Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose

Description Testamentary Bequest

How to fill out Testamentary Trust For Form?

Utilize the most complete legal catalogue of forms. US Legal Forms is the best platform for finding up-to-date Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose templates. Our platform offers thousands of legal documents drafted by licensed lawyers and categorized by state.

To get a template from US Legal Forms, users just need to sign up for a free account first. If you’re already registered on our platform, log in and choose the template you are looking for and buy it. Right after buying templates, users can find them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the steps below:

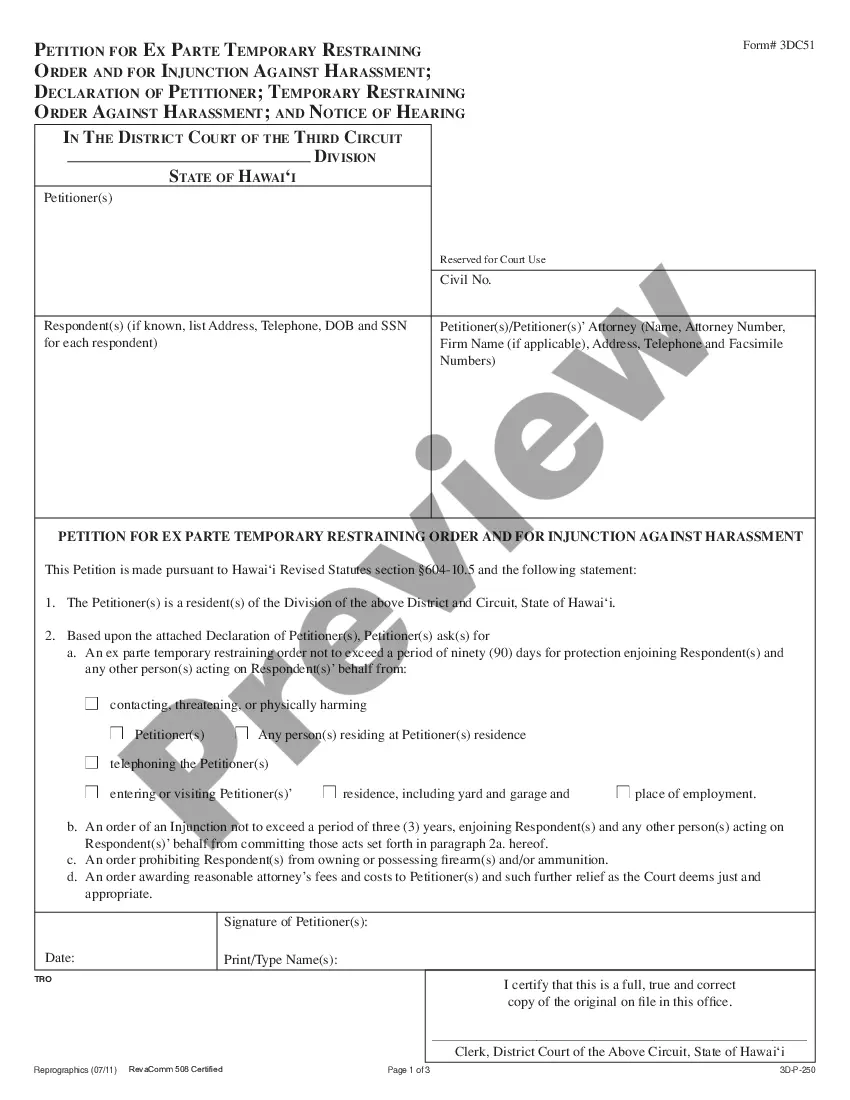

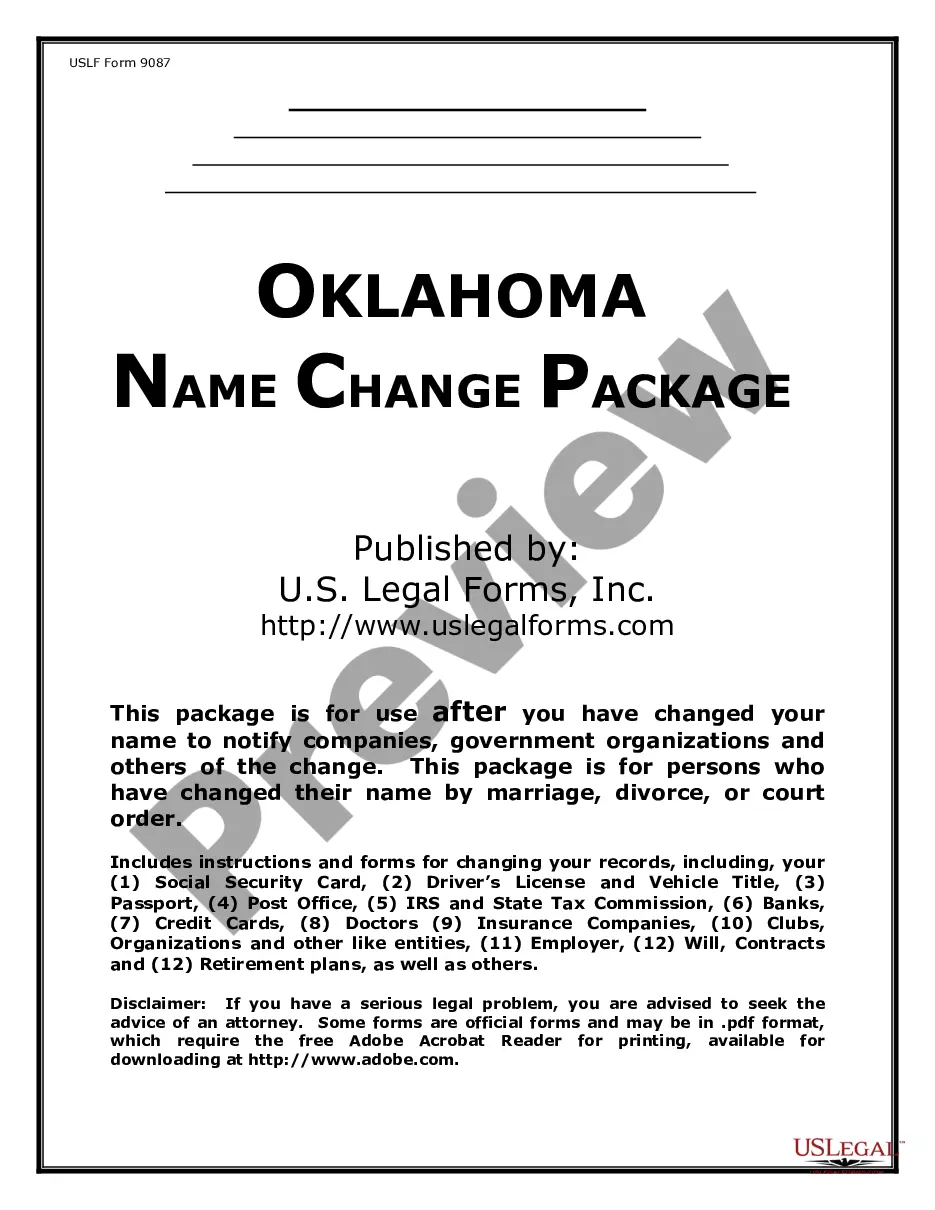

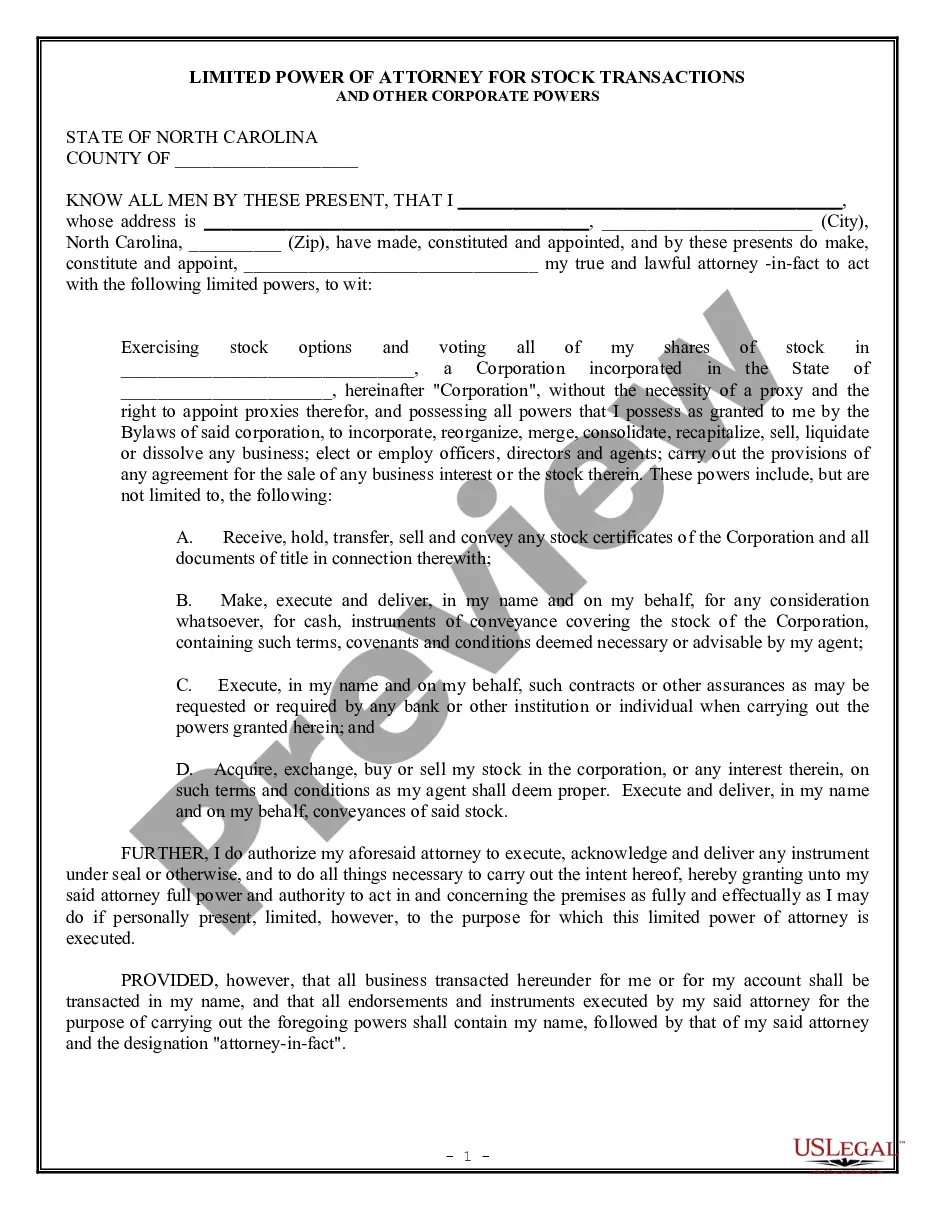

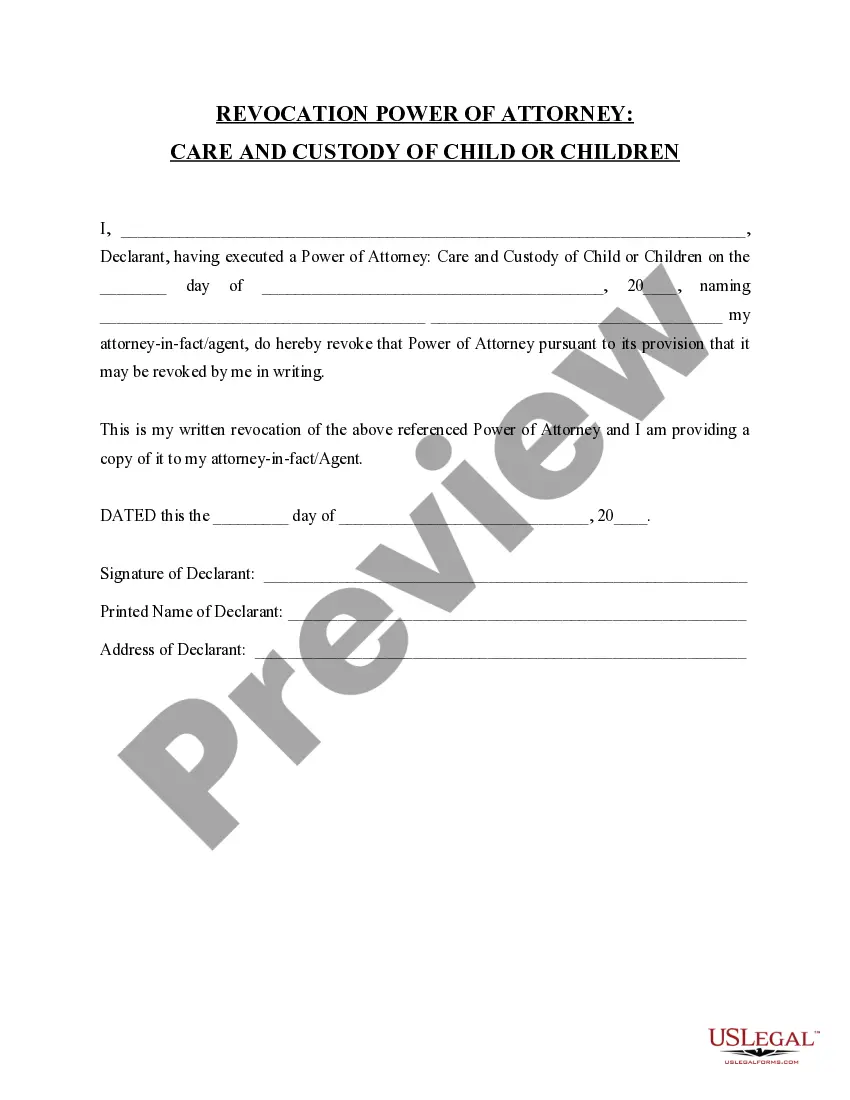

- Check if the Form name you’ve found is state-specific and suits your needs.

