Surety Agreement

Description

Key Concepts & Definitions

Surety Agreement: A surety agreement involves three parties the principal, the surety, and the obligee. In this agreement, the surety guarantees the obligee that the principal will fulfill their obligations. If the principal fails to meet these obligations, the surety covers the losses incurred.

- Surety Bond: A financial guarantee provided by a surety company, ensuring the principal fulfills contractual or legal obligations.

- Penal Bond: A type of surety bond with a penalty sum mentioned, payable if the bond's terms are breached.

- License Permit: A surety bond required by many state and local governments for businesses to legally operate in certain industries.

Step-by-Step Guide on Obtaining a Surety Bond

- Evaluate Your Requirements: Determine the type of bond needed based on industry and legal requirements, such as a License Permit bond for starting a new business or a Miller Act bond for federal construction projects.

- Choose a Reputable Surety Company: Select a surety company authorized in the United States and capable of providing an electronic surety if necessary.

- Submit an Application: Provide detailed information about your business, financial stability, and past performance. Electronic submission systems have streamlined this process.

- Assessment by Surety: The surety company will evaluate your application, focusing on financials, experience, and credit history.

- Issuance of the Bond: Once approved, the bond is issued. Keep it until the obligation is fully satisfied to protect against claims.

Risk Analysis in Surety Agreements

%%Risk%%Factors%%leading%%to%%claims%%against%%surety%%bonds%%include%%contractor%%default,%%fraudulent%%practices%%or%%failure%%to%%adhere%%to%%local%%laws.

- Contractor's Obligation: Ensuring the completion of a project as per the contract, thus minimizing the risk of construction claims.

- Insurance Coverage: Helps mitigate potential financial losses for the surety, thereby protecting the interests of the obligee.

Understanding these risks helps in opting for appropriate coverage and in the implementation of risk management strategies.

Common Mistakes & How to Avoid Them

- Underestimating the Cost: It's essential to understand all costs involved in obtaining a surety bond, including premiums and potential claims.

- Neglecting the Importance of Accurate Information: Providing inaccurate or incomplete information to the surety can delay or prevent the issuance of a bond.

- Failing to Update the Bond: Ensure your bond reflects current business operations and legal requirements, reducing the risk of claims.

How to fill out Surety Agreement?

Employ the most comprehensive legal library of forms. US Legal Forms is the perfect place for getting updated Surety Agreement templates. Our platform provides 1000s of legal forms drafted by licensed legal professionals and categorized by state.

To obtain a template from US Legal Forms, users just need to sign up for an account first. If you are already registered on our platform, log in and select the template you need and buy it. After purchasing forms, users can find them in the My Forms section.

