Sample Letter for Notice of Sale to Junior Lien Holder

Description

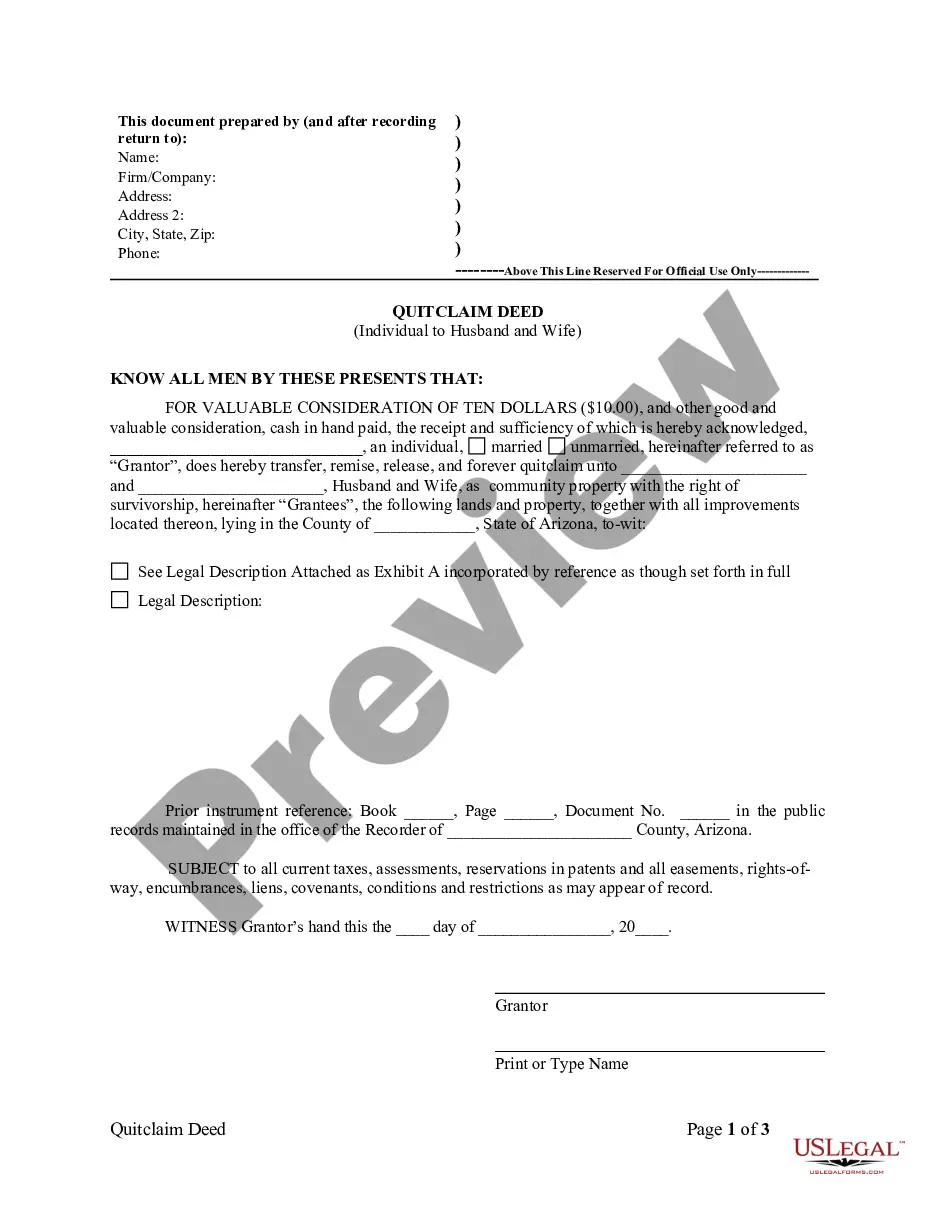

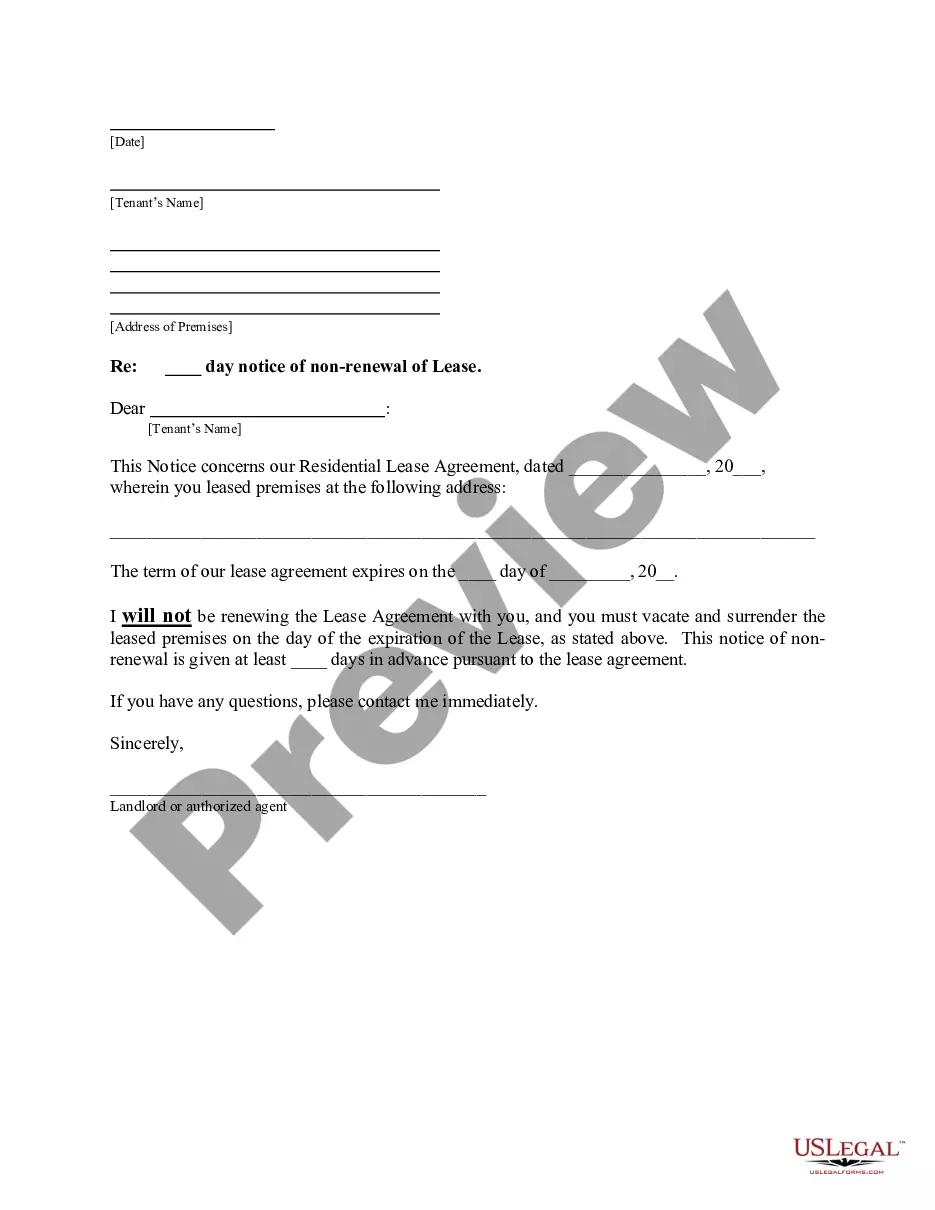

How to fill out Sample Letter For Notice Of Sale To Junior Lien Holder?

Use US Legal Forms to get a printable Sample Letter for Notice of Sale to Junior Lien Holder. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most complete Forms library on the web and offers reasonably priced and accurate samples for consumers and lawyers, and SMBs. The templates are categorized into state-based categories and a few of them can be previewed prior to being downloaded.

To download samples, users must have a subscription and to log in to their account. Press Download next to any form you need and find it in My Forms.

For those who don’t have a subscription, follow the following guidelines to quickly find and download Sample Letter for Notice of Sale to Junior Lien Holder:

- Check to ensure that you have the proper form in relation to the state it is needed in.

- Review the form by reading the description and using the Preview feature.

- Press Buy Now if it is the document you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it many times.

- Make use of the Search field if you want to find another document template.

US Legal Forms provides thousands of legal and tax samples and packages for business and personal needs, including Sample Letter for Notice of Sale to Junior Lien Holder. Above three million users have utilized our platform successfully. Select your subscription plan and get high-quality documents in just a few clicks.

Form popularity

FAQ

When a junior lienholder forecloses, a senior lienholder recovers nothing from the sale proceeds. But the senior lien remains intact and the foreclosure buyer takes title to the property subject to the senior lien.

Junior Lienholder Foreclosures For example, if your home is worth much more than its mortgage balance a junior lienholder might foreclose in expectation of receiving significant sale proceeds. Also, a junior lienholder might buy your first mortgage loan, become the new lienholder and then foreclose that lien.

