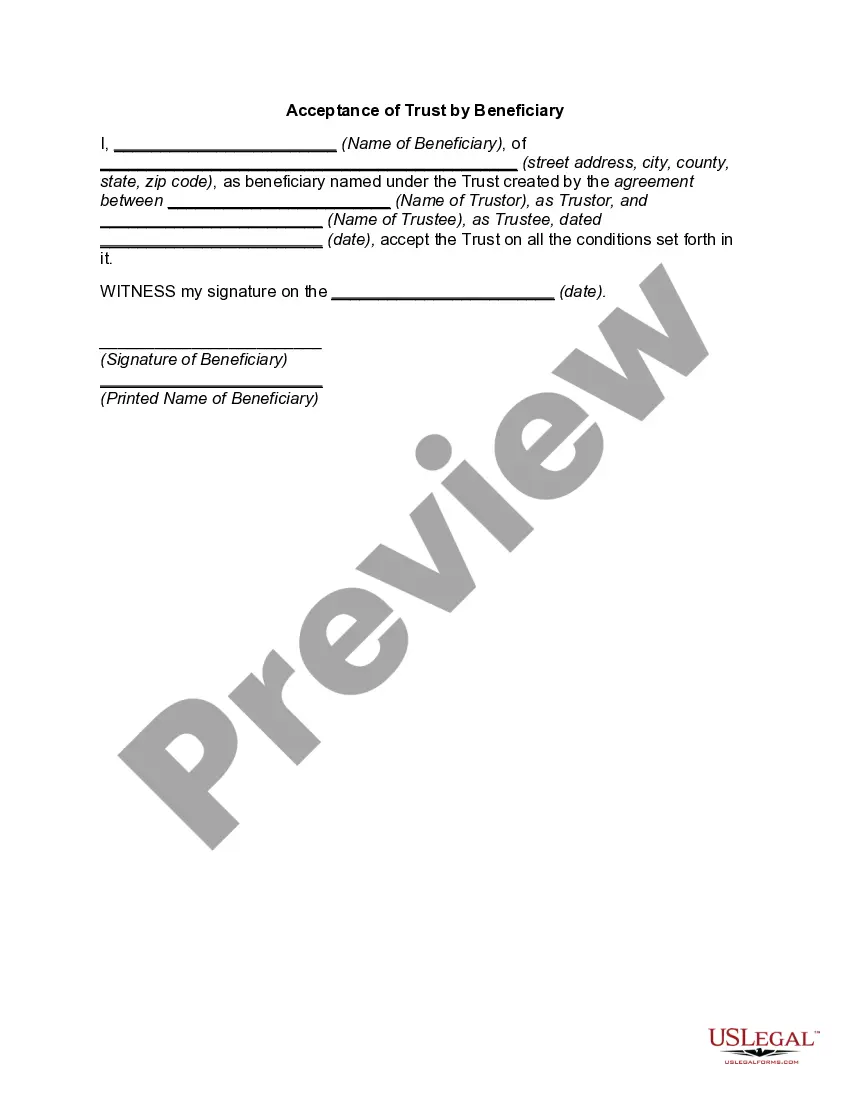

Acceptance of Trust by Beneficiary

Description

How to fill out Acceptance Of Trust By Beneficiary?

Preparing official paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them correspond with federal and state regulations and are examined by our experts. So if you need to fill out Acceptance of Trust by Beneficiary, our service is the best place to download it.

Obtaining your Acceptance of Trust by Beneficiary from our catalog is as easy as ABC. Previously registered users with a valid subscription need only log in and click the Download button once they find the proper template. Afterwards, if they need to, users can get the same document from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few moments. Here’s a quick guide for you:

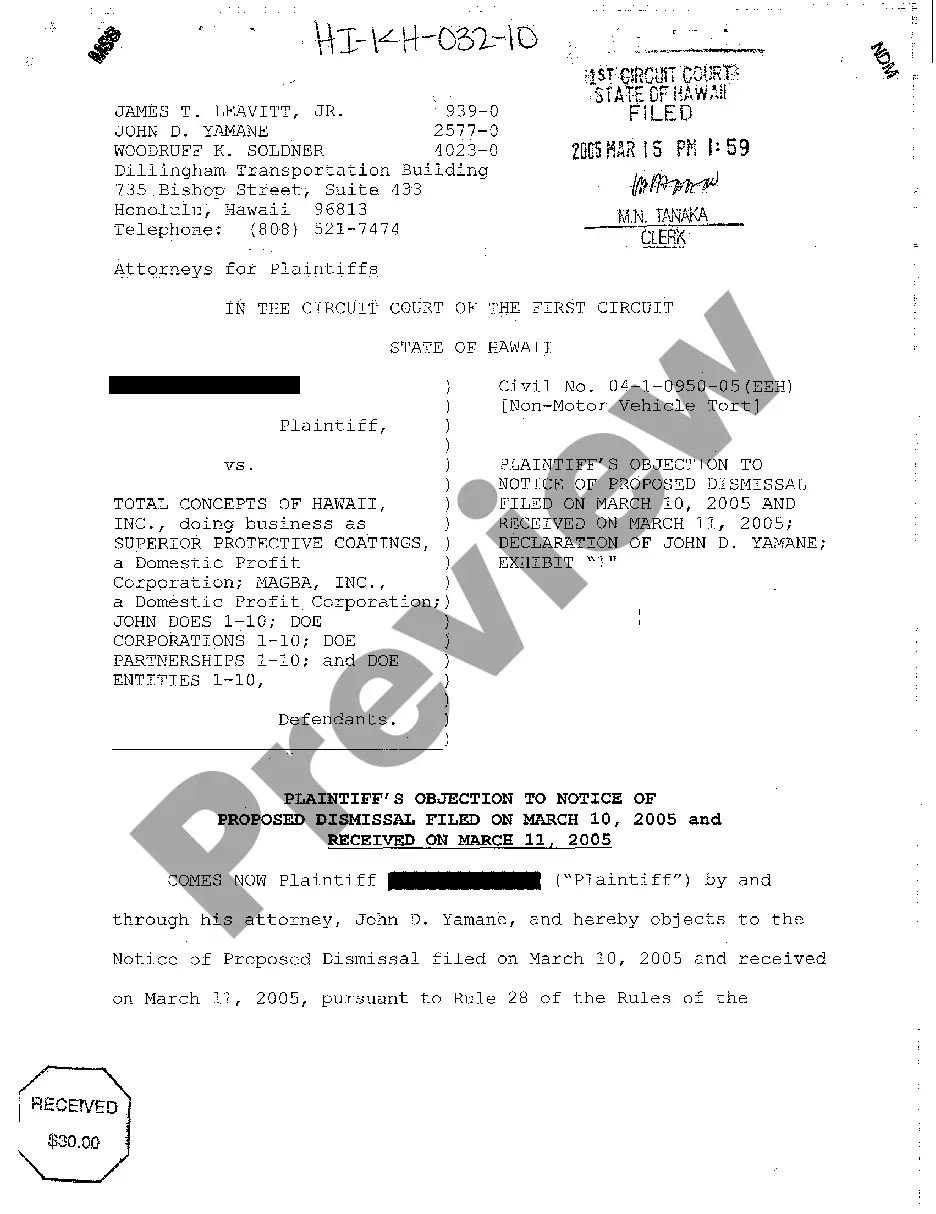

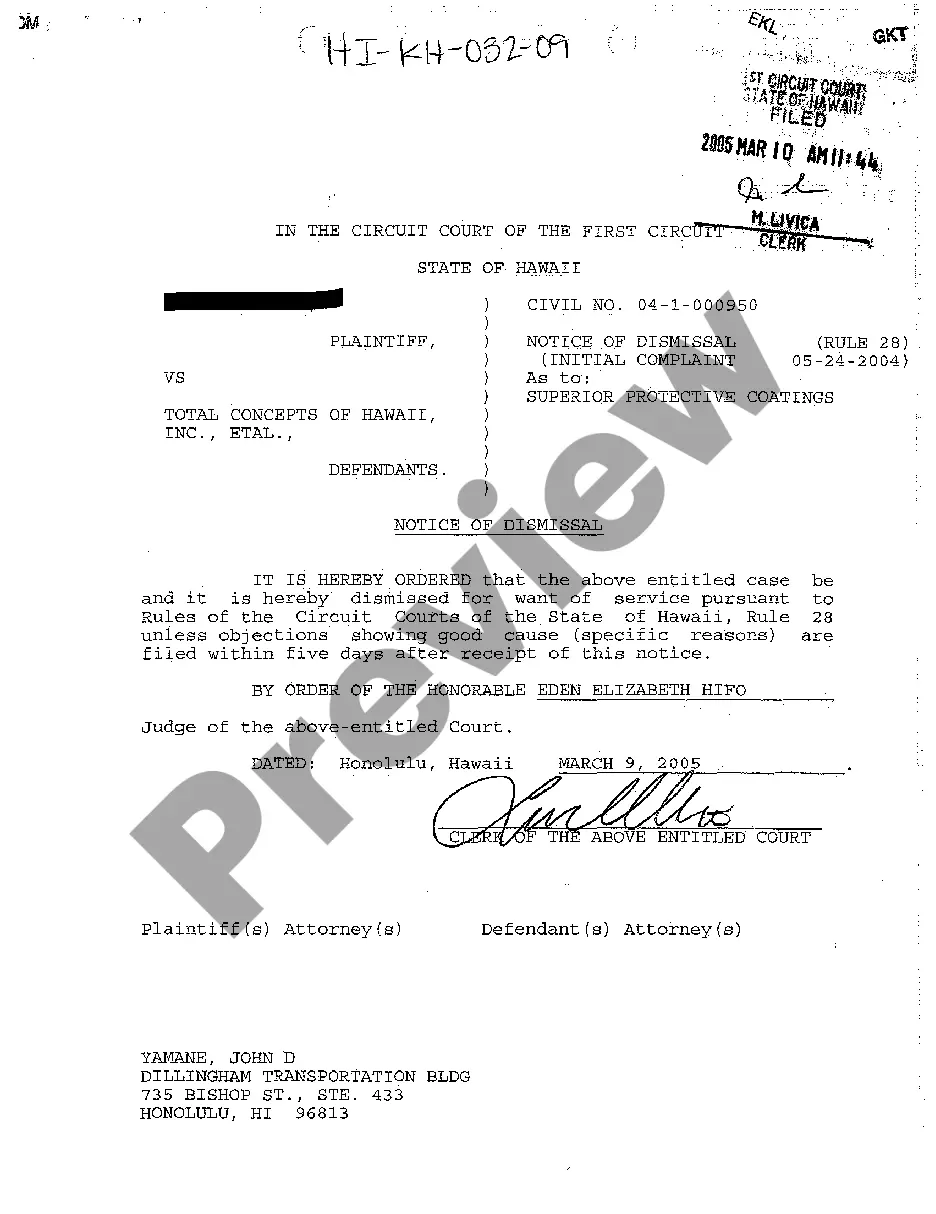

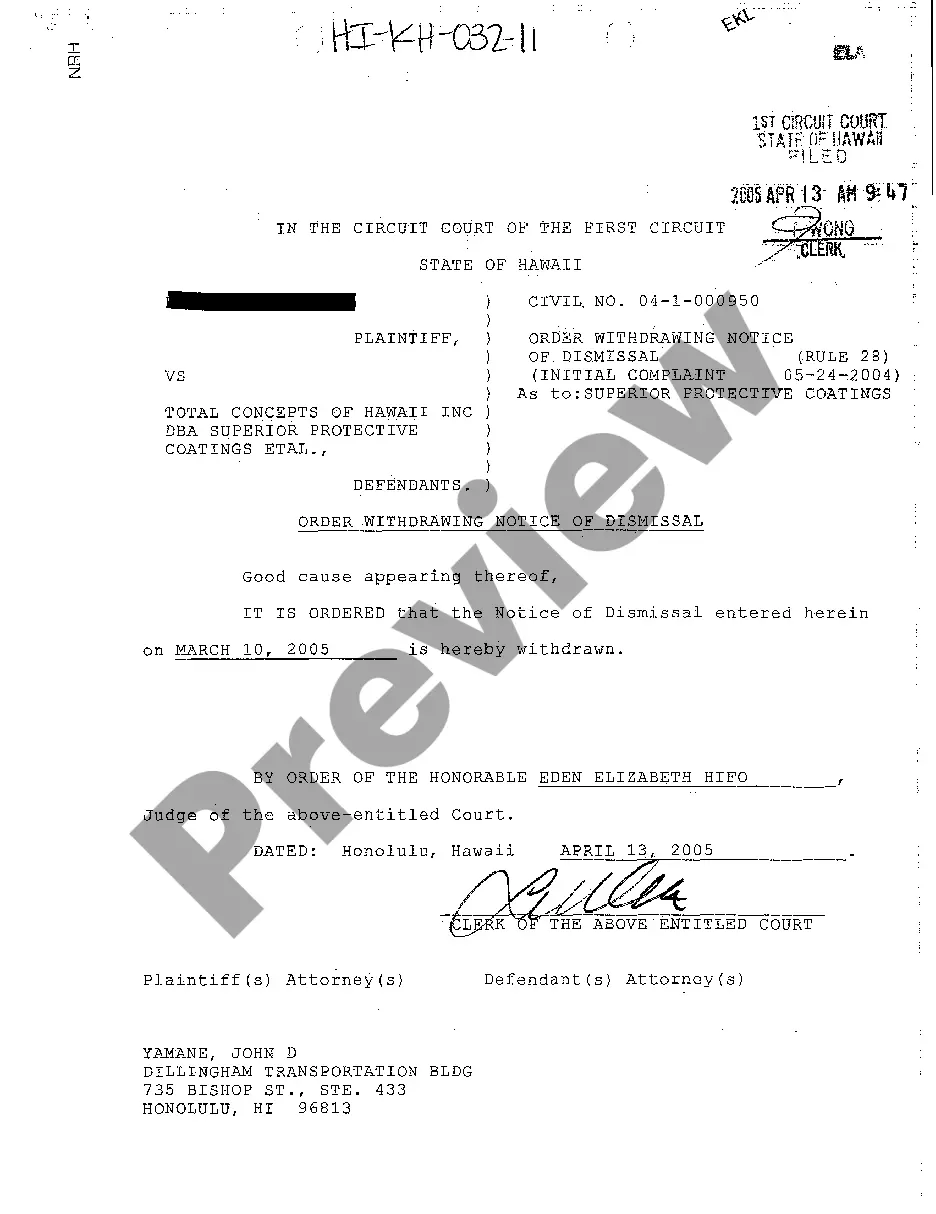

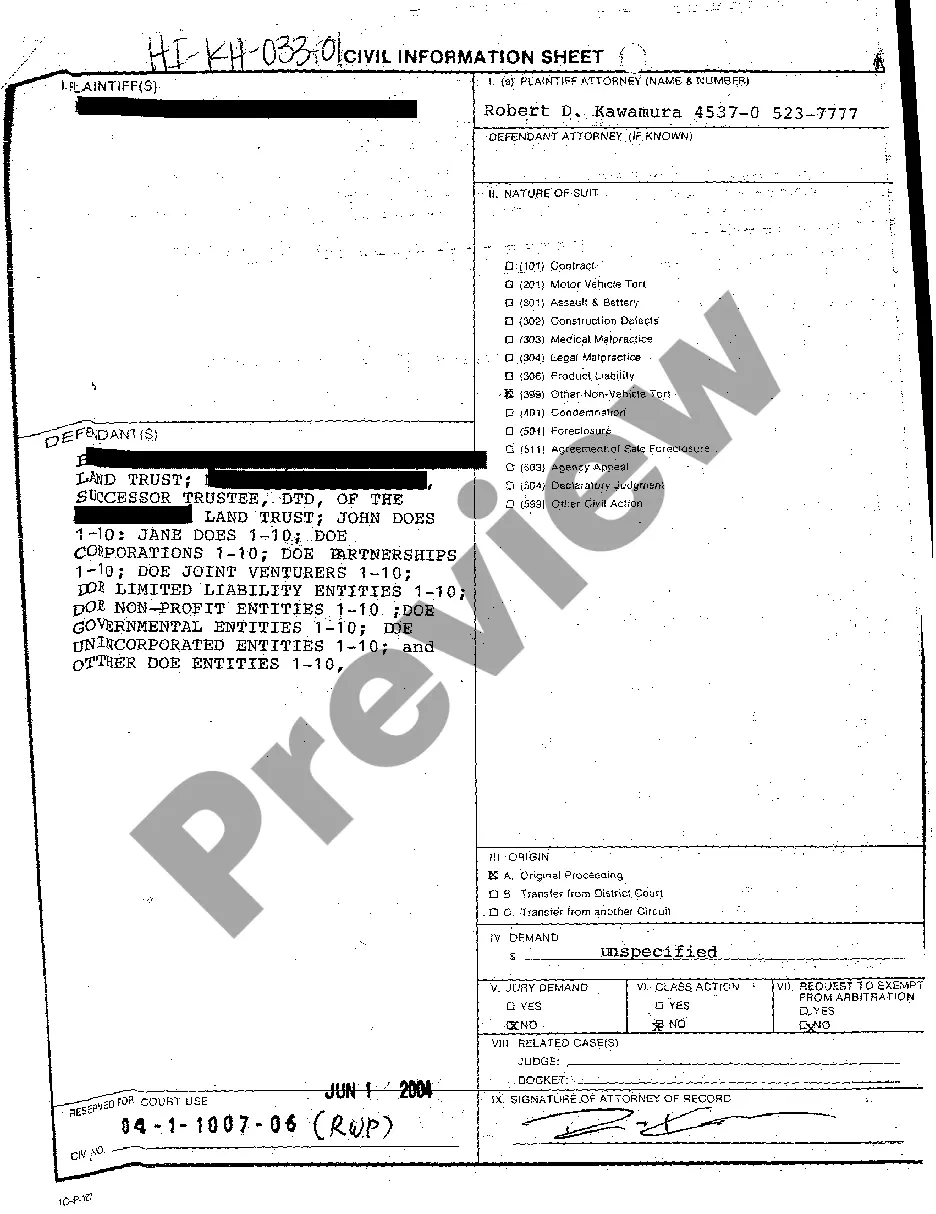

- Document compliance verification. You should attentively review the content of the form you want and ensure whether it satisfies your needs and meets your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library through the Search tab on the top of the page until you find a suitable blank, and click Buy Now once you see the one you need.

- Account registration and form purchase. Create an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Acceptance of Trust by Beneficiary and click Download to save it on your