Election by Beneficiary not to Exercise a Right to Withdraw Trust Contribution

Description

How to fill out Election By Beneficiary Not To Exercise A Right To Withdraw Trust Contribution?

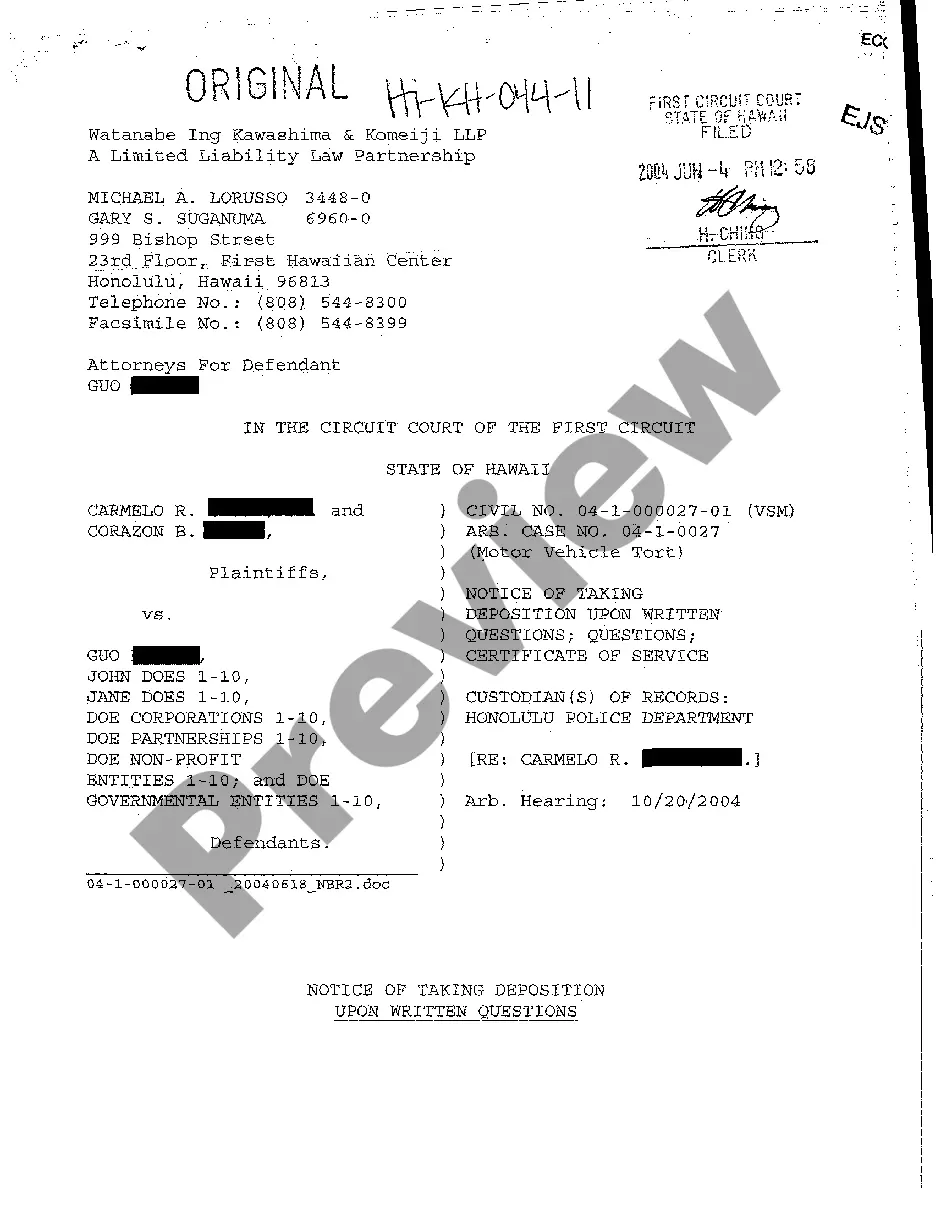

Handling official documentation requires attention, precision, and using well-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Election by Beneficiary not to Exercise a Right to Withdraw Trust Contribution template from our service, you can be sure it meets federal and state regulations.

Dealing with our service is easy and fast. To get the necessary document, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to obtain your Election by Beneficiary not to Exercise a Right to Withdraw Trust Contribution within minutes:

- Remember to carefully examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for another formal template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Election by Beneficiary not to Exercise a Right to Withdraw Trust Contribution in the format you need. If it’s your first experience with our website, click Buy now to proceed.

- Create an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to prepare it electronically.

All documents are created for multi-usage, like the Election by Beneficiary not to Exercise a Right to Withdraw Trust Contribution you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

It is an action taken by the beneficiary of an estate or trust to formally give up their right to receive or take a beneficial interest in an asset (or assets) to which they would otherwise be entitled from an estate or trust. A beneficiary can disclaim all or a portion of anything they are earmarked to receive.

A withdrawal right is the right, given to the beneficiary of a trust, to withdraw all or a portion of each gift made to the trust. For example, if a $1,000 gift is made to a trust and a beneficiary of the trust has a withdrawal right over that gift, he or she can withdraw up to $1,000 from the trust.

Under Internal Revenue Service (IRS) rules, to refuse an inheritance, you must execute a written disclaimer that clearly expresses your "irrevocable and unqualified" intent to refuse the bequest.

With an irrevocable trust, the transfer of assets is permanent. So once the trust is created and assets are transferred, they generally can't be taken out again.

A beneficiary is always free to refuse to accept benefits under a trust or a will. You should ask the beneficiary to execute what is called a disclaimer.

There isn't a standard way of distributing trust assets to beneficiaries, but rather the grantor, the person who creates the trust (also known as the settlor or trustor), determines how the trust assets should be disbursed.

Spendthrift provision: a clause in a trust that prevents a beneficiary from withdrawing more than the greater of $5,000 or 5% of the corpus.

The short answer is yes. Trust beneficiaries may bring a claim against a trustee so long as they have a valid reason.