A junior mortgage is a mortgage that is subordinate to a first or prior (senior) mortgage. A junior mortgage often refers to a second mortgage, but it could also be a third or fourth mortgage (e.g. home equity loans or lines of credit (HELOCs)).

When a junior mortgage holder has been sold-out in a first-mortgage foreclosure, that junior mortgage holder usually can, depending on state law, sue you personally on the promissory note to recover the money it loaned you.

Following a first-mortgage foreclosure, all junior liens (including a second mortgage and any junior judgment liens) are extinguished and the liens are removed from the property title. But the second-mortgage debt and creditor's judgment remain, even though they're no longer attached to the foreclosed property.

Once a non-mortgage lien is placed on your home, the holder of the lien can choose to take one of two routes.For example, property tax liens may sometimes be foreclosed outside of court, while the holder of a mechanics' liens must typically sue the homeowner in court in order to foreclose.

Following a first-mortgage foreclosure, all junior liens (including a second mortgage and any junior judgment liens) are extinguished and the liens are removed from the property title. But the second-mortgage debt and creditor's judgment remain, even though they're no longer attached to the foreclosed property.

In short, consensual liens do not adversely affect your credit as long as repayment terms are satisfied. Statutory and judgment liens have a negative impact on your credit score and report, and they impact your ability to obtain financing in the future.

A second mortgage or junior-lien is a loan you take out using your house as collateral while you still have another loan secured by your house.The term second means that if you can no longer pay your mortgages and your home is sold to pay off the debts, this loan is paid off second.