Assignment of Interest in Trust

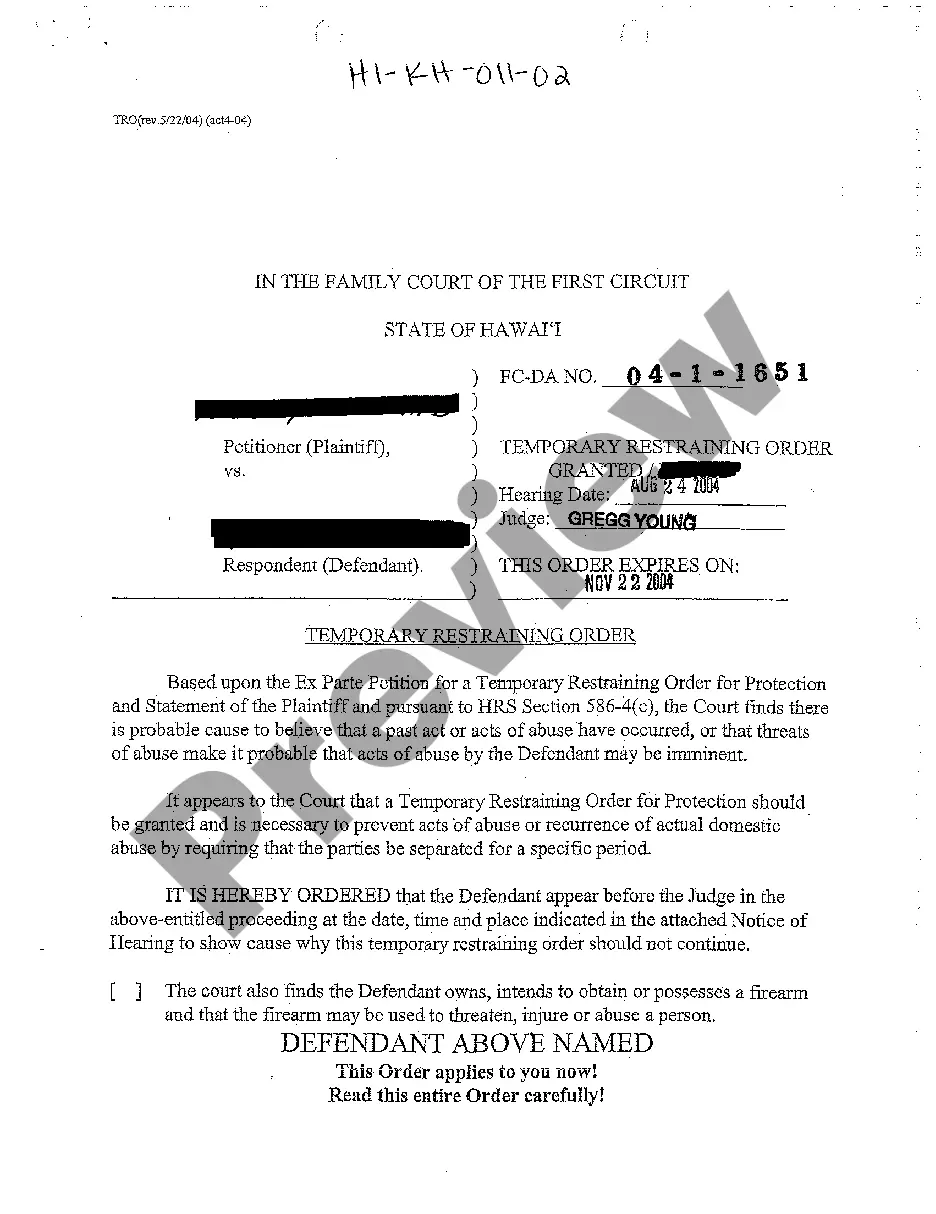

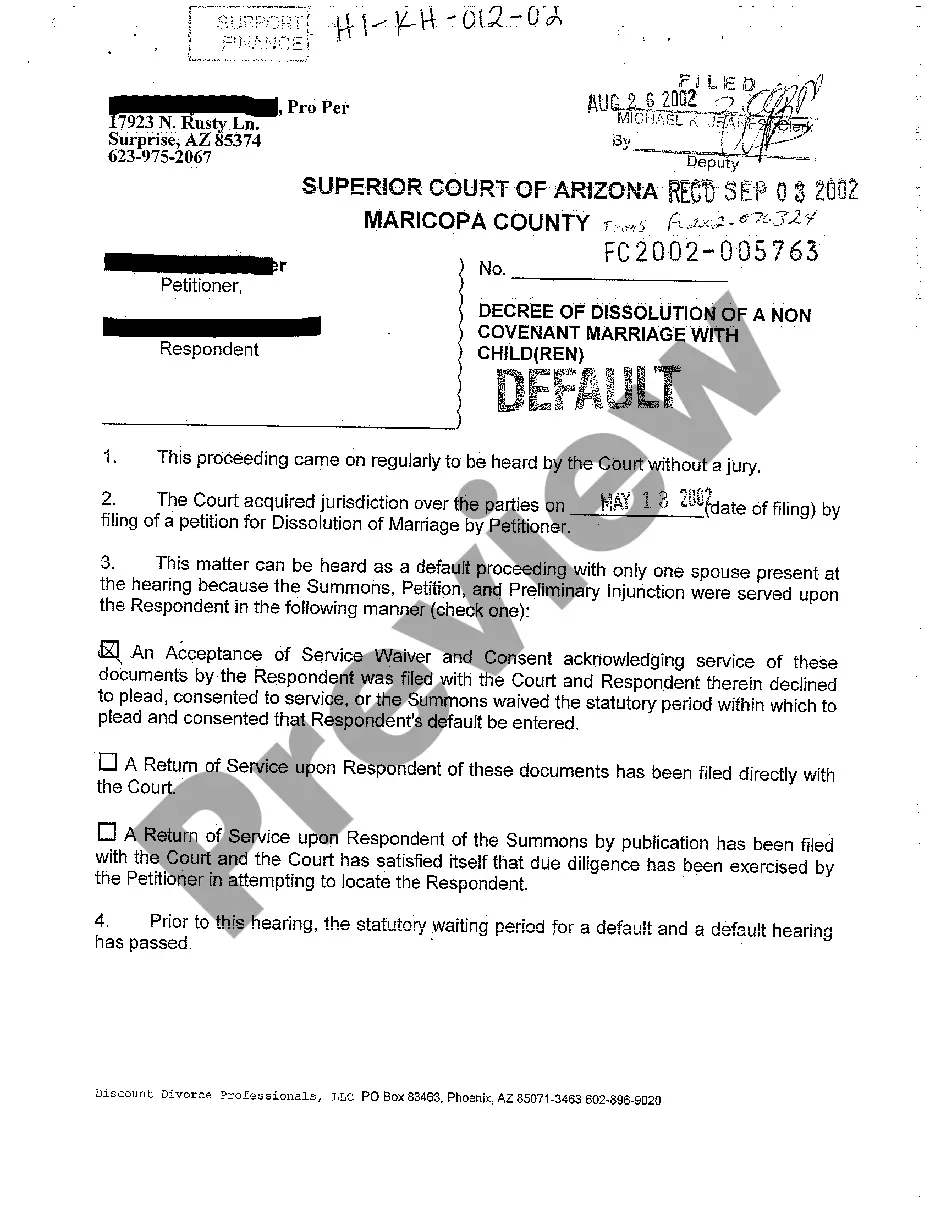

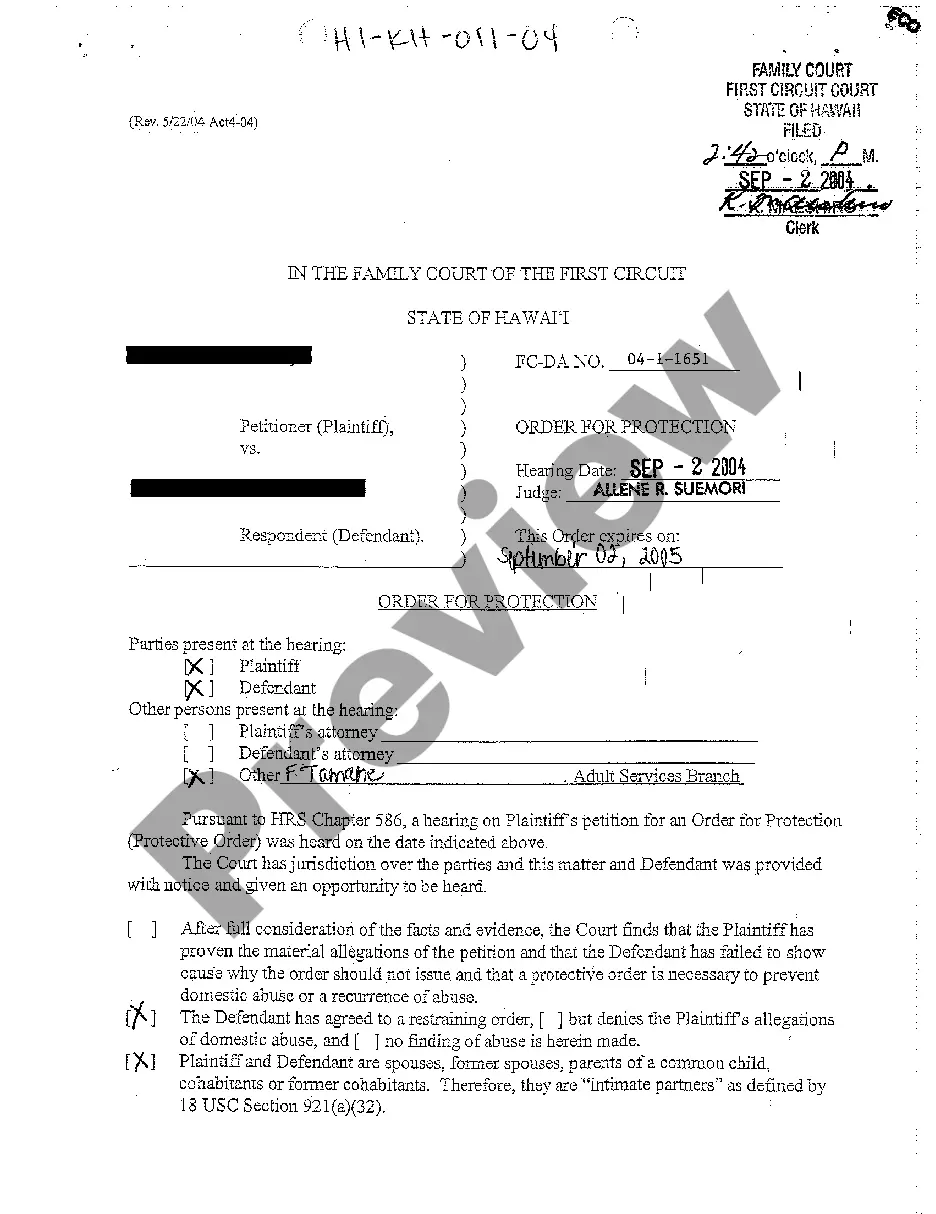

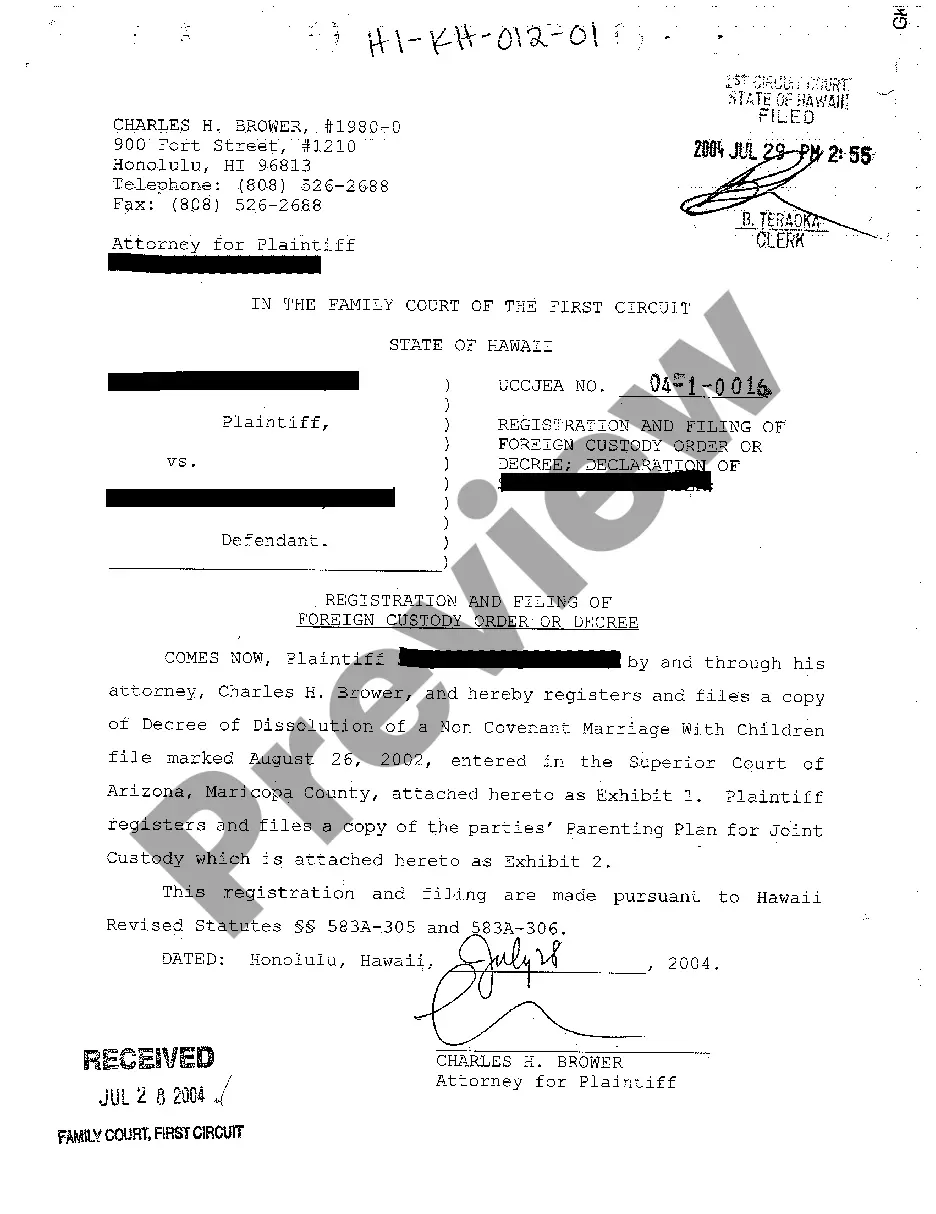

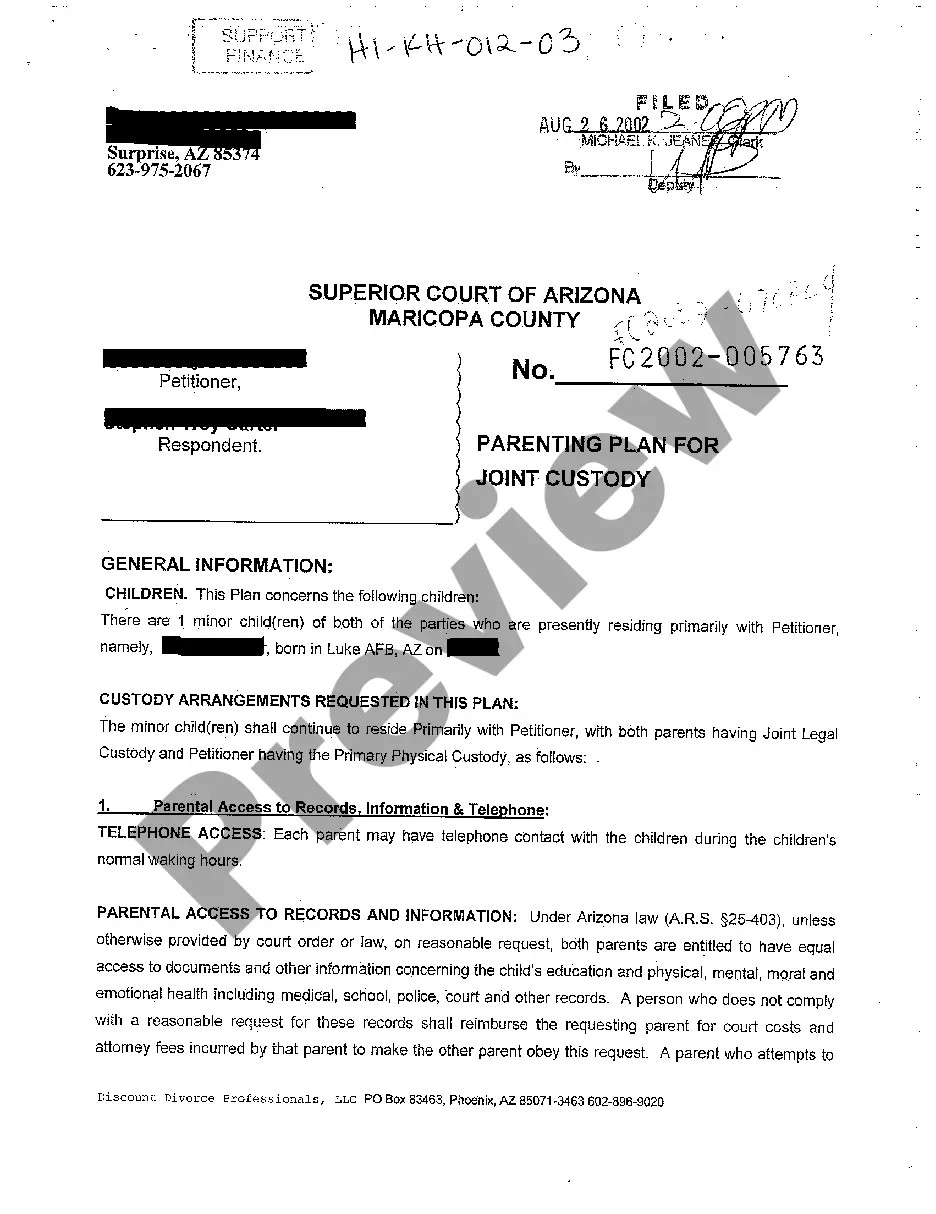

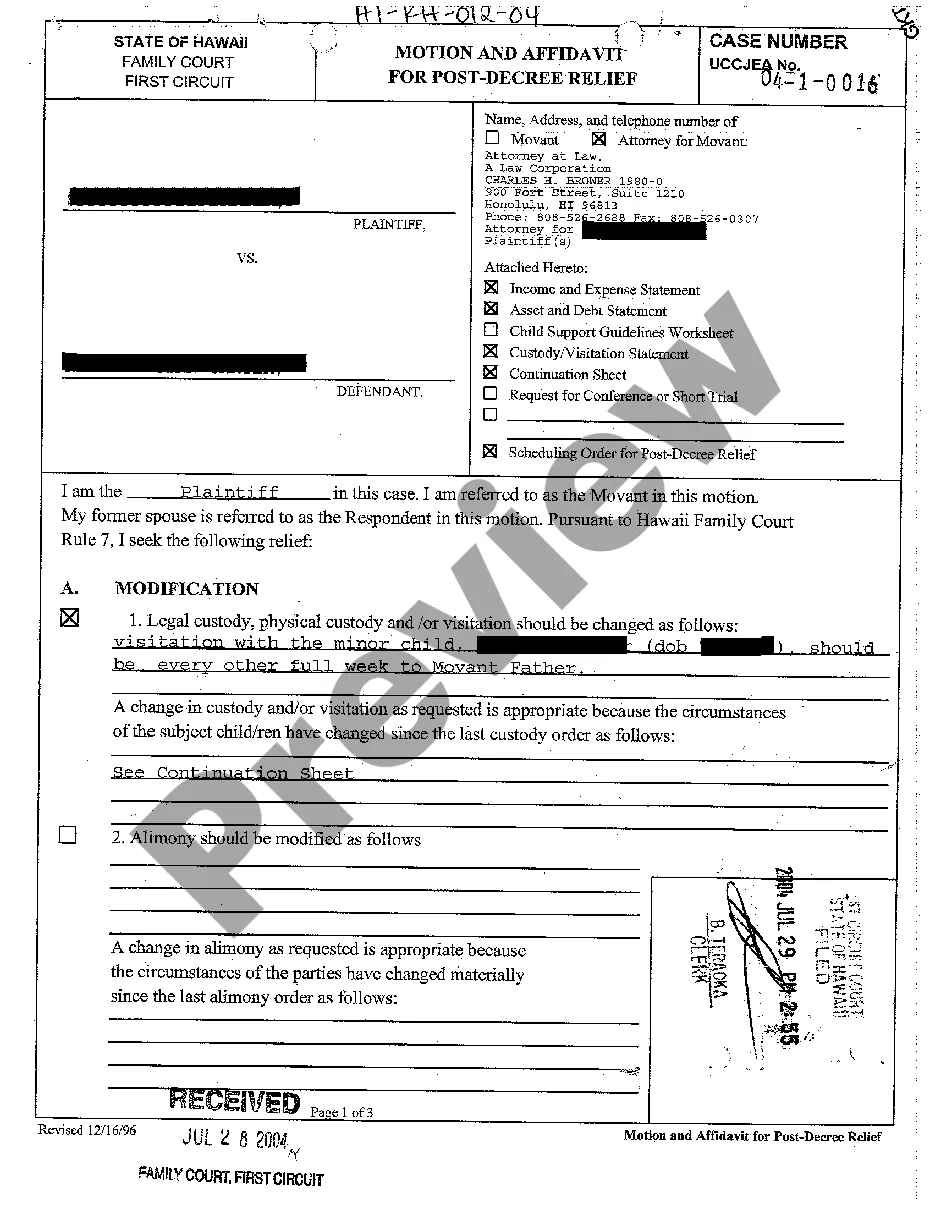

Description Assignment Interest Template

How to fill out Assignment Of Interest In Trust?

Use the most complete legal library of forms. US Legal Forms is the perfect platform for getting updated Assignment of Interest in Trust templates. Our service provides