device. Print it to complete your papers manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to get any official document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

Trusts are not considered individuals; therefore, life insurance proceeds paid to trusts are generally subjected to estate tax. Also, the proceeds payable to a trust may not qualify for the inheritance tax exemption provided by some states for insurance payable to a named beneficiary.

Spouse, partner, children, parents, brothers and sisters, business partner, key employee, trust and charitable organization.

You can name a trust as a direct beneficiary of an account. Upon your death, your assets transfer to the trust and distributions are made from the trust to its beneficiaries ing to your wishes.

To leave property to your living trust, name your trust as beneficiary for that property, using the trustee's name and the name of the trust. For example: John Doe as trustee of the John Doe Living Trust, dated January 1, 20xx.

Name a Trust Provide the following information on the beneficiary designation: The full name of the trust as it shows on the trust document. The date the trust was created. The name of the trustee, followed by the word ?trustee,? or if you cannot provide a trustee, ETF may accept another contact person.

Some of your financial assets need to be owned by your trust and others need to name your trust as the beneficiary. With your day-to-day checking and savings accounts, I always recommend that you own those accounts in the name of your trust.

You can name a trust as a direct beneficiary of an account. Upon your death, your assets transfer to the trust and distributions are made from the trust to its beneficiaries ing to your wishes.

Executors want you to sign a release to ensure that they are protected from personal liability for the work they have done executing the estate. It also ensures they won't have to claw back any assets or distribute them in some new way after they've already distributed everything there is to be distributed.