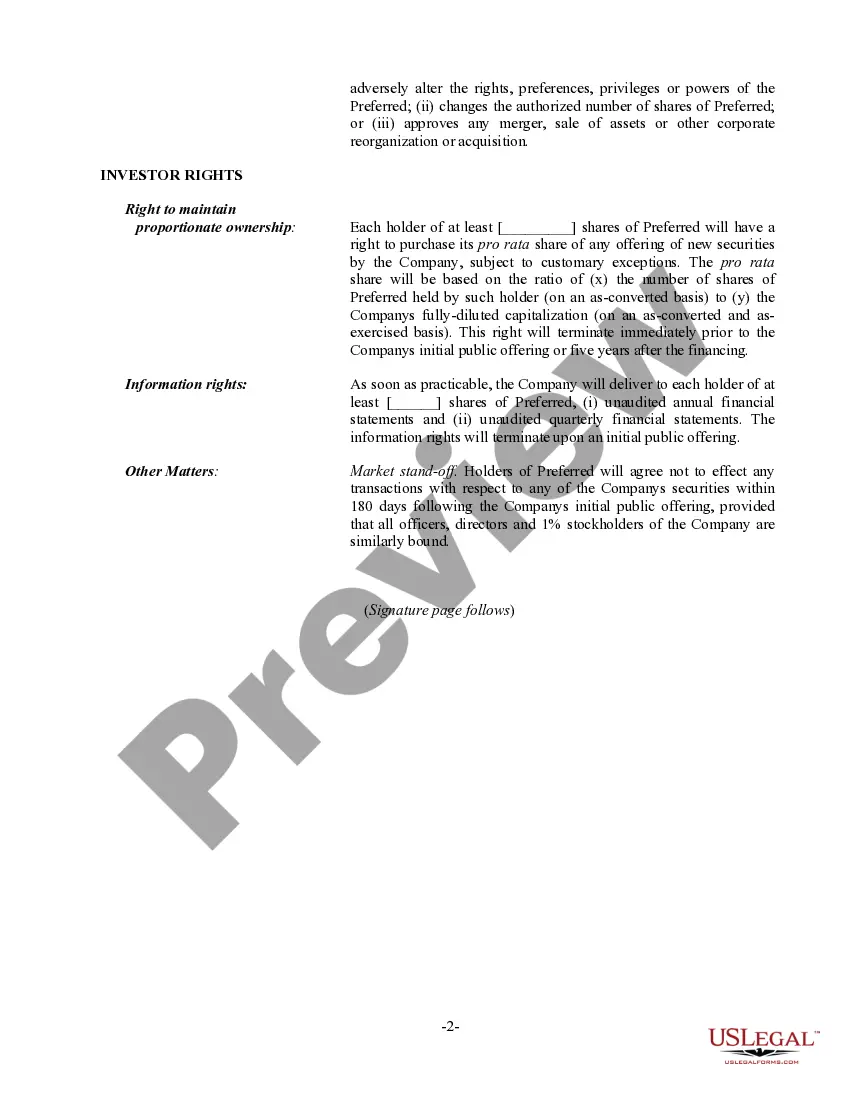

An Angel Investor Term Sheet is a document which outlines the terms of an investment from an angel investor, such as the amount of money invested, the rights of the investor, the valuation of the company, the return on investment, and the exit strategy. There are two types of Angel Investor Term Sheets: convertible debt term sheets and equity term sheets. Convertible debt term sheets involve an angel investor loaning money to a startup company. The startup company will then pay back the loan with interest, and the loan will convert into equity (shares of the company) at a predetermined valuation. Equity term sheets involve the angel investor buying shares of the company in exchange for cash. The term sheet will outline the number of shares, the price per share, the investor’s rights, and the investor’s return on investment. Both types of term sheet will outline the rights of the angel investor and the exit strategy. The exit strategy outlines how the investor can exit their investment, such as through an initial public offering or a sale of the company.

An Angel Investor Term Sheet is a document which outlines the terms of an investment from an angel investor, such as the amount of money invested, the rights of the investor, the valuation of the company, the return on investment, and the exit strategy. There are two types of Angel Investor Term Sheets: convertible debt term sheets and equity term sheets. Convertible debt term sheets involve an angel investor loaning money to a startup company. The startup company will then pay back the loan with interest, and the loan will convert into equity (shares of the company) at a predetermined valuation. Equity term sheets involve the angel investor buying shares of the company in exchange for cash. The term sheet will outline the number of shares, the price per share, the investor’s rights, and the investor’s return on investment. Both types of term sheet will outline the rights of the angel investor and the exit strategy. The exit strategy outlines how the investor can exit their investment, such as through an initial public offering or a sale of the company.