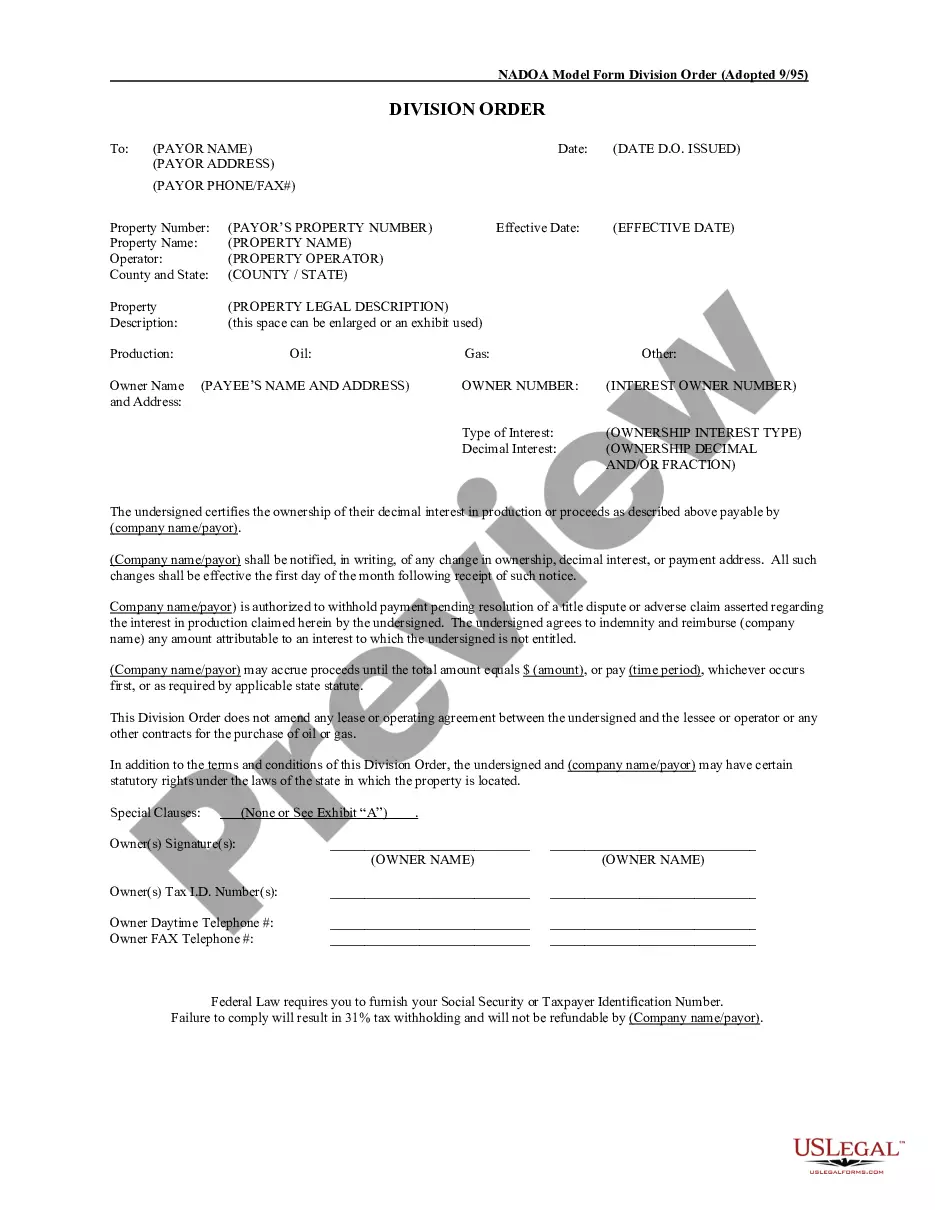

A Shareholders’ Buy-Sell Agreement, also known as a Cross-Purchase Agreement, is a legal document that defines the terms of a buy-sell agreement between shareholders in a corporation. It is used to protect the interests of the shareholders in the event of a shareholder's death, disability, retirement, or other unexpected change in ownership. The agreement establishes a predetermined price for the shares, and outlines a process for the sale of the shares in the event of the triggering events. It also establishes the terms of the buy-sell agreement, including the rights of the parties, the payment of the purchase price, and other matters related to the transfer of ownership. There are two primary types of Shareholders’ Buy-Sell Agreement— - Cross-Purchase Agreement: the Entity Purchase agreement and the Stock Redemption agreement. The Entity Purchase agreement is an agreement between the corporation or LLC and the shareholder, whereby the corporation or LLC purchases the stock of the shareholder in the event of a triggering event. The Stock Redemption agreement is an agreement between the shareholders themselves, whereby the shares are purchased from the shareholder in the event of a triggering event.

Shareholders' Buy-Sell Agreement - Cross-Purchase Agreement

Description

How to fill out Shareholders' Buy-Sell Agreement - Cross-Purchase Agreement?

Working with legal documentation requires attention, accuracy, and using well-drafted blanks. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Shareholders' Buy-Sell Agreement - Cross-Purchase Agreement template from our library, you can be sure it meets federal and state laws.

Working with our service is straightforward and quick. To get the necessary document, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to find your Shareholders' Buy-Sell Agreement - Cross-Purchase Agreement within minutes:

- Make sure to attentively examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for an alternative official blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Shareholders' Buy-Sell Agreement - Cross-Purchase Agreement in the format you prefer. If it’s your first experience with our website, click Buy now to continue.

- Register for an account, select your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to submit it electronically.

All documents are drafted for multi-usage, like the Shareholders' Buy-Sell Agreement - Cross-Purchase Agreement you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

In a cross purchase buy-sell agreement, each business owner buys a life insurance policy on the other owner(s). With multiple owners, this can get very complex and complicated. Instead, try a trusteed cross purchase buy-sell, in which a third-party (acting as trustee) takes care of the buy-sell arrangement.

While a buy-sell agreement typically addresses the sale of shares among co-owners of a business, a shareholder agreement may address a wider range of issues, including the management and control of the business, the distribution of profits, and the appointment of directors and officers.

In a cross purchase buy-sell agreement, each business owner buys a life insurance policy on the other owner(s). With multiple owners, this can get very complex and complicated. Instead, try a trusteed cross purchase buy-sell, in which a third-party (acting as trustee) takes care of the buy-sell arrangement.

sell agreement provides a plan for the orderly transfer of any owner's business interest. Consider a buysell agreement for your business if: You have two or more owners. You want to provide protection in the event of any owner's termination of employment, retirement, divorce, disability, or death.

Example: Alma owns 60%, Betty 20% and Catherine 20% of their company. The cross-purchase agreement states that if one owner dies, her interest is divided equally between the survivors. Therefore, if Betty dies, Alma's ownership interest grows from 60% to 70%, while Catherine's interest grows from 20% to 30%.

Cross purchase buy sell agreements have a variety of purposes. One of the main benefits of this document is that it allows the remaining partners in a business to purchase the shares of a partner who is leaving the company. In addition, this document will decide how these shares can be purchased or distributed.

The disadvantages of cross-purchase buy-sell agreements include: Life insurance policies are not owned by the business so any cash values cannot be considered company assets. Depending on the varying ages of the business owner's actual premium payments may vary greatly.