An Agreement between Retiring Partner and Remaining Partners to Dissolve and Wind up Partnership with Mutual Conveyances of Assets is a legally binding document that outlines the terms and conditions of the dissolution of a partnership. This type of agreement typically covers the division of the partnership's assets, liabilities, and ownership interests. It also outlines the responsibilities and obligations of the remaining partners and the retiring partner. It is important that all parties involved in the agreement understand the terms and conditions of the agreement and agree to them before signing. Types of Agreement between Retiring Partner and Remaining Partners to Dissolve and Wind up Partnership with Mutual Conveyances of Assets include: • Asset Division Agreement: This agreement outlines the division of ownership interests, assets, and liabilities among the remaining partners and the retiring partner. It also outlines the responsibilities of the remaining partners and the retiring partner during the course of the dissolution. • Liability Distribution Agreement: This agreement outlines the division of liabilities between the remaining partners and the retiring partner. It also outlines the responsibilities and obligations of the remaining partners and the retiring partner in regard to the liabilities. • Winding Up Agreement: This agreement outlines the procedures for winding up the partnership and distributing assets among the remaining partners and the retiring partner. It also outlines the responsibilities and obligations of the remaining partners and the retiring partner during the winding up process.

Agreement between Retiring Partner and Remaining Partners to Dissolve and Wind up Partnership with Mutual Conveyances of Assets

