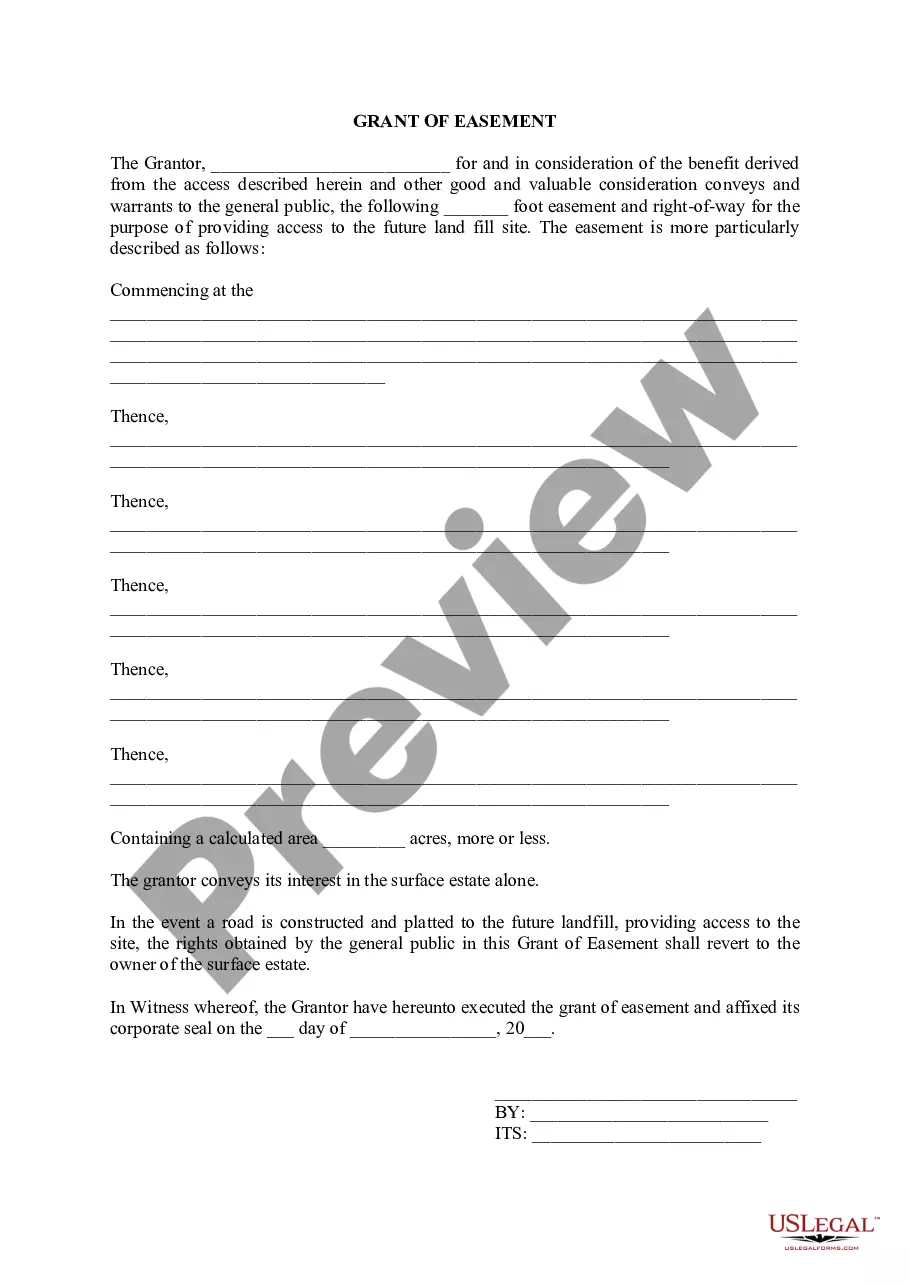

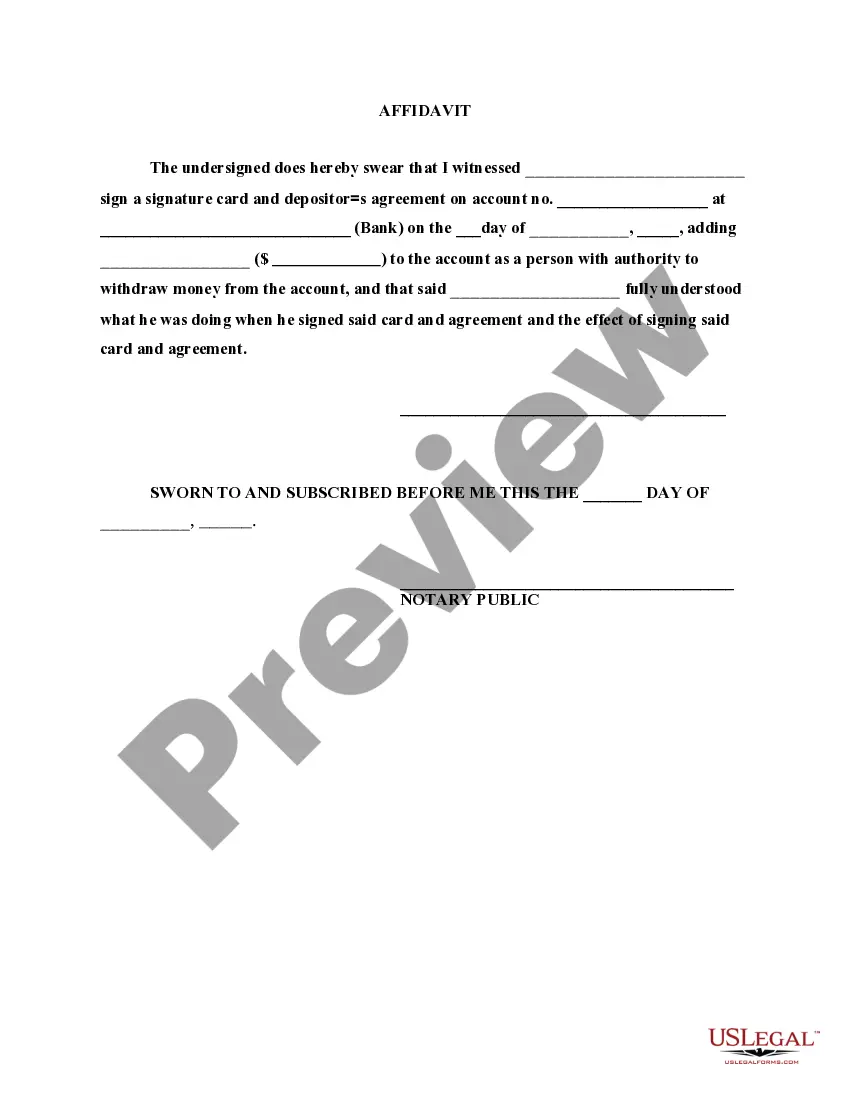

Affidavit regarding Account Access Signature Card

Description Signature Card Form Application

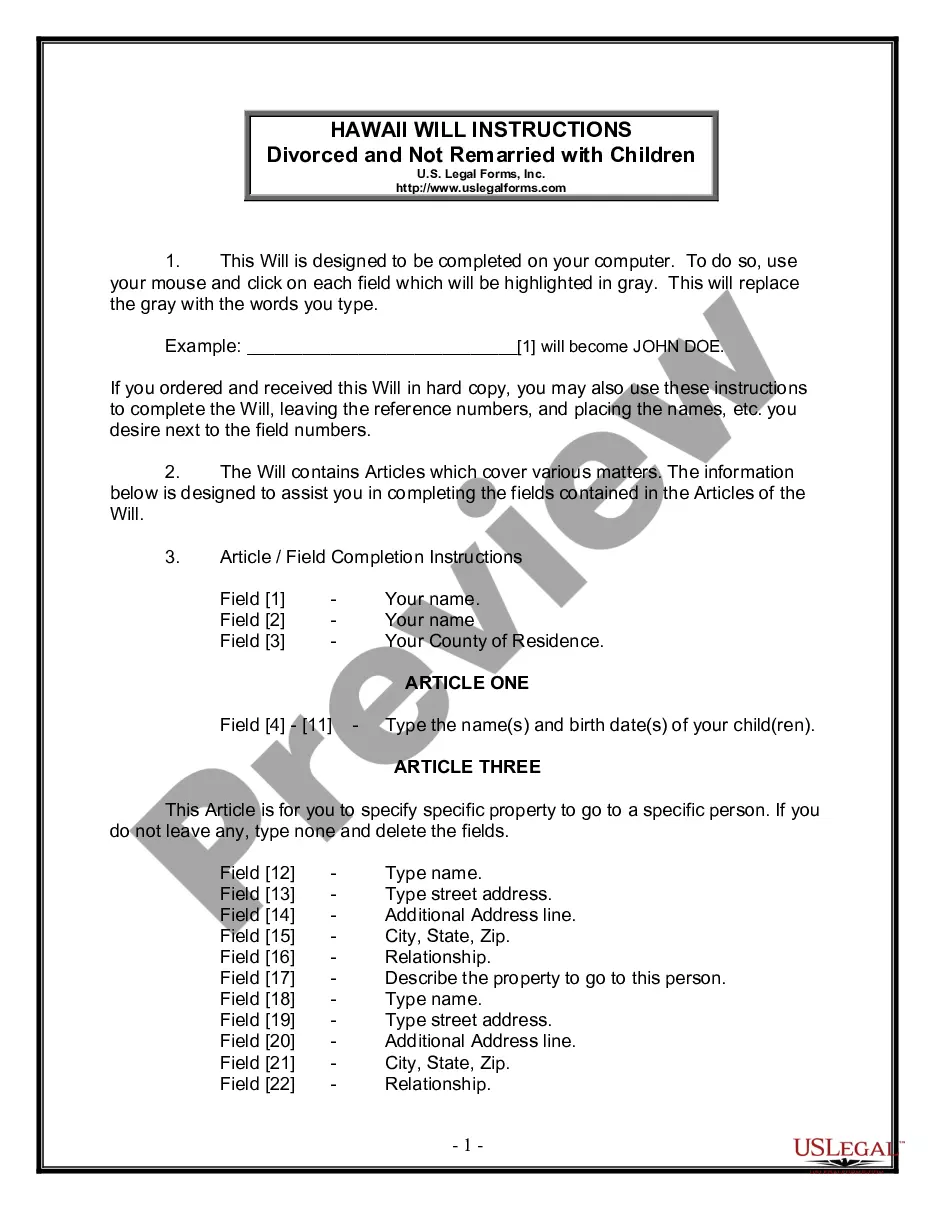

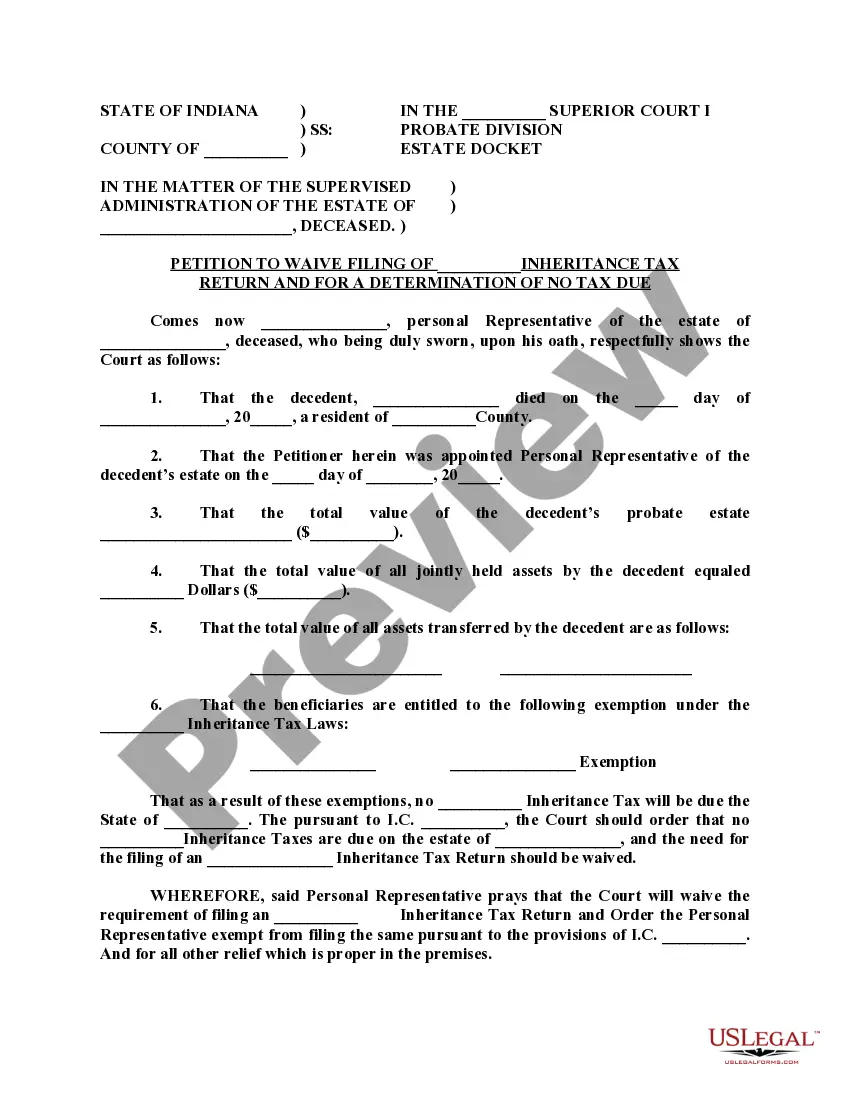

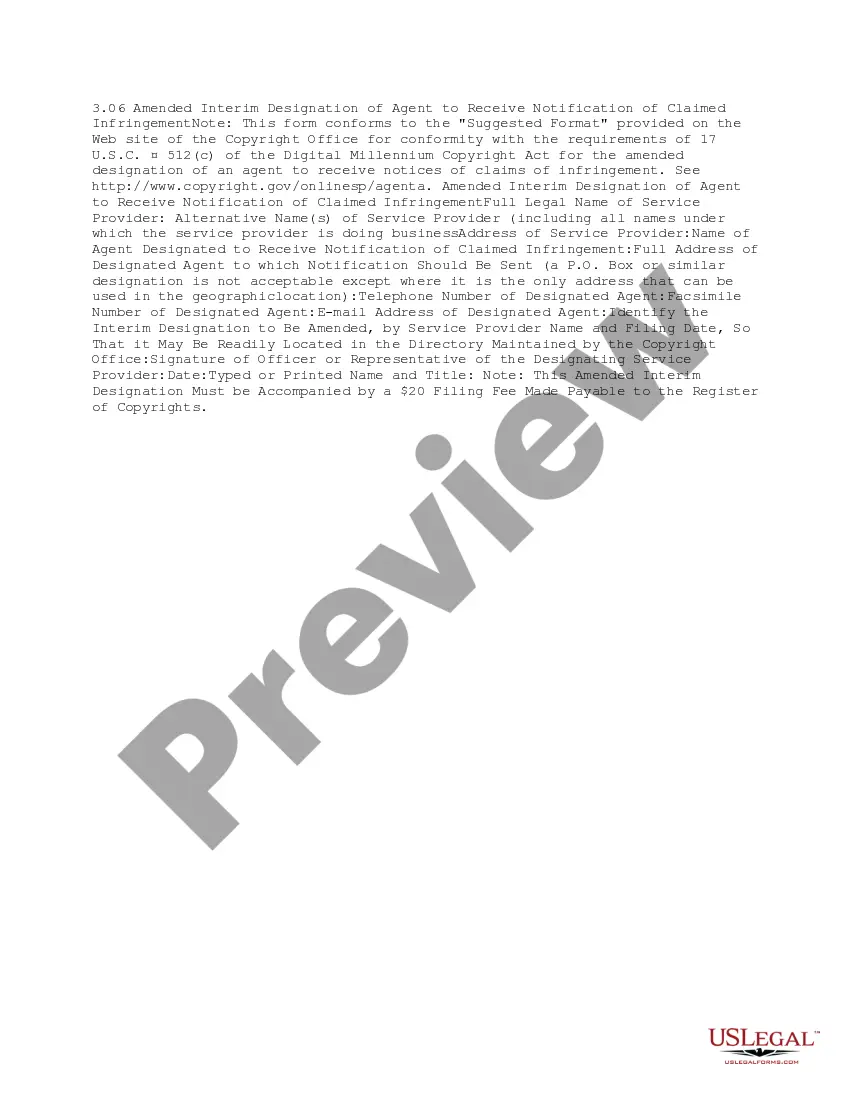

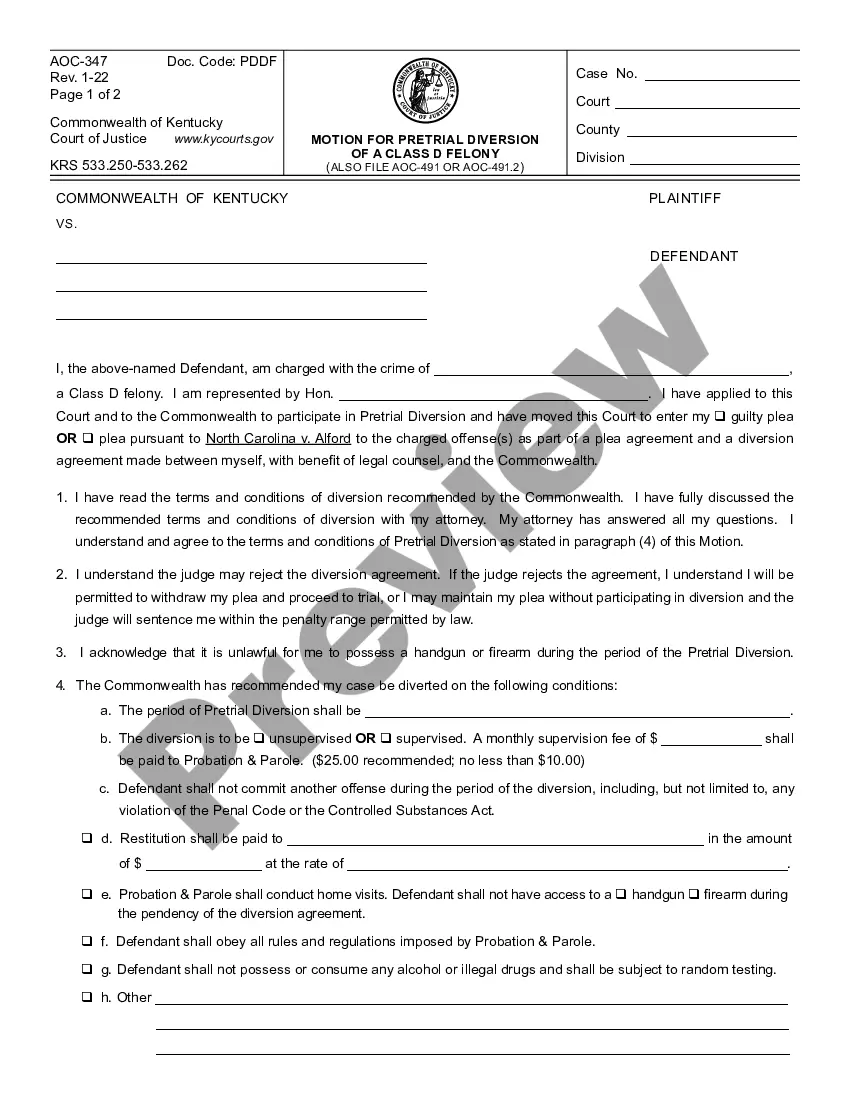

How to fill out Signature Card Sample?

Employ the most comprehensive legal library of forms. US Legal Forms is the perfect platform for getting updated Affidavit regarding Account Access Signature Card templates. Our service offers a large number of legal documents drafted by certified lawyers and grouped by state.

