Sample Letter for Delinquent Account

Description Sample Delinquent Credit Explanation Letter

How to fill out Delinquent Payment Letters?

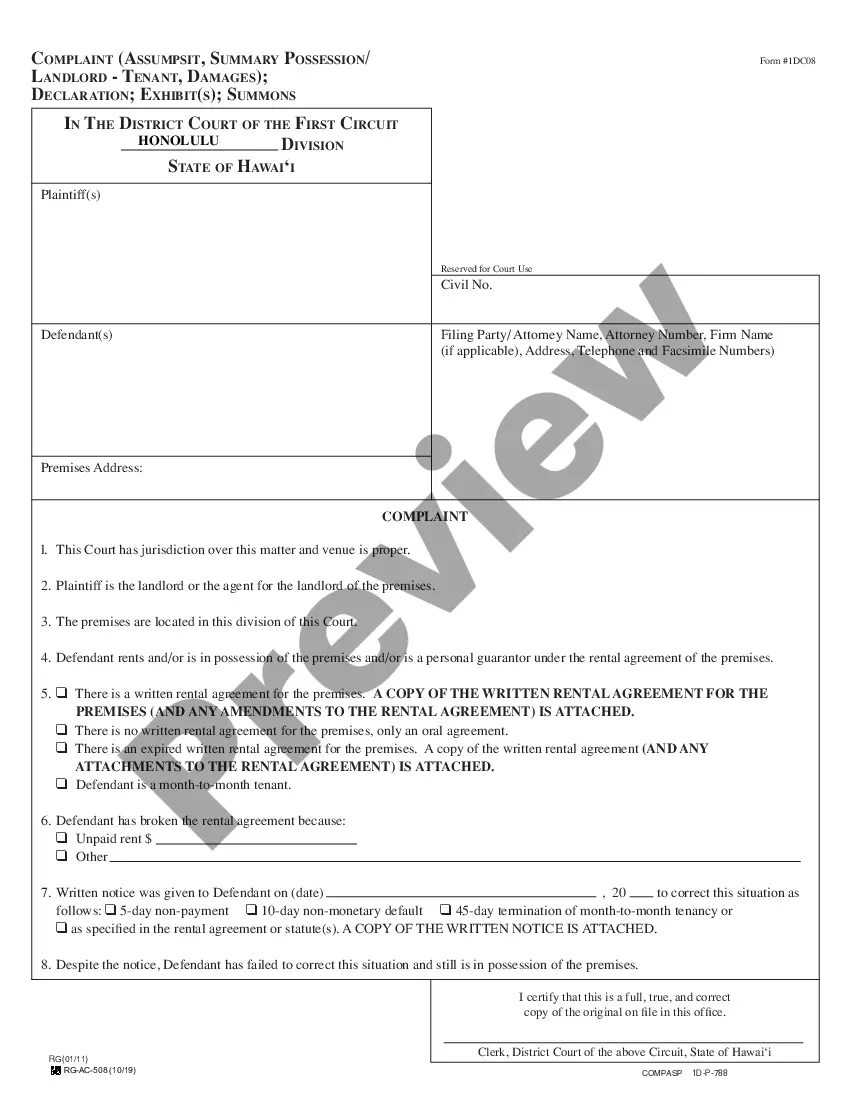

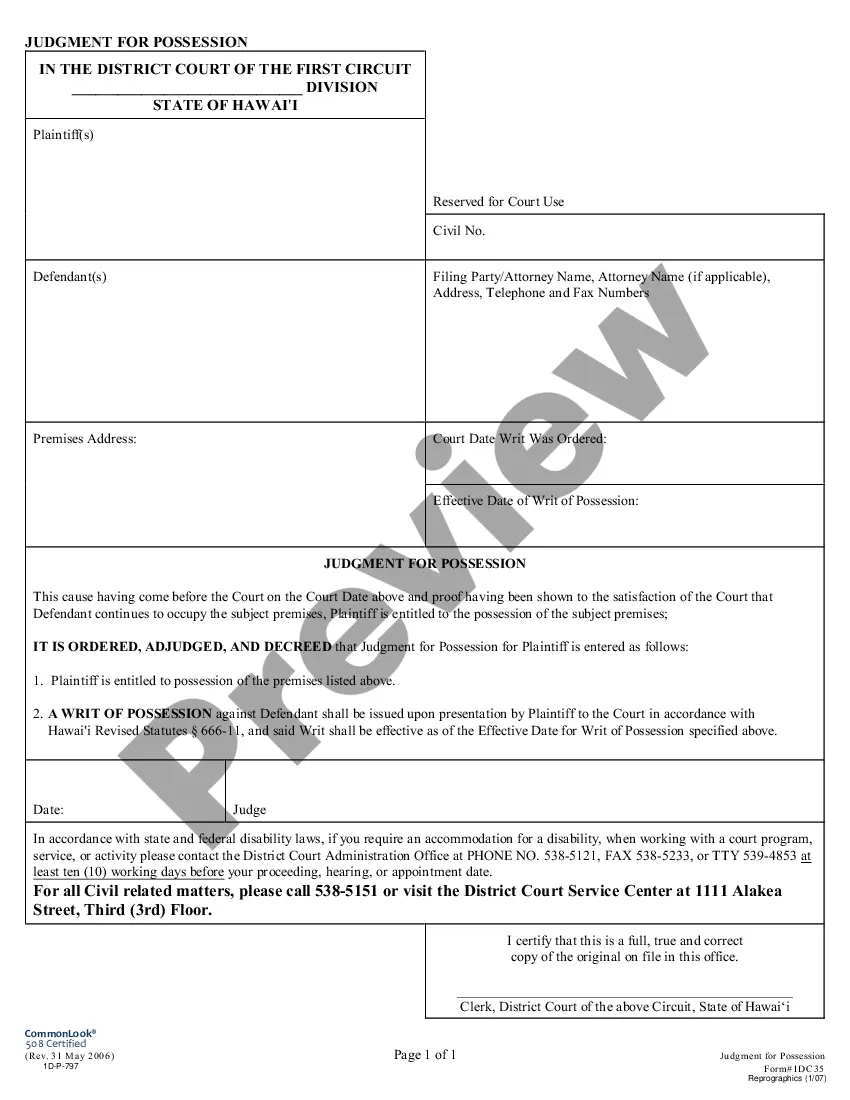

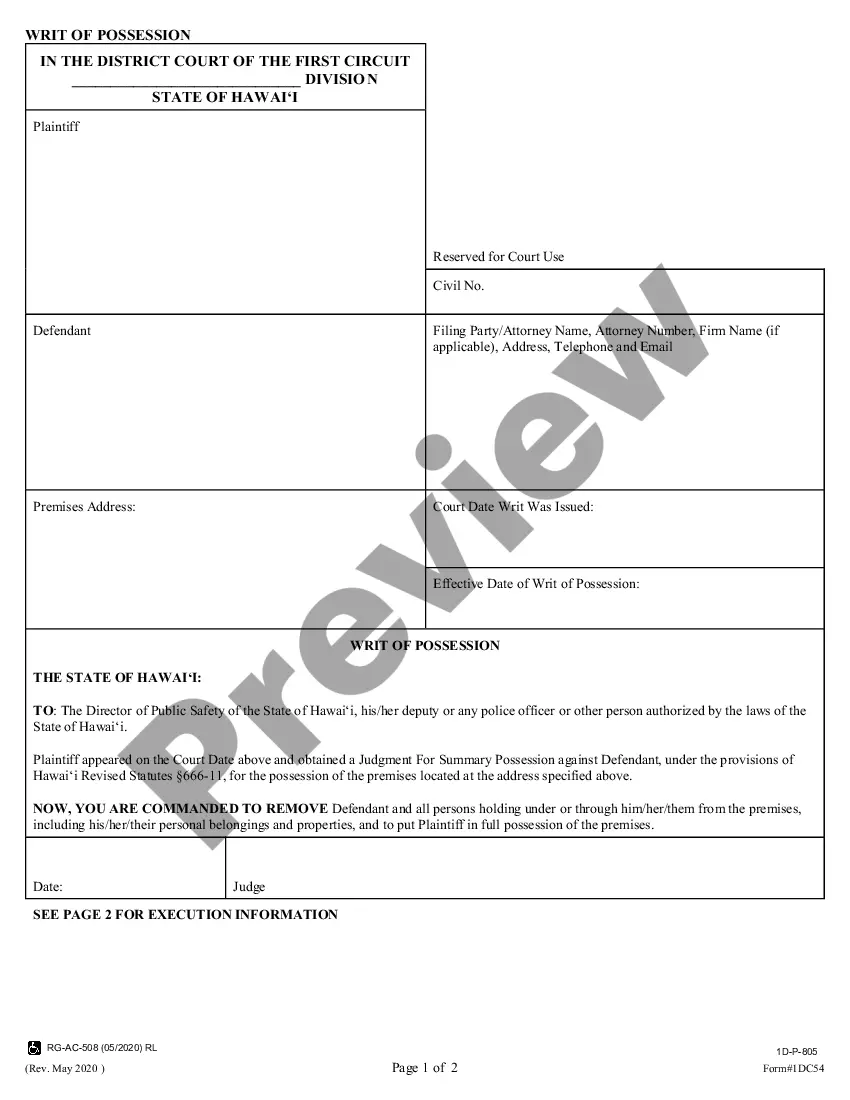

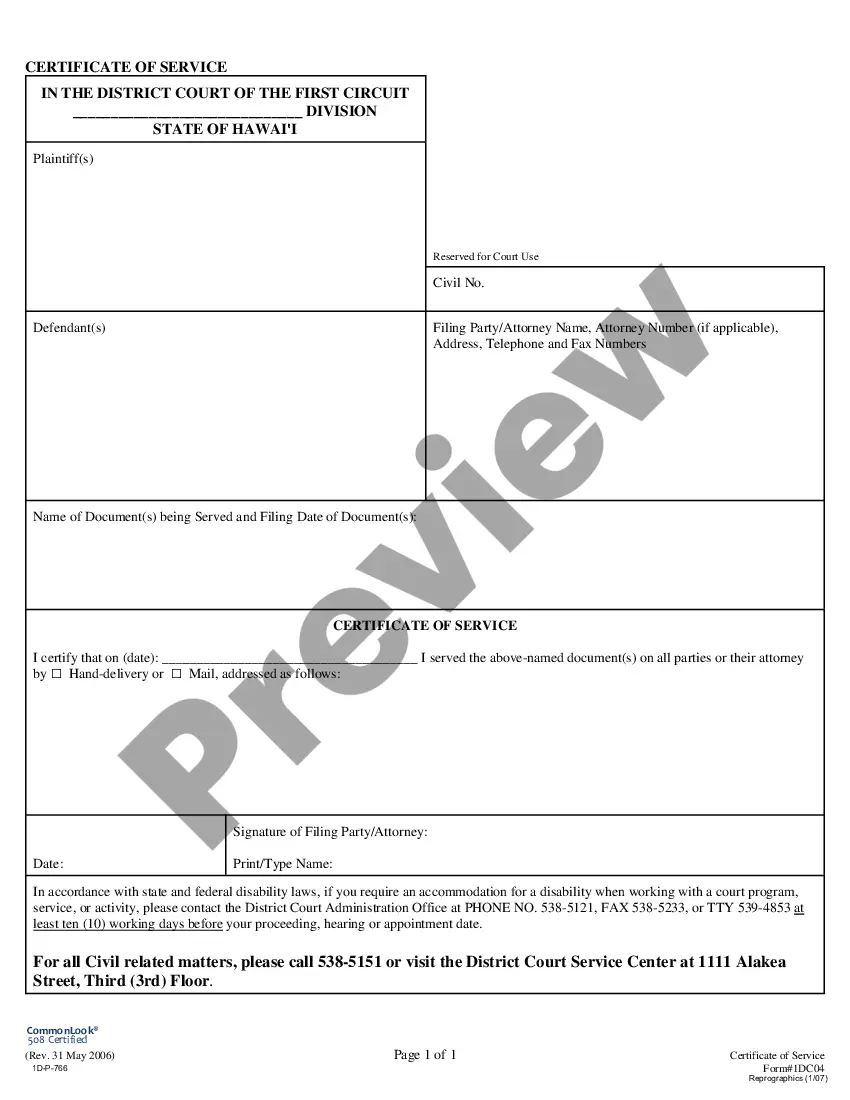

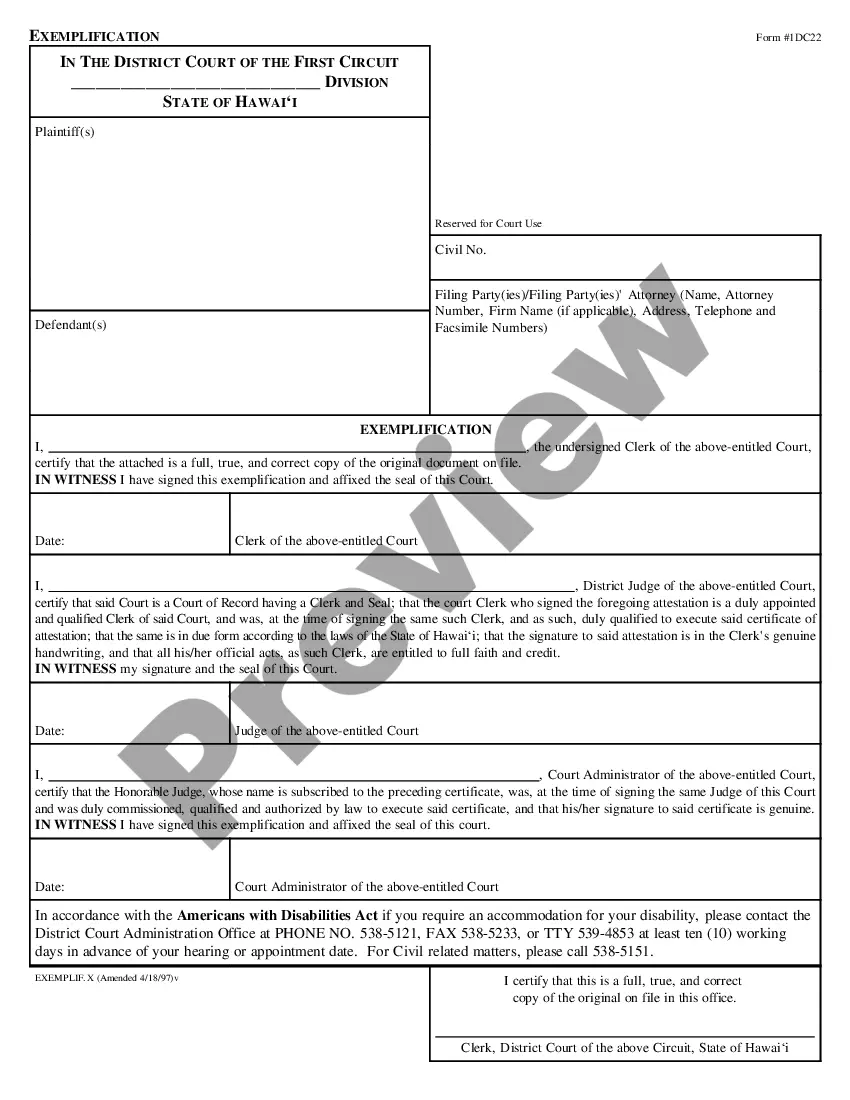

Use US Legal Forms to get a printable Sample Letter for Delinquent Account. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most comprehensive Forms catalogue on the internet and offers affordable and accurate templates for customers and attorneys, and SMBs. The documents are categorized into state-based categories and a few of them can be previewed prior to being downloaded.

To download templates, users must have a subscription and to log in to their account. Hit Download next to any template you need and find it in My Forms.

For individuals who do not have a subscription, follow the tips below to quickly find and download Sample Letter for Delinquent Account:

- Check to make sure you get the right form in relation to the state it’s needed in.

- Review the form by looking through the description and by using the Preview feature.

- Click Buy Now if it’s the template you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it multiple times.

- Make use of the Search field if you need to get another document template.

US Legal Forms offers a large number of legal and tax samples and packages for business and personal needs, including Sample Letter for Delinquent Account. Above three million users have already utilized our platform successfully. Choose your subscription plan and have high-quality forms in a few clicks.

