LLC Operating Agreement for Truckign Company

Description What Is An Operating Agreement

How to fill out Trucking Company Operating Agreement?

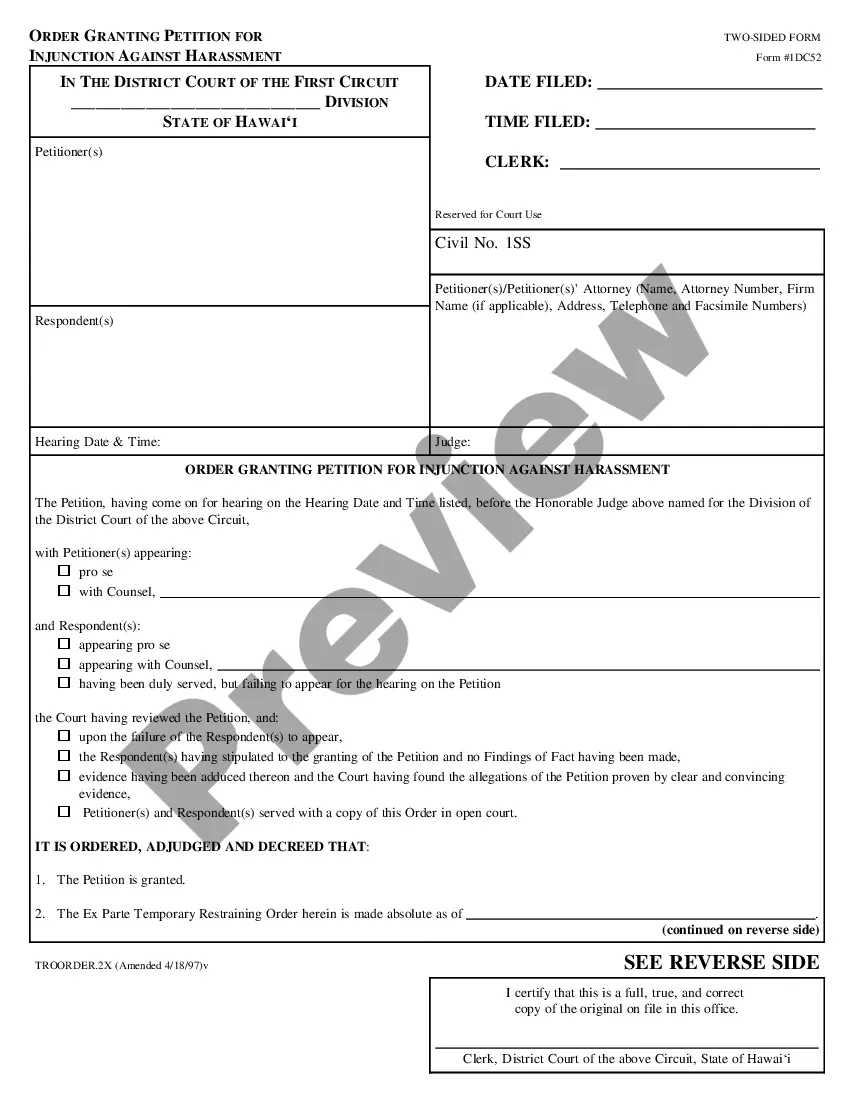

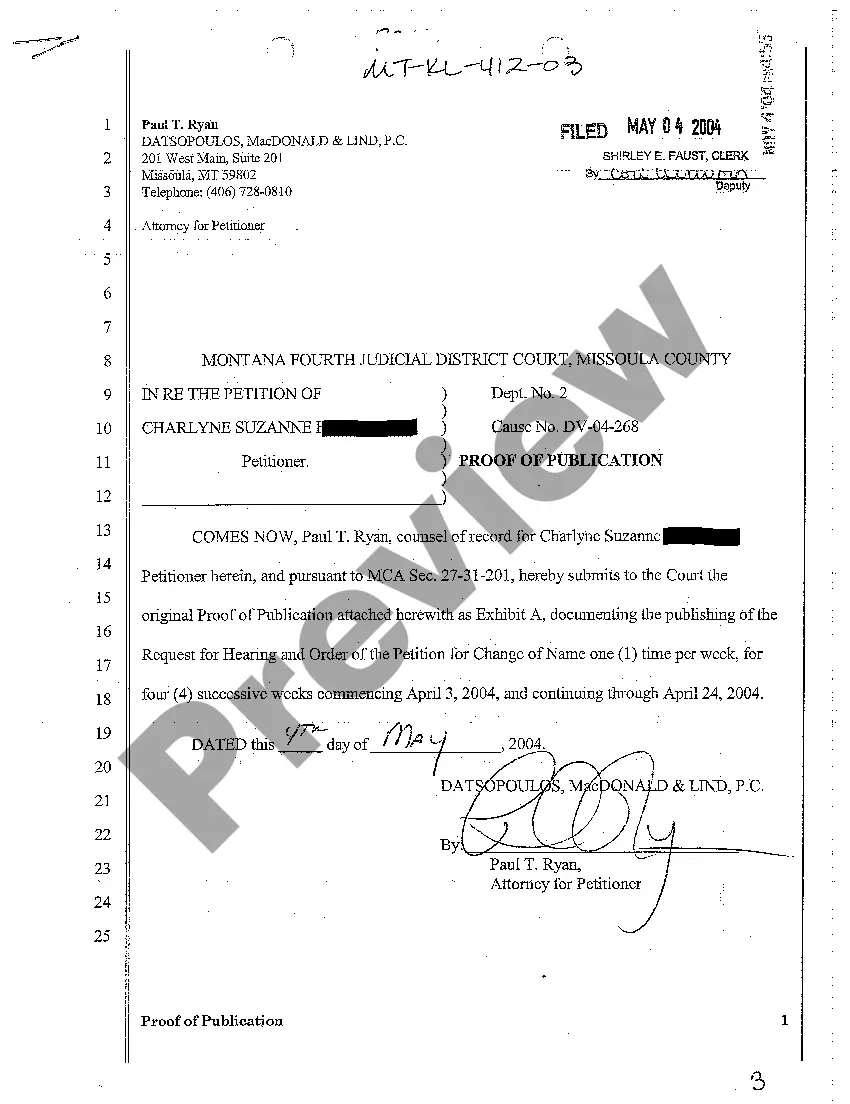

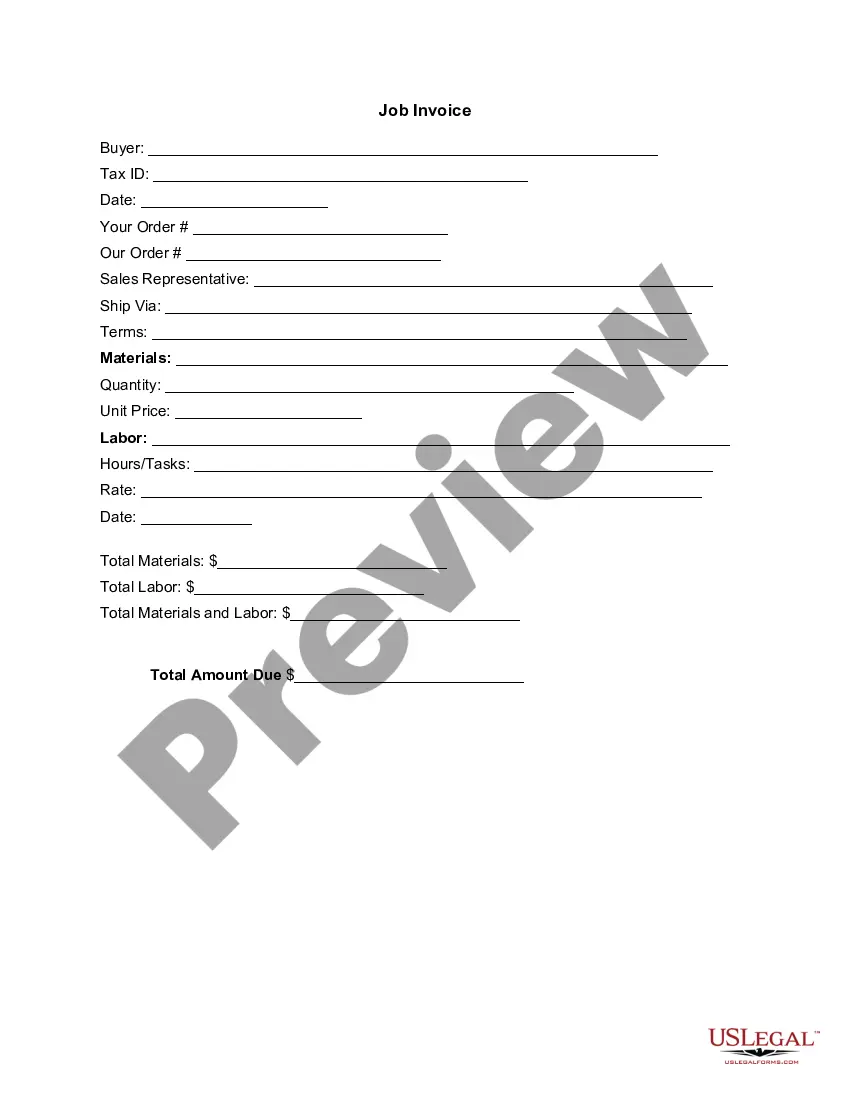

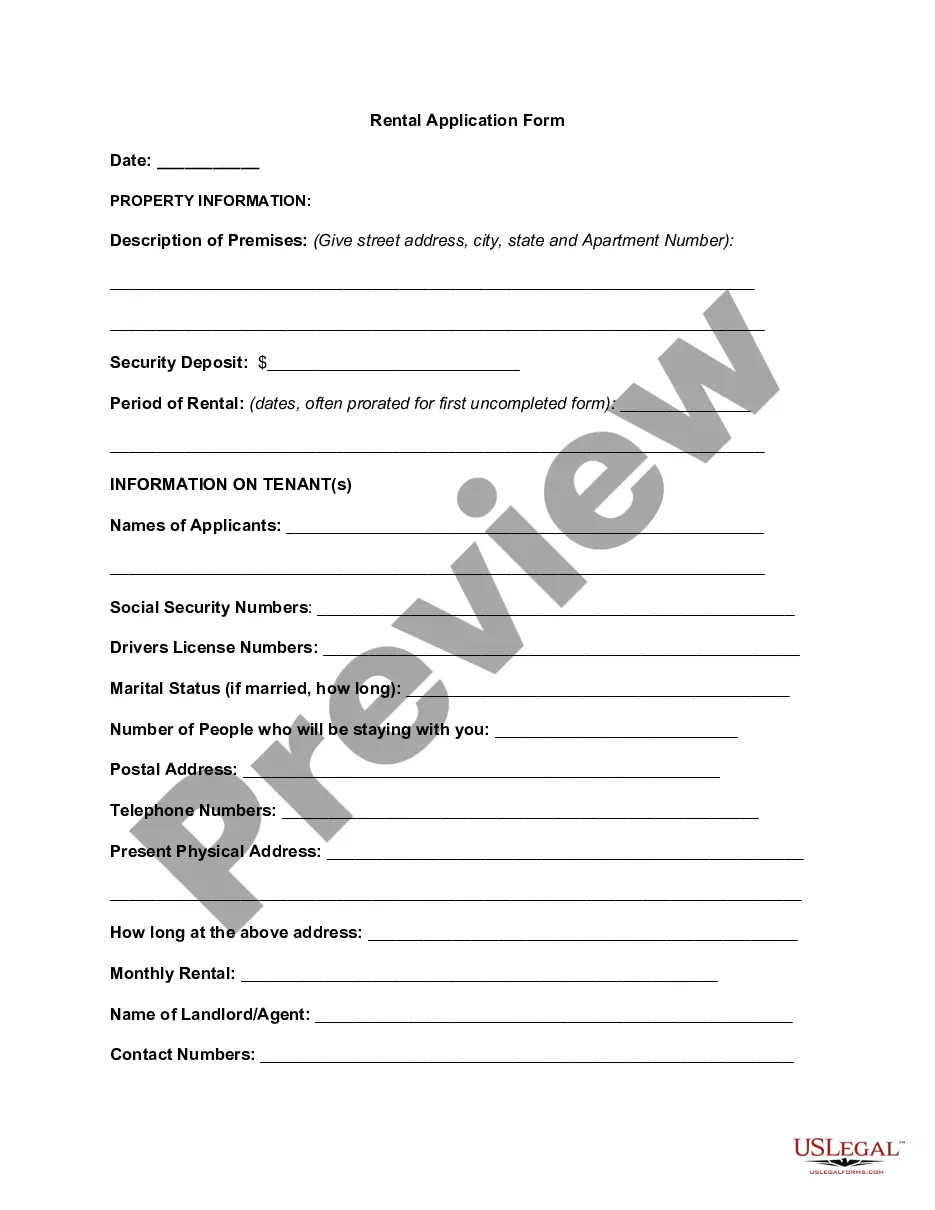

Use US Legal Forms to obtain a printable LLC Operating Agreement for Truckign Company. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most comprehensive Forms catalogue online and offers cost-effective and accurate templates for consumers and legal professionals, and SMBs. The documents are grouped into state-based categories and many of them can be previewed before being downloaded.

To download templates, customers must have a subscription and to log in to their account. Click Download next to any form you need and find it in My Forms.

