Sample Letter Requesting Payoff Balance of Mortgage

Description What Is A Pay Off Letter

How to fill out Payoff Request Form?

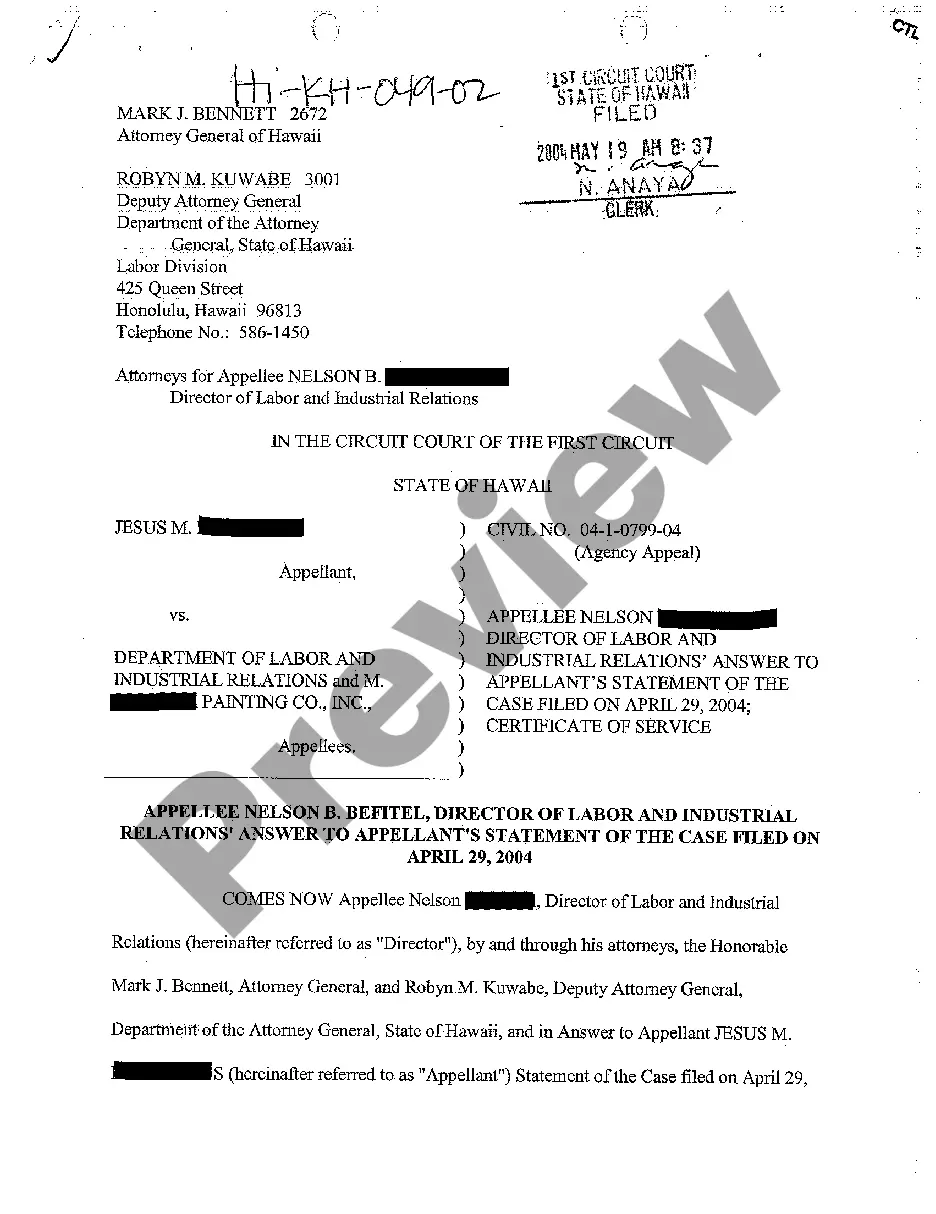

Among numerous free and paid examples which you get on the web, you can't be sure about their reliability. For example, who made them or if they’re qualified enough to deal with what you require these to. Always keep relaxed and utilize US Legal Forms! Find Sample Letter Requesting Payoff Balance of Mortgage samples developed by professional attorneys and prevent the costly and time-consuming process of looking for an lawyer or attorney and after that having to pay them to write a papers for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button near the form you are looking for. You'll also be able to access your previously acquired documents in the My Forms menu.

