Subordination Agreement to Include Future Indebtedness to Secured Party

Description Subordination Agreement Template

How to fill out Subordination Agreement Forms?

Use the most complete legal library of forms. US Legal Forms is the best platform for finding updated Subordination Agreement to Include Future Indebtedness to Secured Party templates. Our platform provides a huge number of legal documents drafted by certified attorneys and grouped by state.

To download a sample from US Legal Forms, users just need to sign up for a free account first. If you’re already registered on our service, log in and select the template you are looking for and purchase it. After buying templates, users can find them in the My Forms section.

To get a US Legal Forms subscription online, follow the steps below:

- Check if the Form name you have found is state-specific and suits your needs.

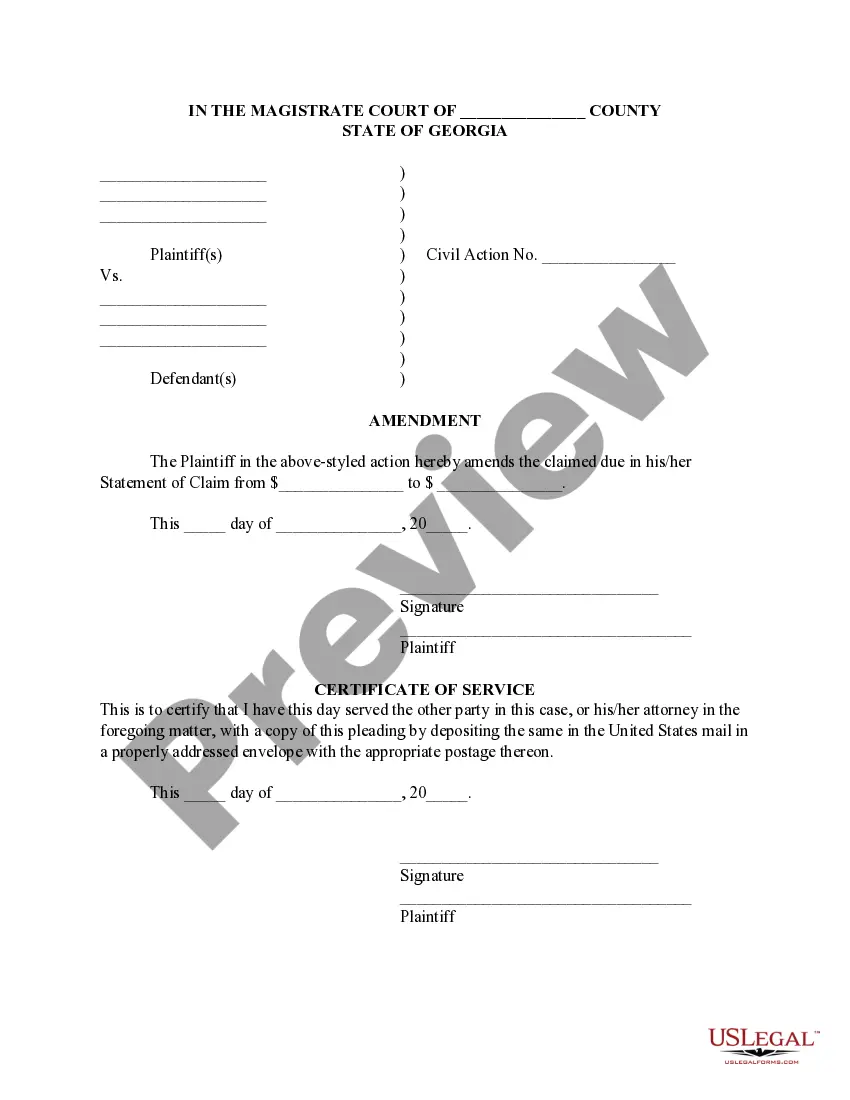

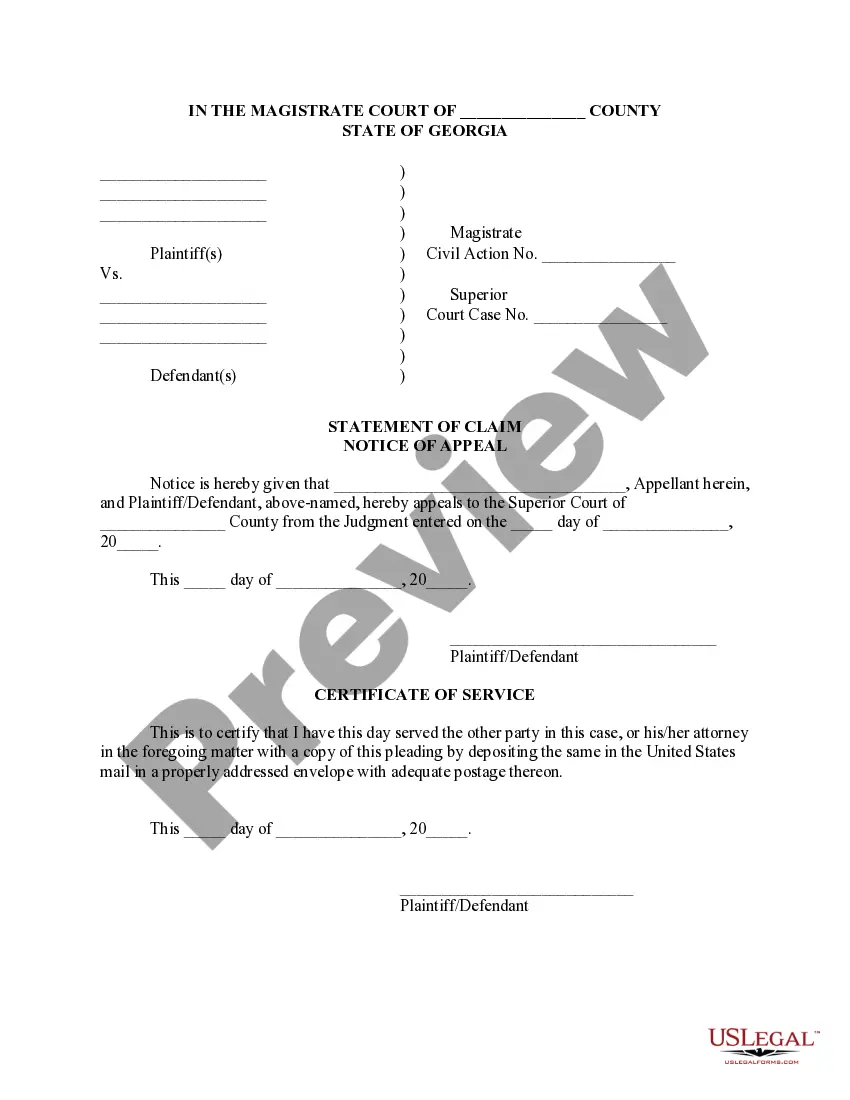

- When the template has a Preview option, utilize it to review the sample.

- In case the template does not suit you, make use of the search bar to find a better one.

- PressClick Buy Now if the template corresponds to your expections.

- Select a pricing plan.

- Create your account.

- Pay with the help of PayPal or with yourr credit/credit card.

- Choose a document format and download the template.

- When it’s downloaded, print it and fill it out.

Save your time and effort with our platform to find, download, and complete the Form name. Join thousands of delighted customers who’re already using US Legal Forms!

Bank Subordination Agreement Form popularity

Secured Party Purchase Other Form Names

Secured Party File FAQ

