Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner

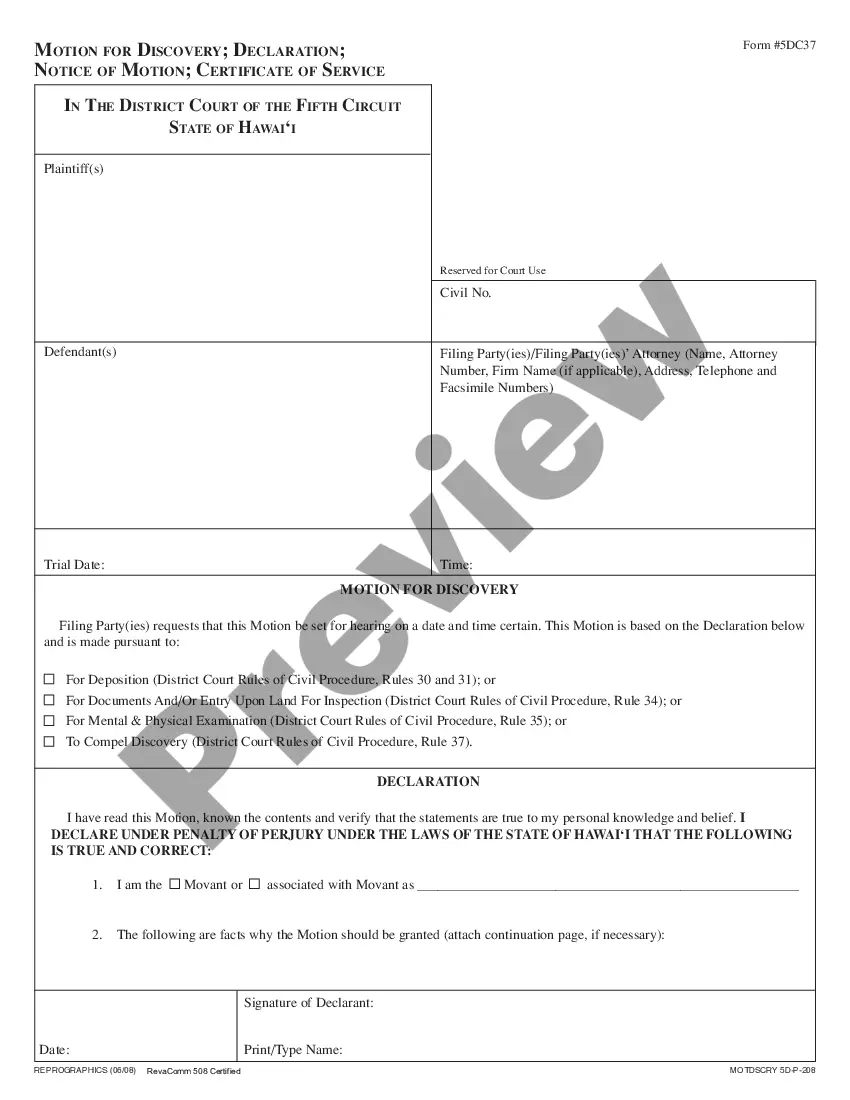

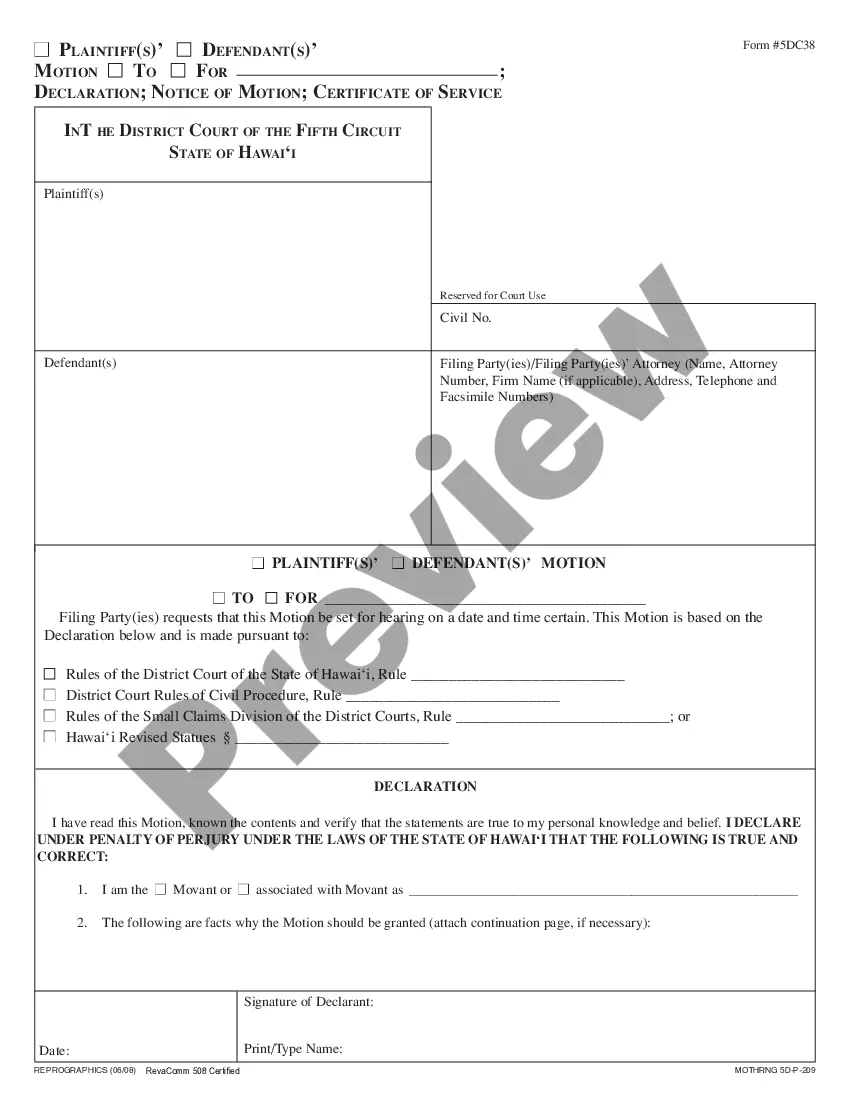

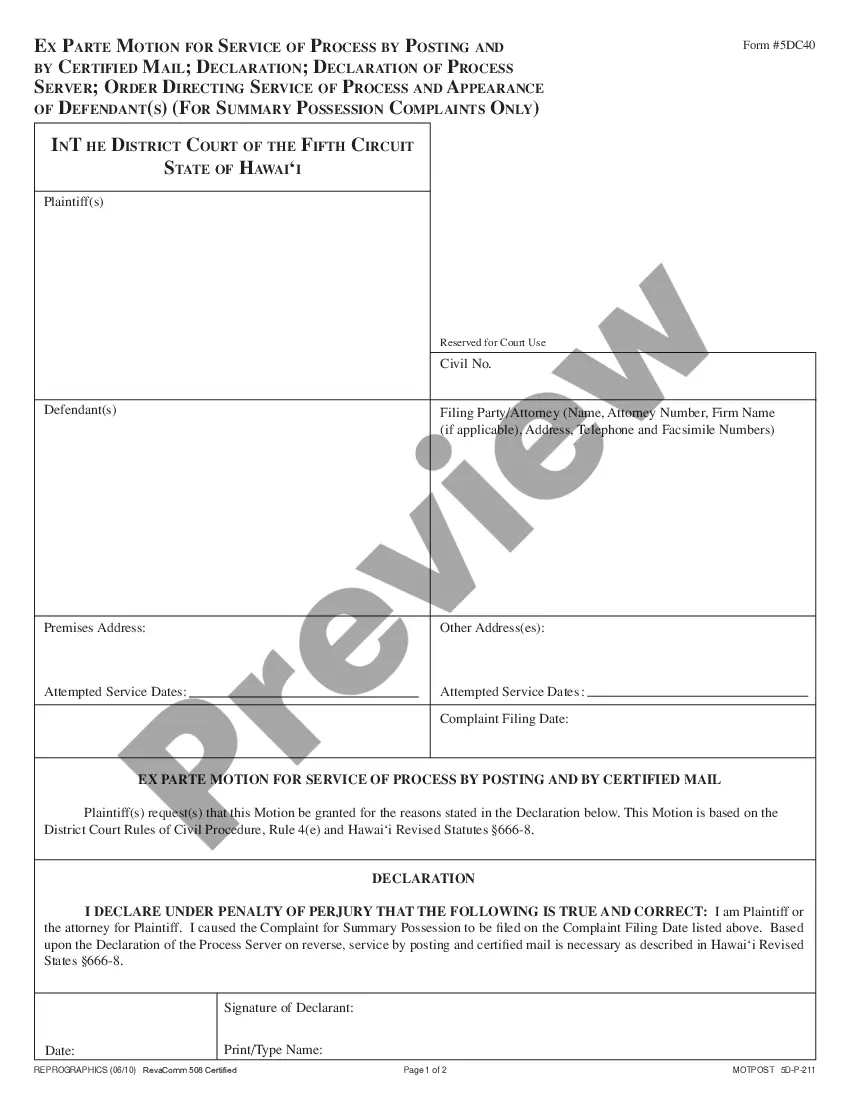

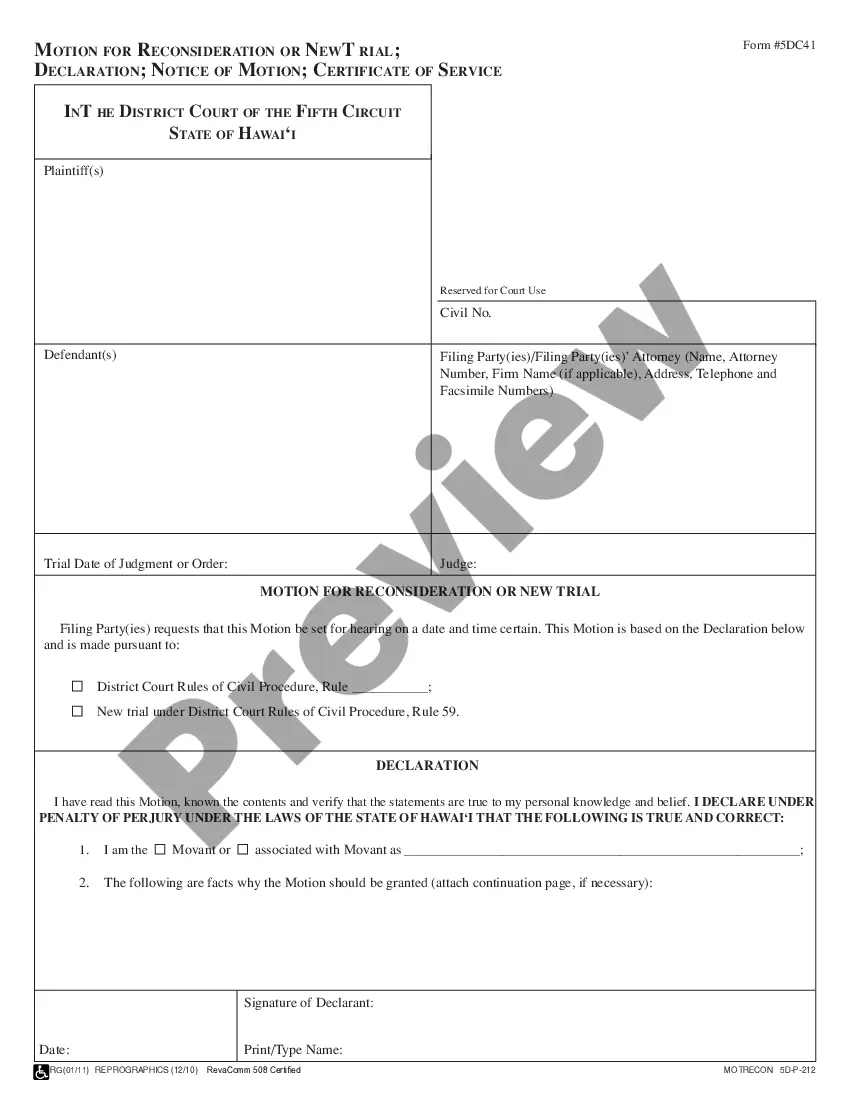

Description Business Transferred Form

How to fill out Business Transferred?

Employ the most complete legal library of forms. US Legal Forms is the perfect place for getting up-to-date Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner templates. Our service provides 1000s of legal documents drafted by licensed legal professionals and categorized by state.

To obtain a template from US Legal Forms, users simply need to sign up for an account first. If you are already registered on our platform, log in and choose the document you are looking for and buy it. After buying forms, users can see them in the My Forms section.

To get a US Legal Forms subscription online, follow the steps listed below:

- Find out if the Form name you have found is state-specific and suits your needs.

- In case the form has a Preview function, use it to check the sample.

- If the sample does not suit you, use the search bar to find a better one.

- PressClick Buy Now if the sample meets your requirements.

