Partnership Agreement for LLP

Description Partnership Agreement For Llp

How to fill out Partnership Agreement For LLP?

Use US Legal Forms to get a printable Partnership Agreement for LLP. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most complete Forms catalogue on the web and offers reasonably priced and accurate templates for consumers and legal professionals, and SMBs. The documents are categorized into state-based categories and some of them might be previewed prior to being downloaded.

To download templates, customers must have a subscription and to log in to their account. Press Download next to any template you need and find it in My Forms.

For individuals who do not have a subscription, follow the following guidelines to easily find and download Partnership Agreement for LLP:

- Check to ensure that you have the proper template in relation to the state it’s needed in.

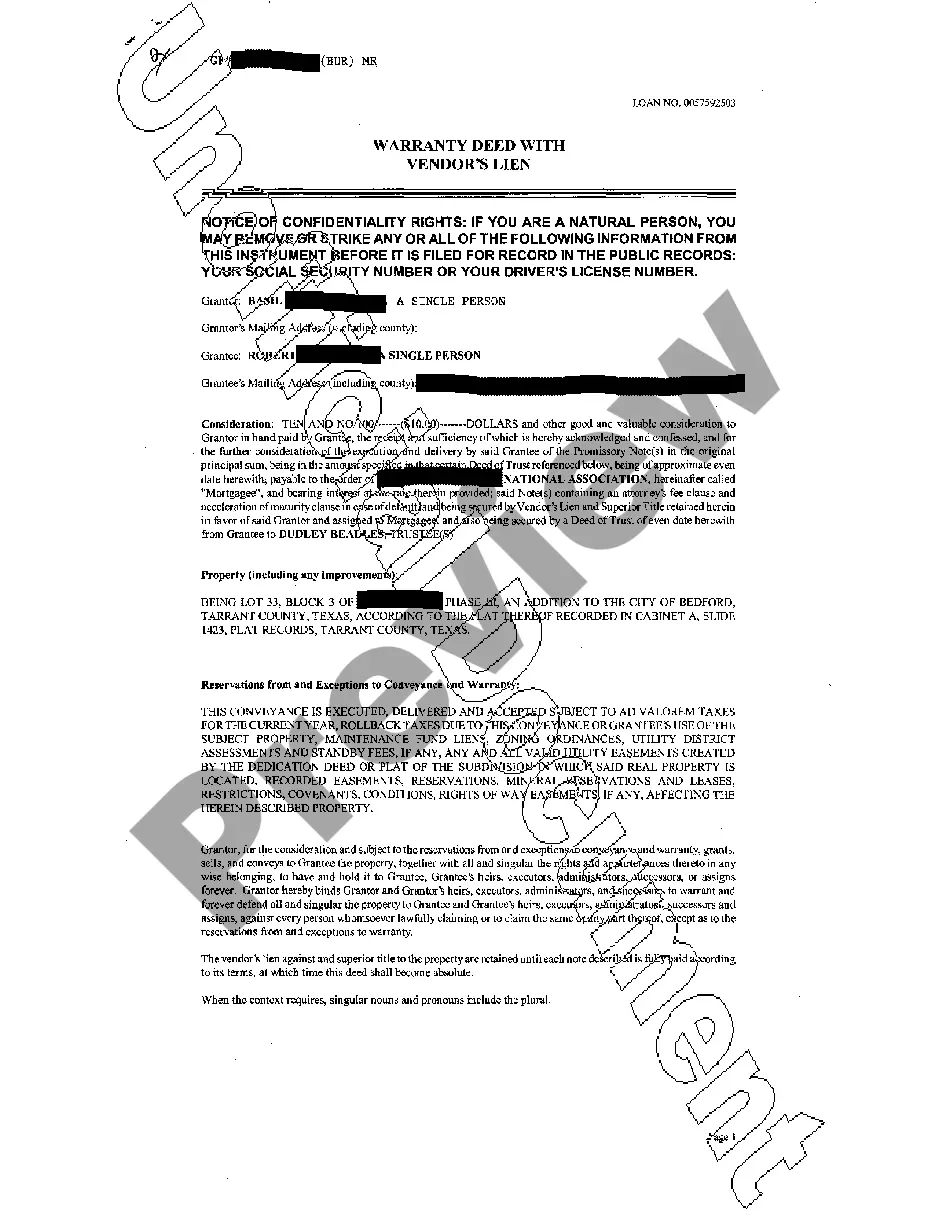

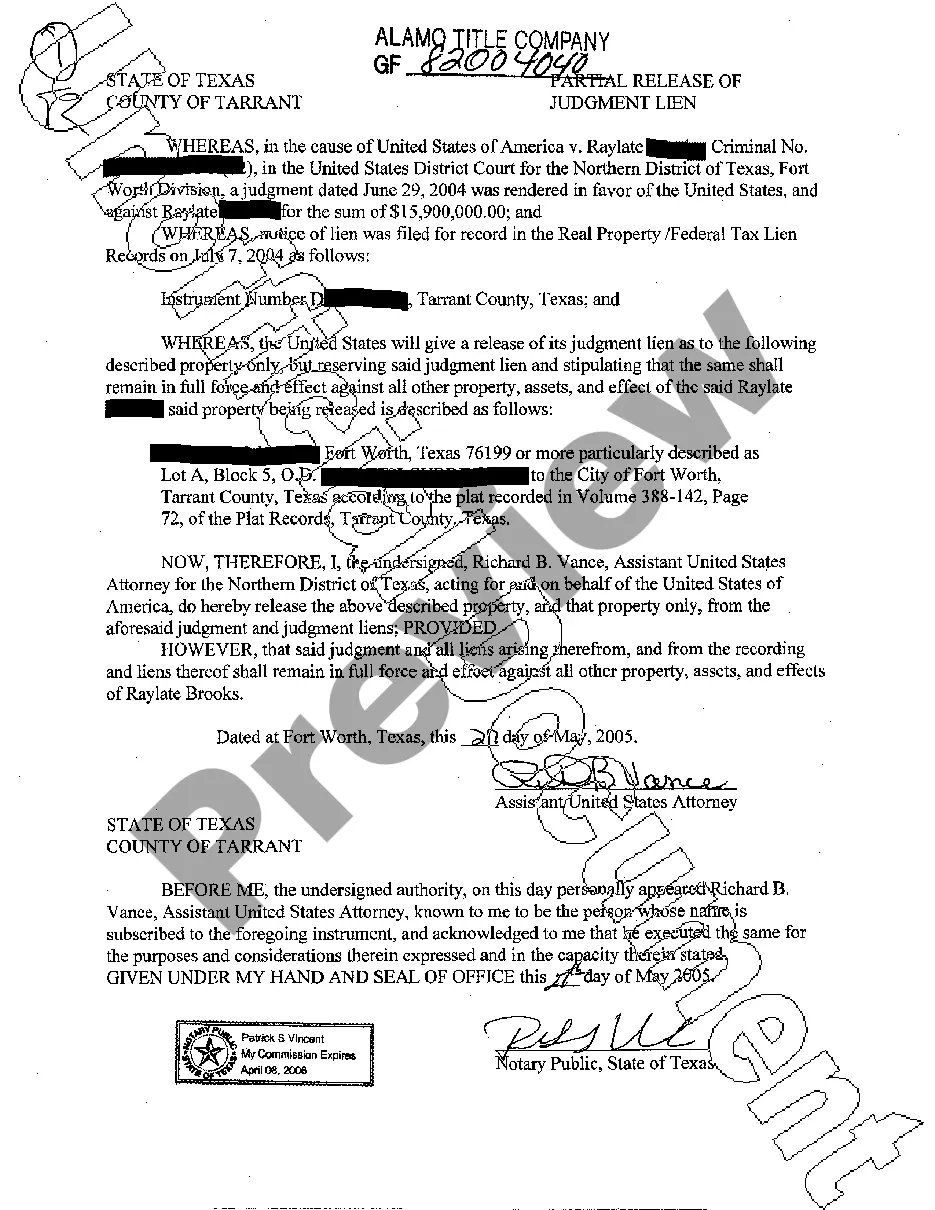

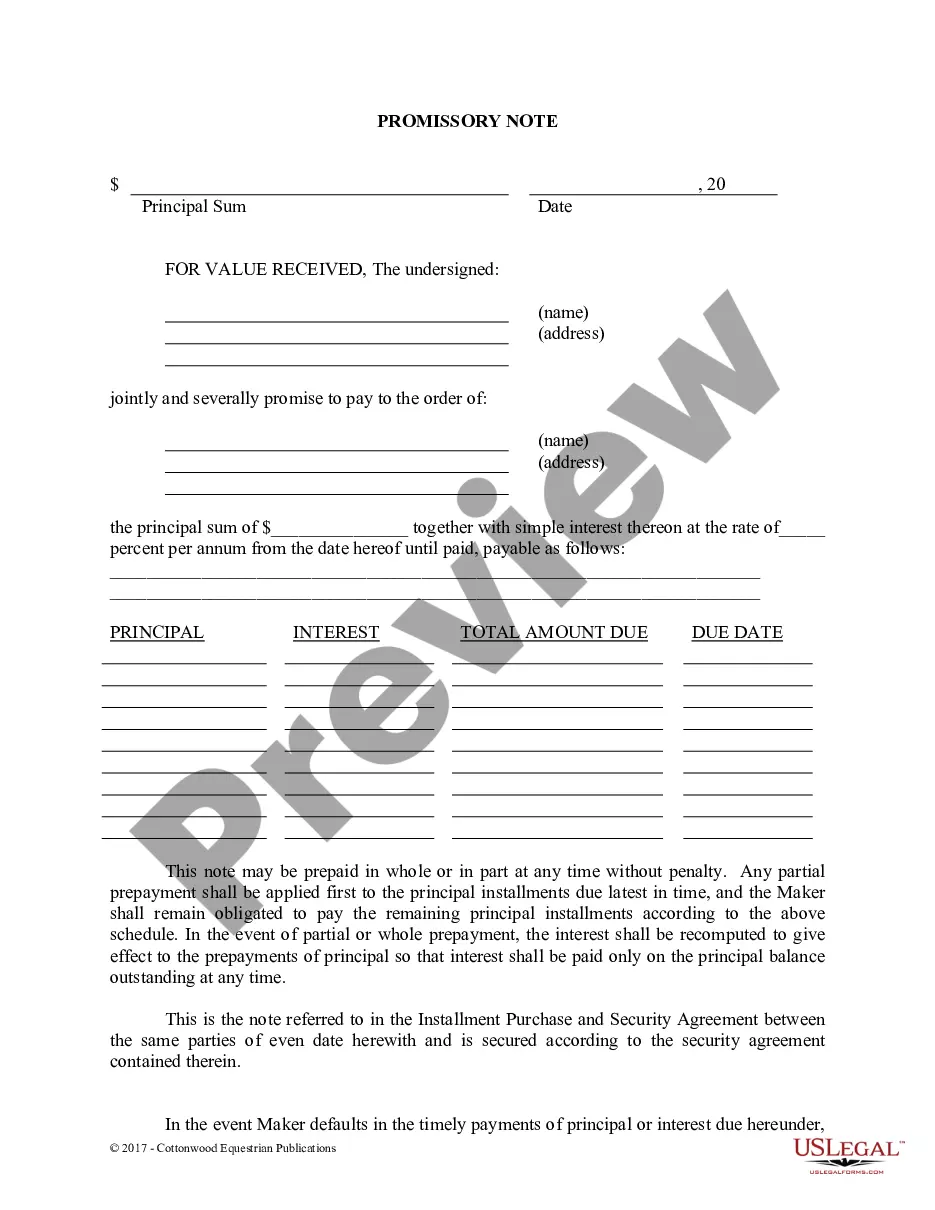

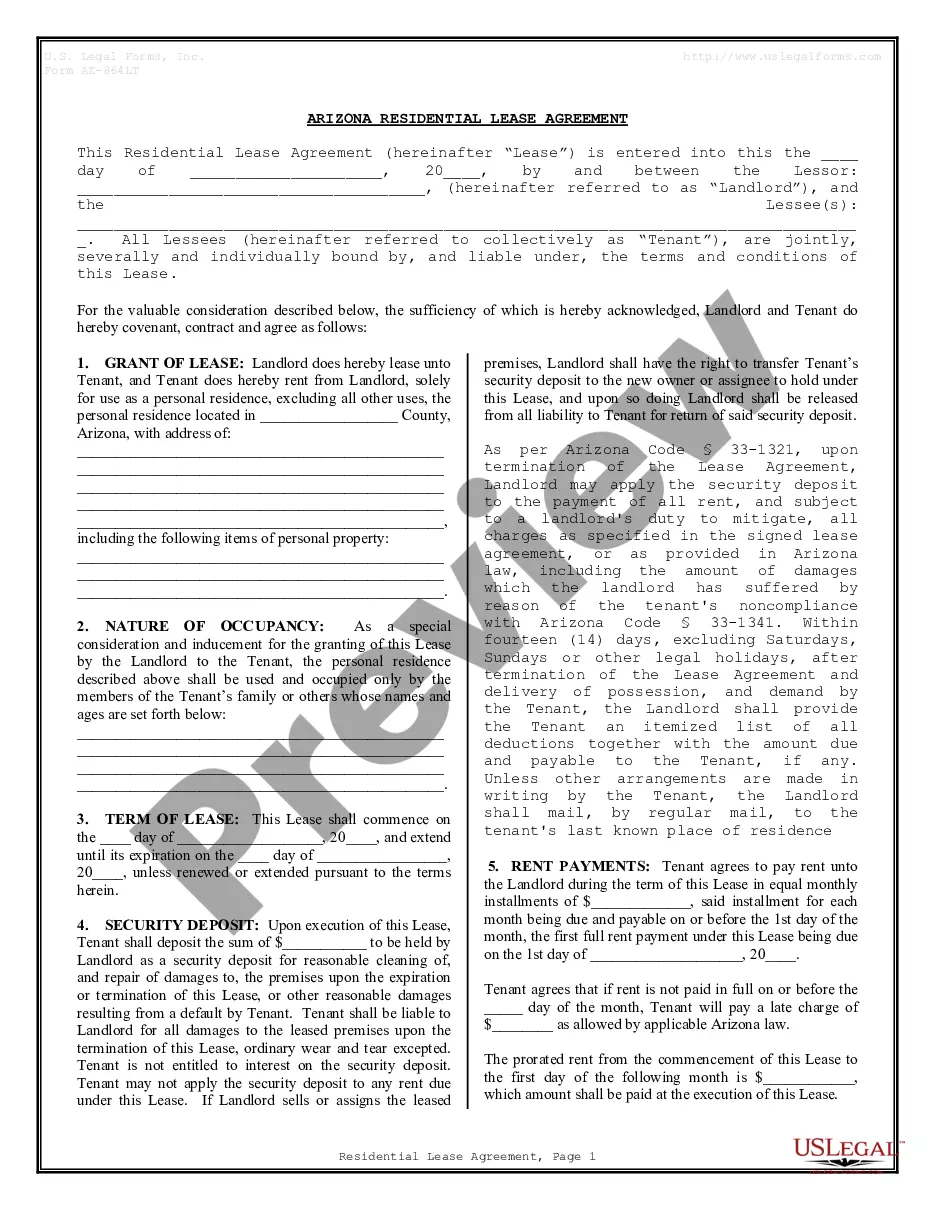

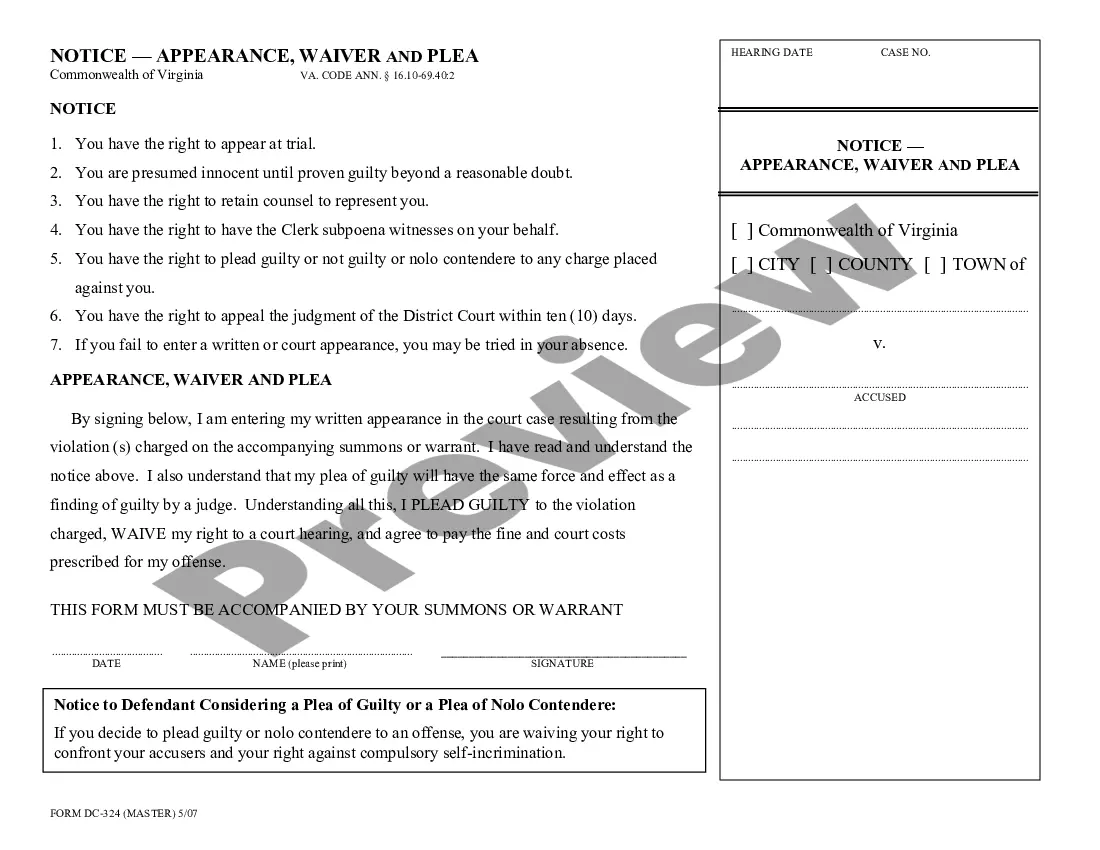

- Review the document by reading the description and by using the Preview feature.

- Hit Buy Now if it’s the template you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it many times.

- Use the Search field if you want to get another document template.

US Legal Forms offers thousands of legal and tax samples and packages for business and personal needs, including Partnership Agreement for