- In case the form has a Preview option, use it to check the sample.

- If the sample doesn’t suit you, use the search bar to find a better one.

- Hit Buy Now if the template meets your requirements.

- Select a pricing plan.

- Create your account.

- Pay with the help of PayPal or with the debit/visa or mastercard.

- Choose a document format and download the template.

- As soon as it’s downloaded, print it and fill it out.

Save your effort and time with the platform to find, download, and complete the Form name. Join thousands of delighted subscribers who’re already using US Legal Forms!

Trust Charity For Form popularity

Charitable Purpose Sample Other Form Names

Testamentary Trust With Form FAQ

A specific bequest or devise is a gift of a specific item of property that can be easily identified and distinguished from all other property in the testator's estate.

Make certain you have a will. If you don't have a will or trust, your children will inherit according to the laws of your state. Use clear language to describe your intention to disinherit. Most states allow a parent to disinherit a child for any reason they choose. Check the rules. Consider alternatives.

As nouns the difference between gift and bequest is that gift is something given to another voluntarily, without charge while bequest is the act of bequeathing or leaving by will.

Make bequests of money. However, if there's no money in the account when you die, the money will come from your estate's general assets. To make the bequest in your will, you can write, I bequeath $5,000 to my sister, Ella, to be paid out of the proceeds from the sale of my stock in Amazon, Inc.

Choose an organization to receive your bequest. Decide what type of bequest you will give. Decide what you will give in your bequest. Add the bequest to your will and tell people about it. Pat yourself on the back while you think about the benefits of making a charitable bequest.

In general, there is an unlimited deduction of charitable bequests against the value of an estate, making it a powerful tool for reducing estate tax. It is possible for an estate to deduct charitable bequests of not only cash, but also property such as real estate, stock, IRAs, autos and other assets.

Charitable bequests from your will combine philanthropy and tax benefits. Bequests are gifts that are made as part of a will or trust. A bequest can be to a person, or it can be a charitable bequest to a nonprofit organization, trust or foundation. Anyone can make a bequestin any amountto an individual or charity.

Put Strings on the Money One way to do this is by leaving the money in a trust, and appointing someone as trustee (the person who controls trust assets) you think will do a good job of doling out the money on behalf of, or to, the beneficiary.

A charity can be the beneficiary of a relatively simple revocable trust or irrevocable trust.If you have substantially appreciated assets (such as real estate or stocks), you can reduce current capital gains tax on the assets by contributing the assets to a charitable remainder trust.