Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years

Description Grantor Trust

How to fill out Grantor Trust Form Sample?

Utilize the most complete legal library of forms. US Legal Forms is the perfect platform for getting updated Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years templates. Our platform provides 1000s of legal forms drafted by certified lawyers and categorized by state.

To download a sample from US Legal Forms, users just need to sign up for an account first. If you’re already registered on our platform, log in and choose the template you need and purchase it. Right after buying templates, users can see them in the My Forms section.

To get a US Legal Forms subscription online, follow the steps below:

- Check if the Form name you have found is state-specific and suits your requirements.

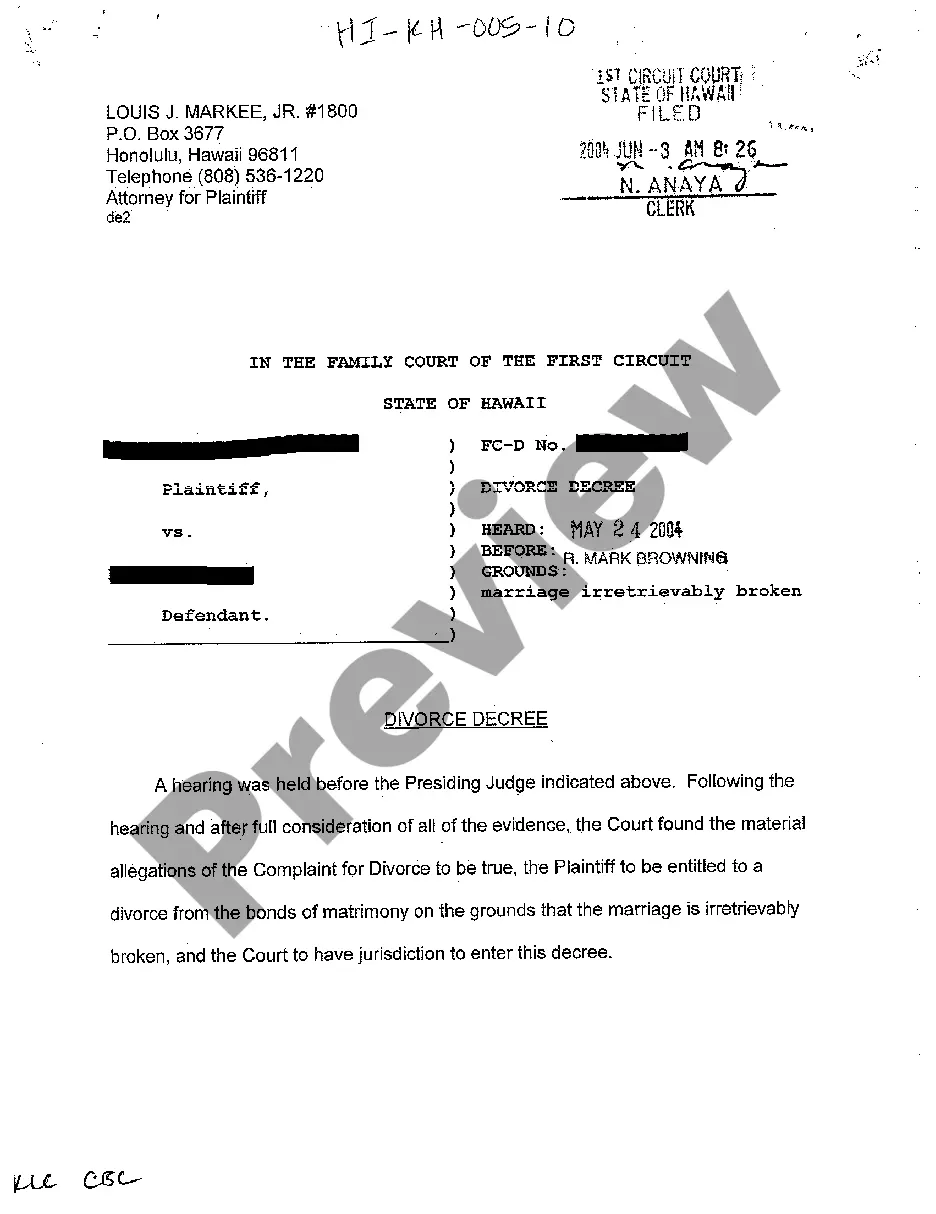

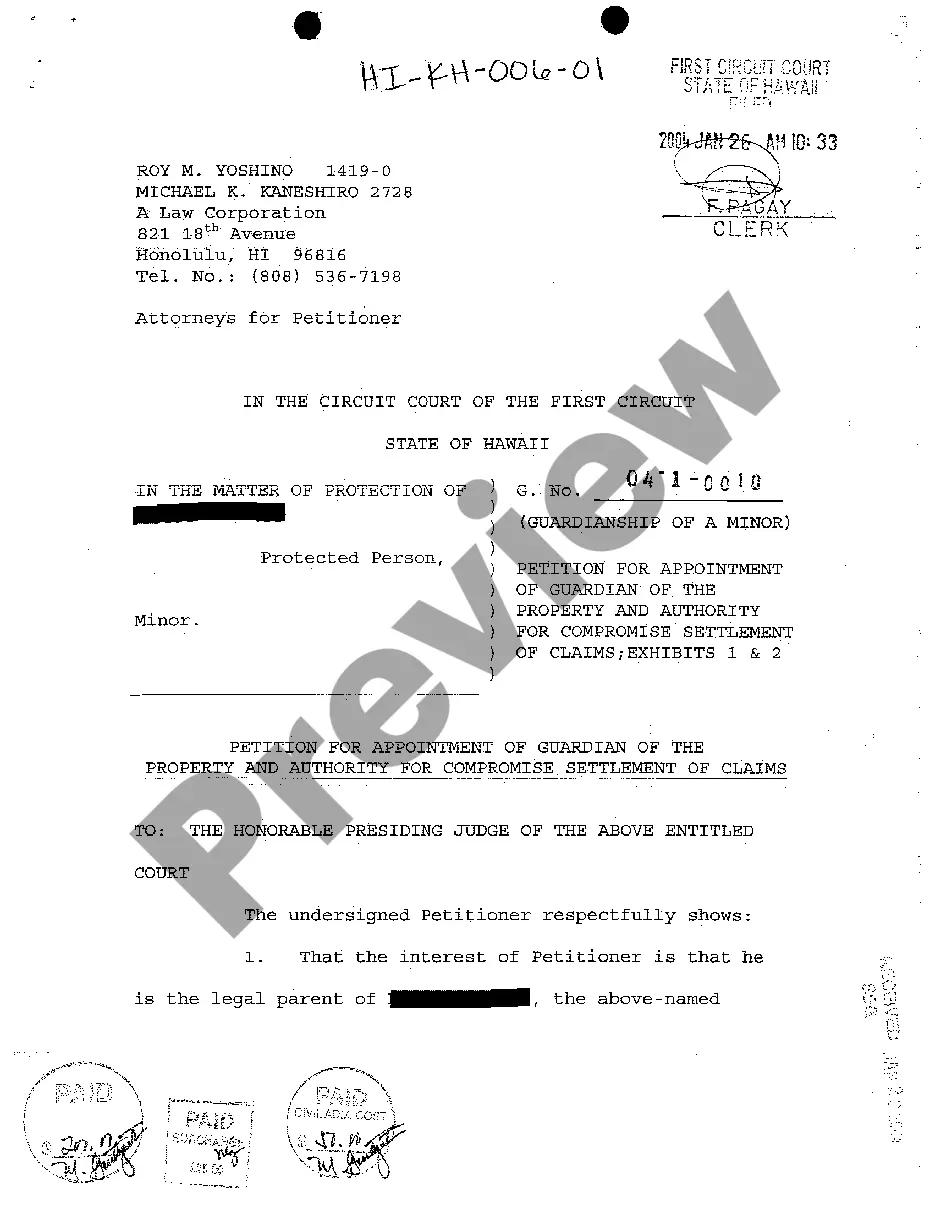

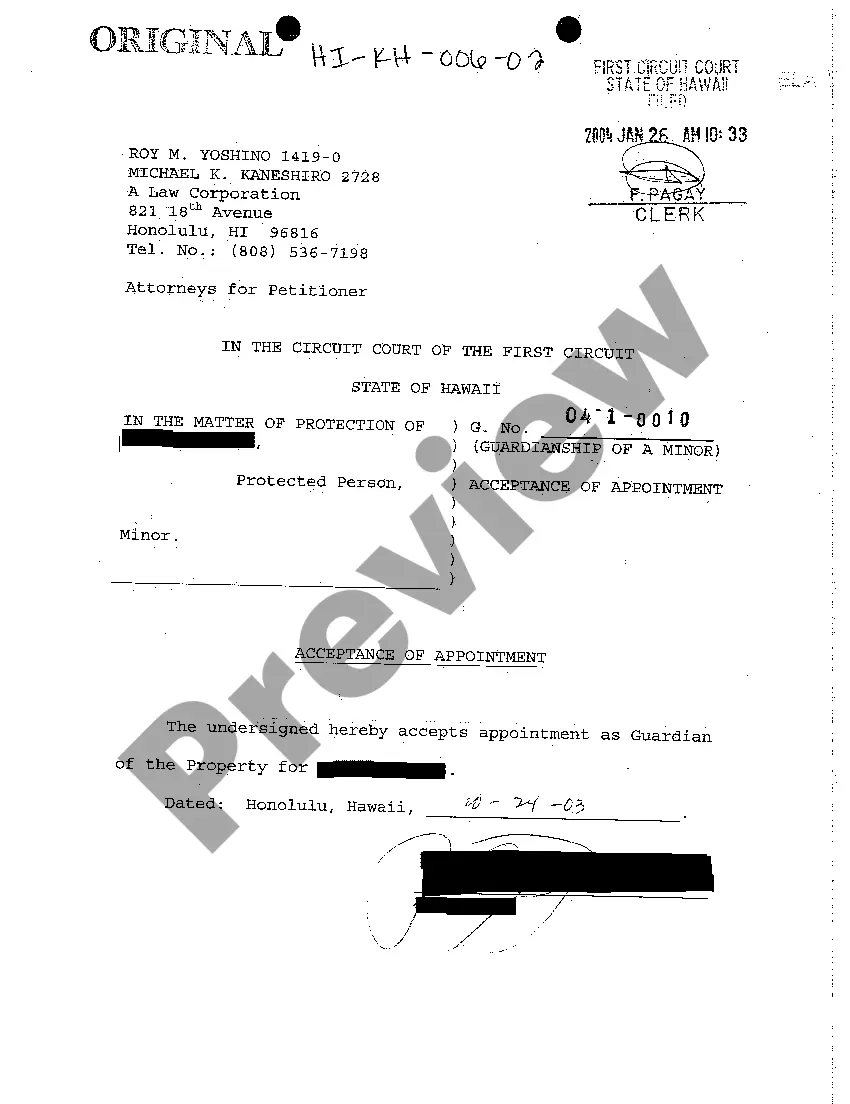

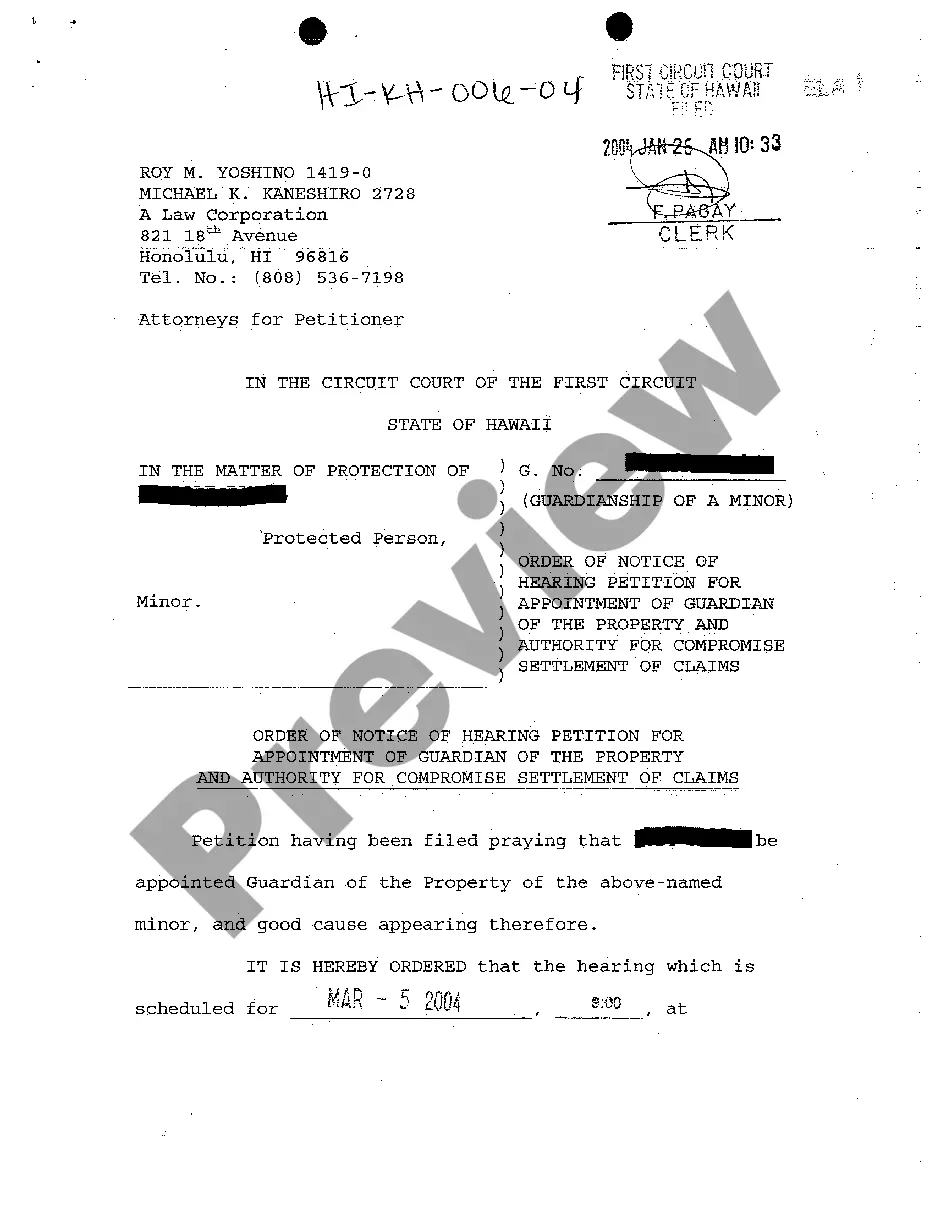