To obtain a sample from US Legal Forms, users just need to sign up for a free account first. If you’re already registered on our platform, log in and choose the template you are looking for and buy it. Right after buying templates, users can see them in the My Forms section.

To get a US Legal Forms subscription online, follow the guidelines below:

- Check if the Form name you have found is state-specific and suits your requirements.

- If the template has a Preview function, use it to review the sample.

- If the sample does not suit you, make use of the search bar to find a better one.

- PressClick Buy Now if the sample corresponds to your requirements.

- Select a pricing plan.

- Create your account.

- Pay via PayPal or with the debit/visa or mastercard.

- Choose a document format and download the template.

- After it is downloaded, print it and fill it out.

Save your effort and time using our service to find, download, and complete the Form name. Join a huge number of happy customers who’re already using US Legal Forms!

Bank Signature Card Form Form popularity

Signature Card Form Other Form Names

Affidavit Access Form FAQ

A signature debit transaction is when you process a debit card by having your customer sign the sales receipt instead of entering her PIN number.Processing a debit card in this manner causes the transaction to be routed through Visa, MasterCard or Discover's interchange instead of through a PIN debit network.

When you compare Visa vs. Visa Signature, the biggest difference is that Visa Signature cards have more benefits. All Visa credit cards come with benefits such as rental