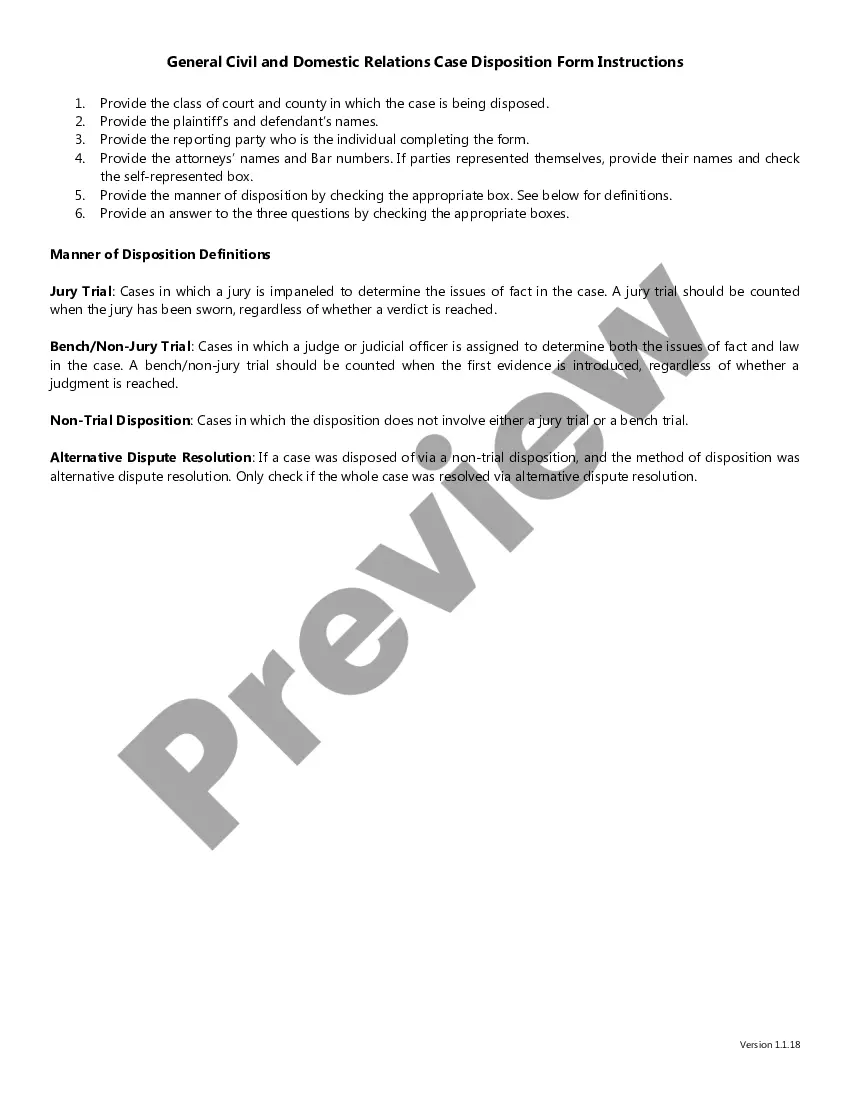

To obtain a US Legal Forms subscription online, follow the guidelines listed below:

- Check if the Form name you’ve found is state-specific and suits your needs.

- If the form has a Preview option, use it to check the sample.

- If the sample doesn’t suit you, use the search bar to find a better one.

- PressClick Buy Now if the template corresponds to your requirements.

- Choose a pricing plan.

- Create a free account.

- Pay with the help of PayPal or with yourr debit/bank card.

- Select a document format and download the template.

- As soon as it’s downloaded, print it and fill it out.

Save your effort and time with our platform to find, download, and complete the Form name. Join thousands of pleased subscribers who’re already using US Legal Forms!

Form popularity

FAQ

This means, a $75,000 surety bond will cost a good credit applicant somewhere between $562 and $1,875. For a bad credit applicant the cost will be in the range between $1,875 and $7,500. Here is a breakdown of what your premiums are likely to be based on your credit score.

At its simplest, a surety bond requires the surety to pay a set amount of money to the obligee if a principal fails to perform a contractual obligation.The surety bond requires the principal to sign an indemnity agreement that pledges company and personal assets to reimburse the surety if a claim occurs.

On average, the cost for a surety bond falls somewhere between 1% and 15% of the bond amount. That means you may be charged between $100 and $1,500 to buy a $10,000 bond policy. Most premium amounts are based on your application and credit health, but there are some bond policies that are written freely.

Obligee a person or organization to whom another party (the "obligor") owes an obligation. In a bonding situation, this is the party that requires and receives the protection of the bond.

When it comes to surety bonds, you will not need to pay month-to-month. In fact, when you get a quote for a surety bond, the quote is a one-time payment quote. This means you will only need to pay it one time (not every month).Most bonds are quoted at a 1-year term, but some are quoted at a 2-year or 3-year term.

The principal is the party being required to obtain the surety bond by the obligee. When filling out a surety bond application, you are the principal. The obligee requires the principal to obtain a surety bond to ensure they uphold their end of the agreement.

Examples of these bonds include construction and environmental performance, payment, supply, maintenance, and warranty bonds. Commercial surety helps obtain capacity at the lowest cost for all corporate surety needs.International surety examines the unique surety requirements internationally.

The cost of your $50,000 surety bond depends mostly on your personal credit score. Applicants with good credit usually pay premiums between 0.75% and 2.5%, which means between $375 and $1,250 per year. Applicants with bad credit, on the other hand, pay premiums in the range of 2.5% to 10%, or between $1,250 and $5,000.

On average, the cost for a surety bond falls somewhere between 1% and 15% of the bond amount. That means you may be charged between $100 and $1,500 to buy a $10,000 bond policy. Most premium amounts are based on your application and credit health, but there are some bond policies that are written freely.