- When the template has a Preview option, use it to check the sample.

- In case the sample doesn’t suit you, utilize the search bar to find a better one.

- PressClick Buy Now if the sample corresponds to your requirements.

- Select a pricing plan.

- Create your account.

- Pay with the help of PayPal or with yourr credit/bank card.

- Select a document format and download the sample.

- Once it’s downloaded, print it and fill it out.

Save your effort and time using our service to find, download, and fill out the Form name. Join thousands of pleased subscribers who’re already using US Legal Forms!

Grantor Retained Income Trust Form popularity

Division Trusts Other Form Names

Income Trusts FAQ

Interest in a closely or family-held business, including S corporation stock, may be placed in a GRAT. The Settlor may be the Trustee of the GRAT during the annuity term unless cer- tain voting stock is used to fund the GRAT.

The annuity amount is paid to the grantor during the term of the GRAT, and any property remaining in the trust at the end of the GRAT term passes to the beneficiaries with no further gift tax consequences.If the grantor lives out the term, the remainder passes to the beneficiaries without any additional transfer tax.

A grantor retained income trust (GRIT) is a specific type of trust that allows you to transfer assets while still benefiting from the income they generate. This is a little more advanced than a typical revocable living trust, but establishing a GRIT could yield some advantages.

Overview. When the grantor, who is also the trustee, dies, the successor trustee named in the Declaration of Trust takes over as trustee. The new trustee is responsible for distributing the trust property to the beneficiaries named in the trust document.

At the end of the initial term retained by the Grantor, if the Grantor is still living, the remainder beneficiaries (or a trust to be administered for the benefit of the remainder beneficiaries) receive $100,0000 plus all capital growth (which is the amount over and above the net income that was paid to the Grantor).

A grantor retained annuity trust (GRAT) is a financial instrument used in estate planning to minimize taxes on large financial gifts to family members.Assets are placed under the trust and then an annuity is paid out every year. When the trust expires the beneficiary receives the assets tax-free.

Trust Basics The trustee may be the grantor. The grantor designates the beneficiaries who are to benefit from the trust and receive its income and principal. Certain trusts allow the grantor to be both the trustee and the beneficiary.

A grantor retained annuity trust (GRAT) is a financial instrument used in estate planning to minimize taxes on large financial gifts to family members.Assets are placed under the trust and then an annuity is paid out every year. When the trust expires the beneficiary receives the assets tax-free.