Sample Letter for Naming a Trustee to a Deed of Trust

Description

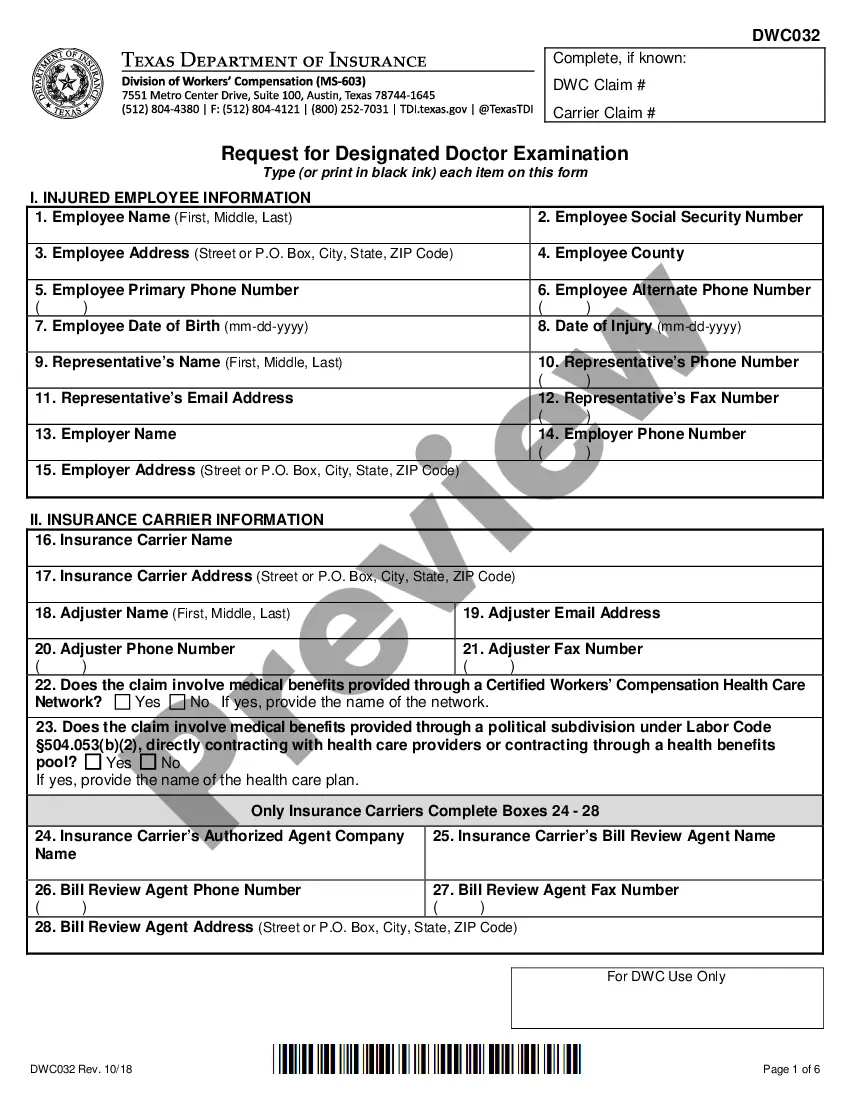

How to fill out Sample Letter For Naming A Trustee To A Deed Of Trust?