Description

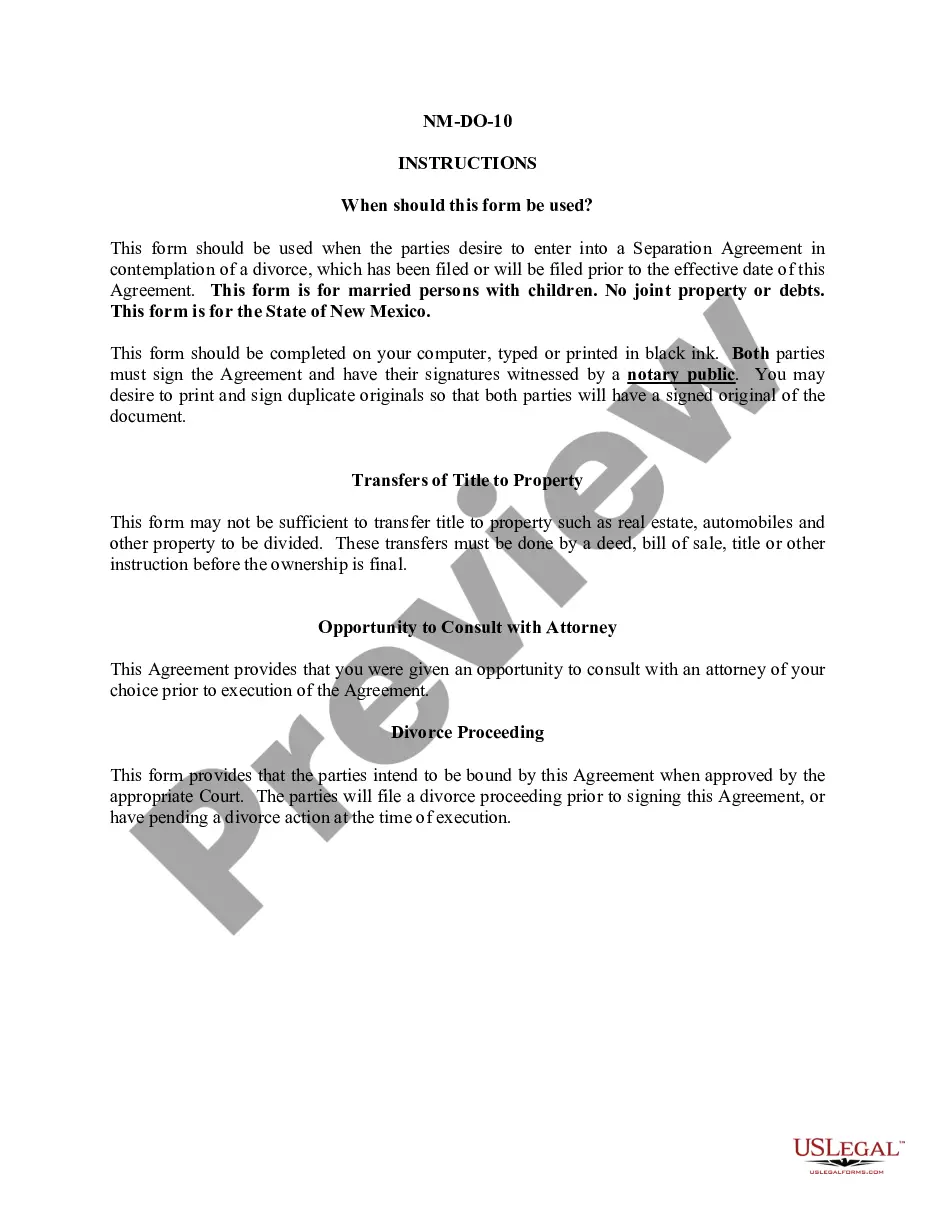

How to fill out Agreement Between Retiring Partner And Remaining Partners To Dissolve And Wind Up Partnership With Mutual Conveyances Of Assets?

US Legal Forms is the most straightforward and cost-effective way to locate appropriate formal templates. It’s the most extensive online library of business and personal legal documentation drafted and checked by attorneys. Here, you can find printable and fillable blanks that comply with federal and local laws - just like your Agreement between Retiring Partner and Remaining Partners to Dissolve and Wind up Partnership with Mutual Conveyances of Assets.

Obtaining your template takes just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can get a properly drafted Agreement between Retiring Partner and Remaining Partners to Dissolve and Wind up Partnership with Mutual Conveyances of Assets if you are using US Legal Forms for the first time:

- Read the form description or preview the document to make certain you’ve found the one meeting your demands, or find another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and choose the subscription plan you like most.

- Register for an account with our service, sign in, and pay for your subscription using PayPal or you credit card.

- Select the preferred file format for your Agreement between Retiring Partner and Remaining Partners to Dissolve and Wind up Partnership with Mutual Conveyances of Assets and save it on your device with the appropriate button.

After you save a template, you can reaccess it at any time - just find it in your profile, re-download it for printing and manual fill-out or upload it to an online editor to fill it out and sign more efficiently.

Take advantage of US Legal Forms, your reliable assistant in obtaining the corresponding formal documentation. Give it a try!

Form popularity

FAQ

The test of good faith as required for expulsion as stated under Section 33(1) includes three aspects. The expulsion must be in the best interest of the partnership. The partner that is to be expelled must be served with a notice. The partner has to be given the opportunity of being heard.

On retirement of a partner : On retirement of the partner the partnership the partnership firm gets dissolved to form new partnership deed and form new partnership.

If it's a business partnership with two partners, the exit of one partner will result in the collapse of the partnership. The exit terms will be detailed in the partnership agreement which is a legally binding document signed by all participating partners when entering a partnership.

On retirement of the partner, the reconstituted firm continues and the retiring partner is to be paid his dues in terms of Section 37 of the Partnership Act. In case of dissolution, accounts have to be settled and distributed as per the mode prescribed in Section 48 of the Partnership Act.

A Deed of Retirement from Partnership is an Agreement entered into between the Retiring Partner (the Partner who intends to leave the Partnership) and the Continuing Partners (the Partners who will continue to work as Partners of the existing Firm with updated terms).

A Partnership Dissolution Agreement is an agreement between two or more partners to end a business partnership. Signing a Partnership Dissolution Agreement will not immediately end the partnership.

The retirement of a partner extinguishes his interest in the Partnership firm and this leads to dissolution of the firm or reconstitution of the Partnership. A partner, who goes out of a firm, is called retiring partner or outgoing partner.

On retirement of the partner, the reconstituted firm continues and the retiring partner is to be paid his dues in terms of Section 37 of the Partnership Act. In case of dissolution, accounts have to be settled and distributed as per the mode prescribed in Section 48 of the Partnership Act.