Assignment of LLC Company Interest to Living Trust

Description

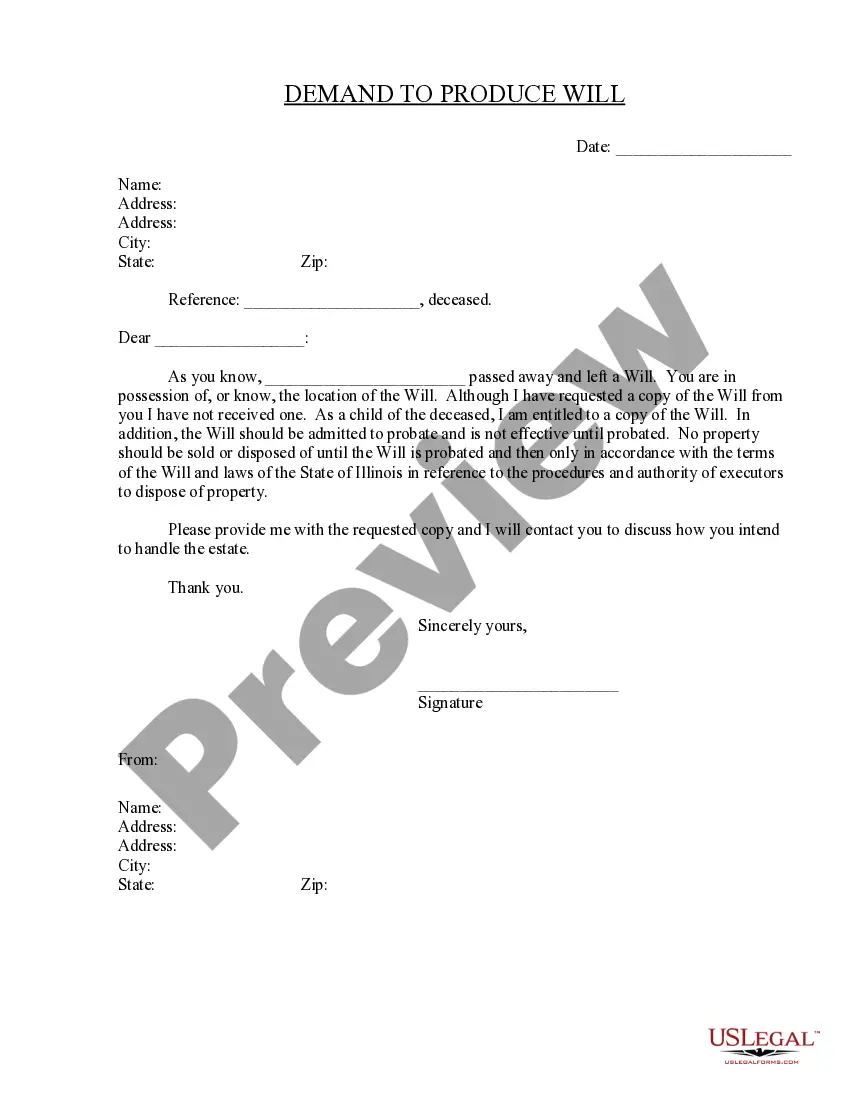

How to fill out Assignment Of LLC Company Interest To Living Trust?

Make use of the most complete legal library of forms. US Legal Forms is the best platform for finding updated Assignment of LLC Company Interest to Living Trust templates. Our service provides a large number of legal forms drafted by certified lawyers and grouped by state.

To download a template from US Legal Forms, users only need to sign up for a free account first. If you’re already registered on our platform, log in and choose the template you need and purchase it. After purchasing templates, users can see them in the My Forms section.

To get a US Legal Forms subscription on-line, follow the steps listed below:

- Find out if the Form name you have found is state-specific and suits your needs.

- When the form features a Preview option, utilize it to review the sample.

- If the template doesn’t suit you, use the search bar to find a better one.

- Hit Buy Now if the sample corresponds to your requirements.

- Select a pricing plan.

- Create a free account.

- Pay with the help of PayPal or with yourr credit/credit card.

- Choose a document format and download the sample.

- After it is downloaded, print it and fill it out.

Save your time and effort using our service to find, download, and fill out the Form name. Join thousands of delighted clients who’re already using US Legal Forms!

Form popularity

FAQ

The answer is yes. First, trust law permits trusteeswho are acting on behalf of trusts, including revocable truststo own any asset, or almost any asset, that an individual can own, and this includes an interest in an LLC, which qualifies as an asset.

1Draft and Execute the Transfer Document.2Draft and File an Amendment to your Articles of Organization with the Arizona Corporation Commission.3Amend the Operating Agreement.4Have LLC Members Sign a Resolution Accepting Transfer.

The only way a member of an LLC may be removed is by submitting a written notice of withdrawal unless the articles of organization or the operating agreement for the LLC in question details a procedure for members to vote out others. The steps to follow are: Determine the procedure for withdrawing members.

There are two main ways to transfer ownership of your LLC: Transferring partial interest in an LLC: This applies if you are not selling the entire business, and you do not have 100 percent ownership. Selling your LLC: This applies if you are transferring ownership of your entire business to someone else.

Ownership in a business can also be transferred through a living trust. To do this, the business owner must first transfer the business to the trust, then name the intended successor as successor trustee to the trust. The business owner, while living, would serve as both trustee and beneficiary of the trust.

Yes. Your LLC can be hired as a consultant or a sales compnay.

Whatever the reason, you can easily change your LLC's name by filing paperwork with your state agency that handles business filings. The most difficult and time-consuming part of an LLC name change is altering your LLC's name on all your business accounts, contracts and marketing materials.

When you move an LLC to another state, your business is considered a foreign LLC in that state.But if your business is organized in one state and registered to do business in another, you will need to maintain a registered agent in each state and keep up with each state's LLC filing and reporting requirements.

Single-member LLC are changes in ownership of the interests transferred, unless the transfers are excluded under a specific statutory provision.