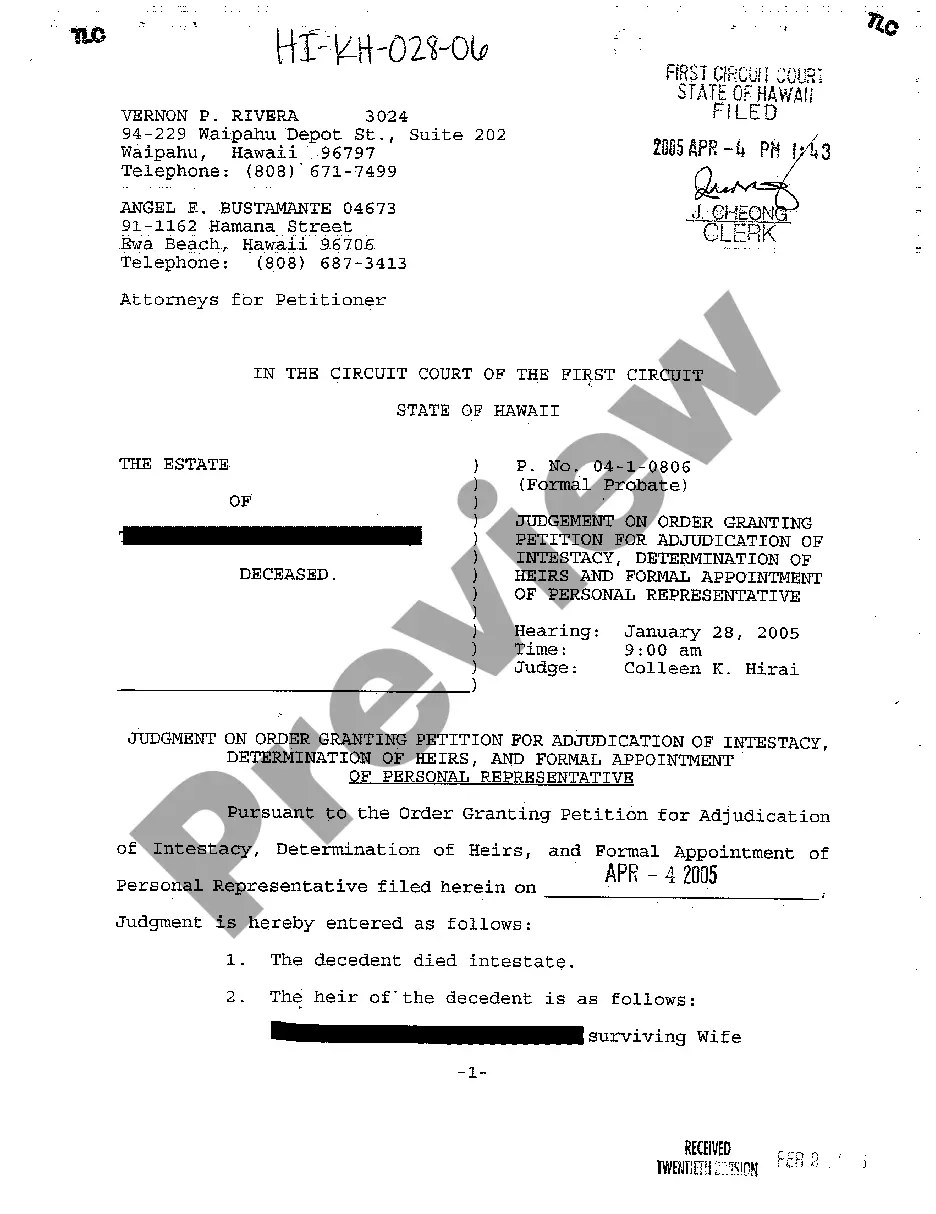

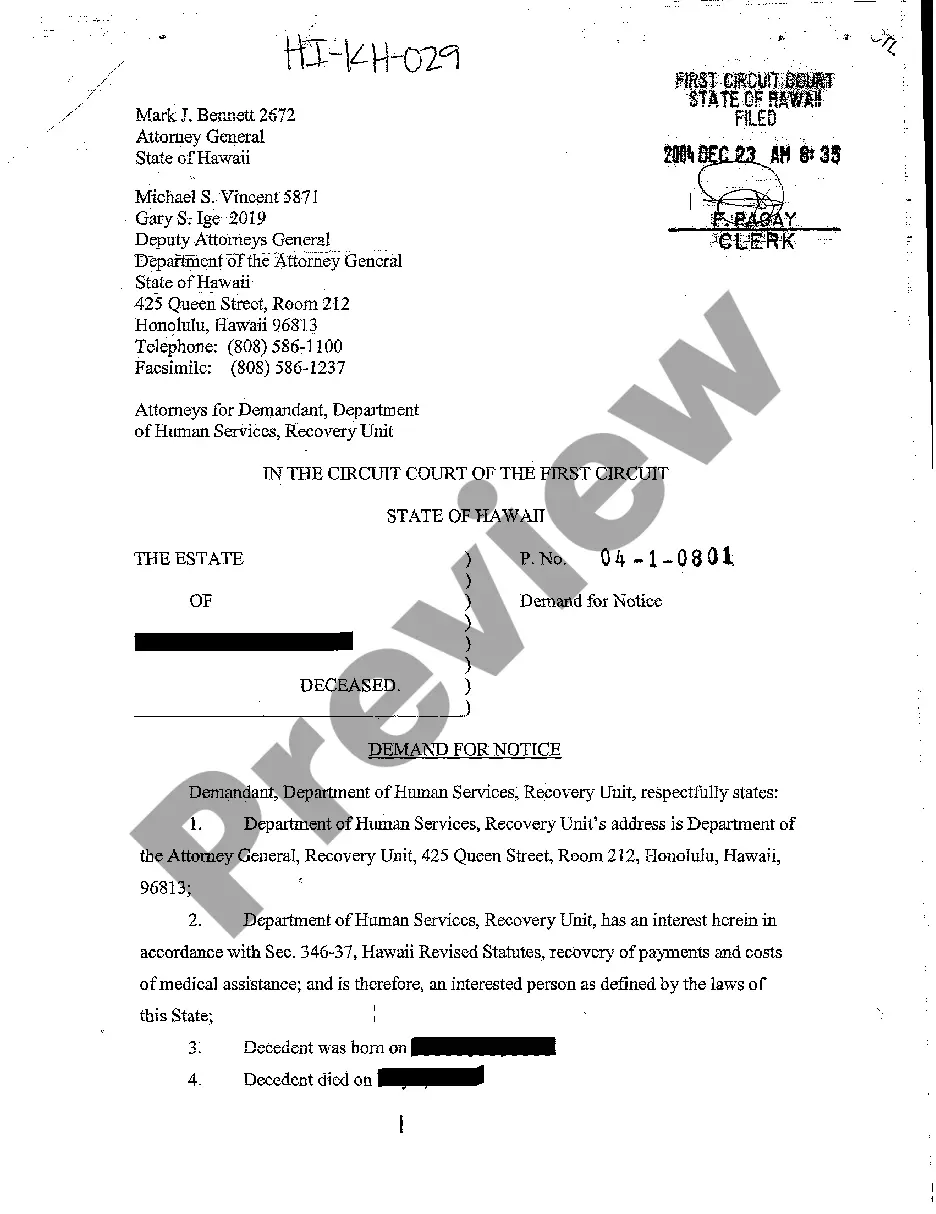

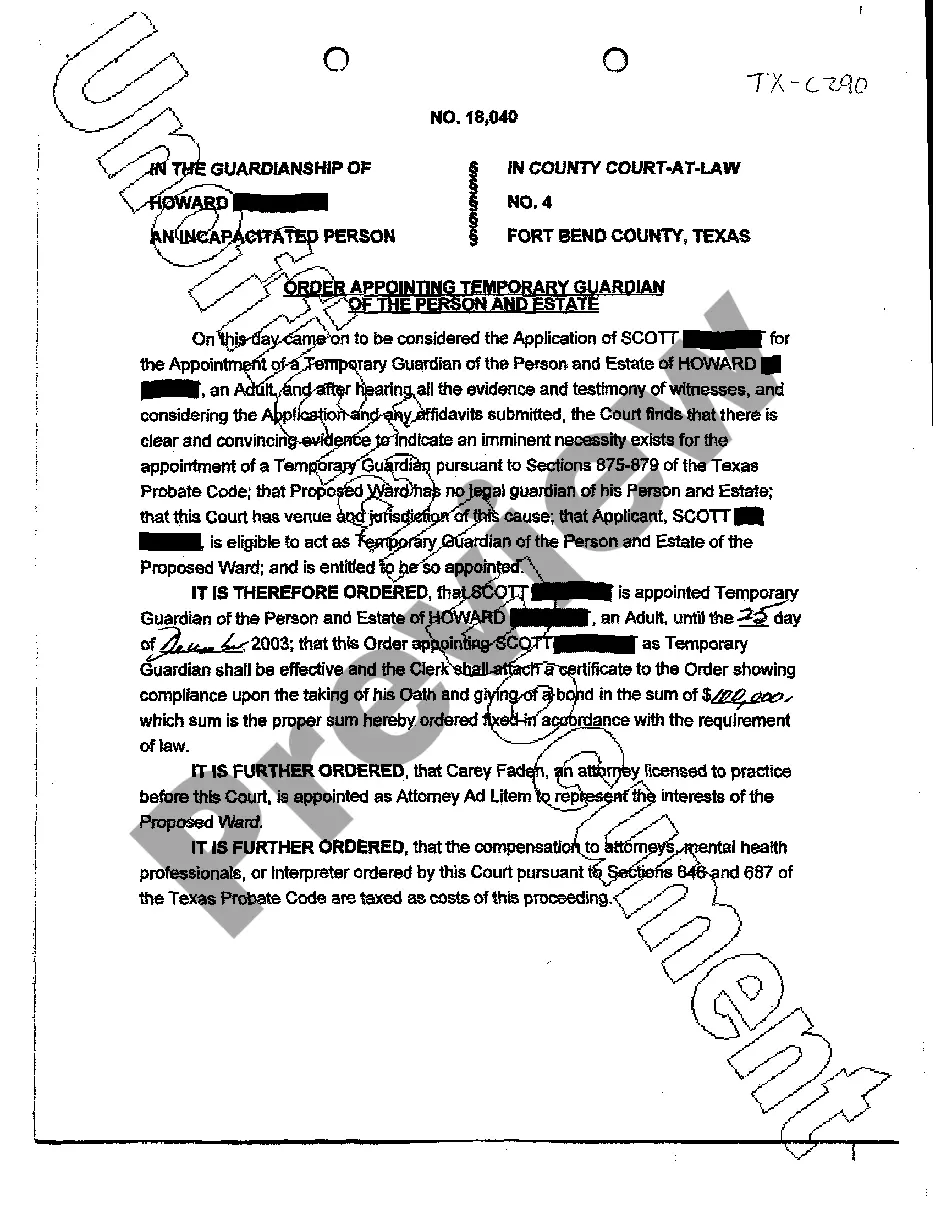

Acceptance of Office by Trustee with Limitations

Description

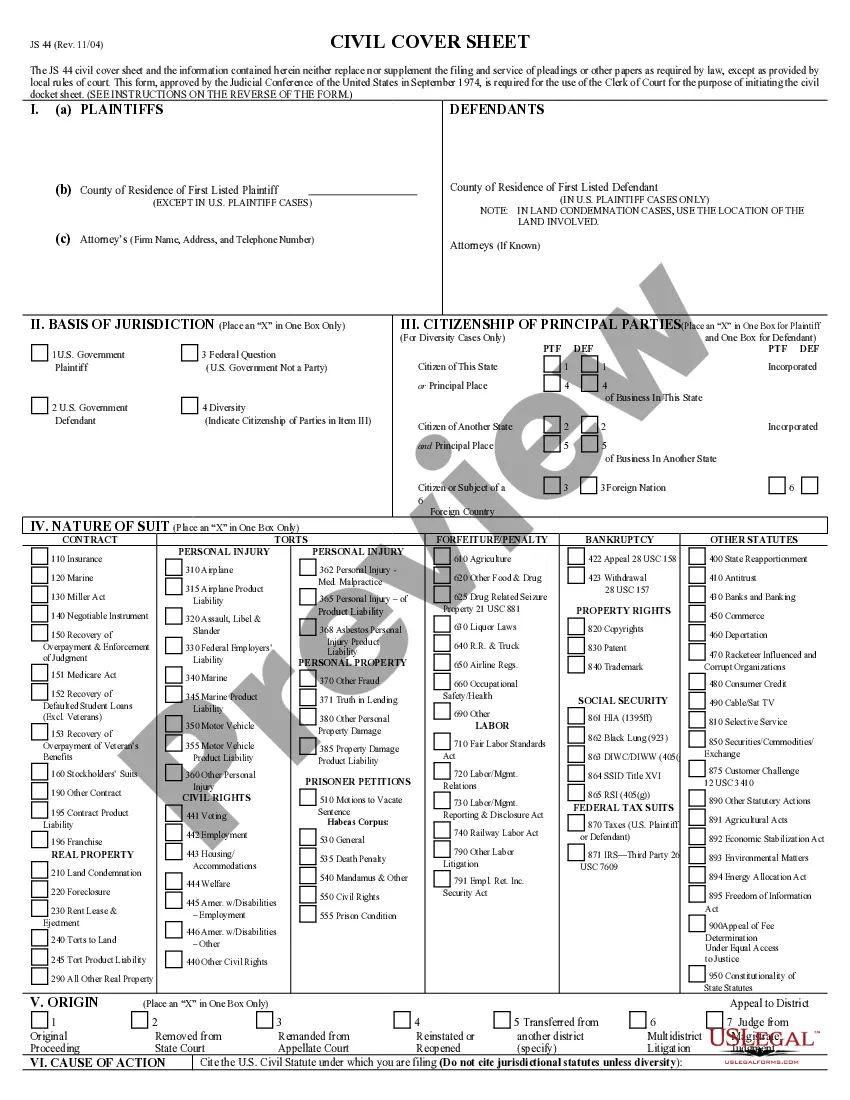

How to fill out Acceptance Of Office By Trustee With Limitations?

Dealing with legal documentation requires attention, accuracy, and using well-drafted blanks. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Acceptance of Office by Trustee with Limitations template from our service, you can be sure it complies with federal and state laws.

Dealing with our service is easy and quick. To obtain the required paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to get your Acceptance of Office by Trustee with Limitations within minutes:

