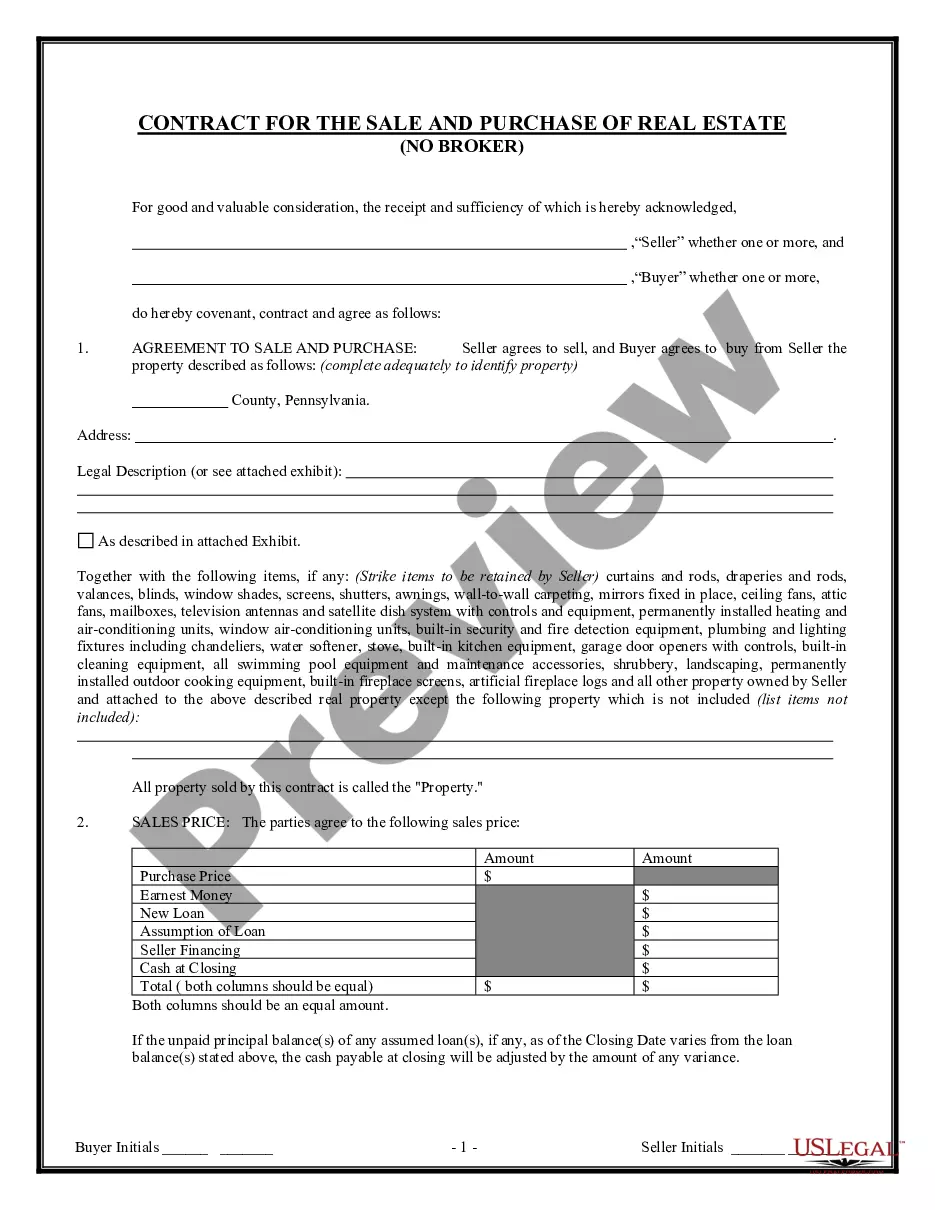

Sample Letter for Employee Automobile Expense Allowance

Description Car Allowance Letter To Employee Template

How to fill out Sample Expense Form Print?

Among countless paid and free samples which you find online, you can't be certain about their accuracy and reliability. For example, who created them or if they are skilled enough to take care of the thing you need those to. Always keep calm and use US Legal Forms! Discover Sample Letter for Employee Automobile Expense Allowance templates made by skilled legal representatives and get away from the expensive and time-consuming procedure of looking for an lawyer or attorney and then having to pay them to write a document for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button near the file you are looking for. You'll also be able to access all your previously downloaded files in the My Forms menu.

If you’re making use of our platform for the first time, follow the instructions listed below to get your Sample Letter for Employee Automobile Expense Allowance easily:

- Ensure that the file you discover is valid where you live.

- Review the file by reading the description for using the Preview function.

- Click Buy Now to begin the ordering procedure or find another sample using the Search field located in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

As soon as you’ve signed up and paid for your subscription, you can use your Sample Letter for Employee Automobile Expense Allowance as many times as you need or for as long as it continues to be valid where you live. Revise it with your preferred online or offline editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Employee Speeding In Company Vehicle Letter Form popularity

Auto Allowance Policy Sample Other Form Names

Letter Automobile Allowance Form FAQ

If you or your employees drive for business, there are several ways your company can pay for it. One is to give your employees a car allowance, or to reimburse them for the cost of driving. You're entitled to write off the costs of an allowance or reimbursement as a business deduction.

Generally speaking, a standard car allowance is considered taxable income because it does not substantiate business use. A mileage reimbursement, however, remains non-taxable as long as it does not exceed the vehicle reimbursement amount determined by the IRS business mileage rate.

Acquaint yourself with the employer's contract or company's policy to determine provisions for allowance. State precisely the reason for the request. Ensure the format and content of the letter are formal. Address the letter to the relevant authority.

The IRS allows employees to calculate their car allowance for mileage reimbursement in the following ways. They can: Base their deductions on the expenses they incurred while driving their vehicle for work. Some of these expenses are for things like vehicle maintenance, mileage, gas, tires, oil changes, and more.

Set Up a Plan You can pay employees who use their cars for work by providing a car allowance, paying them for a trip in advance or reimbursing them afterward. To meet IRS standards for an employee-expense plan, the money can only go for legitimate work trips.

These allowances are contractual and therefore in order to remove or vary them you ideally need to have employee agreement.If you want to change the terms and conditions of employment you need to consult with employees about the proposed changes, and the impact it will have on them personally.

A car allowance is what an employer gives employees for the business use of their personal vehicle. A car allowance is a set amount over a given time. It's meant to cover the costs of using your own car. A car allowance covers things like fuel, wear-and-tear, tires and more.

According to IRS Publication 463, a car allowance meets the accounting requirements for the amount of an employee's expenses only if all the following conditions apply: The employer limits expense payments to those that are ordinary and necessary in the employee's line of business.

You Can Give Employees an Auto Allowance Most businesses give employees an auto allowance to reimburse them for the expense of driving a company car for business purposes. The allowance can be given in addition to providing the car to the employee.