Sample Letter for Distribution of Estate to Church

Description

How to fill out Sample Letter For Distribution Of Estate To Church?

Use US Legal Forms to obtain a printable Sample Letter for Distribution of Estate to Church. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most complete Forms library online and offers affordable and accurate templates for consumers and lawyers, and SMBs. The documents are grouped into state-based categories and a number of them can be previewed before being downloaded.

To download samples, customers must have a subscription and to log in to their account. Click Download next to any form you need and find it in My Forms.

For individuals who don’t have a subscription, follow the tips below to easily find and download Sample Letter for Distribution of Estate to Church:

- Check to make sure you have the right template in relation to the state it is needed in.

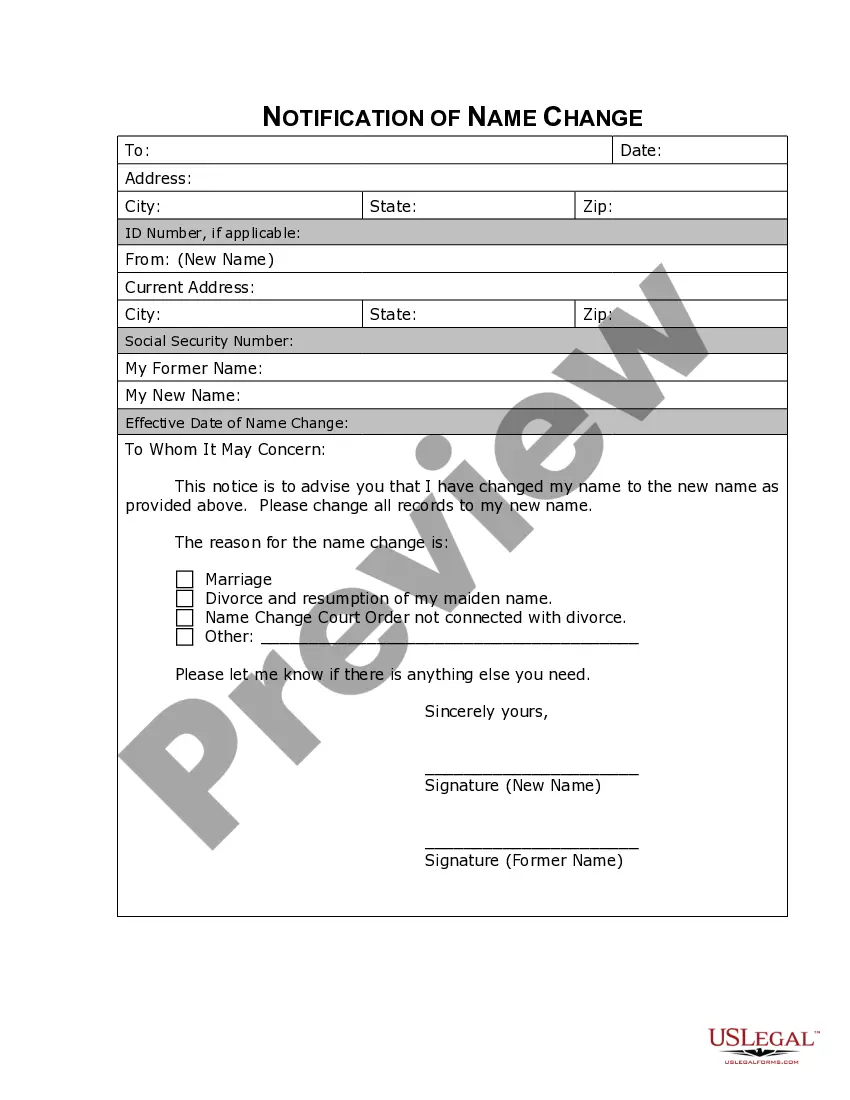

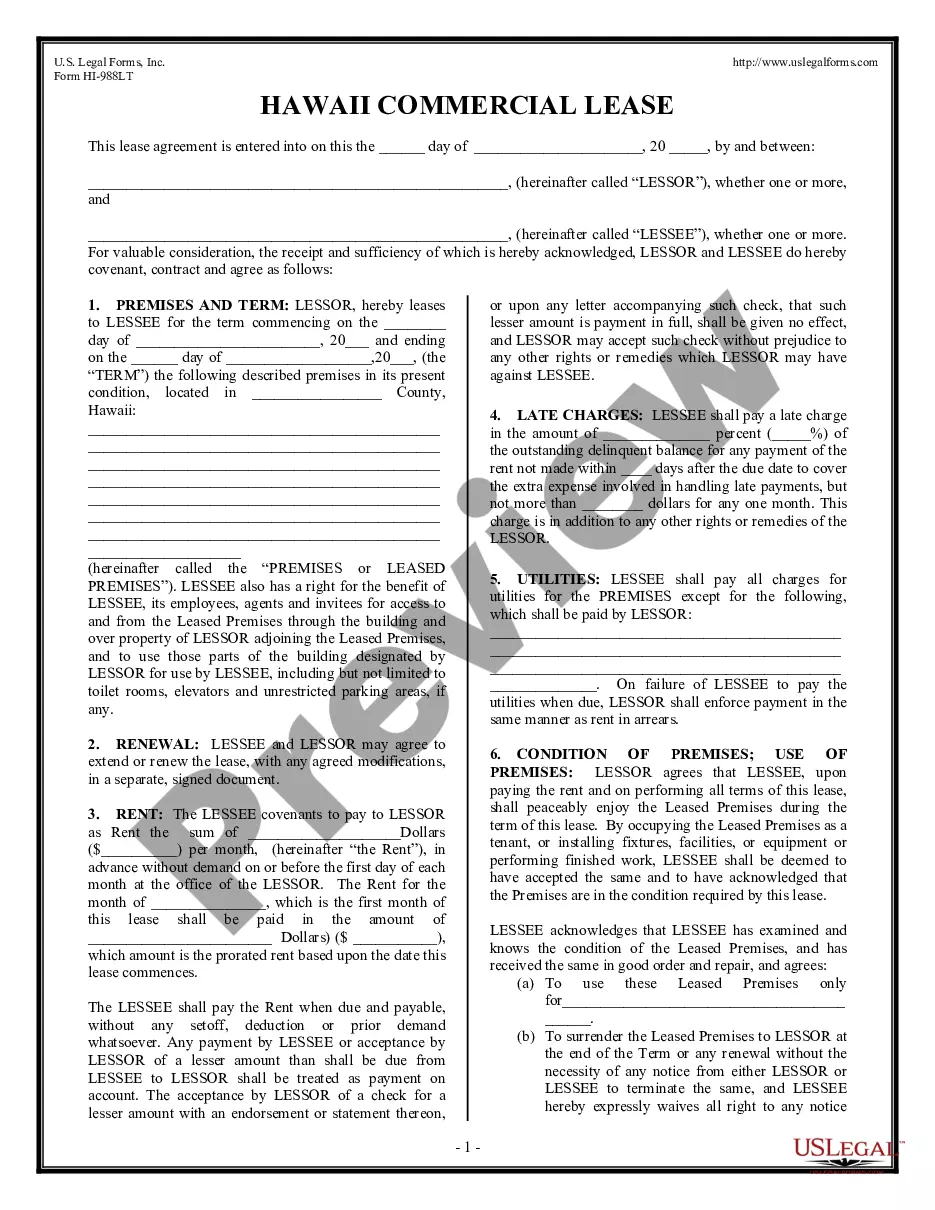

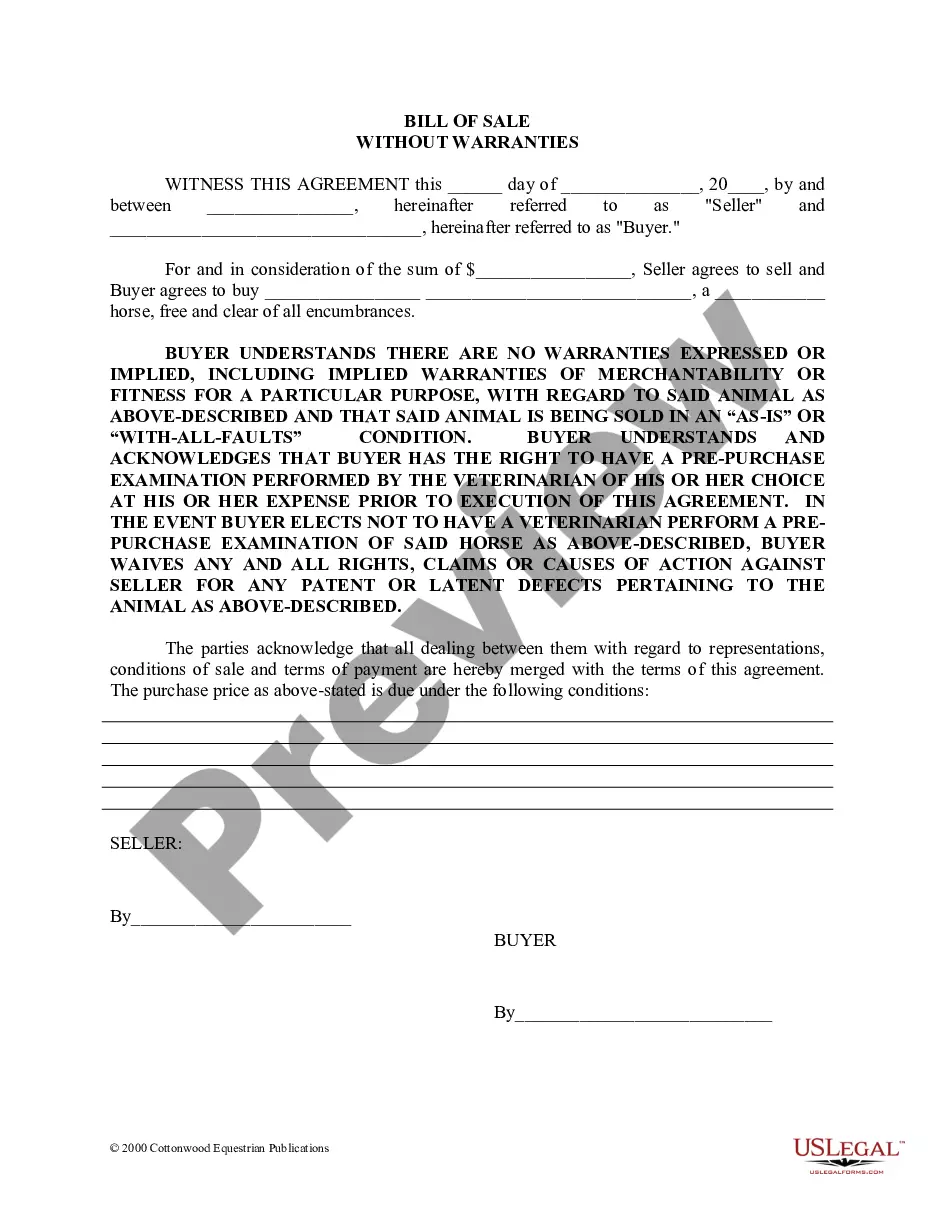

- Review the form by reading the description and by using the Preview feature.

- Press Buy Now if it is the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it many times.

