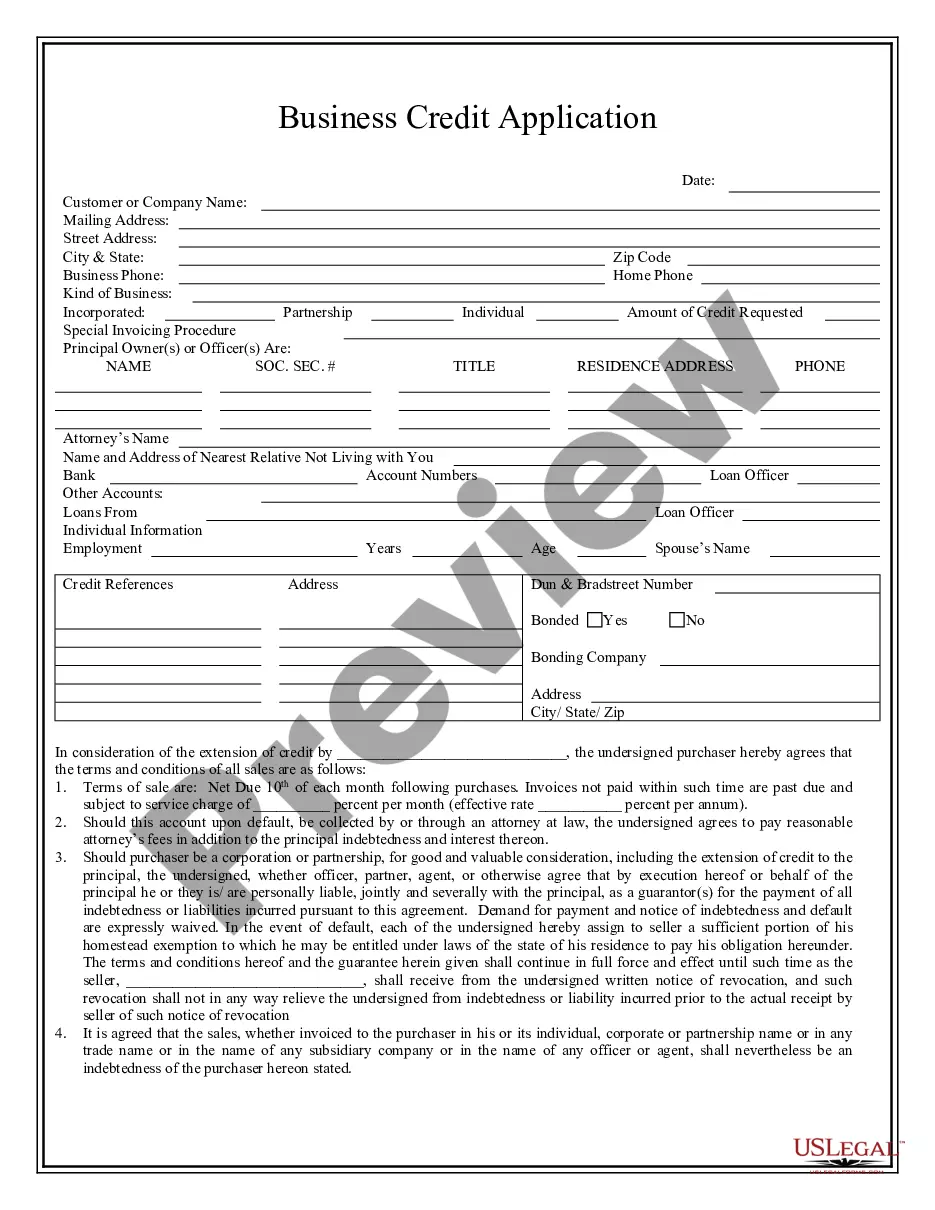

A Bank Withdrawal or Draft Agreement is a legally binding contract between a bank and its customer that outlines the terms and conditions of a withdrawal or draft. It typically includes the withdrawal date, the amount to be withdrawn, the bank's fees, and the customer's signature. The agreement also typically includes the bank's eligibility criteria and any applicable limits or restrictions. There are two main types of Bank Withdrawal or Draft Agreement: Demand Drafts and Time Drafts. A Demand Draft is an agreement between a bank and its customer in which the bank agrees to pay a certain amount of money on demand by the customer. The customer typically pays the bank a fee for this service, and the bank issues a demand draft to the customer. A Time Draft is an agreement between a bank and its customer in which the bank agrees to pay a certain amount of money in the future, usually after a specified period of time. This type of agreement is typically used for larger purchases such as real estate or cars. The customer pays the bank a fee for this service, and the bank issues a time draft to the customer.

Bank Withdrawal or Draft Agreement

Description

How to fill out Bank Withdrawal Or Draft Agreement?

How much time and resources do you normally spend on drafting formal paperwork? There’s a greater opportunity to get such forms than hiring legal experts or wasting hours browsing the web for a suitable blank. US Legal Forms is the top online library that provides professionally drafted and verified state-specific legal documents for any purpose, like the Bank Withdrawal or Draft Agreement.

To obtain and complete a suitable Bank Withdrawal or Draft Agreement blank, adhere to these simple steps:

- Examine the form content to ensure it meets your state regulations. To do so, read the form description or use the Preview option.

- If your legal template doesn’t meet your requirements, find another one using the search tab at the top of the page.

- If you already have an account with us, log in and download the Bank Withdrawal or Draft Agreement. If not, proceed to the next steps.

- Click Buy now once you find the right blank. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Register for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is absolutely secure for that.

- Download your Bank Withdrawal or Draft Agreement on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously acquired documents that you securely keep in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as often as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most reliable web solutions. Sign up for us today!

Form popularity

FAQ

A demand draft allows someone to withdraw money from your checking account without your signature. It is also called a telephone check or preauthorized draft. The person taking money out of your account is supposed to have your permission and your account number and routing number.

Guaranteed availability of funds Unlike a personal check, a bank draft is guaranteed by the bank. It means that the payee is guaranteed the availability of funds. In such a way, bank drafts are safer than personal checks, which might bounce if there are no sufficient funds in the payer's account.

A bank draft is guaranteed by the financial institution and the funds are withdrawn from your account immediately. A cheque has no guarantees and the funds will stay in your account until it's deposited.

Bank draft: Made out by a financial institution that guarantees the funds after withdrawing the amount from one of your accounts. Bank drafts can be made out in foreign currencies. Certified cheque: Similar to a bank draft, but the money isn't withdrawn from your account.

A bank draft is a payment on behalf of the payer, which is guaranteed by the issuing bank. A draft is used when the payee wants a highly secure form of payment. The bank can safely issue this guarantee because it immediately debits the payer's account for the amount of the check, and therefore has no risk.

What's the advantage of using a bank draft? Bank drafts provide the person receiving the funds with a guarantee that they're available. They're more reliable than a cheque, which can bounce due to insufficient funds.

Because bank drafts are guaranteed by the financial institutions that issue them, they are the ideal payment option when customers make a large purchase. And unlike cash, a bank draft provides a clear, secure record of the transaction. This can be important if there's any future dispute about the transaction.

Because bank drafts are guaranteed by the financial institutions that issue them, they are the ideal payment option when customers make a large purchase. And unlike cash, a bank draft provides a clear, secure record of the transaction. This can be important if there's any future dispute about the transaction.