thousands of legal documents drafted by licensed lawyers and categorized by state.

To get a sample from US Legal Forms, users simply need to sign up for an account first. If you’re already registered on our service, log in and select the template you need and purchase it. Right after buying templates, users can find them in the My Forms section.

To get a US Legal Forms subscription online, follow the guidelines listed below:

- Find out if the Form name you’ve found is state-specific and suits your needs.

- When the template has a Preview option, utilize it to check the sample.

- If the template does not suit you, use the search bar to find a better one.

- Hit Buy Now if the sample corresponds to your requirements.

- Choose a pricing plan.

- Create an account.

- Pay with the help of PayPal or with the credit/bank card.

- Select a document format and download the template.

- As soon as it’s downloaded, print it and fill it out.

Save your effort and time using our platform to find, download, and complete the Form name. Join thousands of delighted customers who’re already using US Legal Forms!

Form popularity

FAQ

Generally speaking, beneficiaries have a right to see trust documents which set out the terms of the trusts, the identity of the trustees and the assets within the trust as well as the trust deed, any deeds of appointment/retirement and trust accounts.

A beneficiary of a trust may wish to disclaim their interest in the trust for:Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest.

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).

A beneficiary can also transfer his interest in the trust property and every person to whom a beneficiary transfers his interest acquires the rights and liabilities of the beneficiary at the date of the transfer.

Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest. Silence or otherwise passive behaviour will not suffice.

If you inherit from a simple trust, you must report and pay taxes on the money. By definition, anything you receive from a simple trust is income earned by it during that tax year.Any portion of the money that derives from the trust's capital gains is capital income, and this is taxable to the trust.

A beneficiary of trust is the individual or group of individuals for whom a trust is created. The trust creator or grantor designates beneficiaries and a trustee, who has a fiduciary duty to manage trust assets in the best interests of beneficiaries as outlined in the trust agreement.

Usually, a trust prohibits beneficiaries from assigning their interest in the trust before distribution. The anti-assignment provision protects undistributed trust assets from claims by a beneficiary's creditors.