A Notice to Prior Secured Party of Purchase Money Security Interest is a form of legal notification that is sent to a prior secured party in order to inform them that the borrower has received a new purchase money security interest. This notice serves as a way of informing the prior secured party that their interest is no longer valid, and that the new security interest takes precedence over their interest. There are two main types of Notice to Prior Secured Party of Purchase Money Security Interest: one that is sent when a debtor has obtained a new loan to purchase a new item, and another that is sent when a debtor has refinanced an existing loan. In both cases, the prior secured party is required to receive this notice in order to ensure that their rights are protected.

Notice to Prior Secured Party of Purchase Money Security Interest

Description

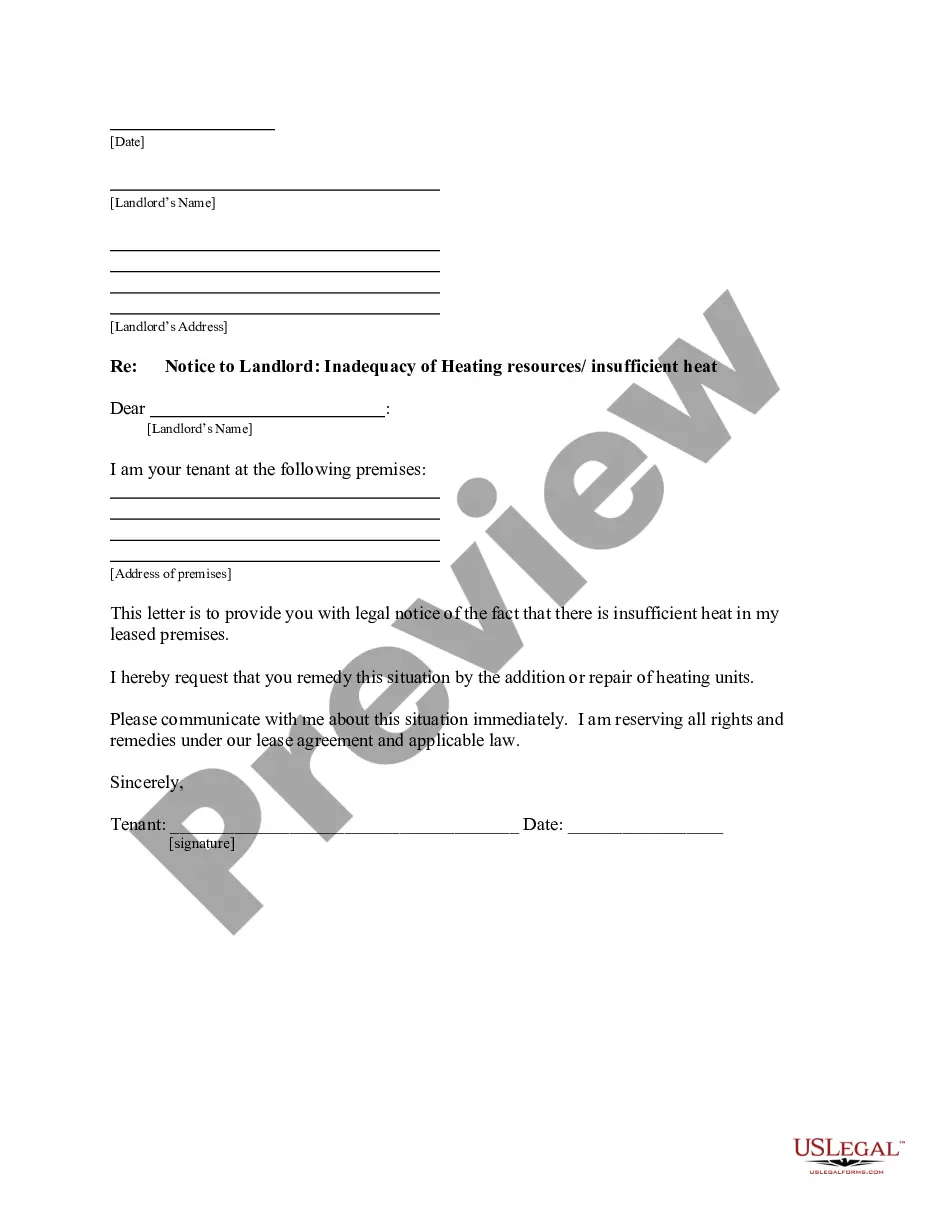

How to fill out Notice To Prior Secured Party Of Purchase Money Security Interest?

Coping with legal documentation requires attention, precision, and using well-drafted blanks. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Notice to Prior Secured Party of Purchase Money Security Interest template from our library, you can be sure it meets federal and state regulations.

Working with our service is simple and quick. To obtain the necessary paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to get your Notice to Prior Secured Party of Purchase Money Security Interest within minutes:

- Remember to attentively examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for another official blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Notice to Prior Secured Party of Purchase Money Security Interest in the format you prefer. If it’s your first time with our website, click Buy now to continue.

- Register for an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it paper-free.

All documents are drafted for multi-usage, like the Notice to Prior Secured Party of Purchase Money Security Interest you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

Three steps are required for attachment of a security interest: value must be given, the debtor must have rights in the collateral or the power to transfer rights in the collateral to the secured party, and the debtor must sign or authenticate a security agreement.

A security interest means that if you don't make the mortgage payments as agreed, or if you break your agreement with the lender, the lender can take your home and sell it to pay off the loan. You give the lender this right when you sign your closing forms.

A person that holds an agricultural lien. A consignor. A person to which accounts, chattel paper, payment intangibles, or promissory notes have been sold. A trustee, indenture trustee, agent, collateral agent, or other representative in whose favor a security interest or agricultural lien is created or provided for.

A security interest is a voluntary lien. With a security interest, the debtor has agreed to give the creditor (or secured party) an interest in their collateral (their property).

In order to obtain a PMSI, the buyer must execute a security agreement granting a security interest in the goods sold in favor of the creditor (be it the seller or a lender).

One of the most common examples of a security interest is a mortgage: a person borrows money from the bank to buy a house, and they grant a mortgage over the house so that if they default in repaying the loan, the bank can sell the house and apply the proceeds to the outstanding loan.

What is a PMSI? A purchase money security interest (PMSI) is an exception to the first-in-time rule. It gives secured creditors who meet its requirements a special advantage to jump ahead in line of other creditors with respect to certain collateral.

A secured party in UCC law is a person who has the favor of the security interest that is created or provided for under a security agreement, whether or not there is an obligation to be secured that is outstanding.