- Choose a pricing plan.

- Create an account.

- Pay with the help of PayPal or with the debit/credit card.

- Select a document format and download the template.

- After it is downloaded, print it and fill it out.

Save your effort and time with our platform to find, download, and complete the Form name. Join a large number of happy subscribers who’re already using US Legal Forms!

Transferred Partner Form popularity

Property Of Transferred Other Form Names

Devise Property FAQ

To dispose of Personal Property owned by a decedent at the time of death as a gift under the provisions of the decedent's will. The term bequeath applies only to personal property. A testator, to give real property to someone in a testamentary provision, devises it.

You can bequeath property, or transfer it upon death, by writing a will. In the will, you'll name the beneficiary for your property, which is the person who will receive it when you die. Drafting a will is easy, and you can do it yourself.

Bank accounts. Brokerage or investment accounts. Retirement accounts and pension plans. A life insurance policy.

To devise is to dispose of real property by will. A bequest is a gift by will of property other than land. To bequeath is to dispose by will of property other than land.

A legal way to get business funds to your beneficiary quickly is to deposit them in a payable-on-death account. Being a sole proprietor doesn't affect the POD option, as the money is still your personal cash. Fill out a form at your bank naming your account beneficiary.

The terms bequest and devise both describe gifting in a Last Will, but their meanings differ slightly. While bequest often describes any type of gift given to a beneficiary after a person passes away, devise only applies when the gift is real property.

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.

Create a section of the LLC operating agreement that names the beneficiaries of all LLC members or, if you are the sole LLC owner, a beneficiary to take over all business operations after you pass away. Ask all LLC members to submit the names of their beneficiaries for the official record.

As the recipient of an inherited property, you'll benefit from a step-up tax basis, meaning you'll inherit the home at the fair market value on the date of inheritance, and you'll only be taxed on any gains between the time you inherit the home and when you sell it.