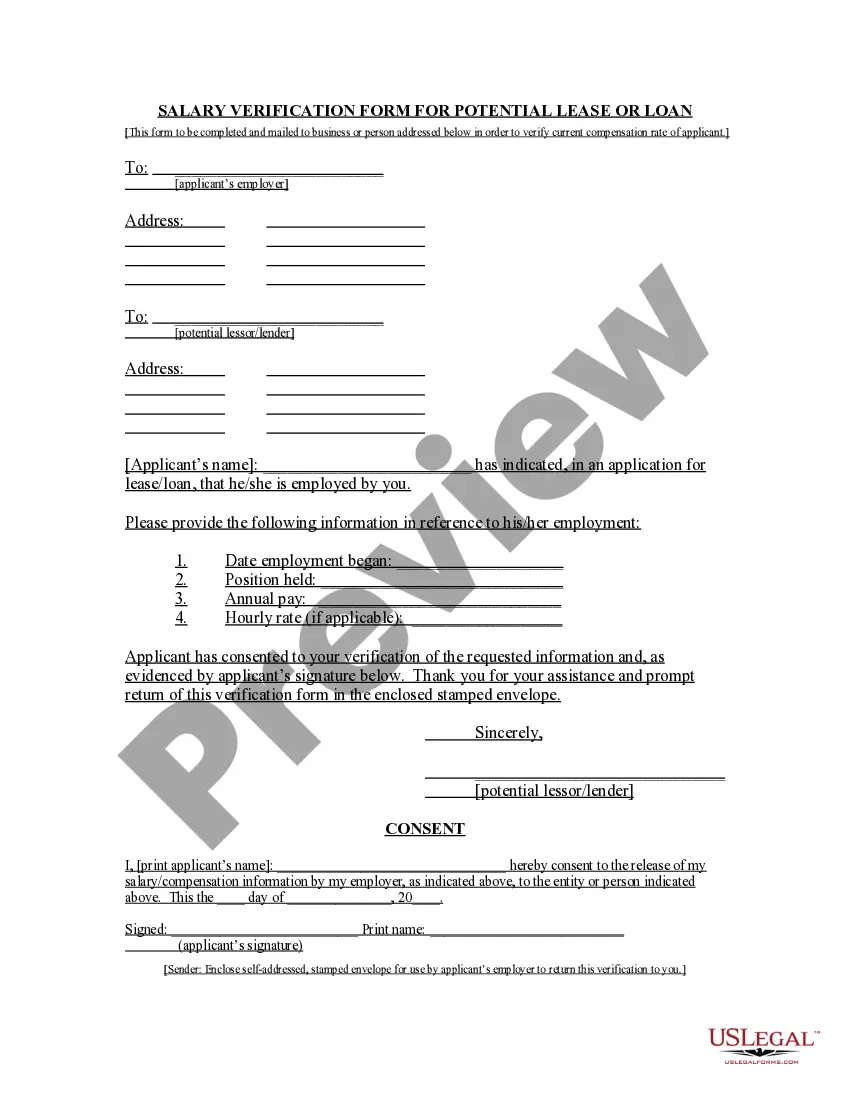

Use US Legal Forms to get a printable Sample Letter for Naming a Trustee to a Deed of Trust. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most extensive Forms catalogue online and offers reasonably priced and accurate templates for customers and lawyers, and SMBs. The templates are categorized into state-based categories and some of them might be previewed prior to being downloaded.

To download samples, customers must have a subscription and to log in to their account. Press Download next to any form you want and find it in My Forms.

For people who do not have a subscription, follow the following guidelines to easily find and download Sample Letter for Naming a Trustee to a Deed of Trust:

- Check out to ensure that you get the correct form with regards to the state it is needed in.

- Review the document by looking through the description and using the Preview feature.

- Press Buy Now if it is the document you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it many times.

- Use the Search engine if you need to get another document template.

US Legal Forms offers a large number of legal and tax templates and packages for business and personal needs, including Sample Letter for Naming a Trustee to a Deed of Trust. Over three million users have utilized our service successfully. Choose your subscription plan and have high-quality forms in a few clicks.

Form popularity

FAQ

Give details of any partnership/other funding. o Conclusion round your letter off appropriately with a 'thank you'. Invite the Trust you're writing to to meet you or visit your project. o Provide a contact for further information and any enclosures if required (for example, your annual accounts or annual report).

Write the name of the trustee, his address, city, state, and zip code about one-quarter inch below the date. Reference the name of your trust, and your trust account number if applicable. Write a salutation followed by a colon, for example, "Dear Mr.

Write a letter to the trustee of the trust and have it delivered certified mail. Keep the receipt. Identify yourself as a beneficiary and request a copy of the trust if you do not yet have one. Once you have reviewed the trust, ask for an accounting...

Write a salutation followed by a colon, for example, "Dear Mr. Jones:"If you'd rather type the letter and print it out instead of writing it by hand, you can do that if you wish. Identify yourself as the trustor of the revocable trust in the body of the letter. State your purpose for requesting money from your trust.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

Generally speaking, a letter of intent, also known as a side letter is a letter from the grantor to the trustee that provides guidance to the trustee in the exercise of some discretionary power.

Most trusts are named after the Trust Creators and also include the date the trust was created. Examples are John and Jane Smith Revocable Trust dated 1/1/20; or Smith Family Trust dated 1/1/20; or John W. Smith and Jane A. Smith Revocable Family Trust dated 1/1/20.