Delinquent Account Letter Form popularity

Payment Delinquency Letter Samples Other Form Names

How To Write A Financial Support Letter For Medicaid FAQ

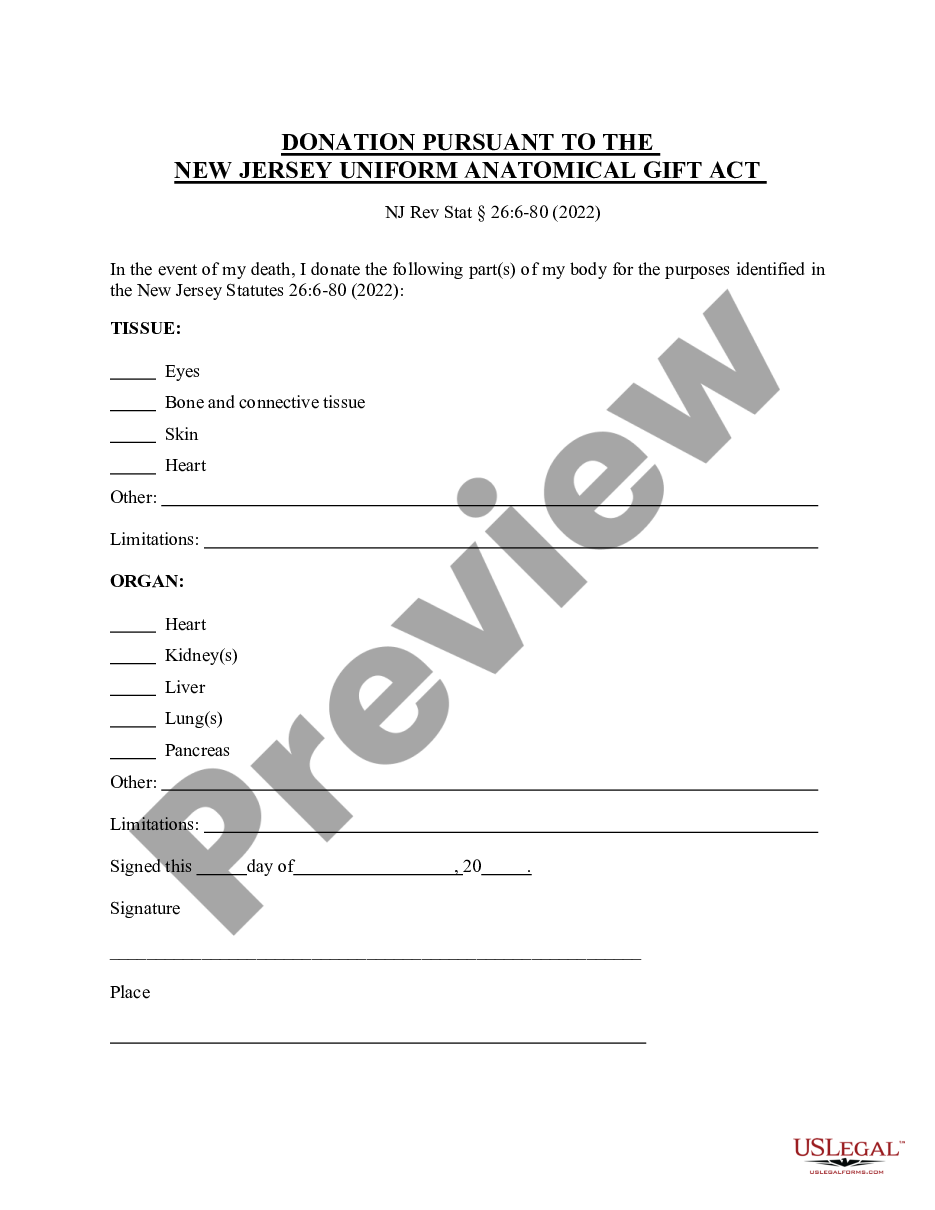

Most companies use a series of letters in three stages: gentle reminders, advanced reminders, and urgent reminders.

Mention of previous attempts to collect including any statements, emails, and letters you have sent. Invoice number and amount. Original invoice due date. Current days past due. Instructions- what they need to do next.

Reference the products or services that were purchased. Make it very clear what you did for your client and how much it costs. Maintain a friendly but firm tone. Remind the payee of their contract or agreement with you. Offer multiple ways the payee can take action. Add a personal touch. Give them a new deadline.

The debt dispute letter should include your personal identifying information; verification of the amount of debt owed; the name of the creditor for the debt; and a request that the debt not be reported to credit reporting agencies until the matter is resolved or have it removed from the report, if it already has been

Your company name and address. recipient's name and address. today's date. a clear reference and/or any account reference numbers. the amount outstanding. original payment due date. a brief explanation that no payment has been received.

Always use a formal and firm tone for the letter. Never use harsh language in your letter. Also, never harass your customers no matter how frustrated you get. Include the amount that the debtor owes as well as the payment due date.

Your company name and address. recipient's name and address. today's date. a clear reference and/or any account reference numbers. the amount outstanding. original payment due date. a brief explanation that no payment has been received.

The amount the debtor owes you. The initial due date of the payment. A new due date for the payment, whether ASAP or longer. Instructions on how to pay the debt.