For individuals who do not have a subscription, follow the following guidelines to quickly find and download LLC Operating Agreement for Truckign Company:

- Check to ensure that you get the proper template in relation to the state it’s needed in.

- Review the document by looking through the description and using the Preview feature.

- Click Buy Now if it is the document you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it multiple times.

- Make use of the Search field if you want to find another document template.

US Legal Forms offers thousands of legal and tax samples and packages for business and personal needs, including LLC Operating Agreement for Truckign Company. Above three million users already have used our service successfully. Choose your subscription plan and get high-quality forms in a few clicks.

Corporate Operating Agreement Form popularity

How To Write A Business Operating Agreement Other Form Names

Llc For Trucking Company FAQ

For an owner-operator who wants to grow a successful business, there are benefits to forming a Limited Liability Companies (LLC). An LLC can offer liability protection for the members. It also allows members to avoid the taxation of a corporation.

An operating agreement is a document which describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. All LLC's with two or more members should have an operating agreement. This document is not required for an LLC, but it's a good idea in any case.

Common structures of trucking businesses include: Sole proprietorship. Partnership. Limited liability corporation (LLC)

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one.

STEP 1: Plan your business. STEP 2: Form a legal entity. STEP 3: Register for taxes. STEP 4: Open a business bank account & credit card. STEP 5: Set up business accounting. STEP 6: Obtain necessary permits and licenses. STEP 7: Get business insurance.

Independent Trucking Contractors Should Consider LLC Status As mentioned, LLCs are beneficial because they shield their owners from liabilities and debts. Truckers who are not employees of a company, but are instead independent contractors, should strongly consider registering themselves as an LLC.

Most small trucking companies and independent owner operators choose to register as an LLC, which stands for Limited Liability Corporation.An LLC works like a mix between a sole-proprietorship and a corporation. It is required to have owners as members, which, unlike a corporation, may be hard to transfer.

For an owner-operator who wants to grow a successful business, there are benefits to forming a Limited Liability Companies (LLC). An LLC can offer liability protection for the members. It also allows members to avoid the taxation of a corporation.A more common election for an LLC will to be taxed as an s-corporation.