- Use the Search engine if you want to get another document template.

US Legal Forms offers a large number of legal and tax templates and packages for business and personal needs, including Sample Letter for Distribution of Estate to Church. Over three million users already have used our service successfully. Choose your subscription plan and have high-quality documents within a few clicks.

Form popularity

FAQ

Distribution Letter means that certain letter agreement, executed and delivered by the Company, the Controlling Stockholder and the Investor concurrently with the execution of this Agreement, as attached hereto as Exhibit E.

No, it can be mailed. Many times people (executor, beneficiary) like to trade the release/check at the same time, but in my experience if I have the release signed (as lawyer for the executor) I'll mail the check after and it is...

Since every estate is different, the time it takes to settle the estate may also differ. Most times, an executor would take 8 to 12 months. But depending on the size and complexity of the estate, it may take up to 2 years or more to settle the estate.

An estate bank account is opened up by the executor, who also obtains a tax ID number.The executor must pay creditors, file tax returns and pay any taxes due. Then, he must collect any money or benefits owed to the decedent. Finally, he or she distributes the remainder in accordance with the will.

That the estate assets are distributed at least 6 months after the deceased's date of death; That the executor has published a 30 day notice of his/her intent to distribute the estate; and. That the time specified in the notice has expired.

Identify persons the executor should notify of your death. Include family members, close friends and business associates, including your attorney. Provide contact information for each person, as well as any final message or instructions to be given. Describe your important estate documents and their exact location.

An executor letter authorizes a person or organization to act on behalf of a decedent's estate as an executor.It's also called "letters of testamentary" or "letters of administration" in some jurisdictions.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

A letter of instructions is an informal document that gives your survivors information concerning important financial and personal matters that must be attended to after your demise.