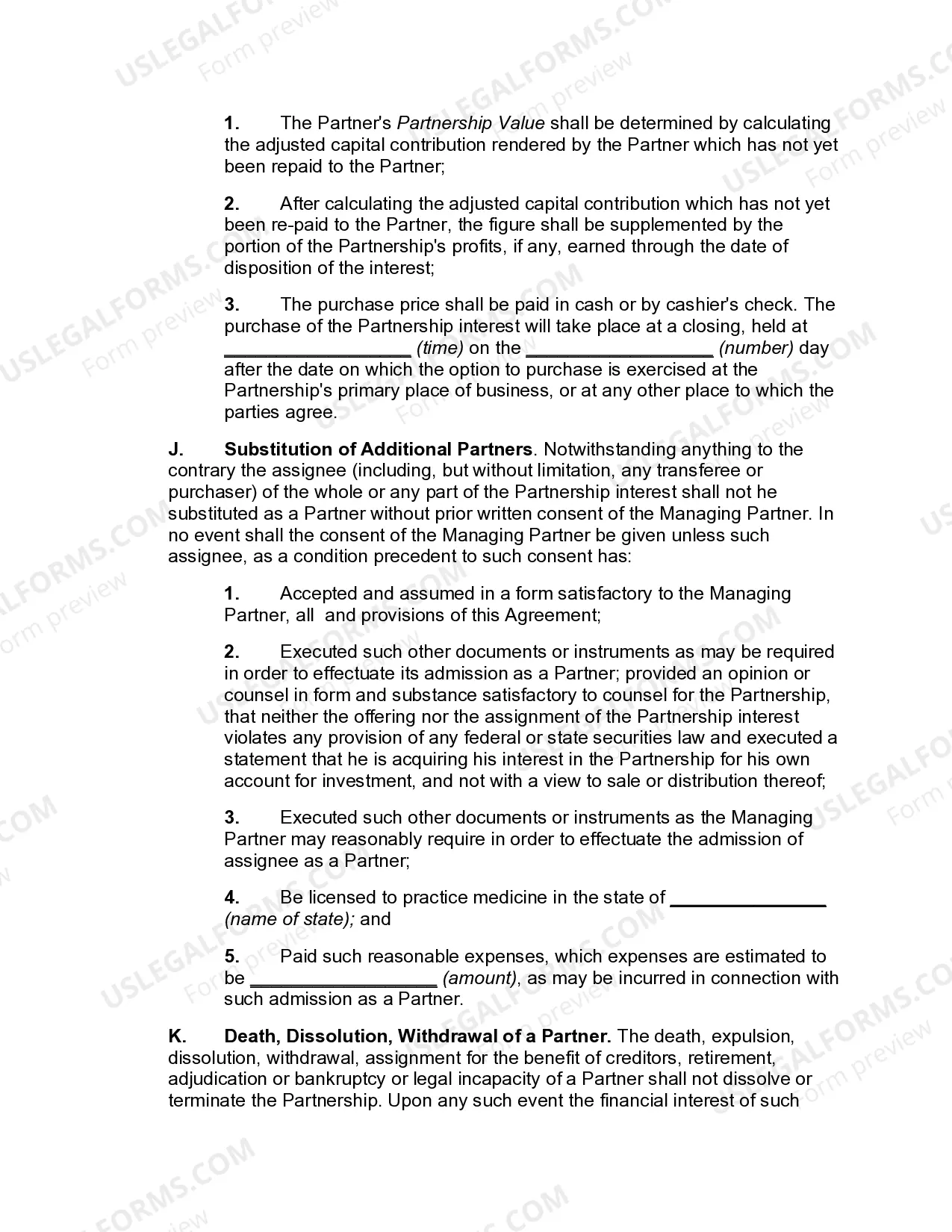

Professional Limited Liability Partnership Agreement to Practice Medicine

Description

How to fill out Professional Limited Liability Partnership Agreement To Practice Medicine?

Employ the most complete legal catalogue of forms. US Legal Forms is the perfect place for finding up-to-date Professional Limited Liability Partnership Agreement to Practice Medicine templates. Our platform provides a huge number of legal forms drafted by licensed attorneys and sorted by state.

To get a sample from US Legal Forms, users simply need to sign up for an account first. If you are already registered on our service, log in and choose the document you are looking for and buy it. Right after purchasing templates, users can see them in the My Forms section.

To get a US Legal Forms subscription online, follow the guidelines below:

- Find out if the Form name you have found is state-specific and suits your needs.

- In case the form features a Preview function, utilize it to check the sample.

- In case the template does not suit you, use the search bar to find a better one.

- Hit Buy Now if the sample meets your expections.

- Select a pricing plan.

- Create your account.

- Pay with the help of PayPal or with yourr debit/visa or mastercard.

- Select a document format and download the sample.

- When it is downloaded, print it and fill it out.

Save your time and effort with the service to find, download, and fill out the Form name. Join a huge number of satisfied clients who’re already using US Legal Forms!

Form popularity

FAQ

PLLC is an acronym of a legal term that stands for professional limited liability company.A PLLC is specifically for services that require professional licensure, including dental, medical, real estate, engineering, nursing, accounting, or law.

A partnership is an arrangement between two or more people to oversee business operations and share its profits and liabilities. In a general partnership company, all members share both profits and liabilities. Professionals like doctors and lawyers often form a limited liability partnership.

Regarding the management flexibility and taxation, a PLLC has the same advantages of an LLC. The difference between the two is that the PLLC has some restrictions on who may be a member of the PLLC and the limitation of liability of the members. With an LLC, anyone can be a member, or owner, of the business.

Learn some of the advantages of this type of partnership structure for professionals. Since the 1990s, a limited liability partnership (LLP) has become a popular form of business organization for many licensed professionals, such as lawyers, doctors, architects, dentists, and accountants.

General partnerships, the most common form.

There are three relatively common partnership types: general partnership (GP), limited partnership (LP) and limited liability partnership (LLP). A fourth, the limited liability limited partnership (LLLP), is not recognized in all states.

Not Everyone Can Operate a Limited Liability Business Attorneys, physicians, and tax preparers, for instance, cannot by law and ethics protect themselves by limiting their liability. They need to be personally responsible for their actions so that they make decisions carefully.

The legal forms of organization that a medical practice can consider are sole proprietorship, general partnership, limited partnership, C corporation (standard corporation), S corporation, limited liability company (LLC), and limited liability partnership (LLP).

Members of a PLLC aren't personally liable for the malpractice of any other member. PLLC members are not personally liable for business debts and lawsuits, such as unpaid office rent. The PLLC can choose to be taxed as a pass-through entity or as a corporation.