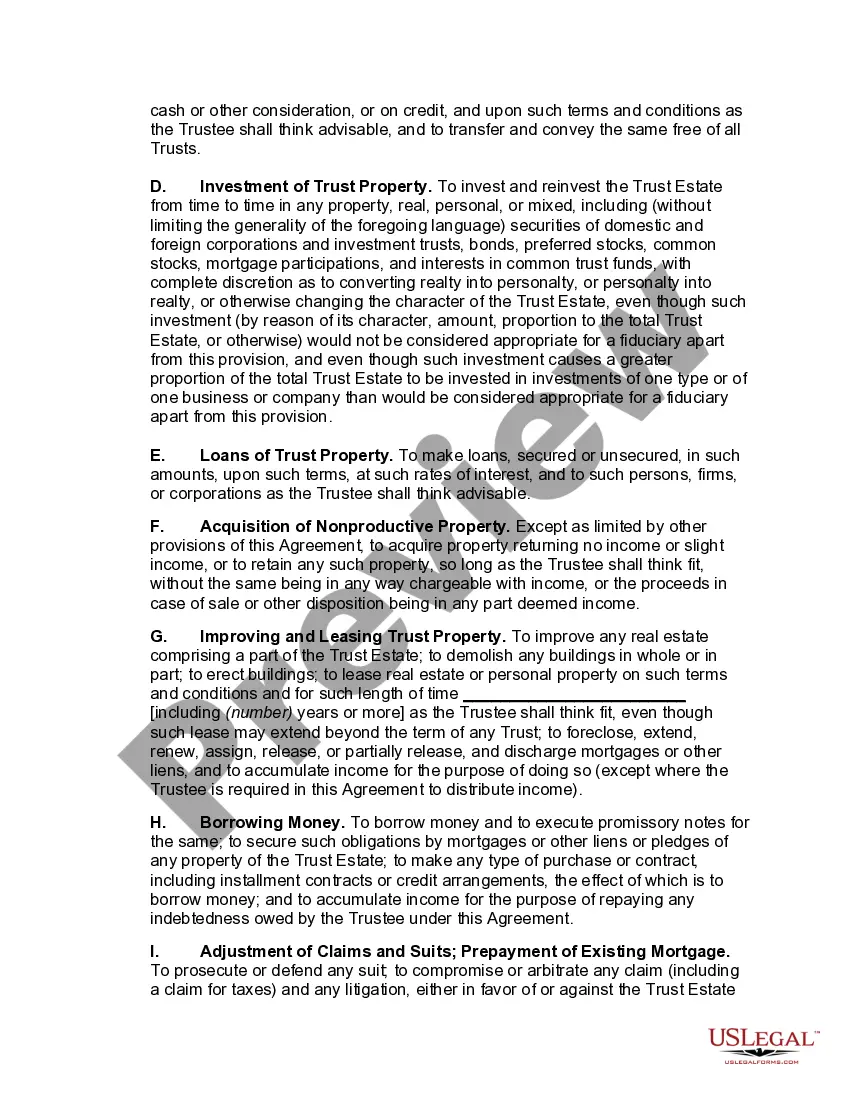

Irrevocable Trust Agreement for Minor which Qualifies for Annual Gift Tax Exclusion -- Multiple Trusts for Children

Description

How to fill out Irrevocable Trust Agreement For Minor Which Qualifies For Annual Gift Tax Exclusion -- Multiple Trusts For Children?

How much time and resources do you often spend on composing official paperwork? There’s a better option to get such forms than hiring legal experts or spending hours searching the web for an appropriate template. US Legal Forms is the top online library that provides professionally designed and verified state-specific legal documents for any purpose, such as the Irrevocable Trust Agreement for Minor which Qualifies for Annual Gift Tax Exclusion -- Multiple Trusts for Children.

To obtain and complete a suitable Irrevocable Trust Agreement for Minor which Qualifies for Annual Gift Tax Exclusion -- Multiple Trusts for Children template, follow these easy steps:

- Look through the form content to make sure it complies with your state regulations. To do so, read the form description or utilize the Preview option.

- If your legal template doesn’t meet your requirements, locate a different one using the search tab at the top of the page.

- If you already have an account with us, log in and download the Irrevocable Trust Agreement for Minor which Qualifies for Annual Gift Tax Exclusion -- Multiple Trusts for Children. If not, proceed to the next steps.

- Click Buy now once you find the right document. Select the subscription plan that suits you best to access our library’s full opportunities.

- Sign up for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is absolutely safe for that.

- Download your Irrevocable Trust Agreement for Minor which Qualifies for Annual Gift Tax Exclusion -- Multiple Trusts for Children on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously acquired documents that you safely store in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as frequently as you need.

Save time and effort completing legal paperwork with US Legal Forms, one of the most trustworthy web solutions. Sign up for us today!

Form popularity

FAQ

Gifts to charity are generally not subject to the gift tax but must be reported on Form 709 if they are made in the same year the donor makes taxable gifts that must be reported. Payments to Sec. 529 plans qualify for the annual gift tax exclusion and are not subject to the GST tax.

Annual Exclusion per Donee for Year of Gift Year of GiftAnnual Exclusion per Donee2011 through 2012$13,0002013 through 2017$14,0002018 through 2021$15,0002022$16,0001 more row ?

The 2022 federal annual exclusion for gifts is $16,000 per beneficiary. The Trust should provide each designated beneficiary with a temporary right to withdraw the annual gift exclusion amount. The beneficiary's withdrawal right is referred to as a ?Crummey power?.

The Annual Gift Exclusion Amount Can Be Saved Every Year in a Crummey Trust. You can use your annual exclusion amount, and provide guidance and instruction on how the funds will be used to benefit members of your family. An annual exclusion trust, also known as a Crummey Trust, is one way to do this.

Key Takeaways. An annual exclusion amount is how much a person can transfer to another without paying a gift tax. For 2022, the annual exclusion amount is $16,000 (increasing to $17,000 in 2023).

The IRS finds out if you gave a gift when you file a form 709 as is required if you gift over the annual exclusion. If you fail to file this form, the IRS can find out via an audit.

Gifts in trust do not qualify for the annual exclusion unless the trust either qualifies as a ?Minor's Trust? under Internal Revenue Code Section 2503(c) or has certain temporary withdrawal powers called ?Crummey? powers.

Is There Tax on Gifts to Children? Gifts made to children may be subject to tax, but typically only if they are large gifts. As of 2022, any gift under $16,000 isn't typically subject to gift tax and doesn't need to be reported to the IRS. This is due to the annual gift tax exclusion.