Seller's Affidavit of Nonforeign Status

Description Nonforeign

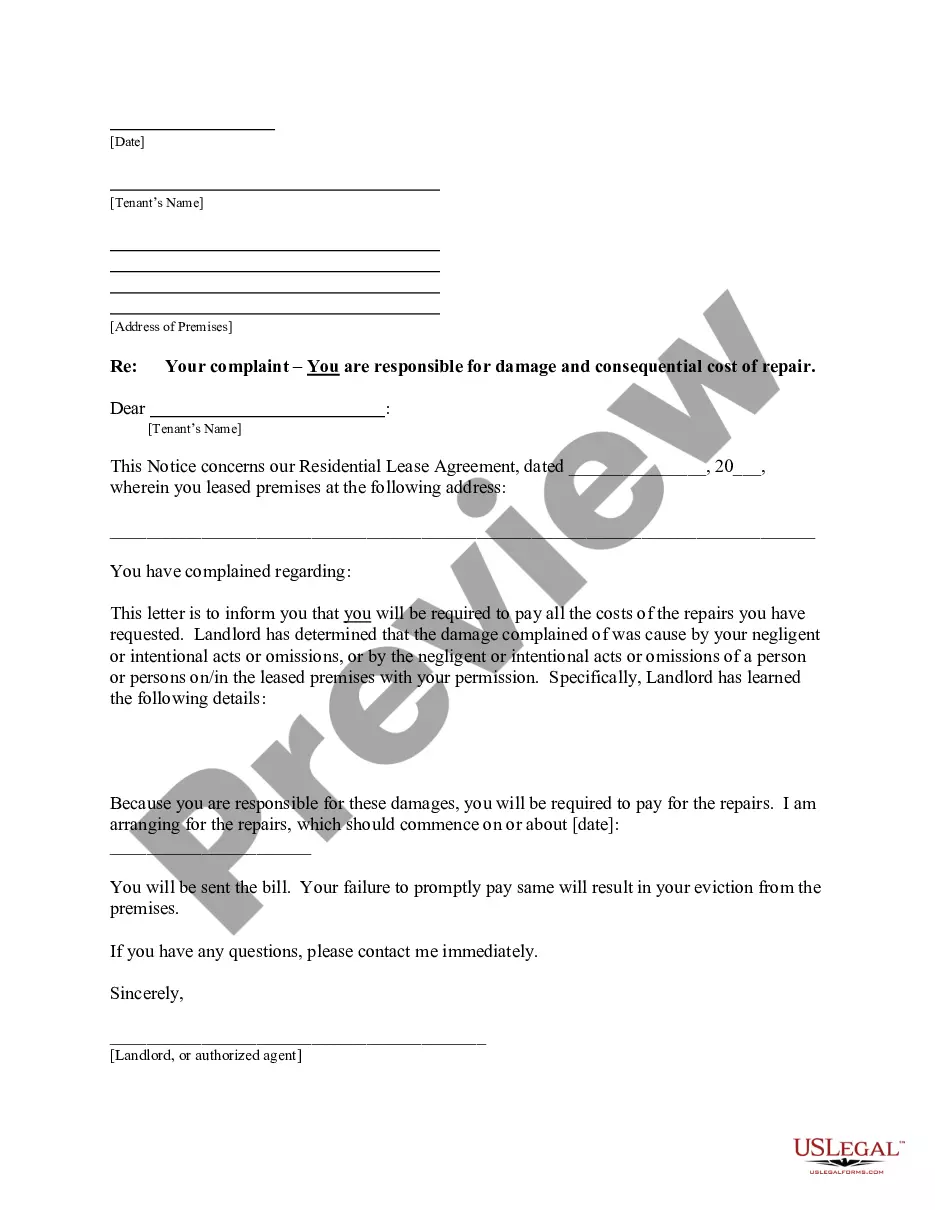

How to fill out Seller Affidavit Editable?

Use the most extensive legal library of forms. US Legal Forms is the perfect place for finding updated Seller's Affidavit of Nonforeign Status templates. Our platform provides a huge number of legal forms drafted by licensed legal professionals and grouped by state.

To get a template from US Legal Forms, users only need to sign up for a free account first. If you’re already registered on our platform, log in and select the document you are looking for and buy it. After purchasing templates, users can see them in the My Forms section.

To get a US Legal Forms subscription online, follow the steps below:

- Find out if the Form name you’ve found is state-specific and suits your needs.

- When the form features a Preview function, utilize it to check the sample.

- In case the sample doesn’t suit you, use the search bar to find a better one.

- Hit Buy Now if the sample corresponds to your requirements.

- Choose a pricing plan.

- Create an account.

- Pay with the help of PayPal or with yourr debit/visa or mastercard.

- Select a document format and download the template.

- After it is downloaded, print it and fill it out.

Save your effort and time with the service to find, download, and complete the Form name. Join thousands of delighted subscribers who’re already using US Legal Forms!

Nonforeign File Form popularity

Seller Affidavit Document Other Form Names

Seller Affidavit File FAQ

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to income tax withholding (IRC section 1445). The transferee is the withholding agent.If the transferor is a foreign person and you fail to withhold, you may be held liable for the tax.

FIRPTA withholding is required to be submitted to the IRS within 20 days of the closing together with IRS Form 8288, U.S. Withholding Tax Return for Disposition by Foreign Persons of U.S. Real Property Interests, and Form 8288-A, Statement of Withholding on Dispositions by Foreign Persons of U.S. Real Property

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

This document, included in the seller's opening package, requests that the seller swears under penalty of perjury that they are not a non-resident alien for purposes of United States income taxation. A Seller unable to complete this affidavit may be subject to withholding up to 15%.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) income tax withholding. FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests.

A: The buyer must agree to sign an affidavit stating that the purchase price is under $300,000 and the buyer intends to occupy. The buyer may choose not to sign the form, in which case withholding must be done.

The address of the property being transferred (or sold) The seller or transferor's information: Full name. Telephone number. Address. Social Security Number, Federal Employer Identification Number, or California Corporation Number.

Rather, A buyer or other transferee of a U.S. real property interest, and a corporation, qualified investment entity, or fiduciary that is required to withhold tax, must file TIP Form 8288 to report and transmit the amount withheld. If two or more persons are joint transferees, each is obligated to withhold.