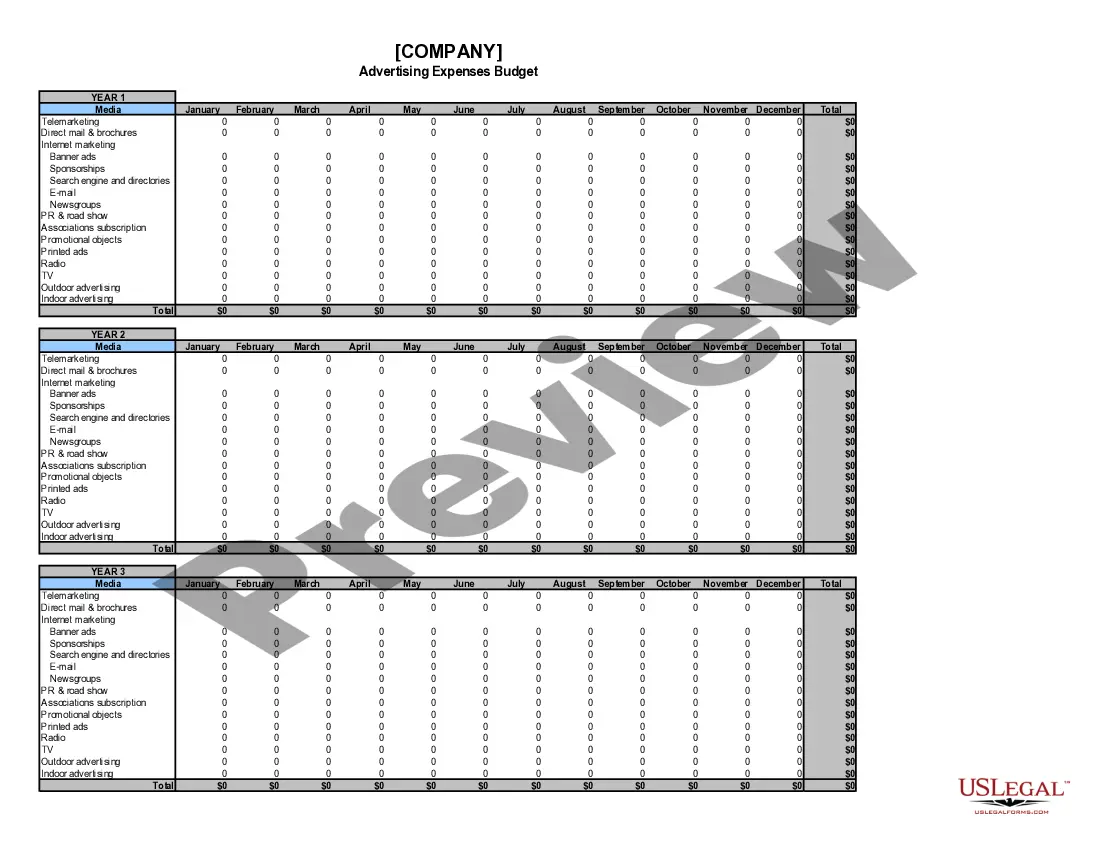

Advertising Expenses

Description

How to fill out Advertising Expenses?

US Legal Forms is the most simple and cost-effective way to find appropriate legal templates. It’s the most extensive web-based library of business and personal legal documentation drafted and checked by lawyers. Here, you can find printable and fillable templates that comply with federal and local regulations - just like your Advertising Expenses.

Obtaining your template requires only a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the document on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can get a properly drafted Advertising Expenses if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to guarantee you’ve found the one meeting your requirements, or locate another one using the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and judge the subscription plan you like most.

- Create an account with our service, log in, and pay for your subscription using PayPal or you credit card.

- Decide on the preferred file format for your Advertising Expenses and download it on your device with the appropriate button.

After you save a template, you can reaccess it at any time - just find it in your profile, re-download it for printing and manual fill-out or import it to an online editor to fill it out and sign more effectively.

Benefit from US Legal Forms, your trustworthy assistant in obtaining the corresponding official documentation. Give it a try!

Form popularity

FAQ

Advertising is a broad category of business expenses that includes business activities such as: Advertising in newspapers and magazines, and on TV or online. Direct marketing. Sponsorship of sports teams and creating promotional items like mugs, hats, T-shirts, or pens.

General and Administrative: Another possibility is that advertising expenses are categorized as general and administrative expenses. This is because advertising can be considered a necessary overhead cost for many businesses.

Advertising Expense is an expense account. It is part of operating expenses in the income statement. Sometimes, companies pay for advertisements in advance to media companies.

GAAP says that you have two kinds of advertising expenses. The first is the cost of producing advertising, and the second kind is the cost of communicating the advertising. The part we're interested in is the cost of producing advertising, since that most closely relates to the question about marketing creative costs.

Advertising is considered an expense item; part of operating expenses recorded on the income statement. In the vernacular, something of worth is often spoken of as being an ?asset.? However, while advertising truly does have merit and value, from an accounting standpoint, generally, it is treated as an expense.

Expenses. The IRS allows you to deduct the cost of business-related expenses that are considered both ordinary and necessary in your trade or business. Advertising - Amounts paid for business-related advertising. Examples- Business cards, flyers, ad space, etc.

Expenses. The IRS allows you to deduct the cost of business-related expenses that are considered both ordinary and necessary in your trade or business. Advertising - Amounts paid for business-related advertising. Examples- Business cards, flyers, ad space, etc.

Advertising and promotion expense Newspapers, magazines, TV, and radio. Flyers, brochures, and business cards. Email marketing, social media, and your website.