Subordinated debt is any debt that falls under, or behind, senior debt.Examples of subordinated debt include mezzanine debt, which is debt that also includes an investment. Additionally, asset-backed securities generally have a subordinated feature, where some tranches are considered subordinate to senior tranches.

And many lenders charge a fee to review the subordination package, a fee that might run as high as $100. Your lender will probably pass this fee to you.

Subordination clauses in mortgages refer to the portion of your agreement with the mortgage company that says their lien takes precedence over any other liens you may have on your property.The primary lien on a house is usually a mortgage. However, it's also possible to have other liens.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit. Signing your agreement is a positive step forward in your refinancing journey.

A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor. The priority of debts can become extremely important when a debtor defaults on payments or declares bankruptcy.

A subordination agreement prioritizes collateralized debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.

But as property values are going up and the demand for refinance isn't as much, it seems that the subordination process has gotten a little easier. Typically, it takes two to three weeks to get the resubordination paperwork through, and it is likely to set you back $200 to $300.

Senior debt is often secured and is more likely to be paid back while subordinated debt is not secured and is more of a risk.

Banks issue subordinated debt for various reasons, including shoring up capital, funding investments in technology, acquisitions or other opportunities, and replacing higher-cost capital. In the current low-interest rate environment, subordinated debt can be relatively inexpensive capital.