Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children

Description Surviving Children Form

How to fill out Trust Spouse Death?

Employ the most extensive legal library of forms. US Legal Forms is the perfect place for getting updated Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children templates. Our service provides a huge number of legal documents drafted by certified attorneys and grouped by state.

To get a sample from US Legal Forms, users only need to sign up for a free account first. If you’re already registered on our platform, log in and choose the template you are looking for and buy it. After purchasing forms, users can see them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the steps below:

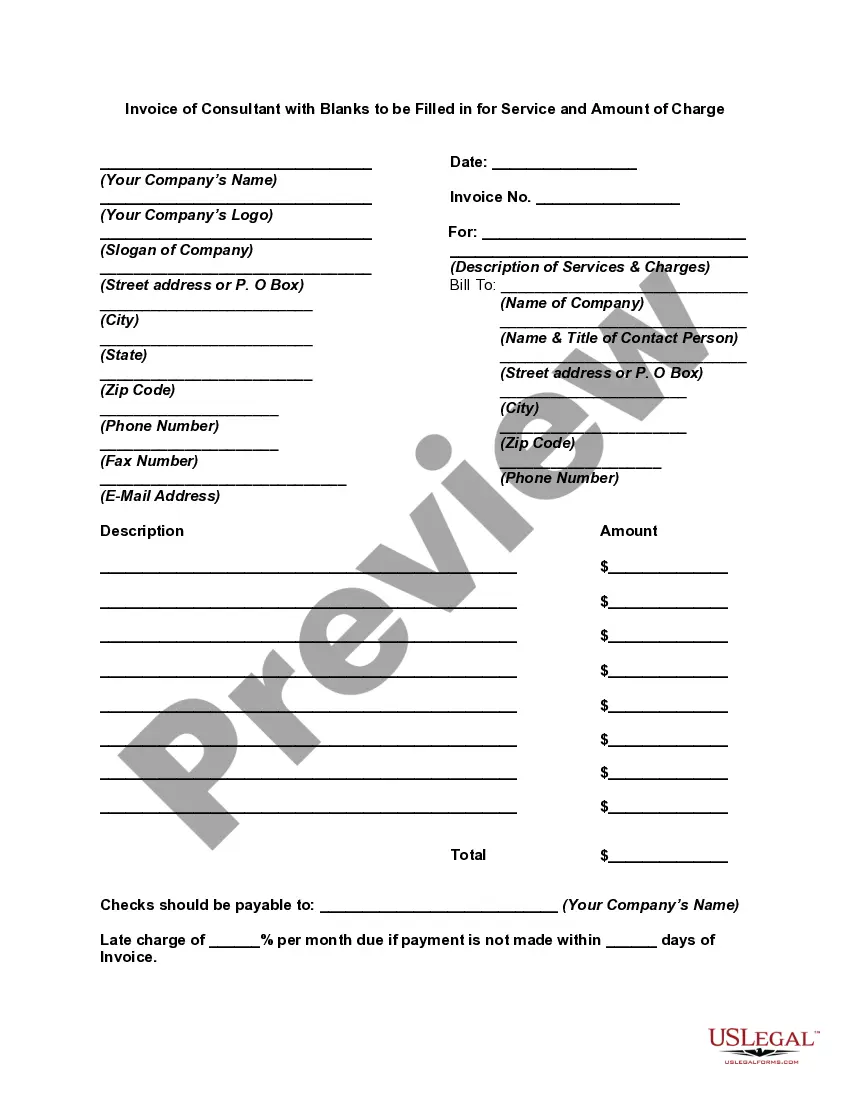

- Find out if the Form name you’ve found is state-specific and suits your needs.

- When the template has a Preview option, use it to review the sample.

- If the template doesn’t suit you, use the search bar to find a better one.

- PressClick Buy Now if the sample corresponds to your expections.

- Choose a pricing plan.

- Create a free account.

- Pay with the help of PayPal or with the credit/credit card.

- Select a document format and download the sample.

- When it is downloaded, print it and fill it out.

Save your effort and time with our platform to find, download, and complete the Form name. Join a huge number of delighted customers who’re already using US Legal Forms!

Revolkable Trust Form popularity

Revolkable Other Form Names

Revocable Trust Surviving Death Trusts FAQ

Like a will, a living trust can be altered whenever you wish.After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property.

There is nothing that says that couple must use a joint revocable trust.When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse. The surviving spouse is the trustee over both trusts.

When they pass away, the assets are distributed to beneficiaries, or the individuals they have chosen to receive their assets. A settlor can change or terminate a revocable trust during their lifetime. Generally, once they die, it becomes irrevocable and is no longer modifiable.

Typically the Survivor's Trust is revocable - in other words, it can be changed by the surviving spouse. The assets contained in the Survivor's Trust are spelled out by the trust document.

Open a bank account in the name of the trust. Close out any bank accounts the grantor established for the trust and put the proceeds into the new trust bank account. Cash in any life insurance policies that name the trust as beneficiary and put the proceeds into the trust bank account.

Irrevocable trusts can remain up and running indefinitely after the trustmaker dies, but most revocable trusts disperse their assets and close up shop. This can take as long as 18 months or so if real estate or other assets must be sold, but it can go on much longer.

When the maker of a revocable trust, also known as the grantor or settlor, dies, the assets become property of the trust. If the grantor acted as trustee while he was alive, the named co-trustee or successor trustee will take over upon the grantor's death.

So, going back to the question, the Trustor(s) or creator(s) of the document are the ones who have the power to make changes or even revoke it during their lifetime, and the Trustee(s) sign onto any changes made. But, when a person passes away, their revocable living trust then becomes irrevocable at their death.

Generally, no. Most living or revocable trusts become irrevocable upon the death of the trust's maker or makers. This means that the trust cannot be altered in any way once the successor trustee takes over management of it.A successor trustee may not modify or add or remove beneficiaries from an irrevocable trust.