- Remember to attentively look through the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for an alternative formal blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Acceptance of Office by Trustee with Limitations in the format you need. If it’s your first experience with our service, click Buy now to proceed.

- Create an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it electronically.

All documents are drafted for multi-usage, like the Acceptance of Office by Trustee with Limitations you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

An acceptance of office by a trustee is the mutual understanding that a person has with an estate that implies they will assume administrative duties after being nominated. Acceptance of office by trustee is basically a formal way of giving consent to serve as a trustee.

While trusts are highly structured, they do not protect your assets from creditors seeking restitution. In fact, creditors can file a claim against the beneficiaries of the estate should they learn of the person's passing.

A trustee can end up having to pay taxes out of their own personal funds if they fail to take action on behalf of the estate in a timely way. Of course, they can also face criminal liability for such crimes as taking money out of a trust to pay for their own kids' college tuition.

Limitation of liability clauses a trustee is entering into a contract in its capacity as the trustee of the trust; and. a trustee's liabilities under the contract will be limited to the property which the trustee holds on trust for the beneficiaries of its trust.

His or her three primary jobs include investment, administration, and distribution. A trustee is personally liable for a breach of his or her fiduciary duties. The trustee's fiduciary duties include a duty of loyalty, a duty of prudence, and subsidiary duties.

What assets cannot be placed in a trust? Retirement assets. While you can transfer ownership of your retirement accounts into your trust, estate planning experts usually don't recommend it.Health savings accounts (HSAs)Assets held in other countries.Vehicles.Cash.

Can a Beneficiary Override a Trustee? No, beneficiaries generally cannot override a trustee unless the trustee fails to follow the terms of the trust instrument or breaches their fiduciary duty.

A document used to accept an appointment as trustee of a revocable or irrevocable inter vivos trust or a testamentary trust in Florida.