LLP. More than three million users already have utilized our platform successfully. Choose your subscription plan and have high-quality documents in a few clicks.

Form popularity

FAQ

A limited liability partnership (LLP) is essentially a general partnership with the addition of limited liability for one or more partners. A general partnership is formed whenever two or more people do business together and does not require any legal filings.

The partnership is governed by the Indian Partnership Act, 1932. On the contrary, Limited Liability Partnership Act, 2008 governs LLP in India. The incorporation of the partnership is voluntary, whereas the registration of the LLP is obligatory. The document that guides the partnership is called Partnership Deed.

Like normal partnerships, the LLP pays no income taxes. Instead, profits and deductions are passed through to individual partners. The partnership will report each partner's share of profit and loss on Schedule K-1 (Form 1065).LLPs may have W-2 employees.

There must be a relation of partnership between the parties concerned through a proper instrument i.e. LLP Agreement. The individual shares of partners must be well specified in the agreement. It shall contain all the details related to partnership, their share, and contribution, etc.

Although there's no requirement for a written partnership agreement, often it's a very good idea to have such a document to prevent internal squabbling (about profits, direction of the company, etc.) and give the partnership solid direction. Limited liability partnerships do have a writing requirement.

It's not a legal requirement to enter into a limited liability partnership agreement and an LLP can be set up without one. However, it's a very common and generally sound recommendation that a new LLP puts a partnership agreement in place.

LLP Agreement is a written contract between the partners of the LLP or between the LLP and its designated partners. It establishes the rights and a duty of the designated partners toward each other as well toward the LLP.

LLP agreement must be filed in form 3 online on MCA Portal. Form 3 for the LLP agreement has to be filed within 30 days of the date of incorporation. The LLP Agreement has to be printed on Stamp Paper.