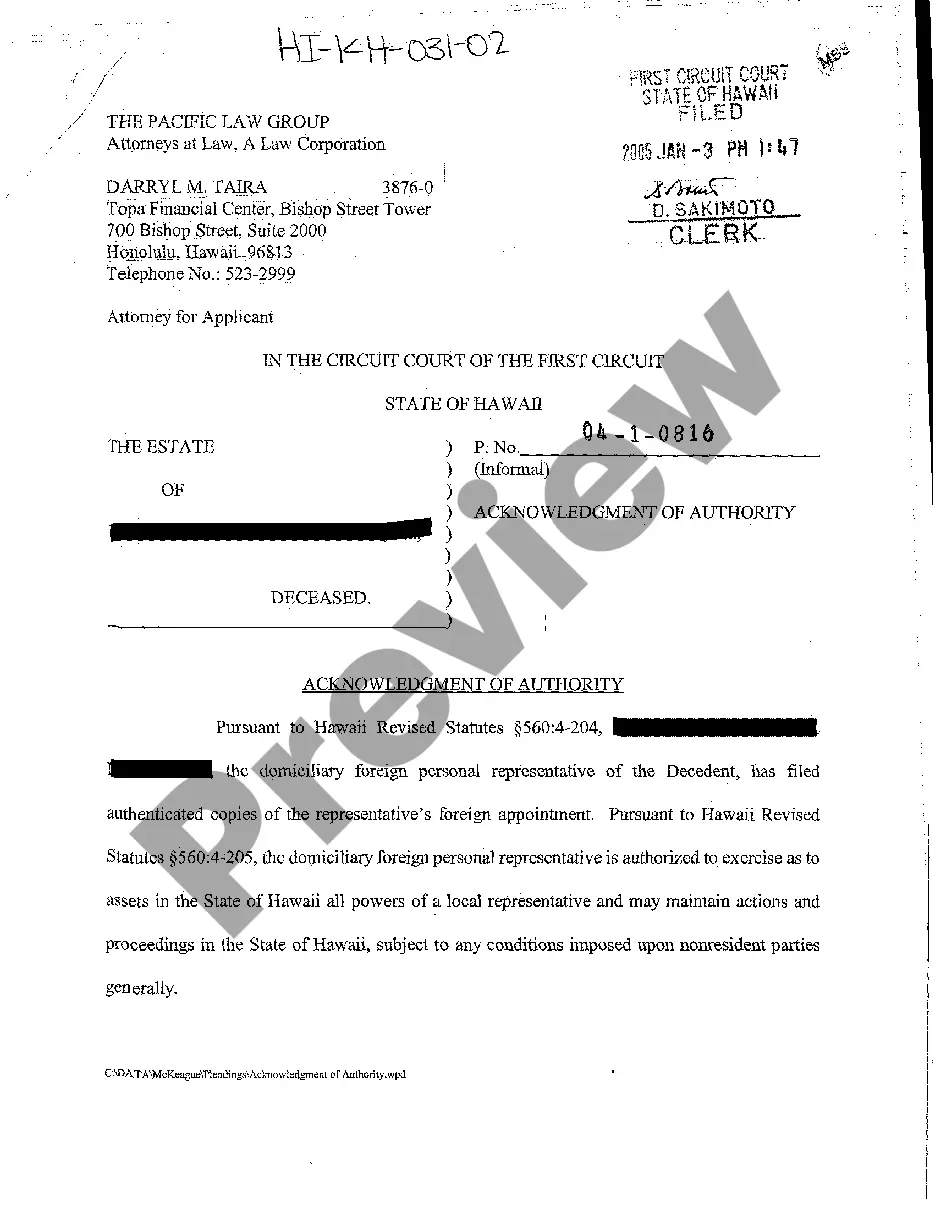

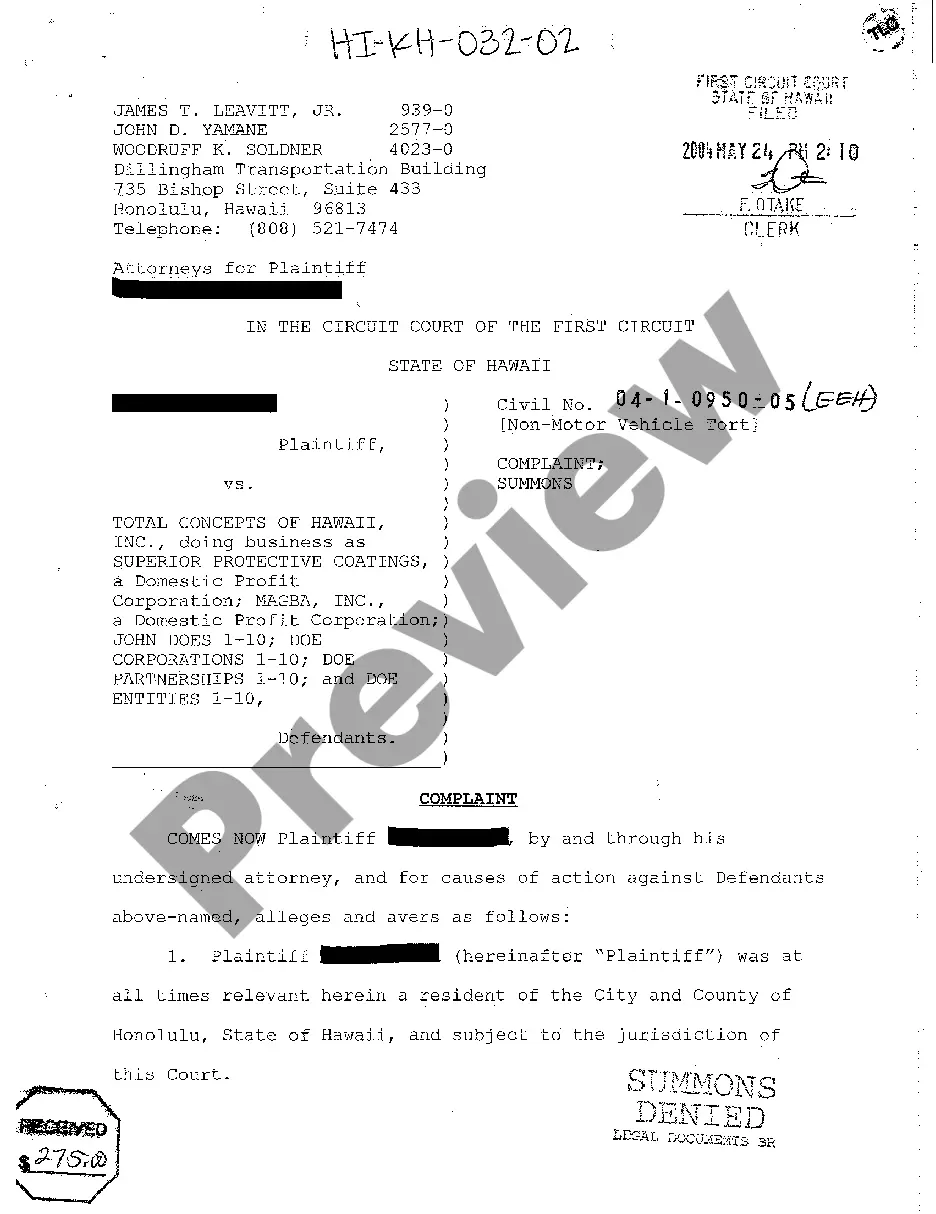

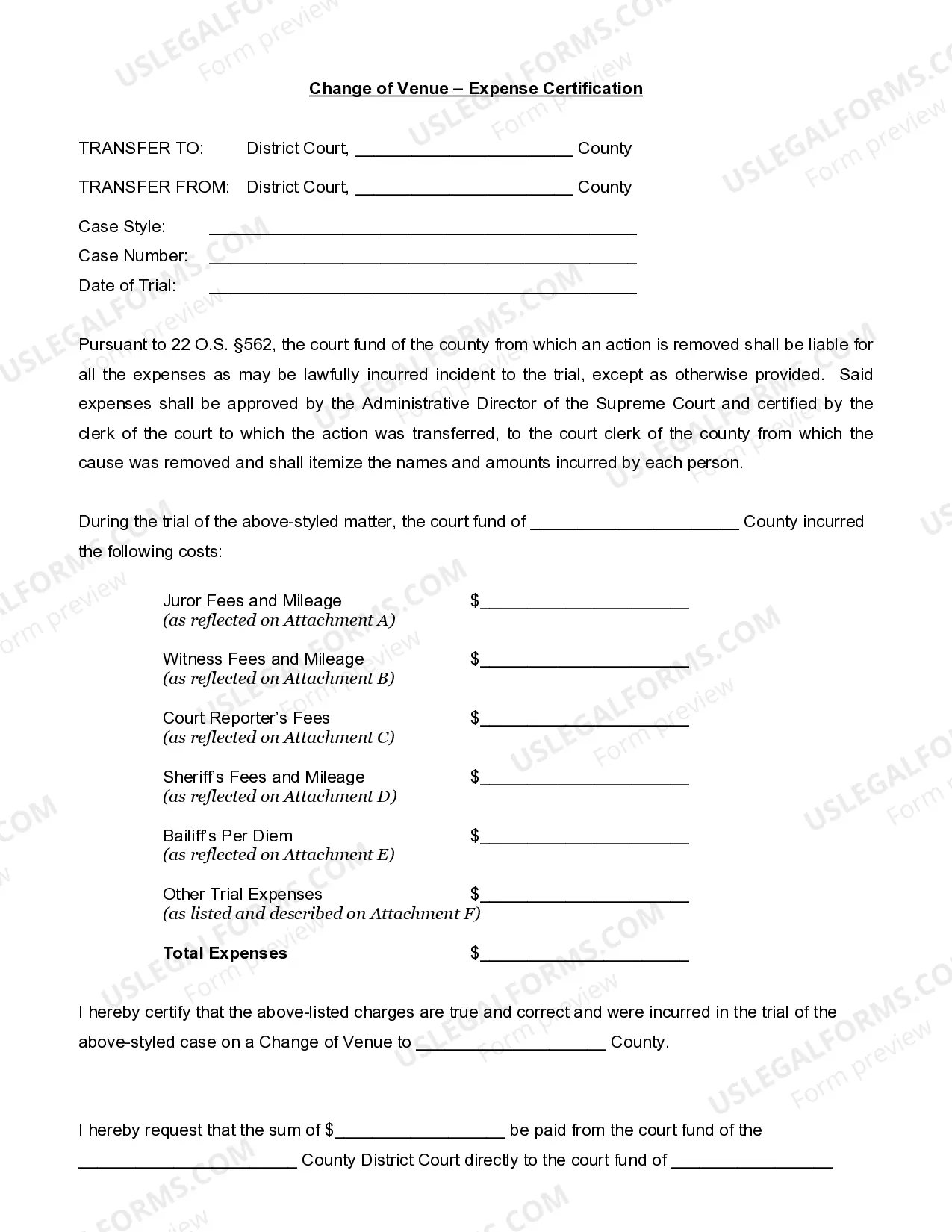

Sample Letter Requesting Direct Deposit of Social Security Checks

Description Requesting Deposit Document

How to fill out Letter Requesting Deposit Security?

Among hundreds of paid and free samples that you’re able to get on the web, you can't be sure about their reliability. For example, who created them or if they are qualified enough to take care of what you require these to. Always keep relaxed and use US Legal Forms! Discover Sample Letter Requesting Direct Deposit of Social Security Checks templates created by skilled lawyers and get away from the high-priced and time-consuming procedure of looking for an lawyer or attorney and then paying them to draft a document for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button near the file you are looking for. You'll also be able to access all your earlier acquired documents in the My Forms menu.

If you’re using our service the first time, follow the tips below to get your Sample Letter Requesting Direct Deposit of Social Security Checks quick:

- Ensure that the document you discover applies in your state.

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing procedure or find another template using the Search field found in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the needed file format.