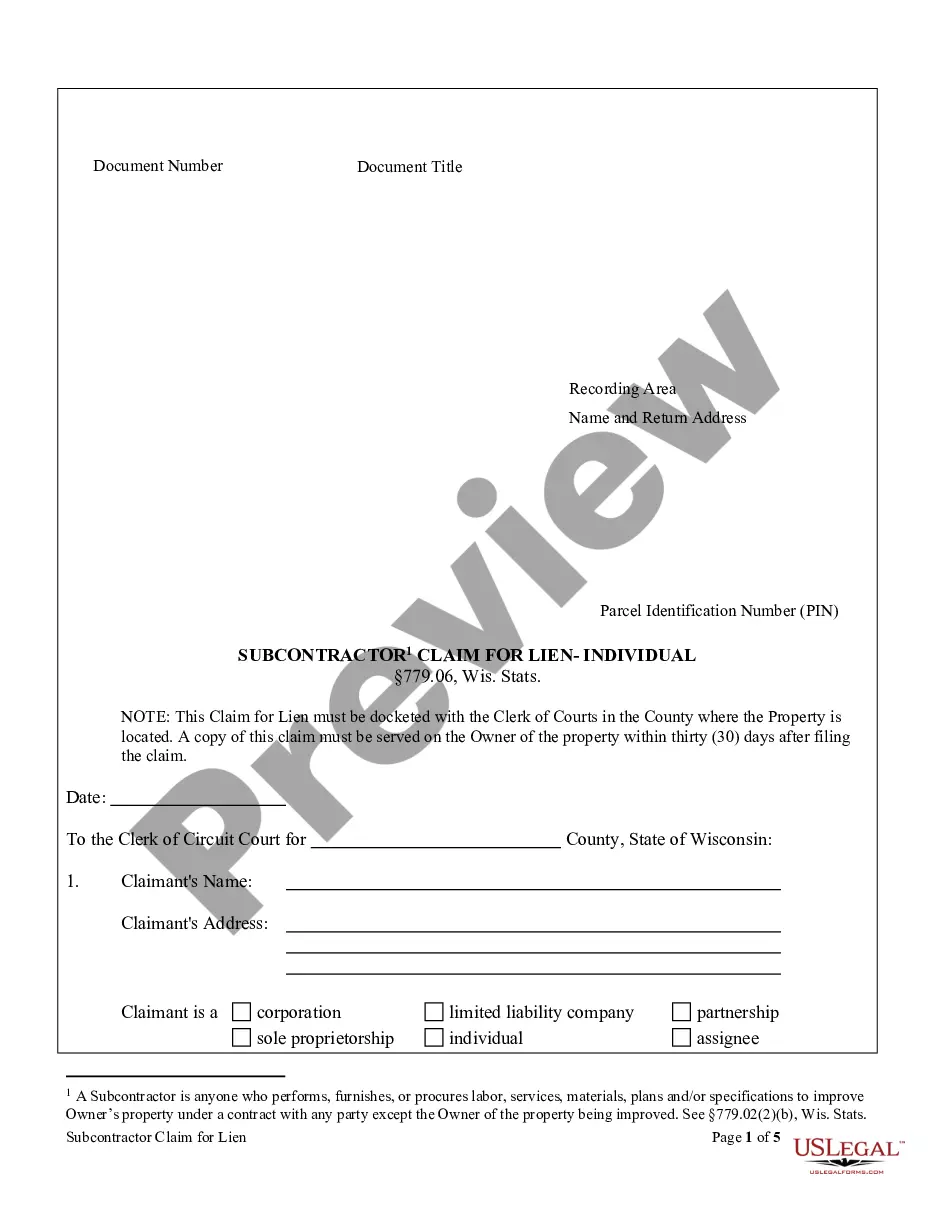

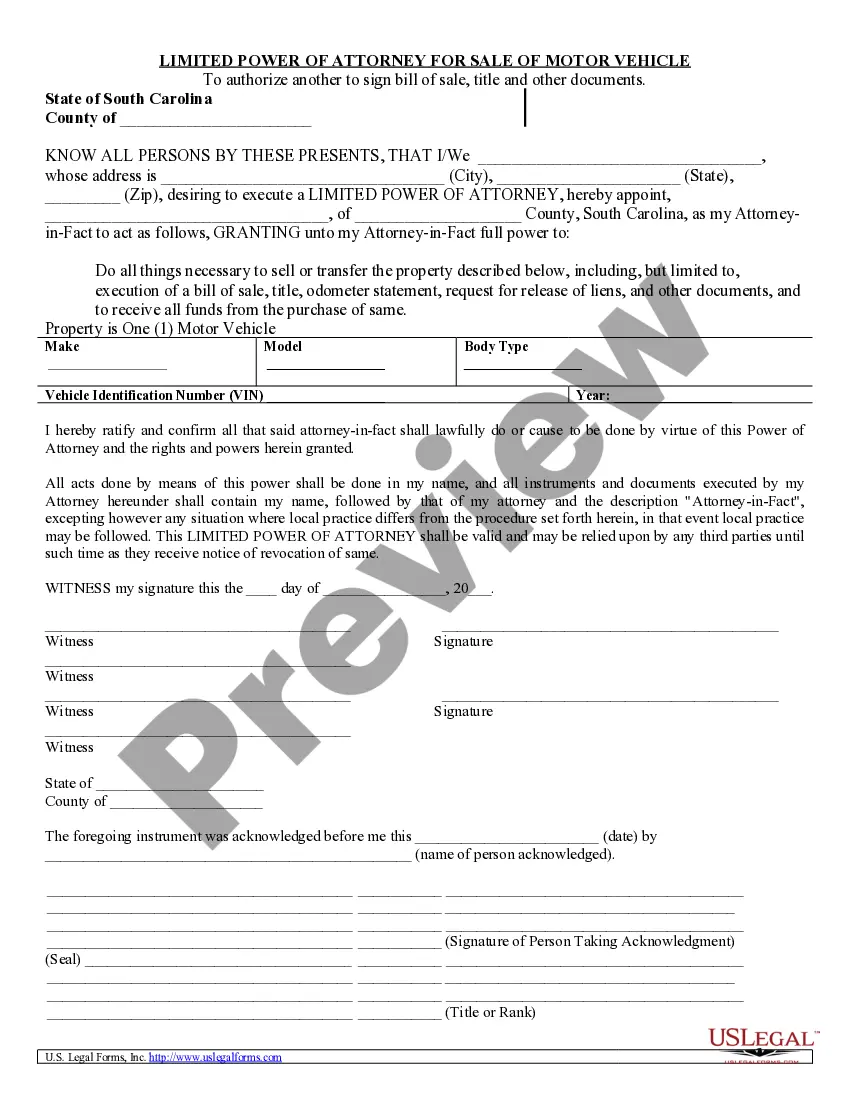

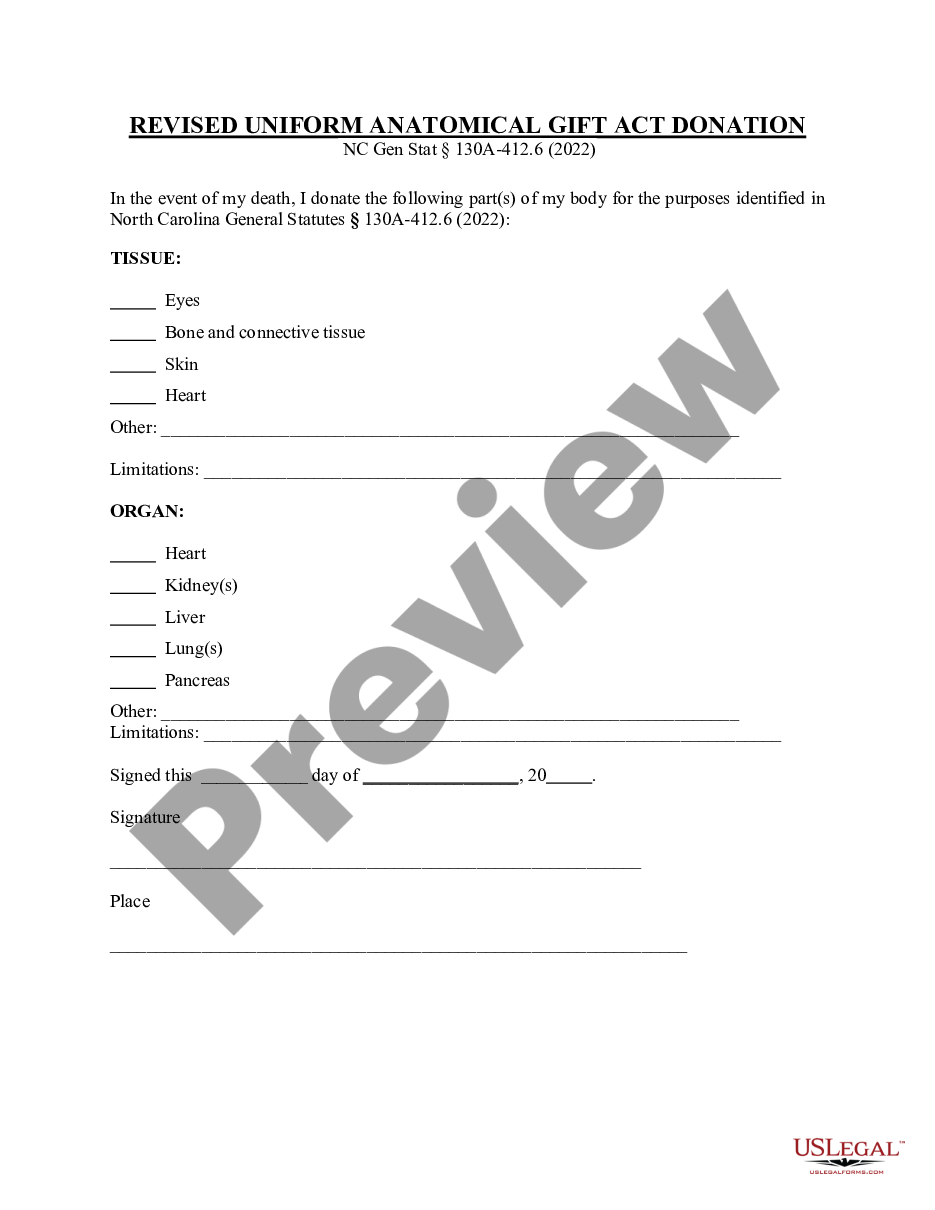

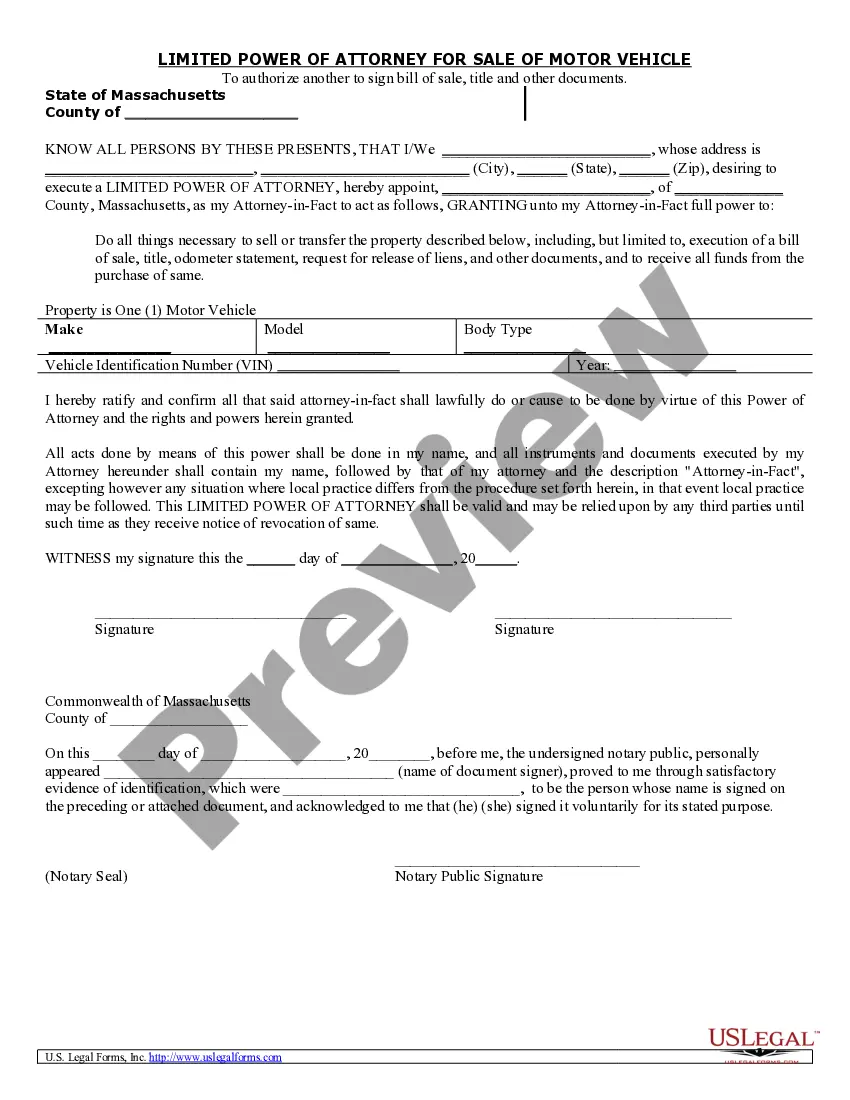

If you’re using our service for the first time, follow the tips below to get your Sample Letter Requesting Payoff Balance of Mortgage quick:

- Ensure that the document you find applies where you live.

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to start the ordering process or find another example utilizing the Search field in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

Once you have signed up and purchased your subscription, you may use your Sample Letter Requesting Payoff Balance of Mortgage as many times as you need or for as long as it continues to be valid in your