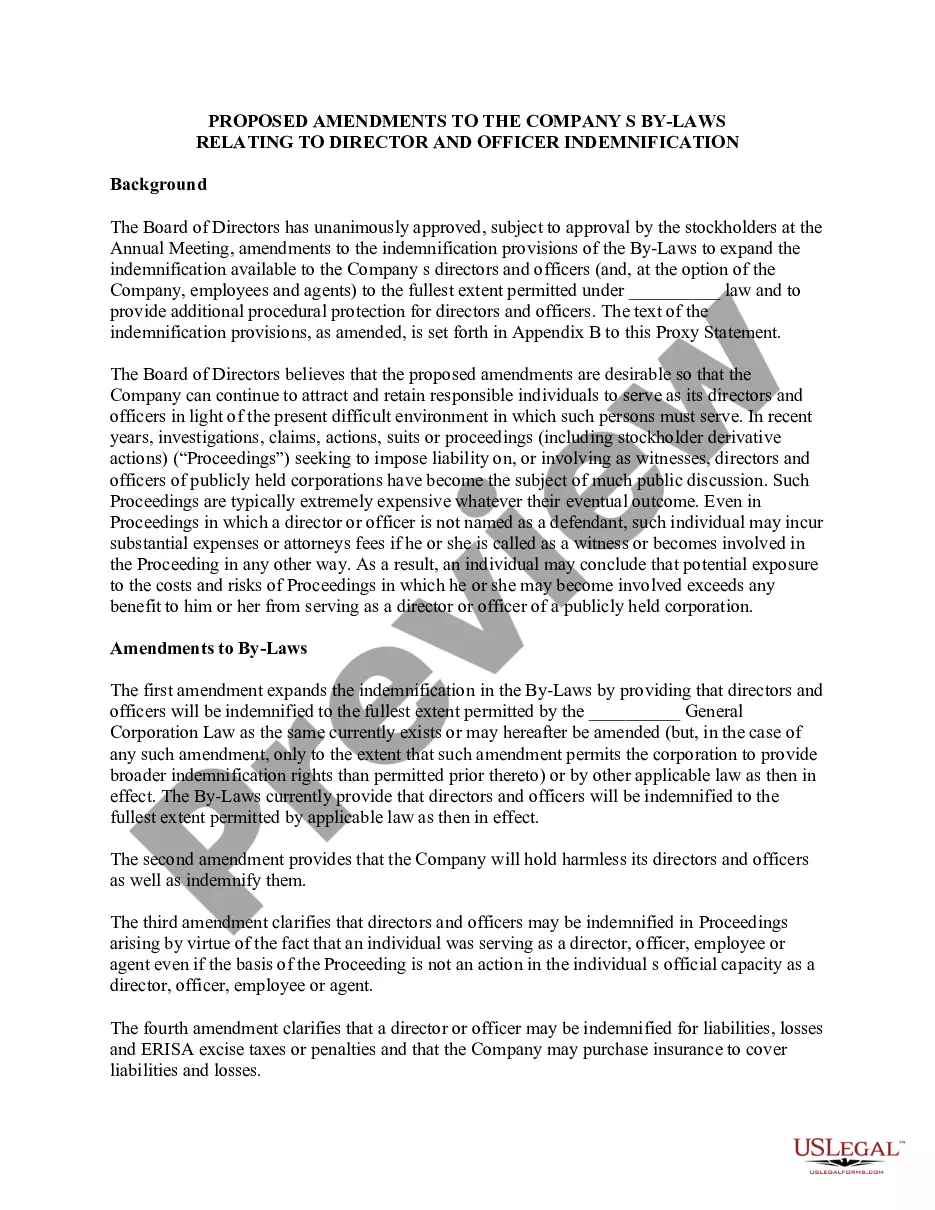

- If the form has a Preview option, utilize it to check the sample.

- In case the sample does not suit you, make use of the search bar to find a better one.

- Hit Buy Now if the template meets your needs.

- Select a pricing plan.

- Create your account.

- Pay via PayPal or with the debit/credit card.

- Choose a document format and download the sample.

- After it is downloaded, print it and fill it out.

Save your effort and time with the platform to find, download, and fill in the Form name. Join a huge number of pleased clients who’re already using US Legal Forms!

Form popularity

FAQ

Your FSA ID, which you can create on fsaid.ed.gov. Your social security number and driver's license, and/or alien registration number if you are not a U.S. citizen. Your federal income tax returns, W-2s, and other records of money earned. Your parents income tax returns, W-2 forms and 1040 forms if you're a dependent.

The FAFSA will require disclosure of financial information, including bank account balances, by the student applicant and also from the student's parents if the student is classified as a dependent student.

Assets on the FAFSA An asset is essentially any money that you have readily available. For the purpose of filling the FAFSA, these are counted as assets: Money deposited in checking accounts and savings accounts.

You can only skip FAFSA questions about assets if you meet the qualifications to do so based on your answers to other questions on the application. However, that's only because your asset information at that point doesn't affect your eligibility for federal student aid.

As a general rule, you should only report assets that are cash-based (i.e. not your car) and liquid (meaning you can easily turn them into cash). Things like trust funds and 529 savings plans (if they're owned by you or your parent) do need to be reported, as well as more obvious things like your bank balances.

If you don't report assets, you'll be automatically disqualified from institutional aid like need based scholarships but can still qualify for government loans or merit based scholarships. The accountant and the financial aid people at multiple medical schools have confirmed this.

Impact of Assets on the FAFSA The impact of an asset depends on whether it is a student asset or a parent asset. The FAFSA has a simplified needs test that causes assets to be disregarded if the parent income (or student income, if the student is independent) is less than $50,000 and certain other criteria apply.

How do I complete the question Does the total amount of your parents' asset net worth exceed the amount listed on the FAFSA® form? Select Yes if your parents' current asset net worth exceeded this amount on the day you submitted your Free Application for Federal Student Aid (FAFSAA®) form.

Your FSA ID Your Social Security number Your driver's license number. Your 2019 tax records Records of your untaxed income Records of your assets (money) List of the school(s) you are interested in attending.