As soon as you have signed up and bought your subscription, you can utilize your Sample Letter Requesting Direct Deposit of Social Security Checks as many times as you need or for as long as it continues to be valid in your state. Edit it in your favorite editor, fill it out, sign it, and create a hard copy of it. Do far more for less with US Legal Forms!

Letter Deposit Pdf Form popularity

Sample Direct Deposit Form Other Form Names

Letter Deposit Application FAQ

Social Security recipients and other Americans who do not normally file a tax return can expect their stimulus payments to be processed this weekend, the Treasury Department announced Tuesday. Many of the payments will be sent electronically and will be in bank accounts by April 7.

Quick It's easy to receive your benefit by Direct Deposit. You can sign up online at Go Direct®, by calling 1-800-333-1795, in person at your bank, savings and loan or credit union, or calling Social Security. Then, just relax. Your benefit will go automatically into your account every month.

Log in to your account. Sign in and Select the blue Benefits & Payment Details link on the right side of the screen. Scroll down and select the Update Direct Deposit button, and choose if you are the owner or co-owner of the bank account. Enter your bank account information and select Next.

It can take 30 to 60 days for direct deposit changes to take effect, regardless of the method you use to make those changes. If you've opened a new bank account, don't close your old one until you're certain your Social Security benefits are being deposited into your new account.

The answer is yes. Those who are collecting Social Security benefits for retirement, disability or Supplemental Security Income (SSI) will be eligible for the stimulus payments.

The tool is called the "Get May Payment" portal, and it can be found at irs.gov/coronavirus/get-my-payment. Social Security recipients can use the portal to track the status of their payment, even if they didn't file a tax return.

Social Security Administration (SS and SSI) Recipients who are already receiving Social Security and or Supplemental Security Income benefits through direct deposit may change their account or bank information by calling1 (800) SSA-1213 (1-800-772-1213).

There is a form online they can use to change the direct deposit account to which their Social Security benefits go. (SSI payments cannot be handled online.) They can download and print the form to sign up or change the bank where Social Security checks are deposited. Look for http://www.ssa.gov/deposit/1199a.pdf .

The IRS says it will automatically send Economic Impact Payments to people who didn't file a return but who receive Social Security retirement, survivor or disability benefits (SSDI), Railroad Retirement benefits, Supplemental Security Income (SSI) or Veterans Affairs benefits.