state. Change it in your preferred offline or online editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Mortgage Payoff Letter Sample Form popularity

Mortgage Payoff Letter Form Other Form Names

Loan Payoff Request Letter FAQ

A payoff statement should include the name and address of the lender preparing the statement and be addressed to the lender that requested the payoff. It also needs to include the customer's name, the loan number and the terms of the loan, including the balance and the interest rate.

A payoff letter is typically requested by a borrower from its lender in connection with the repayment of the borrower's outstanding loans to the lender under a loan agreement and termination of the loan agreement and related security and guaranties.

A payoff statement or a mortgage payoff letter will typically show the balance you must pay in order to close your loan. It may also include additional details, such as the amount of interest that will be rebated due to prepayment, the remaining payment schedule, rate of interest, and money saved for paying early.

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

The loan servicer generally must deliver a payoff quote within seven days of your request. Your servicer will set an expiration date for the quote, after which interest will again accrue.

A payoff statement should include the name and address of the lender preparing the statement and be addressed to the lender that requested the payoff. It also needs to include the customer's name, the loan number and the terms of the loan, including the balance and the interest rate.

1Explain you cannot afford to make the payments.2Request a payoff amount.3Respond with a figure you can afford to pay.4Show evidence proving your home is underwater.How to Negotiate a Reduction of Pay Off of a Second Mortgage\nhomeguides.sfgate.com > negotiate-reduction-pay-off-second-mortgage-53...

1Get all of the terms and other information. A payoff statement should include the name and address of the lender preparing the statement and be addressed to the lender that requested the payoff.2Complete the body of the letter.3Calculate the payoff.4Portfol.com: Example of Payoff Statement.How to Create a Payoff Statement Sapling\nwww.sapling.com > create-payoff-statement