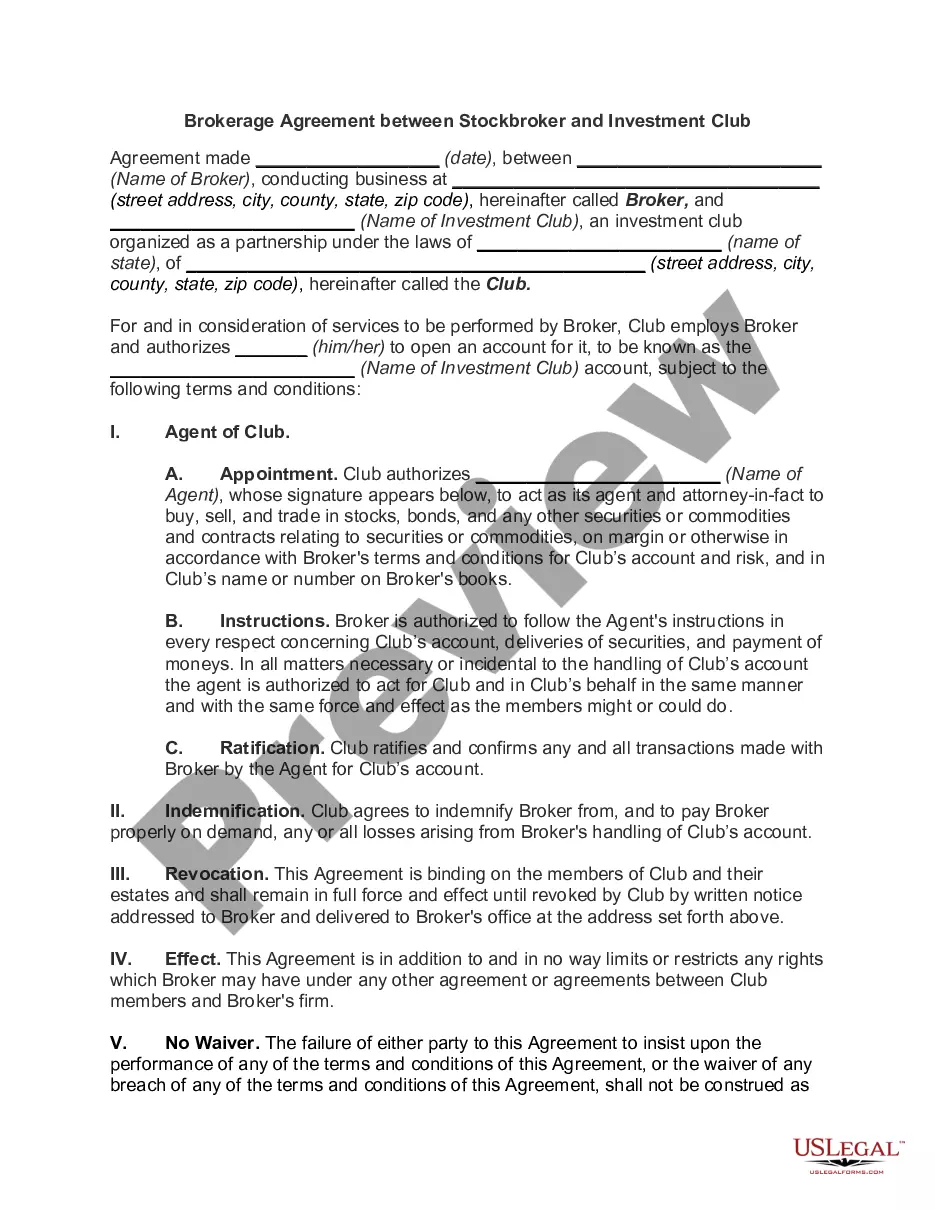

A Brokerage Agreement between a Stockbroker and an Investment Club is a legal contract between the two parties which outlines the rights and responsibilities of the stockbroker and the investment club when engaging in stock trading activities. This agreement helps to protect both parties by providing a clear understanding of the terms and conditions related to the trades. It also establishes the fees that will be paid by the investment club as well as the duties that the stockbroker is obligated to fulfill. The agreement is typically customized to fit the needs of the investment club and covers topics such as the types of investments allowed, the frequency of trading, risk management and the types of services that the stockbroker will provide. It also outlines the procedures that will be followed in case of a dispute, such as arbitration or mediation. Types of Brokerage Agreements between Stockbroker and Investment Club include Full-Service Brokerage Agreement, Direct Access Brokerage Agreement, Limited Service Brokerage Agreement, and Discount Brokerage Agreement. Full-Service Brokerage Agreements provide comprehensive services that include financial advice, asset management, and trading. Direct Access Brokerage Agreements allow the investor to access the stock market directly, without the need for the stockbroker's assistance. Limited Service Brokerage Agreements provide access to the stock market, but with limited services such as order execution and order tracking. Discount Brokerage Agreements are generally the cheapest option, as they provide access to the stock market with minimal services, such as order execution, order tracking, and portfolio monitoring.

Agreement Stockbroker

Description

How to fill out Brokerage Agreement Between Stockbroker And Investment Club?

How much time and resources do you usually spend on drafting formal paperwork? There’s a greater way to get such forms than hiring legal specialists or wasting hours searching the web for a proper template. US Legal Forms is the top online library that provides professionally drafted and verified state-specific legal documents for any purpose, including the Brokerage Agreement between Stockbroker and Investment Club.

To obtain and complete an appropriate Brokerage Agreement between Stockbroker and Investment Club template, adhere to these easy steps:

- Examine the form content to make sure it complies with your state regulations. To do so, check the form description or take advantage of the Preview option.

- If your legal template doesn’t meet your needs, find a different one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Brokerage Agreement between Stockbroker and Investment Club. Otherwise, proceed to the next steps.

- Click Buy now once you find the correct document. Opt for the subscription plan that suits you best to access our library’s full opportunities.

- Register for an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is absolutely reliable for that.

- Download your Brokerage Agreement between Stockbroker and Investment Club on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously purchased documents that you safely keep in your profile in the My Forms tab. Obtain them at any moment and re-complete your paperwork as often as you need.

Save time and effort completing formal paperwork with US Legal Forms, one of the most trustworthy web services. Sign up for us today!