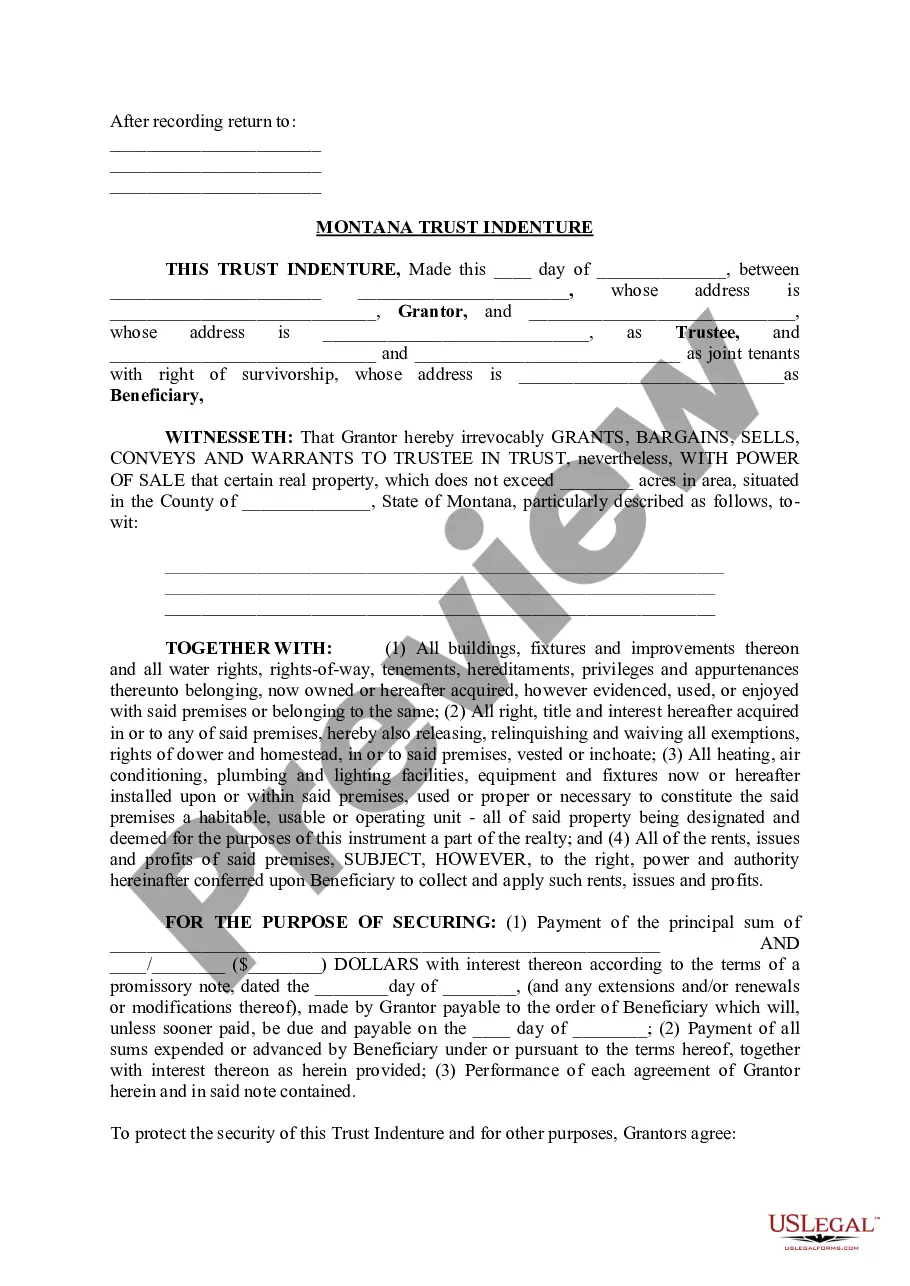

General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion

Description Trust Agreement Gift Tax

How to fill out Trust Agreement Tax Document?

Use the most extensive legal catalogue of forms. US Legal Forms is the perfect place for getting updated General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion templates. Our platform provides thousands of legal documents drafted by certified legal professionals and grouped by state.

To obtain a sample from US Legal Forms, users only need to sign up for an account first. If you are already registered on our service, log in and select the document you need and buy it. After buying forms, users can see them in the My Forms section.

To get a US Legal Forms subscription on-line, follow the steps below:

- Check if the Form name you have found is state-specific and suits your needs.

- If the template features a Preview option, utilize it to review the sample.

- In case the sample does not suit you, make use of the search bar to find a better one.

- PressClick Buy Now if the sample meets your expections.

- Select a pricing plan.

- Create a free account.

- Pay via PayPal or with the credit/bank card.

- Select a document format and download the template.

- After it is downloaded, print it and fill it out.

Save your effort and time with our service to find, download, and fill out the Form name. Join a huge number of pleased subscribers who’re already using US Legal Forms!

Trust Agreement Form Fillable Form popularity

Trust Minor Agreement Other Form Names

General Tax Form FAQ

The value of all gifts made during the year to a single beneficiary count towards the donor's $15,000 annual exclusion, no matter what their form. Thus, if you give your child a $10,000 automobile, you have used $10,000 of your annual exclusion and have $5,000 left to give that child within the annual exclusion amount.

Trusts for minors, or minor's trusts, are very specific types of trusts that are used to hold and distribute property or assets to minors. They typically provide instructions that the money or property assets will be held in trust until the minor reaches the age of majority.

4. Do gifts to a Gift Trust qualify for the annual exclusion?Gifts in trust do not qualify for the annual exclusion unless the trust either qualifies as a Minor's Trust under Internal Revenue Code Section 2503(c) or has certain temporary withdrawal powers called Crummey powers.

A Section 2503c trust is a type of minor's trust established for a beneficiary under the age of 21 which allows parents, grandparents, and other donors to make tax-free gifts to the trust up to the annual gift tax exclusion amount and the generation skipping transfer tax exclusion amount.

The annual exclusion applies to gifts to each donee. In other words, if you give each of your children $11,000 in 2002-2005, $12,000 in 2006-2008, $13,000 in 2009-2012 and $14,000 on or after January 1, 2013, the annual exclusion applies to each gift. The annual exclusion for 2014, 2015, 2016 and 2017 is $14,000.

Each year, a person can make transfers of $14,000 to the trust without any gift tax consequences. Moreover, the annual gift tax exclusion applies to each recipient, so multiple gifts in that amount can be made to as many children, grandchildren, or other individuals as the donor wishes.

In 2020 and 2021, you can give up to $15,000 to someone in a year and generally not have to deal with the IRS about it. If you give more than $15,000 in cash or assets (for example, stocks, land, a new car) in a year to any one person, you need to file a gift tax return.

In all cases, you and your spouse need to file individual gift tax returns. When making a gift to a trust, each trust beneficiary is considered a recipient of your gift and you can still gift each beneficiary $15,000 per year.