car insurance, roadside dispatch and emergency card replacement.A Visa Signature will have a minimum credit limit of $5,000.

Banks Are Now Embracing The Newer And Tougher Signature Verification System. Every branch of every bank maintains customer signatures on index cards or similar documents. These cards are physically stored in boxes or cabinets and require a person to physically search them for a specific client's signature card.

Step1: Visit your bank branch of SBI where your account is registered. Step2: From the help desk/counter, ask for a Signature change form. Step3: Now fill the form correctly with your current signature and new signature.

The bank has you sign a signature card so that they can compare your signature with your signature on any checks or paperwork submitted to the bank. It helps to protect you and your account from fraud.Usually a transfer takes place between a checking and a savings account.

Definition: A signature card is a document that a bank keeps on file with the signatures of all the authorized people on that account.In other words, a signature card is a fraud prevention tool that a bank uses to make sure unauthorized people aren't forging checks in the company's name.

A copy of a valid Driver's License, state issued I.D., or current US Passport for you and each joint account. Driver's license or ID must match to the name on signature card. Application address must match your Driver's License or a utility bill with matching address must be brought in.

Question: What are the legal requirements for a bank to open a savings account for an individual customer? From what I understand, banks usually require (1) a signature card and (2) the following identity information: name, address, date of birth and identification number.

A signature-debit transaction, also known as an offline transaction, is a payment method that uses a debit card to transfer funds from a checking account to a merchant across a digital credit card network.

At my bank, the branch of account keeps the original signature card at the branch until the account is closed. Then the card would be filed with the same year's closed accounts and placed in our storage facility. I believe they are maintained for as long as 7 years after the account has been closed.